Navigating Sustainable, Profitable Growth in a Rapidly Changing World

The growth of the United States mobile payment market is driven by the surge in smartphone use, the rising trend of contactless payments, the push for secure and efficient digital transactions, and increased government initiatives and regulatory support. Mobile payments enable financial transactions via smartphones, using tools like mobile browsers and virtual wallets. Types include proximity and remote payments, employing technologies like NFC, QR codes, and mobile apps. This innovation offers convenience, speed, and security, linking bank accounts or credit cards for seamless transactions in retail, online shopping, peer-to-peer transfers, and public transport fare payments.

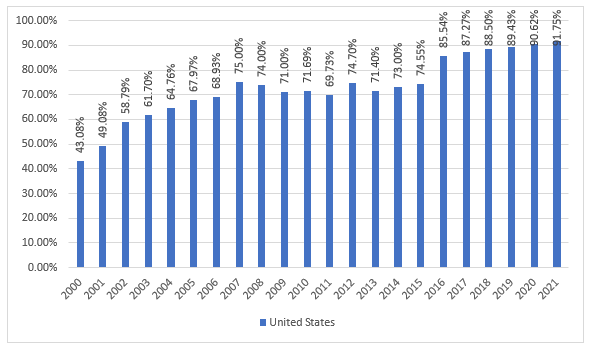

Fig.: Individuals using the Internet (% of population) in the United States, 2000-2021

The U.S. mobile payment market benefits from the rising popularity of mobile wallets, valued for their ease of use, convenience, and security. Open mobile wallets enhance flexibility by enabling users to store various payment methods not restricted to a single company.

Government initiatives and regulatory support have significantly boosted mobile payments in the U.S. By promoting secure, efficient digital transactions and encouraging the adoption of modern payment technologies, policies have fostered a favourable environment for the growth of mobile payments.

The rise of contactless payments is transforming the mobile payment landscape. With growing hygiene and convenience concerns, consumers seek safer, seamless transaction methods. Mobile payment platforms provide a compelling solution, enabling secure payments with a simple phone tap on contactless terminals. This meets modern consumers' preferences for speed, efficiency, and minimal physical contact during financial interactions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Breakup by Technology, Payment Type, Location, End Use, and Region:

- The market is segmented based on technology into direct mobile billing, near field communication, mobile web payment, SMS, and mobile application, among others.

- Based on the payment type, the market is segregated into B2B, B2C, and B2G.

- On the basis of location, the market can be categorised into remote payment and proximity payment.

- The market is further divided based on end use into BFSI, healthcare, IT and telecom, media and entertainment, retail and e-commerce, and transportation, among others.

- By region, the market is categorised into New England, Mideast, Great Lakes, Plains, Southeast, Southwest, Rocky Mountain, and Far West.

Key Findings of the Report:

- Remote payments maintain a substantial portion of the mobile payment market in the United States, primarily due to the implementation of strong security measures such as biometrics, two-factor authentication, and OTPs. The escalating requirement for recurring payment solutions, propelled by the ascent of subscription-based services, serves to further bolster the growth of this segment.

- The retail and e-commerce sectors are poised for substantial expansion, propelled by the integration of mobile payment systems that enhance both speed and convenience. Retailers' introduction of rewards and loyalty programs for mobile payment use further boosts U.S. mobile payment market demand.

- The proliferation of smartphones and the widespread accessibility of the internet have enabled users to conduct financial transactions without being bound by physical locations. Mobile payments enable anytime, anywhere purchases, fund transfers, and bill settlements, reducing cash reliance. Apps and platforms allow storing multiple payment methods, including credit cards, debit cards, and digital wallets, in one application.

- With online shopping booming, consumers demand seamless, secure payment options. Mobile payment platforms meet this need by storing payment credentials and enabling swift transactions, eliminating the need to manually enter details for each purchase.

Key Offerings of the Report:

- The EMR report gives an overview of the mobile payment market in the United States for the periods (2019-2025) and (2026-2035).

- The report also offers historical (2019-2025) and forecast (2026-2035) market information for the technology, payment type, location, end use, and region of the United States mobile payment market.

- The report analyses the market dynamics, covering the key demand and price indicators in the market, along with providing an assessment of the SWOT and Porter’s Five Forces models.

Top Players:

The major players in the United States mobile payment market are:

- PayPal Holdings Inc.

- Apple Inc.

- Alphabet Inc.

- Block, Inc.

- Samsung Electronics Co. Ltd.

- Microsoft Corp.

- Mastercard Inc.

- Amazon.com Inc.

- MoneyGram International, Inc.

- Visa Inc.

- Others

The comprehensive report by EMR looks into the market share, capacity, and latest developments like mergers and acquisitions, plant turnarounds, and capacity expansions of the major players.

About Us

Expert Market Research (EMR) is a leading market research and business intelligence company, ensuring its clients remain at the vanguard of their industries by providing them with exhaustive and actionable market data through its syndicated and custom market reports, covering over 15 major industry domains. The company's expansive and ever-growing database of reports, which are constantly updated, includes reports from industry verticals like chemicals and materials, food and beverages, energy and mining, technology and media, consumer goods, pharmaceuticals, agriculture, and packaging.

EMR leverages its state-of-the-art technological and analytical tools, along with the expertise of its highly skilled team of over a 100 analysts and more than 3000 consultants, to help its clients, ranging from Fortune 1000 companies to small and medium sized enterprises, easily grasp the expansive industry data and help them in formulating market and business strategies, which ensure that they remain ahead of the curve.

Contact Us

Expert Market Research

Website: www.expertmarketresearch.com

Email: [email protected]

US & Canada Phone no: +1-415-325-5166

UK Phone no: +44-702-402-5790

Report Summary

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Payment Type |

|

| Breakup by Location |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Single User License

USD 3,999

USD 3,599

tax inclusive*

- All Segments

- Printing Restrictions

- PDF Delivered via Email

- Custom Report Layout

- Post Sales Analysts Support

- Periodic Updates

- Unlimited Prints

Datasheet

USD 2,499

USD 2,249

tax inclusive*

- Selected Segments

- Printing Restrictions

- Excel Spreadsheet Delivered via Email

- Full Report

- Periodic Updates

- Post Sales Analysts Support

- Unlimited Prints

Five User License

USD 4,999

USD 4,249

tax inclusive*

- All Segments

- Five Prints Available

- PDF Delivered via Email

- Limited Free Customization

- Post Sales Analyst Support

- Custom Report Layout

- Periodic Updates

- Unlimited Prints

Corporate License

USD 5,999

USD 5,099

tax inclusive*

- All Segments

- Unlimited Prints Available

- PDF & Excel Delivery via Email

- Limited Free Customization

- Post Sales Analysts Support

- Discount On Next Update

- Custom Report Layout

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 80 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

- Life Time Access

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 100 Hours

- Complimentary Free 1 Month Subscription to Trade Data Base

- Complimentary One Month Subscription to Price Database (Chemicals only)

- Complimentary PPT Version of the Report

- Complimentary License Upgrade

- Complimentary Power BI Dashboards

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

- 3 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- Complimentary Excel Data Set

- PPT Version of the Report

- Power BI Dashboards

- License Upgrade

- Free Analyst Hours

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

- 5 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- Complimentary Excel Data Set

- PPT Version of the Report

- Power BI Dashboards

- License Upgrade

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

- 8 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- License Upgrade

- Free Analyst Hours - 80 Hours

- Power BI Dashboards

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

- 10 Reports Included

- Life Time Acess

- Analyst Support Related to Report

- PDF Version of the Report

- Complimentary Excel Data Set

- Free Analyst Hours - 50 Hours

- Free 1 Month Subscription to Trade Data Base

- 1 Month Subscription to Price Database (Chemicals only)

- License Upgrade

- Power BI Dashboards

- Free Analyst Hours - 100 Hours