Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Base Year

Historical Period

Forecast Period

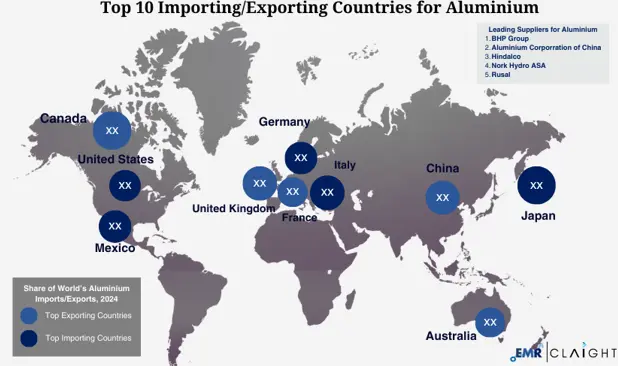

Expert Market Research pricing report on Aluminium covers the top 10 active trading countries/regions.

Aluminium prices exhibited notable fluctuations throughout 2024. Distinct cost structures and trade regulations across major economies including India, China, and the USA contributed to the regional price variances. The final quarter of 2024 saw a price increase from 2023 in October which was driven largely by persistent supply constraints. In Q1 2025, aluminium markets displayed mixed trends. North American and European ingot prices strengthened on tightening supply and rising input costs, while the APAC sheet market experienced price volatility due to fluctuating regional supply-demand conditions.

| Aluminium Price (USD/Ton) YoY Change, CFR China | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 2713 USD/MT | 2866 USD/MT | + 6% | Prices are likely to stay firm with Tight supply and Strong demand |

| November | 2676 USD/MT | 2636 USD/MT | - 1% | |

| December | 2665 USD/MT | 2780 USD/MT | + 4% | |

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

Overall, aluminium prices continued to find support from resilient demand across key industries such as construction, manufacturing, and clean energy. In 2024, Key contributing factors included export disruptions in Guinea, reduced bauxite production in Australia and Jamaica, and the removal of China’s 13% export tax rebate on semi-manufactured aluminium. Additionally, U.S. tariffs on aluminium imports intensified global trade friction, adding upward pressure on prices. Demand for aluminium remained strong, particularly in the electric vehicle (EV) and renewable energy sectors in China, amplifying the bullish outlook.

In H2 2024, aluminium prices are expected to remain volatile due to policy changes, supply chain disruptions, and trade uncertainties. The removal of China’s 13% export tax rebate in December 2024 has created market uncertainty, as it is unclear whether Chinese producers will lower prices to maintain exports or allow costs to rise for end users. Meanwhile, the market faces additional pressure from global alumina supply disruptions, trade barriers, and the closure of a major U.S. aluminium producer, limiting market expansion despite a 10% price increase from 2023.

Get Real-Time Prices (Monthly, Quarterly, and Yearly) - Download Free Sample

By January 2025, aluminium prices in India reached USD 2,573.40 per metric ton, reflecting a 1.27% month-over-month rise and a 17.36% year-over-year increase. Key drivers include supply constraints caused by alumina production disruptions, China’s policy shift eliminating tax rebates, and the U.S. government's 25% tariff on steel and aluminium imports, which have impacted global trade flows. These factors have tightened supply, increased production costs, and added market volatility, supporting elevated aluminium prices into 2025.

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| UAE | USA | Alcoa (USA) |

| Norway | Germany | Alumina Limited (Australia) |

| Canada | Japan | Chalco (China) |

| Bahrain | China | Emirates Global Aluminium (UAE) |

| Malaysia | Italy | Hindalco Industries (India) |

| USA | Poland | Norsk Hydro ASA (Norway) |

| Germany | Mexico | United Company RUSAL (Russia) |

| Italy | Turkey | China Hongqiao Group (China) |

The global aluminum trade is changing due to U.S. tariffs and China's production limits. In the U.S., some aluminum plants have shut down, and in China, energy shortages in areas like Yunnan have slowed output. On top of that, key suppliers like Australia and Jamaica are facing problems shipping bauxite, which is needed to make aluminum. All this has led to less aluminum being available worldwide, pushing prices up and making markets more uncertain.

In response to these issues, emerging producers like India and Indonesia are playing are filling the supply gaps. Their growing production capacities are helping to stabilize the global aluminum supply to some extent. However, the overall situation is still uncertain. As countries change their trade partnerships and adjust how they buy and sell aluminum, the market is expected to become more unstable. This instability, particularly in the European and U.S. markets, where the supply-demand imbalance is most acute. In the long run, these developments are likely to drive fluctuating aluminum prices, with potential spikes depending on geopolitical developments, energy availability, and the pace at which new production capacity comes online.

In 2024, aluminium prices increased largely due to a surge in bauxite and alumina costs. Bauxite prices increased by 50%, driven by supply disruptions in Guinea, Brazil, and China’s environmental regulations. This led to a sharp 70% rise in alumina prices, significantly impacting Aluminium smelting costs. Producers like Rusal reduced output by 6% due to high raw material costs. However, new bauxite and alumina capacities expected in China, India, and Guinea in 2025 may stabilize prices in the coming years.

The aluminium market in 2025 is influenced by geopolitical tensions, supply chain disruptions, and evolving demand. Concerns over global trade conflicts, including potential tariffs, could impact supply chains. Energy shortages, particularly in China’s Yunnan province, have led to production curtailments, tightening supply. Strong demand from the automotive and construction sectors is expected to support prices, with analysts projecting a 6.3% increase, making aluminium the best-performing base metal.

| Report Features | Coverage - Detail Report Annual Subscription |

| Product Name | Aluminium |

| Report Coverage | Price Forecasting and Historical Analysis: Monthly historical prices (2021-2024), short- and long-term price forecasts (2025-2026), scenario forecasts (most probable, optimistic, pessimistic) |

| Regional and Grade-wise Market Breakdown: The top 10 countries in terms of production, consumption, export, and import, regional insights (USA, North West Europe, China, India, South East Asia, Brazil, Mexico, South Africa, Nigeria, GCC, Japan, South Korea, etc.). | |

| Grade Wise Price Trends with Incoterms: Variation in price by product grade and specifications, and Incoterms. | |

| Price Drivers and Cost Structure: Feedstock correlations, production costs, market competition, government policies, economic factors | |

| Supply and Demand Analysis: Regional supply-demand analysis (North America, Europe, Asia Pacific, etc.), company-level and grade-level supply-demand, plant shutdown, expansion, force majeure, details | |

| Trade Balance Analysis: Historical deficit and surplus countries, net importers and exporters, Product movement, Supply Chain, Freight, Duties and Taxes | |

| Production Cost Breakdown: Direct and indirect cost breakdowns: raw material, labour, processing, packaging, overhead, R&D, taxes | |

| Profitability Assessment: Profit margin evaluations | |

| Industry News and Macroeconomic Context: Geopolitical events, policy updates, GDP, inflation, exchange rates, and their impact on coal prices | |

| Data Overview: Macroeconomic Impact, Supply-Demand, Government/Industry Inputs, Custom Insights | |

| Currency | USD (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customised based on the requirements of the customer |

| Post-Sale Analyst Support | Till the end of the subscription |

| Data Access | Lifetime Access, Visualisation |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Gain a competitive edge with Expert Market Research's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Our reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to quarterly or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimize procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share