Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global aerospace 3D printing market is expected to grow at a CAGR of 22.00% during the period 2026-2035. North America, Europe and Asia are expected to be key markets.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

22%

2026-2035

*this image is indicative*

| Global Aerospace 3D Printing Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | XX |

| Market Size 2035 | USD Million | XX |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 22.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 25.4% |

| CAGR 2026-2035 - Market by Country | India | 29.1% |

| CAGR 2026-2035 - Market by Country | China | 24.3% |

| CAGR 2026-2035 - Market by Technology | Polymerization | 27.3% |

| CAGR 2026-2035 - Market by End Use | OEM | 24.2% |

| Market Share by Country 2025 | Japan | 4.2% |

The Aerospace and Defence (A&D) industry adopted 3D printing very early and contributes heavily to its development. While some aerospace companies began using the technology back in the 1980s, the following decades witnessed a significant increase in the adoption of 3D printing. 3D printing is employed in all phases of the design workflow for applications in the aerospace industry. For example, in design communication; designs in the aerospace industry usually start as concept models displaying an aircraft component. These are generally also regularly employed for aerodynamic testing – an activity of vital importance in the aerospace domain. SLA and Material Jetting are employed to devise smooth, high-detail, scale models of aerospace designs.

Prototyping employing 3D printing is a common practice in the aerospace industry. From a full-size landing gear enclosure printed quickly with low-cost FDM, to a high-detail, full-colour control board concept model, there exists a 3D printing process fit for every prototyping need. Engineering materials for 3D printing also enable full testing and validation of prototype performance.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

3D printing has been significantly disruptive and valuable in the production of low-cost rapid tooling for injection moulding, thermoforming and jigs and fixtures. In the aerospace industry, this enables tooling to be quickly produced at lower cost and then employed to manufacture low to medium runs of parts. Such applications are expected to boost the global aerospace 3D printing market.

Considering that production volumes in the aerospace industry are usually large (over seventy thousand parts per year) 3D printing has been extensively employed as a prototyping solution rather than in the production of end parts. With improvements in the size and printing speed of industrial printers and the materials now available, 3D printing has emerged as a viable option for several medium-sized production runs, especially for high-end interior build-outs. 3D printing technologies are particularly impactful, especially to the aerospace industry when the cost of very intricate and unique components can be justified by a significant improvement in aircraft performance. Common 3D printing use-cases in aerospace include jigs and fixtures, surrogates, mounting brackets, and high-detail visual prototypes.

Aerospace applications employ sophisticated engineering materials and intricate geometries to decrease weight and enhance performance. Aerospace parts frequently include internal channels for internal features, conformal cooling, thin walls and complex curved surfaces. 3D printing is capable of producing such features and enables the construction of intricate, lightweight and highly stable structures. Such benefits of 3D printing are likely to boost the global aerospace 3D printing market. High degree of design freedom allows topological optimization of the parts and the integration of functional features into a single element. Further, 3D printing technologies like SLS, DMSL/SLM and Binder Jetting enable small batch production at reasonable unit costs.

Surface finish is vital to the aerospace industry. 3D printing parts can be post-processed to a achieve a very high degree of surface finish.

Some 3D printing processes include SLS, SLA, SLA & Material Jetting, DMLS/SLM, Material Jetting, and Material Jetting & SLA; materials used for aerospace applications include Glass-filled Nylon, Standard Resin, Nylon 12, Standard Resin, Castable Resin or Wax, Titanium or Aluminium.

| CAGR 2026-2035 - Market by | Country |

| India | 29.1% |

| China | 24.3% |

| UK | 20.1% |

| USA | 19.6% |

| Italy | 15.4% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

| Japan | 15.2% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Airbus has become a major user of additive manufacturing in the aerospace industry. Airbus installed the first titanium 3D-printed component for a serial production aircraft, and ever since, more intricate 3D-printed parts have been fitted in its aircraft. For example, Airbus A350 XWB carries over 1,000 3D printed parts; Airbus partnered with Swiss OEM Liebherr-Aerospace to source more serial produced 3D-printed components for it, with a printed nose landing.

Boeing has been trying 3D printing for a long time. In 2019, Boeing created the first 3D printed metal satellite antenna. The antenna was built for Spacecom, an Israeli company which successfully launched its AMOS 17 satellite. Using additive manufacturing, Boeing was able to replace several parts in large assembly with a single 3D printed part, decreasing the weight of the antenna and the time it took to manufacture.

Such adoption of 3D printing by leading companies and benefits experienced are likely to boost the global aerospace 3d printing market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

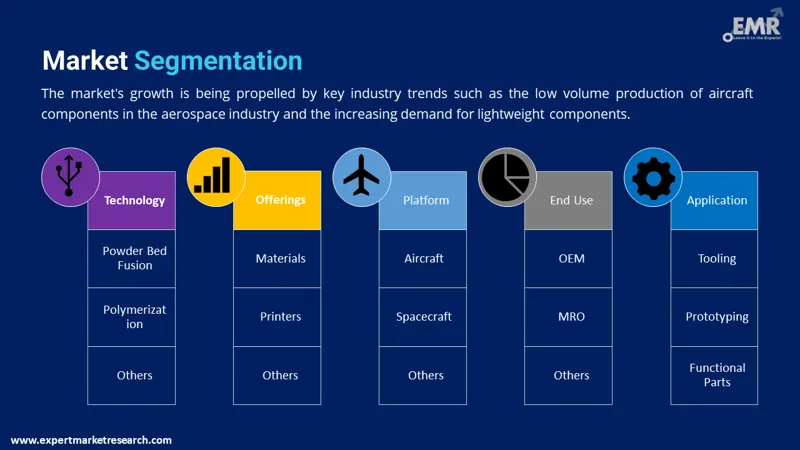

The EMR’s report titled “Aerospace 3D Printing Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

By technology, the market is segmented into:

By offerings, the market is classified into:

By platform, the market is divided into:

By end use, the market is segmented into:

By application, the market is divided into:

By region, the market is classified into:

The report presents a detailed analysis of the following key players in the global aerospace 3D printing market, looking into their capacity, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

The EMR report gives an in-depth insight into the industry by providing a SWOT analysis as well as an analysis of Porter’s Five Forces model.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global aerospace 3D printing market is projected to grow at a CAGR of 22.00% between 2026 and 2035.

The major drivers of the market include the need to reduce the production time of components, requirement for cost-efficient and sustainable products, advancements in 3D printing technology, increasing adoption of 3D printers into manufacturing processes across industries, and growing adoption by leading companies.

The low volume production of aircraft components in the aerospace industry and rising demand for lightweight components are the key industry trends propelling the market's growth.

Air ducts, wall panels, metal structural components, gasoline tanks, intricate gear cases and covers, transmission housings, structural hinges, lightweight engine parts, and other elements are among the lighter and more durable items that 3D printing can produce. It helps in creating sophisticated, complicated design geometries that maximise design performance in a aircraft.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The various technologies involved in the market are powder bed fusion, polymerisation, and material extrusion or fusion deposition modelling (FDM), among others.

Based on offering, the market is classified into materials, printers, software, and services.

The several platforms in the market are aircraft, spacecraft, and unmanned ariel vehicles (UAV).

The end-uses of the market are OEM and MRO.

The major applications of the market are tooling, prototyping, and functional parts.

Metal brackets that have a structural purpose inside of aircraft are made using aerospace 3D printing. As more prototypes are 3D printed, designers may improve the shape and fit of completed items.

The major players in the industry are Stratasys Ltd, 3D Systems, Inc., EOS GmbH Electro Optical Systems, Norsk Titanium US Inc., and Ultimaker BV, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Offerings |

|

| Breakup by Platform |

|

| Breakup by End Use |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share