Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global aerospace fasteners market was valued at USD 8.99 Billion in 2025. The industry is expected to grow at a CAGR of 7.30% during the forecast period of 2026-2035 to reach a value of USD 18.19 Billion by 2035. This market growth is mainly driven by the rising global focus on defense modernization and military aircraft procurement.

Fighter jets, helicopters, and transport aircraft are among the most fastening-intensive platforms in aviation, with every component requiring precision-engineered fasteners that can withstand extreme operational conditions. As nations expand defense budgets and pursue greater self-reliance in aerospace production, the need for advanced fastening solutions has become inseparable from broader military modernization strategies.

Government investments are at the core of this trend. To cite a prime instance, India’s defense production grew substantially since the launch of the "Make in India" initiative, reaching a record INR 1.27 lakh crore in FY 2023-24. Alongside this, the nation’s defence exports rose to INR 23,622 crore in FY 2024-25, reflecting both stronger self-reliance and a growing presence in global defense supply chains. Indigenous fighter jet and helicopter programs, supported by this momentum, are expected to boost aerospace fasteners demand in the coming years.

In Europe, similar patterns can be seen. France and Germany are pushing forward with the Future Combat Air System (FCAS), a joint project valued at more than EUR 100 billion, designed to deliver a next-generation fighter jet by 2040. This program combines manned aircraft with drones and advanced defense cloud systems, reflecting how military modernization is reshaping aerospace manufacturing requirements. Large-scale projects of this nature directly translate into sustained demand for advanced fasteners that meet rigorous quality and safety standards.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.3%

Value in USD Billion

2026-2035

*this image is indicative*

The expansion of aftermarket and MRO demand is a key growth driver for the global aerospace fasteners market. Fasteners are high-replacement items due to wear and stringent safety requirements, creating consistent demand during maintenance cycles. Airlines and defense operators require certified, durable fasteners to ensure fleet reliability. In July 2025, FDH Aero, through its FDH Hardware division, signed a two-year contract with MS Aerospace, reinforcing supply availability for both new aircraft builds and aftermarket requirements.

The growing need for next-generation fastening solutions is boosting the global aerospace fasteners market, as aircraft manufacturers adopt advanced materials and automated production processes. Modern aerospace platforms require lighter, stronger, and more adaptable fasteners to ensure efficiency and safety in both composite and metallic structures. Addressing this need, in February 2025, TriMas Aerospace expanded its multi-year global contract with Airbus, introducing newly qualified fastening systems optimized for robotic assembly and next-generation aircraft programs.

The rising demand for high strength, engineered fasteners in defense programs is fueling the global aerospace fasteners market growth. Advanced fighter aircraft and military platforms require specialized fastening solutions to ensure safety, durability, and performance under extreme operating conditions. Reflecting this trend, in July 2025 FDH Hardware brand AIAP signed a two-year agreement with MS Aerospace to supply high-strength fasteners for the Lockheed Martin F-35 program, reinforcing the growing role of defense projects in shaping fastener demand.

The shift toward digital procurement and eCommerce is fueling the global aerospace fasteners market, improving supply chain efficiency and minimizing aircraft downtime during maintenance and repair operations. Procurement teams, especially younger digitally native professionals, increasingly rely on online platforms for faster fulfilment. For instance, In August 2024, Montage Partners invested in Military Fasteners, a leading B2B eCommerce distributor that has grown revenue nearly five-fold since 2019, showcasing how digital-first models are transforming the industry.

The growing emphasis on quality assurance and operational efficiency is driving aerospace fastener manufacturers to adopt automated inspection systems. These systems provide precise dimensional measurement and visual defect detection, reducing human error and ensuring consistent product quality. For instance, on May 2024, General Inspection installed the Gi-100DT system for a major aerospace fastener producer, enabling inspection of up to 300 parts per minute, rapid part changeovers, and comprehensive detection of surface and internal defects, highlighting technology-driven production improvements.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Aerospace Fasteners Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Key Insight: Nuts and bolts dominate the product landscape, as they are indispensable in aircraft assembly, particularly for structures and engines requiring high durability. Rivets represent the fastest-growing segment, driven by the demand for lightweight fastening solutions and ease of installation in modern airframes. Screws and other fasteners serve specialized roles but contribute steadily. Together, these categories shape the growth of the global aerospace fasteners market, with nuts and bolts retaining the largest share while rivets accelerate rapidly.

Market Breakup by Material Type

Key Insight: Alloy steel fasteners hold the largest share, supported by their superior strength and widespread use in critical aircraft structures and engines. Titanium fasteners are the fastest-growing segment, benefiting from their lightweight and corrosion-resistant properties that align with next-generation aircraft designs. Aluminium fasteners remain important for applications where weight reduction is critical, while other materials cater to niche needs. Together, these categories drive the growth of the global aerospace fasteners market with distinct performance advantages.

Market Breakup by Application

Key Insight: Fuselage applications account for the largest share, as fasteners are extensively used in assembling the main aircraft body, where strength and safety are critical. Control surfaces represent the fastest-growing segment, driven by rising production of advanced aircraft requiring precision components for flight stability. Interior applications also contribute significantly with increasing demand for lightweight cabin fittings, while other uses address specialized needs. These applications collectively shape demand in the global aerospace fasteners market.

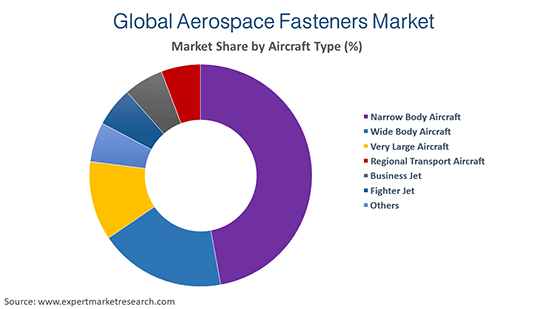

Market Breakup by Aircraft Type

Key Insight: Narrow body aircraft hold the largest share in the global aerospace fasteners market, supported by rising short-haul travel and fleet expansions by low-cost carriers. Fighter jets are the fastest-growing segment, driven by increasing defense spending and military modernization programs worldwide. Wide body aircraft maintain steady demand for long-haul routes, while regional transport aircraft, business jets, and very large aircraft serve specialized niches. Collectively, these categories ensure consistent fastener requirements across commercial and defense aviation.

Market Breakup by End-Use

Key Insight: Commercial aviation represents the largest share in the global aerospace fasteners market, driven by fleet expansion, rising passenger traffic, and demand for lightweight, fuel-efficient aircraft. Defense is the fastest-growing segment, supported by increasing military aircraft procurement, modernization initiatives, and geopolitical tensions boosting investments in fighter jets and helicopters. Other applications contribute steadily through niche aerospace programs. Together, these end-use segments reinforce strong and sustained demand for advanced fastening solutions across the industry.

Market Breakup by Region

Key Insight: North America dominates the global aerospace fasteners market, supported by the presence of major aircraft manufacturers, strong defense investments, and a robust MRO ecosystem. Asia Pacific is the fastest-growing region, driven by rising air travel, expanding commercial fleets, and government-backed aerospace programs in countries like China and India. Europe remains significant with advanced aircraft programs and defense collaborations, while Latin America and the Middle East & Africa provide steady opportunities through regional fleet expansion and defense procurement.

By product, nuts and bolts witness high demand

Nuts and bolts generate substantial revenue in the global aerospace fasteners market driven by their critical role in aircraft assembly. These components ensure structural integrity and reliability in high-stress applications, such as engines and fuselage frameworks. The increasing production of commercial and defense aircraft continues to boost demand for these durable fastening solutions. Large-scale fleet expansions by airlines and defense forces globally highlight the essential requirement for high-quality nuts and bolts in assembly operations.

Rivets demonstrate notable growth in the global aerospace fasteners market propelled by the shift toward lightweight and efficient aircraft designs. Their ease of installation and ability to maintain structural stability make them ideal for modern airframes seeking fuel efficiency and reduced weight. Rising adoption in new-generation aircraft programs and retrofitting projects is accelerating growth. For instance, initiatives like Airbus’ and Boeing’s focus on lighter fuselage components underscore the increasing reliance on rivets across commercial and defense aviation sectors.

By material type, alloy steel to gain significant traction

Alloy steel fasteners dominate the global aerospace fasteners market due to their exceptional strength, durability, and reliability in critical aircraft structures and engine assemblies. Their ability to withstand high stress and extreme operational conditions makes them indispensable for both commercial and defense aircraft. Growing aircraft production and maintenance activities globally continue to reinforce the demand for alloy steel fasteners, ensuring structural safety and long-term performance across high-pressure and high-temperature applications.

On the other hand, titanium fasteners, driven by the demand for lightweight, high-strength, and corrosion-resistant materials in modern aircraft. Their adoption is particularly prominent in next-generation airframes and engine components, where weight reduction is crucial for fuel efficiency and performance. Programs emphasizing advanced aerospace materials, including new commercial aircraft and military fighter jets, highlight titanium fasteners as a preferred solution, accelerating their market growth and establishing them as a key enabler of modern aircraft design.

By application, fuselage leads the market growth

Fuselage applications amass substantial revenue, driven by the critical need for structural integrity and safety in aircraft assembly. Fasteners in the fuselage ensure that the main body endures operational stresses while maintaining long-term durability. Rising production of commercial and defense aircraft globally has intensified demand for high-performance fasteners in fuselage applications, establishing this as the largest segment in the global aerospace fasteners market.

Control surface applications are picking up pace propelled by the demand for precision and reliability in aircraft stability and maneuverability. Fasteners in control surfaces, including ailerons, rudders, and elevators, must withstand dynamic aerodynamic forces while enabling smooth movement. The increasing production of advanced commercial and defense aircraft, along with evolving design requirements, has driven rapid adoption of specialized fasteners, making control surfaces a key growth driver in the global aerospace fasteners market.

By aircraft jet, narrow-body aircrafts represent biggest portion of the market

Narrow-body aircraft hold the largest share in the global aerospace fasteners market, primarily driven by rising short-haul travel and fleet expansions by low-cost carriers. Fasteners in these aircraft play a critical role in maintaining structural integrity and reliability during frequent flight operations. The increasing production of narrow-body jets worldwide has intensified demand for high-performance fastening solutions, ensuring durability, safety, and operational efficiency, thereby solidifying this segment as a key revenue contributor in the aerospace fasteners market.

Fighter jets category showcases notable growth in the global aerospace fasteners market, propelled by rising global defense spending and military modernization programs. Fasteners in fighter jets are required to withstand extreme operational conditions, including high speeds, pressures, and mechanical stresses. The increasing adoption of next-generation military aircraft and advanced defense technologies has escalated the demand for precision-engineered fasteners. This growth highlights the critical role of high-strength aerospace fasteners in supporting the expanding global defense aviation sector and sustaining fighter jet production worldwide.

By end-use, commercial category accounts for the largest revenue share

The commercial category generates the highest revenue in the aerospace fasteners market, driven by airlines expanding and modernizing their fleets to meet rising passenger traffic and enhance operational efficiency. Large-scale aircraft procurement significantly increases the demand for fasteners, rivets, and structural components across assembly lines. For instance, Thai Airways’ June 2025 plan to acquire 80 new Boeing aircraft as part of its business recovery strategy exemplifies how commercial fleet growth continues to underpin strong market revenues globally.

The defense segment in the aerospace fasteners market is driven by increasing government investments in advanced aircraft programs and military modernization. Countries are not only procuring new fighter jets and transport aircraft but also funding next-generation manufacturing technologies to strengthen their defense base. For instance, at the Paris Air Show 2025, the United Kingdom government announced over EUR250 million in funding for green aerospace projects, including additive manufacturing and aerostructures, explicitly highlighting defense sector growth as a key pillar of its national industrial strategy.

By Region, North America dominates the market growth

North America leads the global aerospace fasteners market attributed to the ongoing fleet modernization and rising production of next-generation aircraft. The United States, home to major manufacturers like Boeing and Lockheed Martin, continues to ramp up aircraft output to meet surging commercial and defense demand. In 2023, Boeing significantly increased 737 MAX and 787 Dreamliner production to address airline backlogs, while Lockheed Martin advanced F-35 deliveries under multi-year defense contracts. These programs not only expand the fleet but also create sustained demand for advanced, lightweight, and durable fasteners across the region.

Meanwhile, the rapid expansion of aircraft fleets in the Asia Pacific region is strengthening its position in the global aerospace fasteners market. With rising passenger traffic and new route developments, there is a high demand for fasteners. Boeing’s 2025 outlook highlights that India and South Asia’s airplane fleet is set to nearly quadruple by 2043, with single-aisle jets dominating deliveries to serve short and medium-haul routes. This unprecedented fleet growth directly translates to higher consumption of fasteners for aircraft assembly, maintenance, and lifecycle upgrades across the region.

Key aerospace fasteners companies are prioritizing innovation and advanced engineering to align with the rising demand for lightweight, high strength fastening solutions. Their strategies revolve around developing precision components that enhance fuel efficiency, structural reliability, and safety standards in modern aircraft. Continuous investment in research and compliance with stringent aviation regulations remains central to sustaining growth and meeting the evolving requirements of both commercial and defense aviation sectors.

In addition to product innovation, global aerospace fasteners market players are expanding global footprints through acquisitions, strategic partnerships, and the establishment of modernized production facilities. Emphasis is being placed on automation, digital supply chain integration, and smart manufacturing technologies to optimize efficiency and reduce turnaround times. Strengthening collaborations with original equipment manufacturers and defense organizations ensures steady demand while enhancing competitiveness in the increasingly technology-driven and regulated aerospace fasteners industry.

Founded in 1843 and headquartered in New Britain, Connecticut, Stanley Black & Decker Inc. is a global leader in industrial tools, engineered fastening systems, and storage solutions. The company serves aerospace, automotive, construction, and energy industries with advanced fastening technologies. Its long-standing heritage and continuous innovation make it a trusted partner across critical sectors.

Established in 1953 and based in Portland, Oregon, Precision Castparts Corp. is a leading manufacturer of complex metal components and fasteners for aerospace and power generation markets. The company provides high-strength fasteners, structural castings, and forged products used in aircraft engines and industrial applications. Its reputation is built on precision engineering and stringent quality standards.

LISI Aerospace, founded in 1777 and headquartered in Paris, France, is a major supplier of advanced fastening and assembly solutions to the global aerospace and defense industries. The company manufactures critical structural fasteners and components for leading aircraft manufacturers. With centuries of expertise, it continues to drive innovation in lightweight, high-performance aerospace fastening technologies.

TriMas Corporation, established in 1986 and headquartered in Bloomfield Hills, Michigan, operates as a diversified manufacturer with strong presence in aerospace fasteners and engineered products. The company supports both commercial and defense aviation with specialized fastening solutions. Its focus on innovation, reliability, and global supply capabilities ensures a competitive position in the aerospace sector.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other prominent players in the global aerospace fasteners market include The Boeing Company, and National Aerospace Fasteners Corporation, among others.

Explore the latest trends shaping the Global Aerospace Fasteners Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Get a free sample report or contact our team for customized consultation on global aerospace fasteners market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 7.30% between 2026 and 2035.

Key strategies driving the market include investing in research & development to develop lightweight and high-strength fasteners. Companies are expanding through acquisitions and strategic partnerships. Automation and smart manufacturing improve efficiency. Digital procurement enhances supply chains. Collaborations with commercial and defense aircraft manufacturers secure long-term contracts and market stability.

Increasing passenger willingness to fly by air, rising import and export operations and the increasing acceptance of advanced production technologies are the key market trends propelling the market's growth.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The products include nuts and bolts, rivets, and screws, among others.

The various material types of aerospace fasteners in the market are aluminium, alloy steel, and titanium, among others.

Aerospace fasteners find their major applications in fuselage, control surfaces, and interior, among others.

The significant aircraft types in the market are narrow body aircraft, wide body aircraft, very large aircraft, regional transport aircraft, business jet, and fighter jet, among others.

The end uses of the market include commercial and defence, among others.

The key players in the market include Stanley Black & Decker Inc., Precision Castparts Corp., LISI Aerospace (SAS), Trimas Corporation, The Boeing Company, National Aerospace Fasteners Corporation, among others.

In 2025, the global aerospace fasteners market reached an approximate value of USD 8.99 Billion.

North America holds the largest share. Strong defense spending, major aircraft manufacturers, and fleet modernization drive demand. A well-established MRO ecosystem supports consistent requirements for advanced fasteners in commercial and defense aviation.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Material Type |

|

| Breakup by Application |

|

| Breakup by Aircraft Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share