Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Africa green cement and concrete market size reached around USD 594.47 Million in 2025. The market is estimated to grow at a CAGR of 10.70% between 2026 and 2035, reaching a value of USD 1642.88 Million by 2035.

Base Year

Historical Period

Forecast Period

Africa has the presence of more than 4.6 million square meters of EDGE-certified floor space.

Reportedly, in Sub-Saharan Africa, the population is estimated to double by 2050, offering a USD 768 billion investment opportunity for green future construction until 2030.

The green-certified office buildings in South Africa showcase a 4.5% lower electricity usage, and 14.3% lower water usage per square metre as compared to non-certified office buildings.

Compound Annual Growth Rate

10.7%

Value in USD Million

2026-2035

*this image is indicative*

Green Cement is an eco-friendly cement that employs a carbon-negative method of production. The primary raw materials utilised in the production of green cement are typically wastes that have been discarded by various industries. Commonly used industrial wastes for green cement production include slag and fly ash. Green cement construction offers substantial benefits by minimising industrial waste disposal which tends to be a substantial contributor to land pollution.

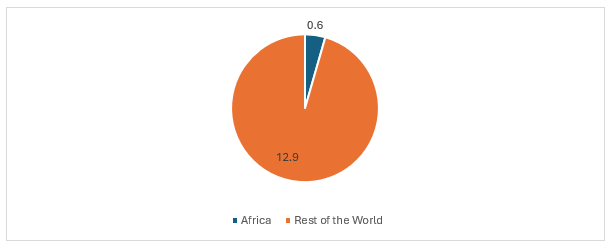

Figure: Size of the Construction Market, 2023, USD Trillion

Countries in Africa are heavily investing in construction projects, both infrastructure and superstructure. The construction industry is among the rapidly growing sectors on the continent. The rising population and urbanisation in the continent are contributing to the strong growth of the construction sector. The increasing demand for sustainable building and construction materials supports the Africa green cement and concrete market expansion.

Significant presence of raw materials; the expanding construction sector; rising importance of green building materials and their manufacturing; and the expansion of affordable housing are the major factors impacting the Africa green cement and concrete market growth.

There is a high availability of a variety of local raw materials for use in cement and concrete production in Africa. The potential of agricultural wastes and natural mineral resources as supplementary cementitious materials, fibrous constituents, and chemical admixtures are anticipated to be significant for the local market growth.

The rapidly growing construction sector owing to rapid urbanisation and industrialisation is expected to propel the use of green concrete in buildings, roads, and mass construction projects. With interest and commitment growing in sustainability and energy efficiency for both buildings and infrastructure, the demand for green cement in Africa is anticipated to increase in the coming years.

Cement manufacturers are replacing energy-intensive clinkers with substitutes, such as natural and artificial pozzolans like energetically modified cement and calcined clays, aiding the production of green building materials.

There is a rising interest in Africa for affordable housing, primarily driven by a growing population. Multiple mortgage liquidity facilities are being established in Kenya, Francophone West Africa, Nigeria, Tanzania, and Egypt that are promoting affordable housing in the region.

The World Green Building Council is putting in efforts to increase the sustainability of Africa’s commercial property sector. For instance, in South Africa, the Council is promoting green building practices by providing the necessary tools, training, and knowledge to Africans. Members of the Green Building Councils (GBCs) across the region include South Africa, Mauritius, Ghana, Rwanda, Kenya, Zambia, Tanzania, and Namibia.

In the African region, there is a growing development of larger and more complex construction projects owing to rapid urbanisation, economic growth, a growing middle-class population, and regional integration. Further, the expanding population has increased the demand for affordable housing and schools in Africa. Reportedly, the continent saw an increase in construction projects by 20% in 2021 from 385 projects in 2020.

The demand for cost-effective, sustainable alternatives to traditional cement has supported the use of green cement to produce mortar for brick and block; and laying, rendering, plastering and repair works.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Africa Green Cement and Concrete Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Raw Material

Market Breakup by End Use

Market Breakup by Countries

Based on type, green cement dominates the Africa green cement and concrete market share while the green concrete segment is expected to offer lucrative growth opportunities to the market

There is a huge potential to boost the production of green cement in Africa owing to the abundance of clinker substitutes, such as fly ash, and slag, in South Africa and Nigeria, and calcined clay in West Africa.

Meanwhile, the abundance of industrial, agricultural, and natural waste materials, such as fly ash, rice husk ash, corncob ash, sugarcane bagasse, and volcanic ash, provides easy accessibility to raw materials for green concrete manufacturers.

The rising urbanisation in Africa is necessitating a high amount of concrete, providing an opportunity to convert the abundant agricultural waste materials into sustainable concrete.

Based on raw material, ground granulated blast-furnace slag based products account for a significant share of the Africa green cement and concrete market

As ground granulated blast-furnace slag (GGBS) is a low CO2, high-quality material, it has aided the development of green concrete to facilitate sustainable construction. Additionally, due to its excellent self-cementing properties, finely grounded granulated blast-furnace slag has been used to produce durable green concrete.

Further, there is also a surge in awareness regarding the benefits of fly ash in reducing the carbon footprint and cost of concrete while improving its workability and strength.

As power plants in countries like Morocco and South Africa produce a large amount of fly ash, it can potentially aid in developing geopolymer concrete, such as pre-cast heat-cured structural elements for buildings, further supporting the Africa green cement and concrete market growth.

The market players are focusing on expanding their geographical presence by continuously innovating their product range and launching cement and concrete with low CO2 emissions.

East African Portland Cement Company is Kenya's leading cement manufacturer offering products for the construction sector for housing, education, health, tourism, transport, and communication.

Headquartered in Italy, Buzzi Unicem manufactures, distributes, and sells cement, ready-mix concrete, and aggregates. The group has manufacturing plants in several countries, which also represent the natural outlet for its goods and services.

PPC Ltd is a leading producer of cement and related products in South Africa with seven integrated cement plants and seven grinding stations, two fly ash plants and five aggregate quarries.

Suez Cement, a subsidiary of HeidelbergCement, is one of the largest cement producers in Egypt with four production facilities across Suez, Kattameya, Tourah, and Helwan.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the Africa green cement and concrete market are Afrisam (South Africa) Properties (Pty) Ltd, Holcim Ltd, and CEMEX S.A.B. DE C.V., among others.

Increased consumption of construction materials has generated considerable carbon emissions, particularly with the production of Ordinary Portland Cement (OPC). As a result, conventional concrete has been replaced with green concrete in the Egyptian residential sectors for non-structural concrete applications, thus contributing to the Africa green cement and concrete market development.

As Nigeria’s population continues to grow and get wealthier, its construction sector is anticipated to witness steady growth. The development of new projects provides an opportunity for the incorporation of green cement to build more environmentally friendly structures in the country.

Additionally, large amounts of fly ash, a raw material for green cement manufacturing, are produced by industrial plants in the region. The use of this waste is expected to increase, to prevent environmental degradation and pollution caused by disposing of it in landfills.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market reached a value of USD 594.47 Million in 2025.

The market is projected to grow at a CAGR of 10.70% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 1642.88 Million by 2035.

The raw materials are ground granulated blast-furnace slag-based, fly ash based, silica fume based, and others.

The major countries include Egypt, Nigeria, Algeria, South Africa, Morocco, Kenya, and others.

The major end uses include residential, commercial, infrastructure, and industrial.

The factors driving the market growth include favourable government initiatives, and the rising green construction sector amidst the growing concerns regarding environmental protection and sustainability.

The key players in the market include East African Portland Cement Company (EAPCC), Buzzi Unicem S.p.A., PPC Ltd, Suez Cement Group of Companies, Afrisam (South Africa) Properties (Pty) Ltd, Holcim Ltd, and CEMEX S.A.B. DE C.V., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Raw Material |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Price Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share