Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global agrochemicals market size reached around USD 247.36 Billion in 2025. The market is projected to grow at a CAGR of 3.10% between 2026 and 2035 to reach nearly USD 335.67 Billion by 2035.

Base Year

Historical Period

Forecast Period

The United States, according to FAO, dominated the world market in fertiliser production in 2021 with 54.4 million tonnes, hence clearly depicting its leadership in the agricultural sector and capacity to support either domestic or international agricultural demand.

As per agrochemicals market analysis, it was closely followed by India at 52.6 million tonnes due to its considerably large agrarian base and the critical role of fertilisers in enhancing crop yield in economies that are primarily agrarian in nature.

Russia was the third largest with 51.9 million tons, drawing from vast natural resources and immense industrial infrastructure to hold a strong position within the world fertiliser market.

Canada: 36.5 MMT due to the large amount of resources and high technology in the manufacture of fertilisers.

Compound Annual Growth Rate

3.1%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Agrochemicals Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 247.36 |

| Market Size 2035 | USD Billion | 335.67 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 3.10% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 3.6% |

| CAGR 2026-2035 - Market by Country | India | 4.1% |

| CAGR 2026-2035 - Market by Country | China | 3.4% |

| CAGR 2026-2035 - Market by Product | Pesticides | 3.5% |

| CAGR 2026-2035 - Market by Nature | Bio Based | 3.8% |

| Market Share by Country 2025 | France | 3.2% |

Agrochemicals are synthetic chemicals or biological compositions used in agriculture, floriculture, and horticulture to increase crop quality and yield. Fertilisers, adjuvants, pesticides, and plant growth regulators are common examples of agrochemicals. These agrochemicals can be bio-based or synthetic, and specific applications tend to vary depending upon the type of crop or plantation being grown.

One of the unique drivers pushing the growth of the agrochemicals market is the growing demand for precision agriculture. The market witnessed increased growth and innovation as farmers quickly started adopting technologies that use agrochemicals more precisely to increase crop productivity and promote a cleaner environment.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Increasing food demand globally, shortage of agricultural land and introduction of bio-based agrichemicals are some factors shaping up new agrochemicals market dynamics and trends.

The growing demand for food is one of the key agrochemicals market trends. Population growth has boosted food consumption worldwide, increasing the demand for agricultural goods, leading to a rise in the usage of agricultural chemicals to improve crop yield. As a result, it has become necessary to utilise agrochemicals, such as fertilisers and pesticides, to meet the growing demand for food.

Shortage of agricultural land attributable to population increase and damage to existing arable land has increased the importance of maximising yield from available agricultural spaces and is a key trend of the agrochemicals market. Through the use of agrochemicals, production from limited land can be increased and the soil quality also improved for future planting, which is driving the agrochemicals market growth.

To produce high-quality agrochemicals, ongoing research and development efforts are being made. Development of high-quality bio-based agrichemicals that are safe around humans and animals, and can improve crop yield, is likely to support the market growth for agrochemicals further in the coming years.

Two of the major trends in agrochemicals include the turn towards sustainable practices and the rise of digital agriculture. Many companies are developing eco-friendly and bio-based agrochemicals to decrease the impact on the environment and improve soil health through regulatory pushes and consumer demand. Similarly, changing agriculture is the advent of digital tools and data analytics. Different advanced technologies are pushing the demand of the agrochemicals market. This includes drones, sensors, and artificial intelligence, which will be used to make farming really 'precise,' apply agrochemicals in an optimum fashion, and improve efficiency and productivity.

Fertiliser And Pesticide Application Growth, To Enhance Agricultural Practices, Drives The Demand For Agrochemicals.

Indonesia and Poland with 11.7 and 10.6 million tonnes put forward regional players, big in contribution to the world's fertiliser’s supply. High clockwise agricultural practices in Indonesia and high expertise in farming techniques in Poland drive up the levels of production.

Saudi Arabia and Trinidad and Tobago are also among the big producers, boasting outputs of 7.8 million and 7.1 million tonnes respectively, the figures shadowing the massively important manner in which these countries position their natural gas reserves to manufacture nitrogen-based fertilisers which are so key to global agricultural productivity. With an output of 6.3 million tonnes, Ukraine underlines the importance of Eastern Europe in the fertiliser market despite geopolitical tensions; Lithuania produced 4.2 million tonnes, bolstering the agrochemicals demand growth globally.

For 2021, the indicator of pesticide use, in kilograms per hectare of cropland, had very high variability among different regions, which indicates that different agricultural practices and strategies were used in pest management. For South America, mainly represented by Brazil, the use was high, above 10 kg per hectare. Other parts of Western Europe, notably France and Spain, also reported high pesticide use, between 2.5 to 5 kg per hectare, due to the intensive farming methods and demands for sustaining high productivity in densely cultivated farmland areas. On the other hand, several countries in Africa and parts of Asia, such as India and Indonesia, showed low pesticide use, normally less than 1 kg per hectare. North America, the United States in particular, showed quite moderate levels of pesticide use. Generally, it fluctuated from 1 to 5 kg per hectare mostly due to a compromise between large-scale industrial farming and strict regulatory methods. Factors such as these affect the growth of the agrochemicals industry.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

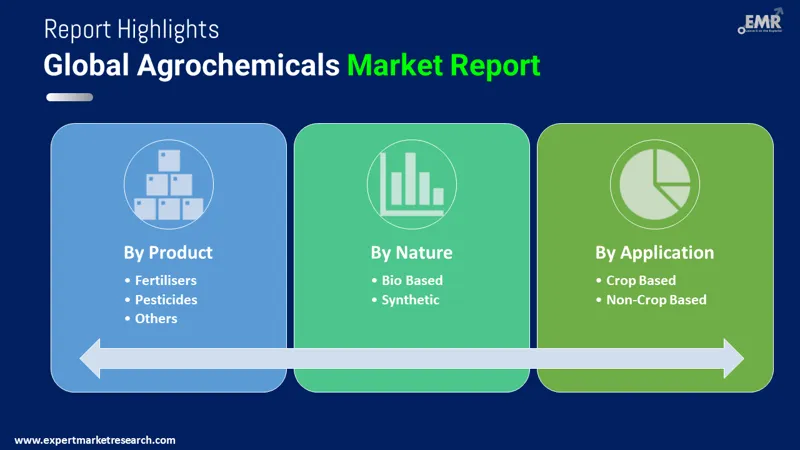

“Global Agrochemicals Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Based on product, the market is divided into:

On the basis of nature, the market is bifurcated into:

The global agrochemical market on the basis of application is segmented into:

The regional markets for agrochemicals are divided into:

Crop Based Application To Gain Traction For The Use Wide Of Fertilisers Used During Their Growth

As per agrochemicals market analysis, crop-based applications account for a sizable share of the agrochemicals market, particularly cereals and grains types of crops as cereals and grains are commonly grown with the use of fertilisers. Cereals and grains are among the most common crops consumed worldwide, particularly in Asian nations, and a significant amount of the world's agricultural land is also utilised for these crops. The increased consumption of cereals and grains including rice, wheat, rye, corn, oats, sorghum, and barley in diverse locations is increasing the demand for crop based applications of agrochemicals. Another crop type increasing the applications of agrochemicals in crops are fruits and vegetables, due to an increase in global demand for fresh produce as people grow more health conscious.

The agrochemicals industry in Asia Pacific region is one of the leading regions in the market for agrochemicals as it is a leading producer of agricultural products worldwide. Crops such as grains and cereals, pulses, and vegetables are widely cultivated in Asia Pacific nations like India, China, and Japan, using agrochemicals. Additionally, the region's growing population is fuelling the demand for food, resulting in increased usage of fertilisers and pesticides to increase crop productivity and protect crops.

| CAGR 2026-2035 - Market by | Country |

| India | 4.1% |

| China | 3.4% |

| USA | 2.8% |

| France | 2.4% |

| Italy | 2.2% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

| Japan | 2.1% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Some of the key players in the agrochemicals market develop a craving for advanced, sustainable solutions to enhance crop yield while reducing environmental impact with this, thus driving innovation in eco-friendly products and technologies related to precision agriculture.

Corteva AgriScience, founded in 2019 with its headquarters in Indiana in the United States, combines market-leading discoveries, high-touch customer interaction, and operational execution for the most urgent agricultural concerns in the world. The company has a unique distribution approach and a well-balanced combination of products and services for crop protection and seeds.

The Mosaic Company, established in 2004 and headquartered in Florida in the United States, is a leader in the worldwide crop nutrient market and has the capacity to generate and transport phosphate and potash, two essential crop nutrients, on a large scale. The entire crop nutrition process is handled by Mosaic, from resource extraction to the production of feed, industrial products, and crop nutrients for clients globally.

Nutrien Ltd., with its headquarters in Saskatoon, Canada is one of the largest providers of crop inputs, services, and solutions in the world. By assisting farmers in increasing food production in a sustainable way, Nutrien is supporting feeding of the future. The company was established in 2018 is one of the biggest producers of nitrogen and phosphate in the world, as well as significant capacity production for potash.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other market players profiles in the agrochemicals market report include Solvay S.A., Clariant AG, Evonik Industries AG, Ashland Global Holdings Inc., BASF SE, Nufarm Ltd, and Yara International ASA, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 247.36 Billion.

The market is projected to grow at a CAGR of 3.10% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 335.67 Billion by 2035.

The major drivers of the market include the rising demand for fertilisers, increasing usage of crop protection products, and growing production of advanced agrochemicals.

Rise in food demand and development of crop-specific agrochemicals are key trends propelling the growth of the market.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The major applications of agrochemicals in the market are crop based and non-crop based. Crop based are further divided into grains and cereals, pulses and oilseeds, and fruits and vegetables whereas non-crop based are sub-divided into turf and ornamental grass, among others.

The various products of agrochemicals in the market are fertilisers, pesticides, adjuvants, and plant growth regulators, among others.

The primary natures of agrochemicals are bio-based and synthetic.

The major players in the agrochemicals market are Solvay S.A., Clariant AG, Evonik Industries AG, Ashland Global Holdings Inc., BASF SE, Corteva AgriScience, The Mosaic Company, Nutrien Ltd., Nufarm Ltd, and Yara International ASA, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Nature |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share