Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global aloe vera market size reached around USD 834.29 Million in 2025. The market is projected to grow at a CAGR of 8.50% between 2026 and 2035 to reach nearly USD 1886.32 Million by 2035.

Base Year

Historical Period

Forecast Period

Manufacturers in the food and beverage sectors are readily launching products containing aloe vera such as tea and juices.

Thailand represents the leading producer of aloe vera, holding more than a third of the total global production.

There is a growing trend towards sustainable and organic farming practices in the cultivation of aloe vera.

Compound Annual Growth Rate

8.5%

Value in USD Million

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Aloe vera is widely known for its healing and restorative properties and has thick and succulent green leaves that contain gel and latex. The gel comprises primarily of water, and the rest includes various vitamins, enzymes, hormones, amino acids, minerals, and sugars, the majority of which are found in the human body. It is an extensively used product in the cosmetics and toiletries, food, and pharmaceutical sectors.

The aloe vera market growth is driven by the therapeutic properties of the product, due to which the product is used in various end-use sectors, including food and beverages, cosmetics, and pharmaceuticals. The product is employed in the healthcare sector in the production of different products, such as tonics, capsules, tablets, salves, and supplements and is used by several people to treat wounds and various skin ailments at home. It has also demonstrated promising results in the treatment of psoriasis, sugar levels, lowering LDL, and increasing HDL. In the cosmetic sector, the plant offers several applications in organic and herbal products, further enhancing aloe vera market growth. The product is an essential ingredient in hair tonics, hair masks, conditioners, eyeliners, sunblocks, shampoos, etc.

Growing preference for natural and organic ingredients; cultural acceptance and traditional use; innovations in aloe vera processing and product development; are the major trends impacting the aloe vera market expansion.

Consumers increasingly prefer products with natural and organic ingredients over synthetic ones, positioning aloe vera as a desirable component across various end-use sectors.

In many cultures, aloe vera has been traditionally used for its medicinal properties, and this cultural acceptance supports its sustained demand.

Technological advancements in processing methods have made it easier to incorporate aloe vera into various products, enhancing its appeal and expanding its range of applications.

In some regions, government initiatives and investments in aloe vera cultivation and research are promoting the sustainable growth of the market.

Technological advancements in processing methods have significantly impacted the aloe vera market by facilitating the extraction and stabilisation of aloe vera, thereby expanding its range of applications. Modern processing technologies allow for the preservation of aloe vera's beneficial properties, such as its vitamins, enzymes, minerals, and amino acids, during extraction and production. This means that the aloe vera used in products is of higher quality and efficacy, making it more appealing to consumers looking for effective natural products.

New market players are expanding their product portfolio and promoting aloe vera market development by incorporating aloe vera in their products. Dettol, a well-known brand in the antiseptic soap category, announced in September 2023 that it has expanded its product line by introducing a new variant of soap called Dettol Aloe Vera. The addition of aloe vera to the soap aims to provide extra care for the skin while still offering the germ-protection qualities that Dettol is known for.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Aloe Vera Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

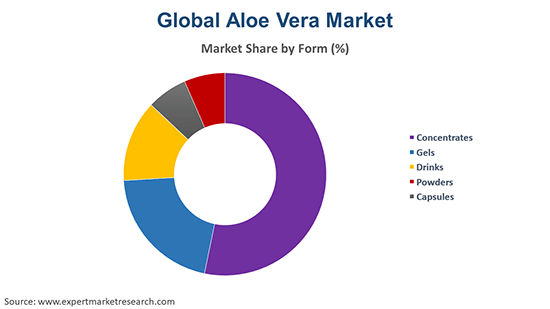

Market Breakup by Form

Market Breakup by End Use

Market Breakup by Region

The aloe vera gel extract occupies a major aloe vera market share due to its rising usage in multiple end-use sectors such as skincare and haircare

The aloe vera gel extract accounts for a significant market share. The gel extract segment is particularly driven by its widespread use in skincare, haircare, and healthcare products, attributed to its soothing, anti-inflammatory, and moisturising properties. This has led to its growing incorporation into natural and organic cosmetic and personal care products, reflecting increasing consumer awareness of aloe vera's health benefits. There is also an increasing consumer awareness about the health benefits of aloe vera gel, including its potential to boost hydration, support digestive health, and provide essential vitamins and minerals. This awareness is propelling its inclusion in dietary supplements and health products.

The whole leaf extract segment also occupies a significant share of the aloe vera market due to its demand in the healthcare and wellness sector, along with the wide range of bioactive compounds it contains, such as vitamins, minerals, and antioxidants. These compounds contribute to various health-promoting effects, making whole leaf extract appealing for its potential to support immune health, digestion, and overall well-being. Furthermore, the pharmaceutical sector’s interest in aloe vera for therapeutic properties exploration has bolstered the demand for whole leaf extract.

The cosmetic sector maintains its dominance in the market due to the rising incorporation of organic ingredients in cosmetic products

The cosmetic sector represents the largest segment in the aloe vera market. The demand here is driven by the increasing consumer focus on personal grooming and appearance, alongside a growing preference for natural and organic ingredients like aloe vera. Aloe vera is valued in the cosmetic sector for its soothing, moisturising, and healing properties, making it a popular choice for skincare products, such as moisturisers, serums, and masks, as well as hair care products. The trend towards clean beauty and the use of social media and influencer marketing to promote the benefits of aloe vera have further boosted its demand in cosmetics.

The pharmaceutical sector is anticipated to witness robust growth in the aloe vera market in the coming years. The pharmaceutical sector is a significant consumer of aloe vera, particularly for its therapeutic properties. Aloe vera is used in the formulation of various medical and healthcare products, including ointments for skin conditions, supplements for digestive health, and treatments for minor burns and wounds. The sector’s interest in natural and holistic remedies has seen a rise in the exploration of aloe vera's potential, including its anti-inflammatory, antibacterial, and antiviral properties. The growing focus on personalised medicine and biopharmaceuticals has also highlighted the use of natural ingredients like aloe vera in drug development.

The Asia Pacific represents the largest consumer of the product, accounting for the majority of the total global consumption. This demand is driven by the rising popularity of natural skincare and home remedies, with aloe vera extract being a key component in DIY beauty and health recipes. The growing environmental concerns have also led to an increased demand for products manufactured and supplied ethically, including aloe vera extracts sourced from responsible farming and eco-friendly extraction techniques. In addition to these factors, the Asia Pacific region is experiencing a surge in the demand for functional foods and beverages, driven by a growing awareness among young consumers about fitness and health. This has led to an increased preference for energy drinks, nutritional supplements, and functional foods, with aloe vera being an integral part of this trend.

The aloe vera market in North America is expected to witness an upward trajectory in the coming years. The use of aloe vera gel as a critical component in personal care products like creams, lotions, soaps, shampoos, and facial cleansers is expanding in the region. The pharmaceutical sector also incorporates aloe vera extracts in various ointments, gels, tablets, and capsules due to their therapeutic properties.

Market players in the aloe vera products market are focusing on expanding their product ranges to include wellness and personal care items and are establishing collaborations with suppliers and strategic partnerships with distributors to enhance their market presence.

Aloe Farms, Inc. based in Harlingen, Texas, has been specialising in the growth, processing, and delivery of Aloe Vera products and offers products, including aloe vera gel and juice.

Aloe Laboratories located in Harlingen, Texas, is known for its variety of aloe vera juices, nopal juices, concentrates, and personal care cosmetics.

Ashland Global Holdings Inc. is a leading speciality chemicals company that has been actively diversifying and expanding its business across various sectors.

Herbalife International of America, Inc. is a global multi-level marketing corporation known for its dietary supplements and offers a range of products aimed at weight management and energy and fitness enhancement.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Terry Laboratories and Aloecorp., among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market attained a value of nearly USD 834.29 Million.

The market is assessed to grow at a CAGR of 8.50% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 1886.32 Million by 2035.

The major market drivers include rising disposable incomes, increasing health consciousness, and the increasing use of aloe vera in diverse products across major end-use sectors.

The key trends guiding the market include the launches of new products, the growing awareness regarding the benefits of aloe vera, and the rising demand for organic products.

The leading regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The various products of aloe vera considered in the market report are aloe vera gel extract and aloe vera whole leaf extract, among others.

The significant forms of aloe vera in the market are concentrates, gels, drinks, powders, and capsules.

The leading end-use industries for the product are pharmaceutical industry, cosmetic industry, and food industry.

The major players in the market are Aloe Farms, Inc., Aloe Laboratories, Terry Laboratories, Aloecorp., Ashland Global Holdings Inc., and Herbalife International of America, Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Form |

|

| Breakup by End Use Industry |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share