Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global market for animal fat reached a volume of nearly 29.41 MMT in 2025. The market is further expected to grow at a CAGR of 2.70% between 2026 and 2035, to reach a volume of 38.39 MMT in 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

2.7%

Value in MMT

2026-2035

*this image is indicative*

| Global Animal Fat Market Report Summary | Description | Value |

| Base Year | 29.41 | 2025 |

| Historical Period | 29.41 | 2019-2025 |

| Forecast Period | 29.41 | 2026-2035 |

| Market Size 2025 | 29.41 | 29.41 |

| Market Size 2035 | 29.41 | 38.39 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 2.70% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 3.1% |

| CAGR 2026-2035 - Market by Country | India | 3.6% |

| CAGR 2026-2035 - Market by Country | China | 3.0% |

| CAGR 2026-2035 - Market by Type | Tallow/Grease | 3.0% |

| CAGR 2026-2035 - Market by Application | Biodiesel | 3.2% |

| Market Share by Country 2025 | Italy | 3.2% |

As per the animal fat market dynamics and trends, the North American region is anticipated to increase significantly, owing to the rising use of edible animal fat in the food and non-food sectors. Butter, for example, is widely consumed by customers in countries such as the United States. Secondly, tallow is used in the production of animal feed in the industrial sector in North America.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Tallow Expected to Dominate the Market Growth

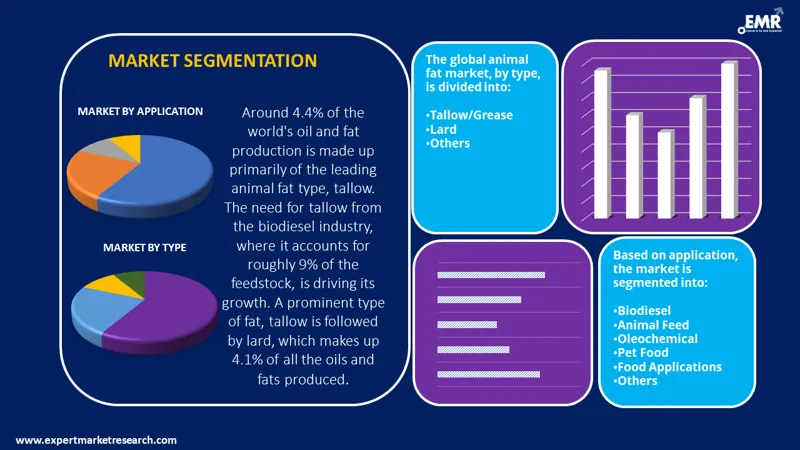

Tallow is the leading animal fat type and accounts for 4.4% of the global oil and fat production, aiding the animal fat market value. Tallow is being driven by its rising demand from the biodiesel industry, where it accounts for nearly 9% of the biodiesel feedstock. Tallow is followed by lard as a significant type of fat, which accounts for 4.1% of the total oils and fat production. The tallow supply has increased owing to the accelerated growth in the global slaughter rates. The major producers of lard are China, Germany, Brazil, the United States, and Italy, while the major producers of tallow include the United States, Europe, China, Brazil, and Australia.

| CAGR 2026-2035 - Market by | Country |

| India | 3.6% |

| China | 3.0% |

| Canada | 2.8% |

| Mexico | 2.7% |

| UK | 2.5% |

| USA | XX% |

| Germany | XX% |

| France | 2.1% |

| Italy | XX% |

| Japan | XX% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

Increase in Demand from the Foodservice Sector Augmenting the Market Growth

The growth of the animal fat market is being driven by the increase in demand from the foodservice sector and the rising application of lard as bread spreads in the baking industry. Due to the rise in demand from downstream sectors, such as biodiesel, food, oleochemical, and pet food industries, the market for animal fat is witnessing a robust growth. The demand for lard (as a spread for bread) from the German baking sector is growing, further enhancing the market growth. Food companies, especially the bakery sector, obtain lard to be used as a substitute for butter at a volume, which could be anywhere between 500–600 million tonnes on a half-yearly basis.

The animal fat demand is also being augmented by the increase in the demand for tallow, which is used in animal food and biodiesel. Moreover, several key players are striving to maintain their presence by adopting strategies such as collaborations and partnerships to gain a competitive edge over their rivals in the global marketplace. For example, in November 2018, Darling Ingredients Inc. (NYSE: DAR) acquired the Poland-based food grade animal fat processing facility of PPH Conto Ltd in Lubien Kujawski. This will enable Darling Ingredients to expand its service portfolio not only in Poland but across Europe for both customers and suppliers.

As per a report by the Washington Post, a few startups are planning to add animal fat to plant-based meats. This report from Feb 2024, states that some companies aim to combine lab-grown animal fat with wheat protein and spices for the production of pork-like plant-based bacon.

According to USDA, in 2021, Argentina produced 3,000 thousand metric tons of beef and veal, Brazil 9,750 thousand metric tons, Canada 1,385 thousand metric tons, China 6,980 thousand metric tons, and the European Union 6,883 thousand metric tons. As per the animal fat industry analysis, Australia and the United States produced 1,895 and 12,734 thousand metric tons, respectively, among other countries. For 2022, Argentina's production of beef and veal was 3,140 thousand metric tons, Brazil 10,350 thousand metric tons, Canada 1,412 thousand metric tons, China 7,180 thousand metric tons, and the European Union 6,722 thousand metric tons. Production figures for Australia and the United States were 1,878 and 12,890 thousand metric tons, respectively.

As per the U.S. Energy Information Administration, in 2021, world biodiesel production was reported at 13,966 million gallons, equivalent to 332,515 thousand barrels (911 thousand barrels per day), which contributed to the animal fat industry revenue. World biodiesel consumption was slightly higher at 13,776 million gallons, or 327,770 thousand barrels, averaging 898 thousand barrels per day. The growing production of biodiesel amidst the rising concerns of environmental pollution and sustainability is contributing to an increased demand for animal fat as feedstock. Additionally, in 2022, U.S. biodiesel production reached 1,622 million gallons, corresponding to 38,620 thousand barrels, or an average of 106 thousand barrels per day. The U.S. also imported 250 million gallons of biodiesel (5,950 thousand barrels, equating to 16 thousand barrels per day) and exported 238 million gallons (5,671 thousand barrels, also averaging 16 thousand barrels per day), which contributed to the growth of the animal fat industry. U.S. biodiesel consumption for the same year was slightly higher than production at 1,658 million gallons, which translated to 39,478 thousand barrels or 108 thousand barrels per day.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Animal fat is a lipid content, which is extracted from animals, such as pigs, cows, and chickens. Physically, it is solid at room temperature, and chemically it is composed of triglycerides. It is also consumed in the form of dairy products such as cheese, milk, and butter.

On the basis of type, the animal fat market is divided into:

The significant applications of the market are:

Market Breakup by Region:

| CAGR 2026-2035 - Market by | Type |

| Tallow/Grease | 3.0% |

| Lard | 2.8% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Application |

| Biodiesel | 3.2% |

| Animal Feed | 2.9% |

| Oleochemical | 2.8% |

| Pet Food | XX% |

| Food Applications | XX% |

| Others | XX% |

| CAGR 2026-2035 - Market by | Region |

| Asia Pacific | 3.1% |

| Europe | 2.3% |

| North America | XX% |

| Latin America | XX% |

| Middle East and Africa | XX% |

| 2025 Market Share by | Country |

| Italy | 3.2% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

The report gives a detailed analysis of the following key players in the global animal fat market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on Porter's five forces model along with giving a SWOT analysis.

Asia Pacific and North America to be Among the Significant Regional Markets for Animal Fat

The Asia Pacific region is expected to have the highest animal fat market share due to the growth in consumption of animal fat. An increase in population and growing consumption of lard by the bakery sector, further enhance the global market growth. In emerging regions, such as the Asia Pacific, the demand has been driven by the inclination towards the consumption of lard instead of butter in baked products. China has achieved self-sufficiency in the production of pork and lard. An increase in the consumption of processed foods which utilise lard has bolstered the market for animal fat in the region.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global animal fat market reached a volume of nearly 29.41 MMT in 2025.

The market is projected to grow at a CAGR of nearly 2.70% in the forecast period of 2026-2035.

The market is estimated to reach a volume of about 38.39 MMT by 2035.

The major drivers of the market include rising disposable incomes, increasing population, rising demand from the foodservice and bakery sector, and the rising demand from the downstream sectors.

The key trends guiding the market include the rising use of lards as bread spreads, the increasing demand for tallows, and the expansion of animal fat offerings by key players.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

The various types of animal fat include tallow/grease and lard, among others.

The product finds wide applications in biodiesel, animal feed, oleochemical, pet food, and food applications, among others.

The leading players in the market are SARIA SE & Co. KG, Darling Ingredients Inc., Ten Kate Vetten BV, Baker Commodities Inc., Jacob Stern & Sons, Tallow Products Pty Ltd, and Australian Tallow Producers, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share