Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global aortic valve replacement devices market size reached a value of USD 9.57 Billion in 2025. The market is estimated to witness a CAGR of 6.50% during the forecast period of 2026-2035 to reach a value of USD 17.96 Billion by 2035.

Base Year

Historical Period

Forecast Period

Development of sutureless aortic valve replacement, increasing demand for minimally invasive surgical procedures, and further advancements in transcatheter aortic valve replacement (TAVR) are aiding the market.

Government-introduced reimbursement policies and insurance benefits, to financially support the patients intending to undergo AVR are increasing.

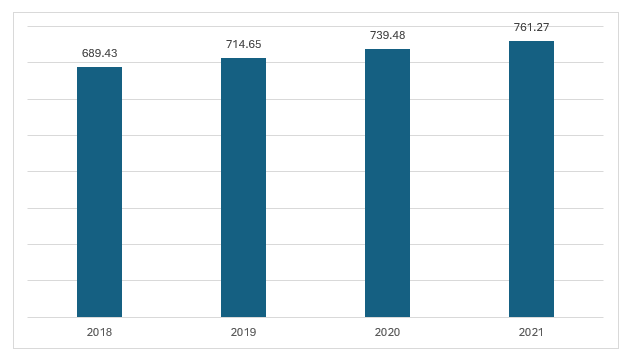

Reportedly, the number of individuals aged 65 years or older is anticipated to more than double, increasing from 761 million in 2021 to 1.6 billion in 2050.

Compound Annual Growth Rate

6.5%

Value in USD Billion

2026-2035

*this image is indicative*

To accelerate the adoption of aortic valve replacement devices in underdeveloped areas, stakeholders in the healthcare segment are focusing on improving the access of the population to interventional cardiology and cardiothoracic surgery specialities. In addition, a rise in educational campaigns to spread awareness regarding aortic valve diseases will increase the use of these devices in the treatment procedure.

As the number of elderly patients with aortic valve stenosis and various other comorbidities is growing, the adoption of less invasive therapies is increasing, as surgeries pose a significant risk to their life. Additionally, the expanding geriatric population in Asian countries is also expected to enhance the adoption of minimally invasive aortic valve replacement procedures.

Figure: World Population of the Elderly (In Million)

Increasing aortic stenosis in geriatric population; adoption of advanced aortic valves to ease surgical procedures; rising sedentary lifestyles; and increasing cases of valvular heart diseases are impacting the aortic valve replacement devices market growth

Aortic stenosis is a common life-threatening heart valve disease that can result in heart failure. Geriatric population can depict severe, symptomatic aortic stenosis.

Advanced aortic valves such as the sutureless aortic valve replacement (SU-AVR) and rapid deployment aortic valve replacement (RD-AVR) allow hospitals to conduct easy, effective, and safe valve implantation under direct vision.

The prevalence of chronic diseases, such as hypertension, cholesterol and diabetes, owing to people’s unhealthy and hectic lifestyle is increasing the risks of aortic valve failure and the need to replace it.

Aortic valve replacement devices are used to treat conditions including aortic valve regurgitation, aortic valve stenosis, and other congenital heart defects that affect the aortic valve.

Aortic valve stenosis cases are increasing in numbers around the globe with a growing geriatric population and the prevalence of atherosclerosis. The geriatric population is highly susceptible to aortic valve conditions, particularly if they have cardiovascular risk factors such as high cholesterol and a history of smoking, which increase their chances for developing aortic valve calcification, requiring valve replacement. Patients aged 75 and above tend to have symptomatic and severe aortic stenosis and are investing in minimally invasive aortic valve replacement procedures to reduce their symptoms.

People aged 75 and above are inclined towards less invasive transcatheter aortic valve replacements as conducting an open-heart surgery on them is risky as they are weak and may be suffering from multiple other diseases.

Additionally, procedures such as the SU-AVR, minimally invasive aortic valve replacement (MIAVR), and transcatheter aortic valve implantation/transcatheter aortic valve replacement (TAVI/TAVR) are being used to overcome the shortcomings of surgical AVRs.

Heart defects such as aortic valves with missing valve openings, incorrect valve size or shape, or blood flowing backwards are increasing the need for aortic valve replacement devices. Some unhealthy habits include a sedentary lifestyle with little to no exercise, alcohol consumption beyond safety limits, excessive stress damaging heart valves, and having a diet high in salt.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Aortic Valve Replacement Devices Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Surgery Type

Market Breakup by Product Type

Market Breakup by End Use

Market Breakup by Region

Based on surgery type, minimally invasive surgery accounts for a significant share of the market

Minimally invasive aortic valve replacement surgeries are preferred by people and healthcare professionals as they prevent excess blood loss during the surgery, involve a lower risk of infection, and leave relatively fewer scars on the patient's body as they involve smaller chest incisions compared to open-heart surgery.

Minimally invasive heart surgeries are associated with benefits like a shorter hospital stay, and faster recovery, and are less painful than the traditional methods.

Open-heart aortic valve replacement surgeries are advisable for patients who need to undergo multiple coronary bypass processes or complex cardiovascular operations.

Based on product type, TAVR significantly contributes to the global aortic valve replacement devices market revenue

The enhanced safety and fast recovery times offered by TAVR (transcatheter aortic valve replacement) have boosted its utilisation as an effective treatment for severe aortic stenosis among geriatric patients. Innovations in the design of valve prosthesis and technological advancements in its haemodynamic performance, along with the availability of data based on trials to establish the efficacy of TAVR, are expected to widen the scope of TAVR in low-risk and immediate patient groups.

Market players are focusing on improving the availability of medical devices and delivering products that guarantee superior clinical outcomes

Headquartered in the United States, Boston Scientific Corporation is a manufacturer and marketer of medical devices that are used in a broad range of interventional medical specialties. The company’s core businesses are organized into three segments: Medsurg, Rhythm and Neuro, and Cardiovascular.

An Italian company, Corcym is primarily engaged in the manufacture of medical devices for heart surgeries. The company was formed after the acquisition of the LivaNova PLC (LivaNova) heart valve business by Gyrus Capital (Gyrus) in June 2021.

Edwards Lifesciences Corporation is primarily engaged in the manufacture of heart valve systems and repair products. The company manufactures transcatheter aortic valve replacement, transcatheter mitral and tricuspid technologies, and structural surgical heart products primarily in the United States (California and Utah), Singapore, Costa Rica, and Ireland.

Headquartered in Ireland, Medtronic is a global leader in the healthcare technology sector. The company is engaged in the manufacture, distribution, and sales of device-based medical therapies and services in the cardiovascular, medical-surgical, neuroscience, and diabetes operating segments.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the global aortic valve replacement devices market are Artivion, Inc, and Abbott Laboratories, among others.

North America is a key market for aortic valve replacement devices, with the US leading the way

North America remains a significant market, supported by the presence of advanced medical facilities, well-established healthcare infrastructure, and increasing geriatric population. In the United States, heart disease is the major cause of death for both men and women, and aortic stenosis, in particular, is one of the most common heart valve illnesses, affecting Americans over the age of 75 years. While surgical aortic valve replacement/implantation (SAVR, or SAVI) is the standard treatment for patients with severe aortic stenosis, transcatheter aortic valve replacement/implantation (TAVR, or TAVI) has established as a reliable and robust alternative for elderly patients who are at high risk for open surgery due to age, frailty, and other factors.

Meanwhile, the growing geriatric population and the rising incidences of aortic stenosis in the Asia Pacific have bolstered the use of TAVR in clinical practices owing to its minimally invasive procedure, fast recovery times, and low mortality rates.

The Japanese government has been providing grants for innovative sutureless aortic heart valve, and unlike various other Asian countries, the national government also funds TAVI, enhancing the domestic accessibility to versatile aortic valve replacement devices.

India Disposable Medical Gloves Market

Latin America In-vitro Diagnostics Market

Global Implantable Medical Devices Market

Health Economics and Outcomes Research (HEOR) Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market reached a value of USD 9.57 Billion in 2025.

The market is estimated to witness a CAGR of 6.50% during the forecast period of 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 17.96 Billion by 2035.

The surgical procedures include open surgery and minimally invasive surgery.

The key regional markets for aortic valve replacement devices are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The product types include transcatheter aortic valve and sutureless aortic valve replacement (SUAVR).

The key factors driving the market include increasing geriatric population, increased government funding, and improving healthcare infrastructure and services.

The key players in the market include Boston Scientific Corporation, Corcym S.r.l, Edwards Lifesciences Corporation, Medtronic plc, Artivion, Inc., and Abbott Laboratories, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Surgery Type |

|

| Breakup by Product Type |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share