Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Asia Pacific flat glass market value reached around USD 75.92 Billion in 2025 due to increased demand for flat glass in residential and commercial construction projects. Countries like China and India are undertaking massive infrastructure developments, including high-rise buildings and transportation hubs, which significantly boost flat glass consumption. As a result, the industry is expected to grow at a CAGR of 8.00% during the forecast period of 2026-2035 to attain a value of USD 163.91 Billion by 2035. Innovations in flat glass technology, such as low-emissivity (Low-E) coatings and smart glass applications, are further fuelling growth of the market.

Base Year

Historical Period

Forecast Period

Flat glass accounts for approximately 33% of total soda ash consumption globally, a key raw material used in its manufacturing. Soda ash plays a crucial role in glass production by acting as a fluxing agent that lowers the melting point of silica sand, thereby reducing energy consumption during the melting process. This significant percentage underscores the dependency of the flat glass industry on soda ash, making fluctuations in soda ash availability or pricing directly impactful on flat glass production costs.

By 2030, it is estimated that the demand for solar glass will correspond to approximately 387 GW of solar energy capacity, significantly increasing flat glass demand in Asia Pacific. As countries strive to meet renewable energy targets and reduce carbon emissions, solar energy is becoming a focal point of energy strategies. The rising adoption of solar panels, which require specialized flat glass, is expected to create opportunities for manufacturers to innovate and expand their product offerings.

As per industry reports, the Indian government recently allocated around USD 9.62 billion for the development of 100 smart cities, invigorating demand for flat glass. Smart city initiatives typically involve modern infrastructure, where flat glass is essential for windows, facades, and other architectural elements.

Compound Annual Growth Rate

8%

Value in USD Billion

2026-2035

*this image is indicative*

Flat glass, also known as plate glass or sheet glass, is a kind of glass that is manufactured in flat or plane form via the processing of floating molten glass on sheets of metal. Flat glass can also be bent unlike container glass as well as reused. It is used in the production of windows, glass doors, tabletops, furniture, transparent walls, wind shields, solar cells, and windscreens, among other products.

With rising disposable income and growing consumer awareness, the Asia Pacific region is expected to witness an increased demand for decorative glasses with digital print technology. In fact, the decorative glass segment in the region is driven by its increasing use in residential and commercial interiors. Additionally, the demand for value-added products such as tempered, laminated, and coated glass has been growing significantly compared to basic glass, further enriching the product mix, and boosting the sales and hence, Asia Pacific flat glass market revenue.

Furthermore, a report by Glass Industry News in 2024 highlighted that value-added flat glass products now account for nearly 30% of total sales in the region, up from 20% in 2020. The increased functionality offered by these value-added products, particularly in automotive glazing, such as solar control glass, lightweight glass, and privacy glazing, has been instrumental in driving the growth of automotive glass sales.

The flat glass market in Asia Pacific is also benefiting from increasing glass consumption in construction, automotive, and solar industries of China and India. China is expected to invest approximately USD 4.2 trillion in new infrastructure during its 14th Five-Year Plan (2021-2025), focusing on energy efficiency and sustainable practices. The adoption of advanced flat glass products, including Low-E and insulating glass units, is projected to rise by 20% over the next five years due to government incentives and a heightened emphasis on green architecture. In the automotive sector, electric vehicle (EV) production is anticipated to surge, with companies like BYD planning a 40% increase in production by 2025, further driving demand for innovative glass solutions that enhance vehicle efficiency and aesthetics. Additionally, China added over 50 GW of solar capacity in 2023, significantly impacting the flat glass market as solar panel installations are expected to grow by more than 20% annually.

Rising demand for energy-efficient glass, growth of solar glass applications, and rising smart city projects are the key trends propelling the market growth.

The Asia Pacific region is experiencing rapid urbanisation, with an average annual urbanization rate of 3%. By 2018, over 1.2 billion people in the region were urban, accounting for one-third of the world’s urban population. Countries like China and India are leading this trend with extensive infrastructure projects. For example, the Xiong’an New Area project in China aims to create a modern urban center that integrates green technology. Additionally, the Asian Development Bank (ADB) estimates that by 2050, the urban population in the region will reach approximately 3 billion, necessitating an annual infrastructure investment of USD 1.7 trillion until 2030, including flat glass.

One of the major trends in the Asia Pacific flat glass market is the increasing demand for energy-efficient glass, particularly in the construction and automotive sectors. Governments across the region are implementing stringent building codes and energy-efficiency standards, promoting the use of Low-Emissivity (Low-E) glass, which helps in reducing heat loss and improving insulation. For example, China’s green building initiatives, such as the Green Building Evaluation Standard and the Three-Star Rating System, mandate the use of energy-efficient materials like Low-E glass in new constructions. Additionally, the Chinese government has implemented the Ultra-Low Energy Consumption Building Standard, which further encourages the adoption of high-performance materials. This trend is expected to drive the growth of high-performance glass products, boosting overall Asia Pacific flat glass market value by improving energy savings and reducing carbon footprints.

Smart city initiatives are becoming increasingly prevalent across Asia Pacific and countries such as Singapore and South Korea are at the forefront of this movement. For instance, Singapore's Smart Nation initiative integrates technology into urban planning to improve efficiency and livability. The ADB's Strategy 2030 highlights making cities more livable, supporting projects that improve urban infrastructure and services. As part of these initiatives, cities are investing in smart transportation systems and sustainable building materials, further driving flat glass demand growth in Asia Pacific.

Consumer preferences are shifting towards decorative and value-added glass products in both residential and commercial sectors. The demand for digitally printed glass is increasing, particularly in high-end architectural projects. For instance, projects like the Crown Sydney have incorporated decorative glass elements to enhance aesthetic appeal. The ADB has reported that investments in urban infrastructure improvements have benefitted millions; for example, their Dhaka Water Supply Network Improvement Project improved supply to 8 million people, showcasing how enhanced building materials contribute to better living conditions.

The rapid growth of renewable energy projects, particularly solar power, is driving the demand for solar glass in the region. Countries like China and India are leading global solar panel installations, and flat glass like anti-reflective solar glass, is a critical component in these projects. In 2023, China alone installed over 50 GW of solar capacity, making it the world’s largest market for solar energy and boosting demand for solar glass. The Chinese government's ambitious renewable energy targets and policies, such as the expansion of solar farms and floating solar projects, are expected to further favour Asia Pacific flat glass market outlook.

India's solar energy growth is equally substantial, with the country aiming to reach 280 GW of solar capacity by 2030. Indian manufacturers are ramping up production to meet the rising demand for solar glass, driven by initiatives like the Production Linked Incentive (PLI) scheme. Moreover, according to the Asia-Pacific Environmental Council, the region's glass industry is mandated to reduce carbon emissions by 15% by 2030, prompting increased investments in energy-efficient building materials like flat glass.

One major opportunity lies in the growing adoption of energy-efficient buildings, with governments across the region, such as in China, Japan, and Australia, implementing green building codes and offering incentives to promote the use of high-performance flat glass products like Low-E glass and insulating glass units (IGUs). Additionally, China’s 2024 Green Building Action Plan is expected to boost demand for energy-efficient glass by 20% over the next five years. This shift toward sustainable construction opens Asia Pacific flat glass market opportunities for manufacturers to develop innovative, energy-saving glass solutions.

Additionally, the surge in electric vehicle (EV) production presents opportunities for automotive glass innovations. Lightweight glazing and solar-control glass are being increasingly integrated into EV designs to improve energy efficiency and passenger comfort. As per Asia Pacific flat glass market statistics, Tesla’s Shanghai Gigafactory expansion and BYD's projected 40% increase in EV production by 2025 are driving demand for advanced automotive glass.

One of the key restraints in the market is the volatility in raw material prices, particularly for silica sand, soda ash, and limestone, which are essential components in glass production. Fluctuations in these input costs, driven by global supply chain disruptions and environmental regulations on mining activities, have led to increased production costs for glass manufacturers. For example, in 2023, the price of soda ash rose by nearly 15% due to supply shortages and stricter environmental policies in China, the world’s largest producer of flat glass. Additionally, Asia Pacific flat glass demand forecast is being impacted as energy-intensive production processes add to the cost pressures, especially as many countries in the region are transitioning to greener energy sources, making traditional manufacturing more expensive.

Thriving Construction Industry

The marker for flat glass in APAC is experiencing significant growth driven by booming construction industry, particularly in countries like China and India. Rapid urbanisation and infrastructure development in these countries are fuelling demand for flat glass in applications such as windows, facades, and interior partitions. Recently, in 2024, China announced new infrastructure projects aimed at boosting its economy, which is expected to further propel growth of the Asia Pacific flat glass market. Examples include the expansion of high-speed rail networks, the construction of smart cities, and the development of ultra-modern transportation hubs such as airports and green urban centers. Additionally, the Belt and Road Initiative is promoting infrastructure projects across Asia, boosting regional demand for flat glass.

Rising Production of EVs

The rise in the automotive industry in the region, especially with the growing production of electric vehicles (EVs), is boosting the use of flat glass in car windows, windshields, and sunroofs. For instance, China as of 2023 accounted for approximately 60% of total EV production and even holds a stock of 20.5 million highway-legal plug-in passenger cars. Similarly, India EVs sales accounted for 1.3% of new car sales in 2023 and the country targets 30% of new vehicles sales to be electric by 2030. This roughly translates to a sale of around 50,000 EVs out of 3.8 million passenger vehicle sales. Apart from India and China, Australia also registered 21,000 EVs in FY 2023. These figures demonstrate the growing automobile production, which in turn, will impact flat glass demand in the region.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Asia Pacific Flat Glass Market Report and Forecast 2026 to 2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Component

Market Breakup by Type

Market Breakup by Raw Material

Market Breakup by Application

Market Breakup by Region

Market Insights by Component

Float glass leads due to its extensive use in high-quality construction projects and the automotive industry. For example, in China’s booming construction sector, float glass is widely used for skyscrapers and commercial buildings due to its superior optical clarity and strength. Similarly, in the automotive sector, companies like Tesla and BYD use float glass for windshields and windows in electric vehicles. Sheet glass, typically used in more cost-sensitive projects, is prominent in residential housing in countries like India and Indonesia, where affordable housing initiatives rely on basic glass for windows and interior partitions.

As per Asia Pacific flat glass industry analysis, rolled glass, with its textured surface, is gaining popularity in decorative applications like glass doors and partitions, particularly in Japan and Australia. Additionally, its growing use in solar panels, especially in India’s expanding solar energy projects, highlights the increasing demand for this type of glass due to its light diffusion properties. For instance, in FY 2024, India plans to issue total 40 GW tenders for solar projects and the installed solar energy capacity have increased by 30 times in the last 9 years, from 2.6 GW in 2014 to 87.2 GW as of July 2024.

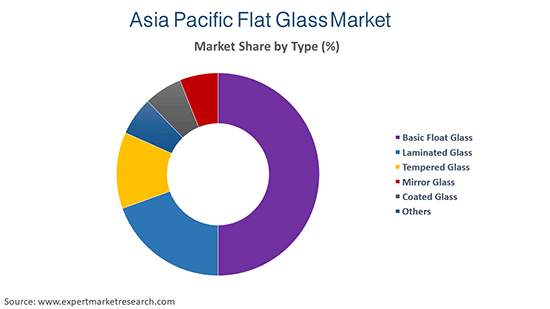

Market Insights by Type

Basic float glass holds the largest share, driven by its widespread use in construction and automotive industries. Countries like China and India, with massive infrastructure and residential developments, heavily rely on float glass for windows and facades.

Laminated glass is gaining traction due to its safety and soundproofing features, especially in automotive and high-rise building applications. With the rise in electric vehicle (EV) production, companies like BYD and Tesla are increasingly using laminated glass in windshields and sunroofs, increasing the overall Asia Pacific flat glass industry revenue.

Tempered glass also sees strong demand in both automotive and construction sectors due its strength and safety properties. For instance, Japan’s stringent building codes and safety regulations have boosted tempered glass demand for skyscrapers and earthquake-resistant structures.

Mirror glass, however, is used primarily in interior design and decorative applications, and its demand is rising in commercial and residential projects. As per Asia Pacific flat glass market analysis, in 2023, Australia’s interior design market saw a 10% increase in demand for decorative glass products, including mirror glass.

Market Insights by Raw Material

The supply of key raw materials, such as sand, soda ash, and limestone, plays a crucial role in flat glass production and pricing. Sand is the primary raw material for glassmaking. However, increasing environmental regulations and resource depletion, especially in countries like India and China, have caused supply constraints. In 2023, sand shortages led to a 10-15% rise in glass production costs across the region, pressuring manufacturers to find alternative sources. This also affected Asia Pacific flat glass market dynamics and trends.

Soda ash, another essential component, has also seen volatile pricing due to production limitations and environmental regulations. For instance, in 2023, China, the world’s largest soda ash producer, imposed stricter environmental controls, causing a 15% price surge. This significantly affected glass manufacturers' margins as well.

In contrast, limestone, used to improve the chemical durability of glass, is more stable in supply compared to sand and soda ash. However, environmental concerns related to quarrying have prompted countries like Japan to impose regulations on mining activities, further impacting production costs and Asia Pacific flat glass market expansion.

Market Insights by Applications

Architectural application dominates the market due to strong demand in large-scale infrastructure projects in countries like India, Indonesia, and Vietnam. For instance, Vietnam’s urbanisation efforts and high-rise construction boom have significantly increased demand for architectural glass products like Low-E and tempered glass. Additionally, Malaysia's Green Building Index initiatives have accelerated the use of energy-efficient glass in commercial construction projects.

Electronics applications, particularly in display technologies, contribute substantially to flat glass market share in Asia Pacific. South Korea’s tech giants, such as Samsung and LG, rely heavily on high-quality flat glass for OLED and flexible displays. Similarly, the rise of local electronics manufacturing in Vietnam and India is further boosting demand for display glass. The electronics segment is expected to grow due to significant investments in advanced glass for foldable phones.

In the automotive sector, the adoption of advanced glass solutions is growing, particularly with the rise of electric and autonomous vehicles. Companies like NIO and XPeng in China are incorporating lightweight and solar-control glass in EVs to improve energy efficiency and passenger comfort. According to Asia Pacific flat glass market overview, India’s expanding automotive manufacturing base is also creating new opportunities for automotive glass suppliers.

Solar energy applications are also rapidly expanding, especially in emerging markets like the Philippines and Thailand, which are ramping up solar panel installations to meet renewable energy targets. India’s National Solar Mission aims to reach 280 GW of solar capacity by 2030, creating substantial demand for anti-reflective and high-transmittance solar glass.

China is anticipated to dominate the market and is also expected to witness the fastest growth rate over the forecast period. As of 2019, China's flat glass output was recorded to be around 80.15 million weight cases, that is, an increase of 10.29% year-on-year growth. Currently, the country is one of the largest producers of glass and glass products with the highest number of glass-producing enterprises and flat glass production lines in the world. By 2016, the product demand in the region reached a volume of around 3.4 billion square metres. Moreover, China added over 50 GW of solar capacity in 2023, significantly impacting growth of the Asia Pacific flat glass market.

India’s flat glass market is expanding rapidly due to its booming construction sector, driven by large-scale government initiatives like Housing for All and Smart Cities Mission. Demand for basic float glass, as well as value-added products like laminated and tempered glass, is growing in urban infrastructure projects. India’s automotive industry is also evolving, with new manufacturing hubs like Gujarat driving demand for automotive glazing. Additionally, India’s aggressive targets under the National Solar Mission, aiming for 280 GW of solar capacity by 2030, are fuelling solar flat glass demand growth in Asia Pacific.

Similarly, the market in Australia is primarily driven due to the construction sector’s focus on energy-efficient and sustainable building materials. Government incentives and regulations, such as the National Construction Code mandating higher energy efficiency in new buildings, have increased demand for Low-E and double-glazed flat glass. In 2023, Australia experienced a surge in demand for decorative glass, particularly for residential renovations and commercial projects. Furthermore, Australia’s investments in solar energy, particularly in large-scale solar farms, are creating new opportunities for solar flat glass manufacturers.

Start-ups in the market are focusing on energy-efficient and value-added glass technologies, such as Low-E and smart glass, to meet the rising demand for sustainable building materials. They are also innovating in decorative and digitally printed glass for architectural applications. Additionally, many are targeting the automotive and solar sectors by developing lightweight and high-performance glazing solutions for electric vehicles and solar panels. These start-ups aim to enhance product functionality and aesthetics in Asia Pacific flat glass market.

KDX Glass was founded in 2010 and is a China-based start-up. It is known for its innovations in smart and energy-efficient glass solutions. The company specialises in producing Low-E glass, solar control glass, and automotive glazing, catering to the construction, automotive, and solar industries. KDX has expanded rapidly due to its advanced technologies and focus on sustainability. Headquartered in Beijing, the company’s major achievements include supplying high-performance flat glass for several large-scale infrastructure projects in China.

AGC Asia Pacific is a subsidiary of AGC Inc. and was founded in 1907. Headquartered in Singapore, it focuses on cutting-edge glass technologies. AGC is known for its decorative, high-performance glass products, serving sectors like architecture, automotive, and electronics. In recent years, AGC Asia Pacific has pioneered innovations in UV-cutting glass and Low-E glass, contributing to green building and automotive projects across the region. Their achievements include the integration of smart glazing technologies in several high-profile smart city projects in Japan and Southeast Asia.

Market players are focused on innovation, sustainability, and expanding value-added product offerings. They are prioritising the development of energy-efficient glass in response to growing demand for green building materials. Companies are also investing in advanced technologies like smart glass and digital printing to cater to both residential and commercial sectors. Additionally, with the rise of electric vehicles, players are enhancing automotive glazing solutions, including lightweight and solar-control glass, to meet the evolving needs of the automotive industry.

Saint-Gobain S.A., founded in 1665, is a global leader in manufacturing and distributing building materials, including flat glass. Headquartered in Courbevoie, France, the company focuses on sustainable glass solutions like Low-E and smart glass for construction, automotive, and solar applications.

Central Glass Co., Ltd. was established in 1936 and is headquartered in Tokyo, Japan. It is a significant player in the Asia Pacific flat glass market as it offers flat glass for the construction, automotive, and chemical sectors.

AGC Inc., founded in 1907, is a prominent player in the flat glass market. It offers advanced glass products for automotive, construction, and electronics sectors. Its headquarters is in Tokyo, Japan. AGC is known for its innovations in UV-cutting, Low-E, and smart glass.

Nippon Sheet Glass Co., Ltd. (NSG Group), founded in 1918 and headquartered in Tokyo, Japan, is a leading manufacturer of flat glass. It focuses on architectural, automotive, and speciality glass. The company is known for its solar control glass and advanced automotive glazing.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other Asia Pacific flat glass market players include China Glass Holdings Limited and Fuyao Glass Industry Group Co., Ltd., among others.

Asia Pacific Green Construction Materials Opportunities

Asia Pacific Architectural Façade Materials Innovations

Asia Pacific Automotive Glazing Technology Trends

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 75.92 Billion.

The market is assessed to grow at a CAGR of 8.00% between 2026 and 2035.

The major market drivers include the robust growth of the construction sector, rapid urbanisation and industrialisation, the rising demand for flat glass in automobile production, and surging sales of consumer electronics.

The key trends guiding the market growth include the increasing adoption of solar panels, the surging acceptance of green buildings, and favourable government initiatives aimed at boosting the adoption of renewable energy.

The major regions in the market include India, China, ASEAN, Japan, and Australia, among others.

Float, sheet, and rolled, among others, are the major flat glass components in the market.

The significant flat glass types include basic float glass, laminated glass, tempered glass, mirror glass, and coated glass, among others.

Sand, soda ash, limestone, and cullet, among others, are the significant raw materials of the product.

Architectural, electronics, automotive, aerospace and defence, and solar energy, among others are the major applications of the product.

The major players in the market are Saint-Gobain S.A., AGC Inc., Nippon Sheet Glass Co., Ltd, Central Glass Co. Ltd., China Glass Holdings Limited, and Fuyao Glass Industry Group Co., Ltd., among others.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 163.91 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Type |

|

| Breakup by Raw Material |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share