Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global automotive pedestrian protection system market size is projected to grow at a CAGR of 10.00% between 2026-2035.

Base Year

Historical Period

Forecast Period

The World Health Organisation (WHO) reported yearly loss of around 1.19 million lives to road accidents, with 20-50 million injured.

The European Commission's data on 2022 road fatalities shows around 20,600 deaths, a 3% rise from 2021, thus, propelling the global automotive pedestrian protection system market growth.

During 2023, the NHTSA proposed adding pedestrian crash protection ratings to the NCAP to mitigate increasing pedestrian injuries and deaths.

Compound Annual Growth Rate

10%

2026-2035

*this image is indicative*

As per the global automotive pedestrian protection system market report, the automotive pedestrian protection system is an essential safety feature intended to notify the driver and reduce the likelihood of accidents. It's designed to safeguard pedestrians in the event of a collision, minimizing potential harm.

The global automotive pedestrian protection system market development is driven by technological innovation. These systems are equipped with sensors that detect pedestrian collisions and activate actuators to raise the engine hood. It is also accompanied by an automatic alarm for the driver. Various systems like popup hoods, speed airbags, and flexible air tubes are employed to enhance pedestrian safety during sudden accidents.

The National Highway Traffic Safety Administration (NHTSA) reports that in 2021, 7,388 pedestrians lost their lives in traffic accidents on US public roads, thus, driving the global automotive pedestrian protection system market.

The global automotive pedestrian protection system market is growing with rising fatal injuries, technological advancements, safety features and rising car demands.

The World Health Organization (WHO) states that around 1.19 million fatalities occur each year from road traffic accidents. Moreover, between 20 to 50 million people suffer non-fatal injuries, often leading to disabilities, which increases demand for pedestrian protection systems in the global automotive market.

The recent technological advancement has been instrumental in propelling the global automotive pedestrian protection system market growth. Integrating advanced safety systems into ADAS and AVs helps drivers avoid collisions. Pedestrian detection systems issue alerts and activate emergency braking, while forward-collision warnings provide audio and/or visual cues to prevent collisions.

Increasingly, there's a demand for pedestrian protection systems. These include front peripheral sensors and an airbag control unit, which activate actuators for swift actions like lifting the engine hood. Legislation in Europe like the Pedestrian Safety Regulation mandates energy-absorbing bonnets, front bumpers, and brake-assist systems in vehicles for pedestrian safety.

The increasing preference for passenger cars and pedestrian safety systems, driven by consumer interest in advanced safety features and substantial investments in the automotive sector, continues to supplement the global pedestrian protection system market. In India, the Federation of Automobile Dealers Associations observed a significant 11% year-over-year growth in vehicle sales for the entire calendar year of 2023.

Based on the global automotive pedestrian protection system market analysis, the increasing demand for PPS systems adaptable to electric and autonomous vehicles mirrors the growing usage of these technologies. Advancements in sensor tech like LiDAR, radar, and cameras, coupled with AI and machine learning, improve pedestrian detection and collision prevention systems, offering avenues for innovative PPS technology development.

The global pedestrian protection system market is driven by rising road accidents, widespread acceptance of advanced emergency braking and collision control systems, and a growing desire for improved visibility and safety features in vehicles. Additionally, major companies' initiatives to enhance safety features also contribute to market growth.

Global Automotive Pedestrian Protection System Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Technology

Market Breakup by Type

Market Breakup by Vehicle Type

Market Breakup by Component Type

Market Breakup by Distribution Channel

Market Breakup by Region

Active pedestrian protection systems enhance the global automotive pedestrian protection system market by protecting pedestrians in vehicle collisions

The passive safety mechanism diminishes the severity of injuries sustained by pedestrians during or after an accident. Components of the pedestrian protection system include airbag control units, acceleration sensors, control units, and actuators.

In terms of type, pop-up bonnets contribute to the global automotive pedestrian protection system market share by aiming to safeguard pedestrians struck by the front of the vehicle

A pop-up bonnet rises during pedestrian accidents, absorbing head impact energy to lessen injury severity, activated by sensors detecting pedestrians.

An automatic braking and collision avoidance system employs radars, sensors, cameras, or lasers to identify potential crashes, warning the driver and activating brakes if necessary. An external airbag system for a vehicle absorbs impact from a frontal collision, significantly enhancing passenger protection within the vehicle.

In terms of component type, sensors play a crucial role in driving the global automotive pedestrian protection system market by detecting human movements

During frontal collisions involving pedestrians, sensors located at the front of the vehicle trigger the system's activation. A control unit receives input from various vehicle components, enabling it to take necessary action. For instance, an airbag ECU processes data from crash and seat sensors.

A camera serves as an impartial observer, recording crucial moments pre- and post-accident, revealing details like vehicle speed and driver behaviour.

Based on geography, Europe occupies a significant automotive pedestrian protection system market share due to consumer preference for highly safe vehicles. The European Commission has released data regarding road fatalities in 2022. Approximately 20,600 individuals lost their lives in traffic accidents during that year, marking a 3% rise compared to 2021.

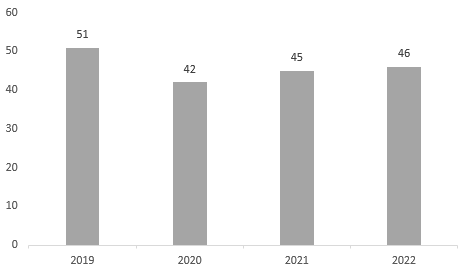

EUROPE ROAD DEATHS PER MILLION INHABITANTS, 2022

In Asia Pacific, substantial growth is anticipated with increased vehicle manufacturers and electric vehicle demand. In 2023, the North American National Highway Traffic Safety Administration (NHTSA) suggested integrating pedestrian crash protection ratings into the New Car Assessment Program (NCAP). This aims to curb rising pedestrian injuries and fatalities in light-duty vehicle collisions.

The players in the global automotive pedestrian protection system market are integrating IoT and AI in the products and services to stay ahead in the market.

Continental AG was founded in 1871 and is based in Germany. They focus on cutting-edge technologies and services aimed at sustainable, interconnected mobility. Their offerings deliver safe, efficient, and cost-effective solutions for vehicles, machinery, traffic, and transportation, improving mobility for both people and goods.

DENSO Corporation was founded in 1949 and is based in Japan. DENSO, as a global manufacturer of automotive components, delivers state-of-the-art automotive technologies, systems, and goods. They aim to create a society characterized by safe and reliable mobility through the provision of high-quality products and effective information management.

Autoliv was founded in 1953 and is based in Sweden. The company engaged in the development, production, and commercialization of protective systems, including airbags, seatbelts, and steering wheels, serving all prominent automotive manufacturers globally. Furthermore, we provide mobility safety solutions such as pedestrian protection, connected safety services, and rider safety solutions.

Mobileye Technologies Limited, headquartered in Israel, is a leading company in the field of autonomous driving. It focuses on developing cutting-edge autonomous driving technologies and advanced driver-assistance systems (ADAS), utilizing cameras, computer chips, and software. Mobileye was acquired by Intel in 2017 and underwent another public offering in 2022.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other global automotive pedestrian protection system market key players are Robert Bosch GmbH, Nissan Motor Company Corporation, Honda Motor Co., Ltd, AB Volvo, and Ford Motor Company among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 10.00% between 2026 and 2035.

The market is growing with rising fatal injuries, technological advancements, safety features and rising car demands.

Based on the technology, the market is bifurcated into active pedestrian protection system and passive pedestrian protection system.

Key players in the industry are Continental AG, DENSO Corporation, Autoliv, Mobileye Technologies Limited, Robert Bosch GmbH, Nissan Motor Company Corporation, Honda Motor Co., Ltd, AB Volvo, and Ford Motor Company among others.

Based on components, the automotive pedestrian protection system market is divided into sensors, actuators, control units, cameras, and others.

The major market areas include North America, Europe, Asia Pacific, Latin America, Middle East, and Africa.

The different types of vehicles in the market are passenger cars, commercial vehicles, and electric vehicles.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Technology |

|

| Breakup by Type |

|

| Breakup by Vehicle Type |

|

| Breakup by Component Type |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share