Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global bioherbicides market reached a value of about USD 2.61 Billion in 2025. The market is further expected to grow at a CAGR of 12.80% between 2026 and 2035 to reach a value of around USD 8.70 Billion by 2035.

Base Year

Historical Period

Forecast Period

Agricultural production reached 319 million metric tonnes in India, driven by its diversified agricultural base and large rural population dependent on farming, pushing the need for bioherbicides.

As per bioherbicides market analysis, the Russian Federation produced 262 million metric tonnes, based on its large land resources and recent investment in agricultural technology. France manufactured 184 million metric tonnes.

This underpins the important role the agricultural part plays for the nation and Europe.

Compound Annual Growth Rate

12.8%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Bioherbicides Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 2.61 |

| Market Size 2035 | USD Billion | 8.70 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 12.80% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 14.8% |

| CAGR 2026-2035 - Market by Country | India | 16.9% |

| CAGR 2026-2035 - Market by Country | China | 14.1% |

| CAGR 2026-2035 - Market by Crop Type | Non-Agricultural Crops | 11.5% |

| CAGR 2026-2035 - Market by Formulation | Liquid | 14.3% |

| Market Share by Country 2025 | France | 3.4% |

Bioherbicides are the pesticides that are used to stop the growth of unwanted weeds or plants that absorb water, sunlight, and nutrients intended for crops and hinder their development. These herbicides contain microorganisms, including fungi, bacteria and viruses, and insects like painted lady butterflies and parasitic wasps. In addition, they will live long enough in the soil to be effective in a productive growing season. Since they do not pose a danger to crops or human health, these are increasingly preferred by farmers to traditional herbicides and bolsters the growth of the bioherbicides market.

Inclination towards organic farming, technological advancements and regulatory support are a few factors leading to new bioherbicides market dynamics and trends.

There is a rising demand for bioherbicides, resulting from the growing adoption of organic farming and integrated pest management. Thus, farmers are inclined towards eco-friendly herbicides that will provide less toxic and sustainable weed management options.

Biotechnological innovation is another key trend of the bioherbicides market that is increasing the potency of bioherbicides. Few of such developments include better formulations and genetic changes in improving delivery mechanisms that further enhance the efficacy and applicability of the product of bioherbicides.

Governments and regulatory bodies are promoting bioherbicides through supportive policies and incentives. Streamlined approval procedures and subsidies for sustainable agriculture practices that encourage the implementation of biological control methods.

Global proliferation of bioherbicides is in a growth phase, with increasing adoption across regions such as North America, Europe, and Asia-Pacific. Growth in this market is being driven by rising concerns about the environment and sustainability.

The increasing awareness of the health risks posed by the use of synthetic herbicides is a key driver of the bioherbicides market development. Chemicals present in synthetic varieties damage crops that, if ingested, affect human health. Consumption of food derived from crops cultivated using synthetic herbicides is known to increase the risk of serious health problems like cancer.

Moreover, changing the preference of the majority of the population to a nutritious diet is increasing the demand for organic products, which promotes the practice of organic farming throughout the globe. Bio-based herbicides are also a cost-effective and environmentally-friendly alternative compared to conventionally used herbicides, that further add to their demand. In addition, policymakers in many countries are promoting the bioherbicides demand, which is generating a favourable business outlook.

For example, the Government of India provides capital investment subsidies to commercial production units producing organic and bio-fertilizers under the National Organic Production Project Scheme. In addition, developments in genetic engineering have led to the production of highly effective bioherbicides, further fuelling the growth of the bioherbicides market.

Advancements In Organic Agriculture And Yield Increase The Necessity For Bio-Herbicides.

The organic agriculture sector recorded growth and expansion in the global arena in 2022. Organic farmland acreage increased by 26.6% year-on-year to 96.4 million hectares in 188 countries. Australia had 53.0 million hectares, India with 4.7 million hectares, and Argentina with 4.1 million hectares. All this laudable increase of grasslands on the organic scale is a result of growing sustainable agriculture practice and high organic product demand across the world, thus pushing the bioherbicides demand growth.

The other near reaction of the increases was the number of organic producers, which was reported at 4.5 million in the world. This reflects a growth of 25.6% from the year 2021. India has the highest number of organic producers at 2.4 million, followed by Uganda at 404,246 and Thailand at 121,540. The growth reflects the expansive opportunities that have opened up for many small-scale farmers in the developing world to join the world organic market, which has been further triggered by better market access and supportive policies by governments.

Overall for the whole of agricultural production, China, in the year 2021, led the world's agricultural production at 1,095 million metric tonnes and strengthened its supremacy in the world agricultural industry. The USA followed at 605 million metric tonnes, followed by Brazil at 522 million metric tonnes.

This implies great support for the robust agricultural sectors in Mexico and Japan, which produced 158 million and 150 million metric tonnes, respectively. Germany produced 124 million, and 107 million metric tonnes are from Turkey, showing high technological development and relatively good policies in agriculture, eventually aiding the growth of the bioherbicides industry.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Global Bioherbicides Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Based on crop type, the market can be divided into:

On the basis of sources, the market is segmented into:

It finds application in the following industries:

The mode of action can be categorised as follows:

On the basis of formulation, the market can be divided into:

On the basis of region, the market is segmented into:

Agricultural Crops To Gain Traction Owing To Sustainable Agriculture Practices

Plant crops, such as agricultural crops, are likely to propel the bioherbicides market growth. It is being driven by the continuous and growing demand for sustainable agriculture practices coupled with weed control requirements in major crops like cereals, legumes, and vegetables. Due to increased pressure from regulatory authorities and consumer demand, farmers are looking for eco-friendly herbicides that could replace chemical herbicides.

Moreover, as per bioherbicides industry analysis, it will promote the utilisation of bioherbicides within the agricultural realm by giving more attention to the issues of increasing crop yield and improving soil health.

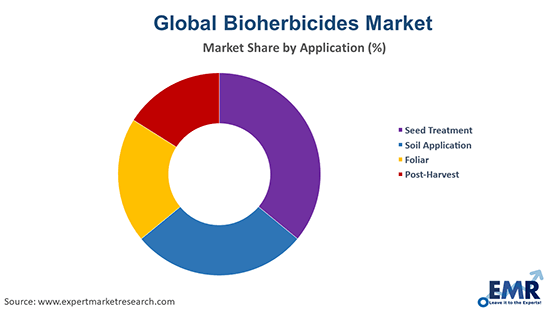

Bioherbicides Are Going To Be Mostly Used For Seed Treatment For Better Yield

Among the application industries, seed treatment is projected to register considerable growth. The process involves the direct application of bioherbicides onto the seeds before planting, improving its health and promoting early growth. Doing this would ensure proper management of the weeds right at the very start, improving crop yield with lesser use of post-emergence herbicides. Interest in seed treatment solutions is growing, which is backed by an increased focus on sustainable agriculture and integrated pest management; these provide a proactive way to weed control and guarantee health for crops and soil, thereby boosting the bioherbicides market revenue.

The bioherbicides industry in Asia Pacific is supplying most of the global demand for bioherbicides and is likely to remain the leading regional market due to the growing demand for high quantity and high-quality yields. The densely populated and agriculturally-dependent emerging economies of India and China are the country's most prominent bioherbicide markets in the Asia Pacific region, while Japan, Australia, Taiwan, and South Korea are also anticipated to display an increase in demand during the forecast period.

| CAGR 2026-2035 - Market by | Country |

| India | 16.9% |

| China | 14.1% |

| Canada | 13.2% |

| Australia | 10.0% |

| Italy | 9.0% |

| USA | XX% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The bioherbicides market share in North America is driven by the demand from the ornamental gardening industry and crop defence chemicals.

Key players differentiate themselves through the innovation of formulation technologies, development of customised solutions, investment in research and development, and strategic partnerships to enhance efficacy in the bioherbicides market.

Verdesian Life Sciences, based in North Carolina, United States, is a company that deals in providing bio-herbicides for enhanced nutrient management and better soil health. Its products increase crop yields by applying the most recent biological technologies, promoting sustainable farming methods.

Emery Oleochemicals was founded in 1840 and operates from Malaysia. It deals with turning natural oils and fats into bio-herbicides. This enables them to come up with eco-friendly solutions that reduce environmental impact while at the same time ensuring effective management of weed growth.

Hindustan Bio-Tech, founded in 1990 and based in India, produces bioherbicides utilising living organisms as the active weed control agent. The company targets sustainable agriculture with improved health for crops and fertility of the soil in various farming systems.

Deer Creek Holdings is a USA-based company, founded in 2005, and based in Ohio. The company offers state-of-the-art, biotechnology-developed bioherbicides. Their products ensure a safe environment and high effectiveness in agricultural applications by providing precision weed management.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players profiled in the bioherbicides market report are Verdesian Life Sciences, Emery Oleochemicals, Hindustan Bio-Tech, Deer Creek Holdings, Barmac Pty Ltd and BioHerbicides Australia, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global bioherbicides market attained a value of nearly USD 2.61 Billion.

The market is projected to grow at a CAGR of 12.80% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 8.70 Billion by 2035.

The major drivers of the market are the growing demand for high-quality yield, the increasing demand for the product from the ornamental gardening sector, and agriculturally-dependent emerging economies.

The key trends guiding the growth of the market include the developments in genetic engineering, the production of highly effective bioherbicides, and rising population.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The significant crop types using bioherbicides include agricultural crops and non-agricultural crops.

The major sources of the product are microbial and biochemical, among others.

The different applications of bioherbicides are seed treatment, soil application, foliar, and post-harvest.

The major players in the global bioherbicides market are Verdesian Life Sciences, Emery Oleochemicals, Hindustan Bio-Tech, Deer Creek Holdings, Barmac Pty Ltd, and BioHerbicides Australia, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Crop Type |

|

| Breakup by Source |

|

| Breakup by Mode of Application |

|

| Breakup by Mode of Action |

|

| Breakup by Formulation |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share