Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global biometrics market size reached USD 52.17 Billion in 2025. The market is estimated to grow at a CAGR of 12.50% during 2026-2035 to reach a value of USD 169.41 Billion by 2035.

Base Year

Historical Period

Forecast Period

According to the data issued in 2024, in China, 74 airports, representing 86% of the country’s international airports have biometric technology installed.

By 2030, the global e-commerce sector is projected to reach USD 5.5 trillion compared to USD 1.3 trillion in 2019.

In China, about 7,500 central and state government organizations, are using over 80,000 suspect biometric attendance systems.

Compound Annual Growth Rate

12.5%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Biometrics Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 52.17 |

| Market Size 2035 | USD Billion | 169.41 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 12.50% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 13.6% |

| CAGR 2026-2035 - Market by Region | Latin America | 13.0% |

| CAGR 2026-2035 - Market by Component | Services | 13.6% |

| CAGR 2026-2035 - Market by Biometric Type | Face Recognition | 15.1% |

| CAGR 2026-2035 - Market by Country | India | 14.9% |

| 2025 Market Share by Country | UK | 5.2% |

Biometric solutions are gaining popularity due to the need for security solutions in end use markets, such as BFSI, retail and e-commerce, and government.

In the banking sector, biometric security enhances fraud prevention strategies by discouraging financial crime and unauthorised access. Biometric technology offers an effective measure for banks to fulfill their KYC and Anti-Money Laundering (AML) requirements. The banking sector is expanding and according to 2022 data, the sector manages an estimated USD 370 trillion of assets worldwide.

The integration of biometric sensors in physical security systems ensures that access to sensitive areas is restricted to individuals with authenticated biometric credentials. This significantly mitigates the risk of unauthorised entry, thereby bolstering the overall security framework of military bases.

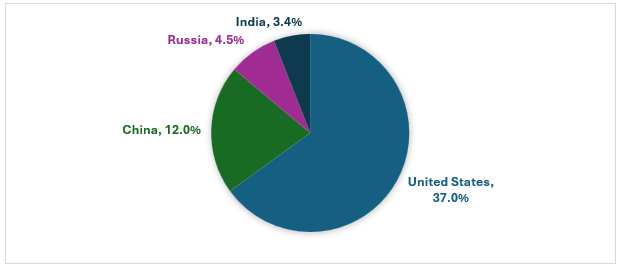

Figure: Global Military Expenditure by Country (2023), Percentage

Global military expenditure is continuously rising as a direct response to global deterioration in security. Military spending expanded from USD 1,989.8 billion in 2018 to USD 2,443.4 billion in 2023. The USA led global military spending, accounting for 37.0% in 2023. China followed with 12.0%, and Russia with 4.5%. India spent 3.4%, while Saudi Arabia and the UK each contributed 3.1%. In October 2022, Army Secretary Christine E. Wormuth approved the U.S. Army Biometric Program, focusing on biometric capabilities in areas like data collection, matching, storage, and analysis, all aimed at supporting military operations.

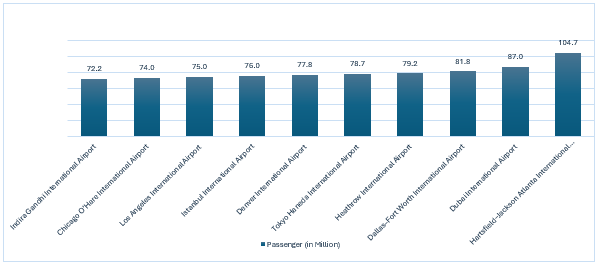

Biometric systems streamline airport processes, making travel faster and more convenient for passengers. These systems ensure that passengers are accurately identified through unique physical traits, reducing the risk of identity theft and data breaches.

According to the Airports Council International (ACI), the number of global air passengers reached nearly 8.5 billion in 2023, up 27% from 2022 levels and 94% from 2019.

Rising importance of security in airports; technological advancements; growing digital payments; and increasing importance of security are key trends impacting the biometrics market growth

Airports around the world are adopting biometric solutions such as facial and iris recognition for user authentication and contactless boarding. Biometrics reduce the risk of identity fraud and boarding mistakes and bring accuracy in verification. In 2023, airline industry revenue passenger- kilometres (RPKs) reached 94.1% of 2019 levels.

The incorporation of artificial intelligence (AI) and machine learning has improved biometric technology by introducing features such as facial and voice recognition, which increases the precision of biometrics.

Biometrics are crucial for digital payment as it eliminate the risk of payment card theft or fraud. In 2022, 195.0 billion real-time payments (RTP) transactions were recorded globally, a 63.2% year-over-year growth. The expansion in digital payment systems expand the use of advanced biometric solutions.

Biometrics cannot be easily shared, lost, or duplicated, as they are generally unique to individuals. Biometrics is increasingly being used in identity management, particularly for authentication. The rising importance of safety and security in various sectors such as government, law enforcement and healthcare is resulting in the adoption of biometrics.

Reportedly, an increasing number of developing nations, including China and India, are adopting biometric technologies for national identification programs and specific applications such as cash transfers, voter registration, and disaster relief. The United Nations Sustainable Development Goals aim to ensure that everyone has a legal identity by 2030, pushing organizations such as the World Bank to establish initiatives like ID4D (Identity for Development) and ID4 Africa. Utilizing biometric technology, these organizations are promoting the expansion of biometric usage in developing countries.

The biometrics market is witnessing an increased integration of new technologies such as IoT and artificial intelligence. AI is anticipated to play a key role in improving biometric accuracy, detecting spoofing attempts and identifying emerging threats. Additionally, the scalability of AI-enabled biometric solutions allows for the deployment across various sectors, including banking and finance, government, and retail, addressing the security and identification needs.

“Global Biometrics Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Component

Market Breakup by Biometric Type

Market Breakup by Contact Type

Market Breakup by Authentication

Market Breakup by End Use

Market Breakup by Region

Based on contact type, contact based biometric systems account for a significant market share

Contact based biometric devices require physical contact for collecting data. The commonly found contact based biometrics are fingerprint scanners, palm print scanners, and hand geometry scanners. According to 2023 data, 70% of the American population used fingerprint scanning, making it a prominent method of biometric technology in the United States.

Non-contact-based biometric systems include facial recognition terminals, iris scanners, and retina scanners. As per 2022 data, 18 airports across the United States have implemented facial recognition scanners.

Hybrid biometric devices verify the identity of an individual making use of two or more biometric modalities. The common hybrid biometric systems used are fingerprint, iris, and facial recognition. Hybrid biometrics is being widely used in airport terminals where multi-factor authentication is required.

Based on end use, the government and law enforcement sector is a major contributor to the global biometrics market revenue

Law enforcement uses various biometric tools, like fingerprint and facial recognition technologies to accelerate criminal identification. Governments employ biometrics for identity verification at international borders and mass surveillance. In 2023, Interpol announced the launch of its new biometric hub, BioHUB, powered by Idemia’s advanced Multibiometric Identification System (MBIS). MBIS 5 integrates next-generation algorithms to deliver higher matching accuracy, faster response times, and an improved user interface, with plans to deploy the system at border control points worldwide.

Biometric technologies are transforming BFSI sector by enhancing accessibility and security. They reduce fraud risks and eliminate the need of passwords or PINs thus, enhancing user experience. Prominent companies using biometric technologies for secure payments include Apple Pay, Google Pay, and Amazon One.

As digitization and demand for secure banking grows, the use of biometrics is rising in the banking sector. The digital wallet users, globally, are expected to reach 5.2 billion by 2026, leading to more usage of biometric solutions.

The market players are focusing on providing advanced biometric solutions with improved security features and customer service

Fujitsu is a global leader in providing technology and business solutions. Its business structure is aligned with the modern digital world. Headquartered in Japan, company offers its products and services to various industries including Automotive, Manufacturing, Retail, Financial Services, Transport, Public Sector, Energy and Utilities, and Customer Stories.

Founded in 1899, the company offers its products and services across various industries including Aerospace, Agriculture, Aviation, Broadcasting, Finance, Government, Healthcare, Logistics, Manufacturing, Retail, Telecom and Transportation.

The company offers its solutions through its core divisions and products including Cloud Solutions, Biometric technology, Enterprise solutions, and Healthcare solutions. M2SYS is globally recognized for its leadership in digital transformation, with its identification and authentication solutions implemented in countries such as the USA (prison management), Egypt (military database), Bolivia (Prison management), Uganda (NS security fund), Oman (Military database), Turkey (national ID), etc.

Leidos is a leading innovation company addressing national security and health challenges. The company have a presence across various markets including Aviation, Defense, Energy, Government, Health, Homeland, Intelligence, Science, and Space.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the global biometrics market are Thales SA, Aware, Inc, Imageware Systems, Inc, Accu-Time Systems, Inc, S.I.C. Biometrics Global Inc, and Phonexia s.r.o, among others.

Airports in Asia Pacific are increasingly adopting biometrics for contactless boarding to reduce the risk of identity fraud and boarding mistakes. In 2024, the air passenger number in the Asia Pacific region is projected to witness the highest year-on-year growth rate of 17.2%.

| CAGR 2026-2035 - Market by | Country |

| India | 14.9% |

| Mexico | 12.6% |

| Germany | 12.0% |

| Saudi Arabia | 11.8% |

| Canada | 10.8% |

| USA | XX% |

| UK | XX% |

| France | XX% |

| Italy | 10.6% |

| China | XX% |

| Japan | XX% |

| Australia | XX% |

| Brazil | XX% |

According to 2023 data, the transaction value of digital and mobile payments in Europe has grown by over 30% over the past three years. Leading digital wallet apps contributing to this rise include PayPal, Apple Pay, and Samsung Pay.

Biometrics are being widely used for detecting and preventing illegal entry into the North American countries. As recorded in 2022, the US Department of Homeland Security’s IDENT biometric system has around 260 million people in the database.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global market for biometrics attained a value of USD 52.17 Billion in 2025.

The market is estimated to grow at a CAGR of 12.50% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 169.41 Billion by 2035.

The factors driving the market growth are increasing requirements for safety and security, rising technological advancements, and expansion of the government and law sector.

The key trends of the market include growing incidences of identity thefts, cybercrime, document fraud, and terrorism, increasing affordability of IP cameras, sensors and other smart devices, advancements in artificial intelligence (AI), and development of new markers in high-security applications.

The key regional markets for biometrics are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Different components are solution and services.

The key players in the market include Fujitsu Ltd, NEC Corporation, M2SYS Technology, Leidos Holdings Inc, Thales SA, Aware, Inc, Imageware Systems, Inc, Accu-Time Systems, Inc, S.I.C. Biometrics Global Inc, and Phonexia s.r.o, among others.

The biometric systems based on contact types are contact based, non-contact based, and hybrid.

The end uses are BFSI, government and law enforcement, commercial and retail, healthcare, travel and immigration, and others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Biometric Type |

|

| Breakup by Contact Type |

|

| Breakup by Authentication |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share