Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global biopharmaceuticals market size was valued at USD 472.14 Billion in 2025, driven by the increasing prevalence of chronic diseases, advancements in the medical sector, and the growing investments by the leading life sciences companies. The market is anticipated to grow at a CAGR of 7.60% during the forecast period 2026-2035 to reach a value of USD 982.19 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.6%

Value in USD Billion

2026-2035

*this image is indicative*

Based on product type, monoclonal antibodies (MAbs) are expected to hold a significant share in the biopharmaceuticals industry during the forecast period, owing to their increased therapeutic applications to treat chronic disorders and in the field of oncology. They are developed artificially in laboratories using biotechnological tools. Monoclonal antibodies are used to cure different types of autoimmune conditions, infectious diseases, and cancer. Their lower toxicity and enhanced safety compared to chemotherapy drugs have proven to improve patient survival rates and reduce adverse side effects. These factors are expected to aid the growth of the segment in the coming years.

Geographically, North America is anticipated to dominate the global market for biopharmaceuticals during the forecast period. The increasing investments in research and development activities and the growing burden of chronic disease are the key factors driving the biopharmaceuticals industry growth in North America. Meanwhile, the biopharmaceuticals industry is expected to grow at a significant CAGR in the Asia Pacific region during the forecast period due to an increase in the number of people suffering from diabetes and other chronic diseases and the increased availability of biopharmaceutical products in the region.

Biopharmaceuticals are medicinal products containing proteins, sugars, nucleic acid, tissues, and living cells derived from various biological sources such as animals, microorganisms, and humans. In 1982, recombinant human insulin (Humulin) made from specially modified bacteria was the first biopharmaceutical approved by the food and drug administration (FDA) for human therapeutic uses and marketing. Following the success of Humulin, various types of biopharmaceuticals have been derived from recombinant DNA such as whole blood, vaccine, antigens, hormones, immunosera, enzymes, cytokines, monoclonal antibodies, allergenic, and gene therapies, among others.

By product type, the industry can be segmented into:

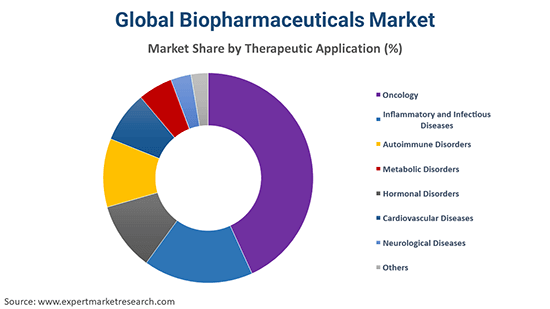

Based on therapeutic application, the industry can be divided into:

Based on region, the industry can be segmented into:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The biopharmaceuticals industry has been growing considerably for the last few years. The biopharmaceutical products are widely used in the treatment of diabetes, cancer, rheumatoid arthritis, and psoriasis. Extensive use of biopharmaceuticals in the treatment of chronic diseases, such as diabetes, cancer, and heart diseases, is a key factor expected to propel the market growth during the forecast period. Moreover, the growing research and development activities by the major pharmaceutical companies and the rapid advancements in genetic engineering are the key trends in the market, which are expected to further propel the biopharmaceuticals industry.

The report gives a detailed analysis of the following key players in the global biopharmaceuticals market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global biopharmaceuticals market reached a value of USD 472.14 Billion in 2025.

The market is anticipated to grow at a CAGR of 7.60% during the forecast period of 2026-2035 to reach a value of USD 982.19 Billion by 2035.

The increasing prevalence of chronic diseases, advancements in the medical sector, and the growing investments by the leading life sciences companies are the major factors propelling the growth of the market.

The key market trends guiding the growth of the industry include the rise in research and development activities by pharmaceutical companies and the advancements in genetic engineering.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific, with North America accounting for the largest share in the market.

Monoclonal antibodies, recombinant growth factors, purified proteins, recombinant proteins, recombinant hormones, vaccines, recombinant enzymes, cell and gene therapies, and synthetic immunomodulators, among others are the significant product types in the industry.

Oncology, inflammatory and infectious diseases, autoimmune disorders, metabolic disorders, hormonal disorders, cardiovascular diseases, and neurological diseases, among others are the significant therapeutic applications of the product.

The major players in the industry are Amgen Inc., AbbVie Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Novo Nordisk A/S, Pfizer Inc., and GlaxoSmithKline plc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Therapeutic Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share