Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global buckwheat market reached a volume of 5.03 Million Tons in 2025. The market is further expected to grow at a CAGR of 4.00% in the forecast period of 2026-2035 to reach a volume of 7.45 Million Tons by 2035.

Base Year

Historical Period

Forecast Period

The market is experiencing a surge in demand for gluten-free foods, benefiting buckwheat as a naturally gluten-free grain.

Buckwheat is recognised for its environmental benefits, including its ability to thrive in poor soil conditions with minimal inputs.

Companies are innovating, introducing a range of buckwheat-based products, including snacks, beverages, and health supplements.

Compound Annual Growth Rate

4%

Value in Million Tons

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Buckwheat, a whole grain possessing similarity to quinoa, is highly nutritious and is commonly used as an ingredient in various food products, including breakfast foods and flour. Often considered a superfood, buckwheat contains a rutin called flavonoid that strengthens the blood vessels. Rutin has also been described as vitamin P, and its ability to improve and retain the elasticity of the blood vessel is well established. Buckwheat is a varied component in supplements used to avoid diseases related to ageing vessels, including hypertension, atherosclerosis, and stroke of myocardial infarction. Many benefits of the product consumption include improved digestion, building immunity, and bone safety, among others.

The diversified use of buckwheat extract in herbal formulations offering benefits like strengthening the blood vessels and increasing blood flow as well as added health benefits in bone health management are some of the major factors expected to accelerate the buckwheat market growth in the forecast period. Buckwheat extract can also be combined with the majority of food items that can be used in the food and beverage sector as an additive. Moreover, buckwheat is also versatile in culinary applications, used in a variety of dishes ranging from pancakes and noodles to porridge and salads, and its increasing use in both traditional and innovative recipes contributes to the demand for buckwheat.

Growing preference for plant-based and vegan diets; organic farming practices; innovation in food products; and research and development are the major trends impacting the buckwheat market expansion.

The rise of plant-based and vegan diets is fueling the buckwheat market development due to the high protein content and nutritional benefits of buckwheat.

Buckwheat is often grown without the use of synthetic pesticides and fertilisers, making it an ideal crop for organic farming systems.

The food sector is exploring innovative uses of buckwheat in various products, from breakfast cereals and energy bars to alternative meat products.

Continued research into buckwheat genetics and cultivation practices is leading to the development of higher-yielding and more disease-resistant varieties.

The rise of plant-based and vegan diets is a significant trend impacting various segments of the food sector. Buckwheat’s protein content is higher than that of many grains, and it includes all eight essential amino acids, making it an excellent source of complete protein for vegans and vegetarians who may struggle to obtain sufficient protein from plant-based sources alone. In response to the growing demand for plant-based and vegan products, food manufacturers are expanding their product lines to include buckwheat-based options. Buckwheat is being incorporated into a wide range of products, from traditional items like soba noodles and pancakes to innovative products such as buckwheat-based snacks, breakfast cereals, and meat substitutes.

In December 2023, Big Bold Health announced the launch of the first 100% organic Himalayan Tartary Buckwheat (HTB) Sprout Powder, a plant-based superfood. Himalayan Tartary Buckwheat (HTB) is recognised for its superior nutritional profile compared to common buckwheat varieties. It's rich in antioxidants, minerals, and amino acids, making it an exceptional choice for those seeking to enhance their diet with nutrient-dense foods. By introducing a sprout powder form, Big Bold Health is leveraging the increased bioavailability of nutrients that sprouting offers, ensuring consumers receive maximum health benefits.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Buckwheat Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Breakup by Source

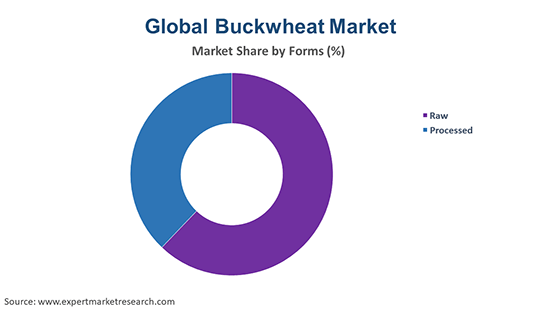

Breakup by Form

Breakup by Application

Breakup by Region

By form, flour accounts for a major buckwheat market share due to its heightened use in the preparation of pancakes and bread, among other food items

Buckwheat flour is the leading segment in terms of market share. Buckwheat flour is used to prepare a wide range of products, from baked goods like bread, pancakes, and noodles to various gluten-free recipes, and this versatility makes it highly sought after by both consumers and manufacturers. The growing awareness of gluten intolerance and celiac disease, along with the rise in health-conscious consumers seeking nutritious and whole grain options, has significantly boosted the demand for buckwheat flour as its high nutritional value, including protein, dietary fibres, and minerals, aligns well with these dietary trends.

Buckwheat groats are also anticipated to experience a robust growth in the coming years. Groats, which are the hulled kernels of buckwheat, are consumed as a whole grain and have been gaining popularity due to the increasing consumer preference for whole, unprocessed foods. They are often used in porridges, salads, and as a rice alternative, offering a nutritious and flavourful component to meals.

The food and beverages sector maintains its dominance in the market owing to the increasing usage of buckwheat in a broad range of food products

The buckwheat market is driven by its growing usage in the food and beverages sector. Buckwheat is used in a wide range of food products, including noodles (especially in Japanese and Korean cuisines), pancakes, bread, and other baked goods. Its nutritional benefits, such as high protein content and gluten-free nature, make it popular among health-conscious and gluten-intolerant populations. In some cultures, buckwheat is a staple food, contributing significantly to its consumption. For example, in Russia, buckwheat porridge is a traditional dish, while in Japan, soba noodles are widely consumed.

Buckwheat is also used in animal feed as a source of protein and other nutrients as its amino acid profile and digestibility can be beneficial for livestock health and productivity, thereby contributing to the buckwheat market expansion. Moreover, utilising buckwheat in animal feed can be part of sustainable agriculture practices. As a crop, buckwheat can improve soil health and biodiversity, making it an eco-friendly option for animal feed production.

The market is significantly dominated by Europe and North America. Poland accounts for a significant share of exports, followed by Bolivia and Peru. The demand for the product is growing in the European and North American regions due to the changing lifestyles of consumers, which has led to the rising occurrence of lifestyle-related diseases such as diabetes, obesity, high cholesterol, and high blood pressure, among others. The rising demand for superfoods owing to the rising health consciousness across the regions is also propelling the market growth.

The Asia Pacific buckwheat market is also expected to witness robust growth, with China and Japan showcasing a thriving demand for the product. Buckwheat is a healthy food product, and the rising awareness about its health benefits is boosting the market growth. Factors such as changing food habits of consumers, preference for superfoods, rising disposable incomes as well as the availability of these superfoods on e-commerce platforms, are boosting the market expansion in the region.

The market players are increasing their collaboration efforts and launching new products to gain a competitive edge in the market

| Company | Founding Year | Headquarters | Products |

| Archer Daniels Midland Company (ADM) | 1902 | Illinois, United States | Food ingredients, animal feeds and feed ingredients, and biofuels |

| Wilmar International Limited | 1991 | Singapore | Edible oils and grains |

| Bulk Barn Foods Limited | 1982 | Ontario, Canada | Baking ingredients, health foods, sweets, snacks, nuts, and grains |

| Bob’s Red Mill Natural Foods | 1978 | Oregon, USA | Flours, cereals, baking mixes, grains, and beans |

Other major players in the buckwheat market include Skvyrskyi Grain Processing Factory Ltd, Minn-Dak Growers Ltd., and The Birkett Mills, among others. The market players engage in various activities to strengthen their position, meet the growing demand for buckwheat products, and capitalise upon the growing trends of health-conscious consumption and sustainable agriculture.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global buckwheat market attained a production volume of nearly 5.03 Million Tons.

The market is projected to grow in terms of value at a CAGR of 4.00% between 2026 and 2035.

The major drivers of the industry, such as rising disposable incomes, increasing population, rising health consciousness, the growing use of its extract in a variety of food products as an additive, diversified use of buckwheat extract in herbal formulations, changing lifestyles of the consumers, and rising prevalence of lifestyle-related diseases, are expected to aid the market growth.

The key market trends guiding the growth of the market include the growing demand for superfoods and the rising penetration of e-commerce platforms.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The leading sources of buckwheat in the market are organic and non organic.

The major forms of buckwheat in the industry are groats, flour, and flakes, among others.

The significant application segments in the market are food and beverages, animal feed, and cosmetic and personal care, among others.

The major players in the market are Archer Daniels Midland Company (ADM), Wilmar International Limited, Skvyrskyi Grain Processing Factory Ltd, Bob’s Red Mill Natural Foods, Minn-Dak Growers Ltd., Bulk Barn Foods Limited, and The Birkett Mills, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Source |

|

| Breakup by Form |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share