Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global bunker fuel market reached 4.62 Million B/d in 2025. The market is further expected to grow at a CAGR of 1.80% in the forecast period of 2026-2035 to reach a volume of about 5.52 Million B/d by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

1.8%

Value in Million B/d

2026-2035

*this image is indicative*

| Global Bunker Fuel Market Report Summary | Description | Value |

| Base Year | Million B/d | 2025 |

| Historical Period | Million B/d | 2019-2025 |

| Forecast Period | Million B/d | 2026-2035 |

| Market Size 2025 | Million B/d | 4.62 |

| Market Size 2035 | Million B/d | 5.52 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 1.80% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 2.1% |

| CAGR 2026-2035 - Market by Country | India | 2.7% |

| CAGR 2026-2035 - Market by Country | China | 2.3% |

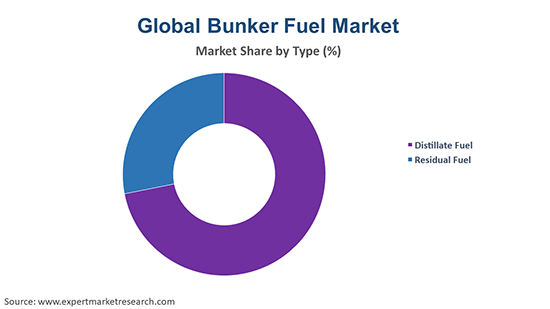

| CAGR 2026-2035 - Market by Type | Residual Fuel | 2.0% |

| CAGR 2026-2035 - Market by End Use | Tankers | 2.4% |

| Market Share by Country 2025 | UK | 3.4% |

Bunker fuel refers to the fuel used in ships, especially large vessels like tankers and cargo ships, derived from the residue of crude oil distillation. Common types include High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Gas Oil (MGO), and Liquefied Natural Gas (LNG). Bunker fuels offer several benefits including cost-effectiveness, with fuels like HSFO being cheaper to produce. Their high energy density allows ships to operate efficiently over vast ocean routes without frequent refuelling.

The bunker fuel demand growth is being fuelled by the increased development of hydrogen resources in offshore areas. Additionally, the rising need for bunker fuel in product tankers and crude oil transportation is playing a significant role in expanding the market. Moreover, the growth of marine trade, spurred by heightened import and export activities, is further contributing to this trend.

The bunker fuel industry growth is being boosted by the increasing adoption of LNG. Liquefied natural gas (LNG) is gaining traction as a bunker fuel due to its lower environmental impact compared to traditional fuels. LNG emits significantly fewer pollutants, including sulfur oxides (SOx) and nitrogen oxides (NOx), making it a popular option for shipping companies aiming to comply with environmental regulations and reduce their carbon footprint.

The bunker fuel market dynamics and trends are influenced by the integration of digital technologies, including AI and blockchain, which optimise fuel consumption and enhance supply chain transparency. Digital tools such as real-time fuel monitoring, route optimization software, and automated engine tuning are helping ships reduce fuel usage and improve operational efficiency. These innovations are driving demand for bunker fuels that optimize performance and support sustainability goals.

The shipping industry is also exploring renewable energy sources such as wind and solar power to supplement traditional bunker fuels. Hybrid systems that integrate renewable energy with conventional marine engines are under development, offering the potential to significantly reduce fuel consumption and emissions. These advancements are part of a broader effort to decarbonise the maritime industry and reduce its environmental footprint, further driving the demand of bunker fuel market.

According to the UNCTAD secretariat, between 2002 and 2022, international maritime trade expanded significantly across various cargo types. In 2002, main bulk cargo, such as coal and iron ore, accounted for approximately 17,000 billion ton-miles, while oil contributed around 12,000 billion ton-miles, and container trade stood at about 3,000 billion ton-miles. Gas trade reached nearly 1,000 billion ton-miles, with chemicals at 2,000 billion. By 2005, main bulk rose to 20,000 billion ton-miles, oil to 13,000 billion, container trade to 5,500 billion, gas to 1,000 billion, and chemicals to 2,000 billion ton-miles. This upward trend continued in 2010, with main bulk growing to 24,000 billion ton-miles, oil reaching 14,500 billion, containers climbing to 7,000 billion, gas at 2,500 billion, and chemicals at 3,500 billion ton-miles. In 2015, the main bulk increased to 28,000 billion ton-miles, oil maintained around 15,000 billion, container trade advanced to 13,500 billion, gas rose to 6,500 billion, and chemicals to 4,500 billion. By 2020, main bulk had expanded to 32,000 billion ton-miles, oil to 17,000 billion, container trade to 14,500 billion, gas to 7,500 billion, and chemicals to 5,000 billion ton-miles. In 2021, main bulk reached 32,500 billion, oil 15,500 billion, containers 15,000 billion, gas 8,000 billion, and chemicals 5,500 billion ton-miles. In 2022, the trade for main bulk reached 33,000 billion ton-miles, oil at 16,000 billion, containers at 15,500 billion, gas at 8,500 billion, and chemicals at 6,000 billion ton-miles. Increasing maritime trade is boosting the bunker fuel industry revenue through heightened fuel demand as more vessels operate and transport larger cargo volumes over longer distances.

ExxonMobil Corporation

Royal Dutch Shell plc.

BP Plc

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Bunker Fuel Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Fuel Grade

Market Breakup by Commercial Distributors

Market Breakup by End Use

Market Breakup by Region

| CAGR 2026-2035 - Market by | Country |

| India | 2.7% |

| China | 2.3% |

| UK | 1.9% |

| USA | 1.8% |

| France | 1.6% |

| Canada | XX% |

| Germany | XX% |

| Italy | XX% |

| Japan | 1.4% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

marine diesel oil (mdo) is becoming a significant driver in the growth of the bunker fuel industry, over high sulfur fuel oil (hsfo) for several key reasons, largely due to regulatory changes and environmental concerns. One of the primary factors boosting MDO’s growth is compliance with the International Maritime Organization’s (IMO) 2020 regulations, which mandate that ships must use fuels with a sulfur content of no more than 0.5%. HSFO, with its higher sulfur content, is restricted in most regions unless ships are fitted with costly scrubber systems to reduce emissions.

Liquefied natural gas (LNG) is increasingly driving the demand of bunker fuel market over very low sulfur fuel oil (vlsfo) due to several key advantages, particularly around environmental benefits, and long-term sustainability. One of the most significant factors is LNG’s ability to significantly reduce harmful emissions compared to VLSFO. LNG emits lower levels of sulfur oxides (SOx), nitrogen oxides (NOx), carbon dioxide (CO2), and particulate matter, making it a much cleaner alternative. As the maritime industry faces growing pressure to reduce its environmental impact, LNG provides a better option for meeting both current and future emission regulations.

The companies specialise in the exploration, production, and distribution of oil and gas, as well as providing a range of energy solutions, including refining, marketing, and the development of renewable energy sources.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global bunker fuel market attained a volume of nearly 4.62 Million B/d .

The market is projected to grow at a CAGR of 1.80% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035, reaching a value of around 5.52 Million B/d by 2035.

The major drivers of the industry, such as the rising marine trade, growing oil and gas exploration activities, rising demand from the developing regions, and increasing demand for MDO, are expected to aid the market growth.

The key market trend guiding the growth of the bunker fuel market includes the exploration of these untapped reserves to meet the growing energy demand.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The leading types of bunker fuel in the market are distillate fuel and residual fuel.

By fuel grade, the market is divided into high sulphur fuel oil (HSFO), very low sulphur fuel oil (VLSFO), marine diesel oil (MDO), liquefied natural gas (LNG), and others.

Based on commercial distributors, the market is segmented into oil majors, large independent, and small independent.

The leading end use sectors in the industry are oil majors, large independent, and small independent.

The competitive landscape consists of ExxonMobil Corporation, Royal Dutch Shell plc., BP Plc, Total SA, Chevron Corporation, and Neste Oyj, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Fuel Grade |

|

| Breakup by Commercial Distributors |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share