Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global cancer cachexia market size attained a value of USD 2.43 Billion in 2025 driven by continuous clinical trials in oncology, expanding mindfulness among individuals and healthcare experts, presence of an enormous pool of undiscovered patients, quick urbanisation, and expanding government support for healthcare. The market is anticipated to grow at a CAGR of 4.70% during the forecast period of 2026-2035 to attain a value of USD 3.85 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.7%

Value in USD Billion

2026-2035

*this image is indicative*

The global market for cancer cachexia is expected to be driven by rising instances of cachexia and developments in modern treatment systems. North America, Europe and Japan are expected to be key markets. Cases of cachexia are growing and presently, the condition affects nearly 1 percent of all patients. Recent years have witnessed increased understanding of the multifarious nature of cachexia, in particular, the function of inflammatory mediators and anabolic and catabolic imbalances. While many treatment methodologies have not been able to clear phase III clinical trials despite initial promise, the ghrelin receptor agonist anamorelin has delivered initial results.

Cachexia is a serious outcome of a variety of chronic conditions, and associated with a poor quality of life. In last-stage chronic heart failure, the occurrence of cachexia ranges from 5–15 percent; in cases of advanced cancer, the incidence of cachexia lies between 50–80 percent. Many people with chronic renal disease, chronic obstructive pulmonary disease (COPD), and rheumatoid arthritis develop cachexia as they near the end of their lives. Cachectic syndrome is a key source of morbidity and mortality in cancer patients. Cancer cachexia has also been linked to decreased chemotherapeutic efficacy, increased adverse effects, and discontinuation of treatment. Progressive cachexia signals poor prognosis with a shorter survival time, and explains close to 20 percent of all cancer deaths. If there is weight loss of 10 percent or more within a period of 6 months, it may indicate presence of cachexia. There is a direct relation between survival of cancer patients and rate and amount of weight loss.

Cachectic syndrome is described to have three stages - precachexia, cachexia, and refractory cachexia. In the precachectic stage, indications such as such as weight loss (less than 5 percent), anorexia, and impaired glucose tolerance appear. Advancement to cachexia depends on several factors including systemic inflammation, type and stage of cancer, low food intake, and response to treatment. In refractory cachexia, active weight loss management is rendered almost impossible due to active catabolism or presence of cachectic factors. Patients experiencing acute muscle wasting are not likely to gain from treatments aimed at achieving lean tissue and function. In this phase, therapy seeks to mitigate symptoms and reduce distress rather than prolong life.

At present, cancer cachexia is incurable. Current therapies for cachexia entail a multidisciplinary approach; combination therapy including diet adjustments and exercise (where possible) has been integrated with new medicinal agents such as Megestrol acetate, medroxyprogesterone, ghrelin, and omega-3-fatty acid, among others. These treatments have been reported to yield better survival rates and quality of life. Advancements in treatment systems and promise shown by under-trial drugs are expected to boost the market.

In 2021, Helsinn, a Swiss pharmaceutical group engaged in the production of high-quality cancer care and rare disease products, announced the first launch of Adlumizo (anamorelin) to treat cancer cachexia in malignant non-small cell lung cancer, gastric cancer, pancreatic cancer and colorectal cancer in Japan, through Ono Pharmaceutical, its partner firm. Adlumizo (anamorelin), approved by the Japanese Health Authorities, has been shown to be effective in increasing body weight, muscle mass, and appetite in cancer cachexia patients.

AV-380 by AVEO is first-in-class, potent, humanized inhibitory IgG1 antibody targeting growth differentiation factor 15 (GDF15). Preclinical data suggest that inhibition of GDF15 leads to a switch from catabolism to anabolism, which indicates that GDF15 inhibition with AV-380 may reverse the effects of cachexia. As of 2023, AVEO Oncology completed enrolment in its phase I trial in Cachexia (In volunteers) in USA (Parenteral) (NCT04815551), and planned to commence a phase Ib trial in Cancer in mid-2022.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

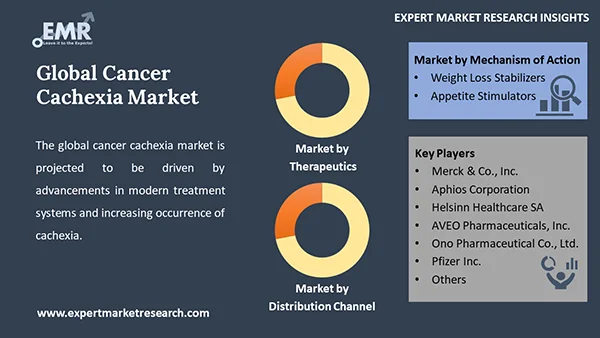

“Cancer Cachexia Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Therapeutics

Market Breakup by Mechanism of Action

Market Breakup by Distribution Channel

Market Breakup by Region

The report presents a detailed analysis of the following key players in the market, looking into their capacity, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:

The EMR report gives an in-depth insight into the industry by providing a SWOT analysis as well as an analysis of Porter’s Five Forces model.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global market of Cancer Cachexia attained a value of USD 2.43 Billion.

The market is anticipated to grow at a CAGR of 4.70% during the forecast period of 2026-2035 to reach a value of USD 3.85 Billion by 2035.

The major drivers of the market include the neglected requirement for the therapy of cancer cachexia in creating economies, continuous clinical trials in oncology, expanding mindfulness among individuals and healthcare experts, presence of an enormous pool of undiscovered patients, quick urbanisation, and expanding government support for healthcare.

The rising instances of cachexia and developments in modern treatment systems are the key industry trends propelling the market's growth.

The major regions in the industry are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

On the basis of therapeutics, the market is divided into progestogens, corticosteroids, and combination therapy, among others.

Based on mechanism of action, the market is divided into appetite stimulators and weight loss stabilisers.

The several distribution channels include hospital pharmacy, retail pharmacy, and online pharmacy.

The major players in the industry are Merck & Co., Inc., Aphios Corporation, Helsinn Healthcare SA, AVEO Pharmaceuticals, Inc., Ono Pharmaceutical Co., Ltd., and Pfizer Inc., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Therapeutics |

|

| Breakup by Mechanism of Action |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share