Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global cardiac biomarkers market reached a value of about USD 12.47 Billion in 2025. The market is further estimated to grow at a CAGR of 9.90% in the forecast period of 2026-2035 to reach a value of around USD 32.05 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

9.9%

Value in USD Billion

2026-2035

*this image is indicative*

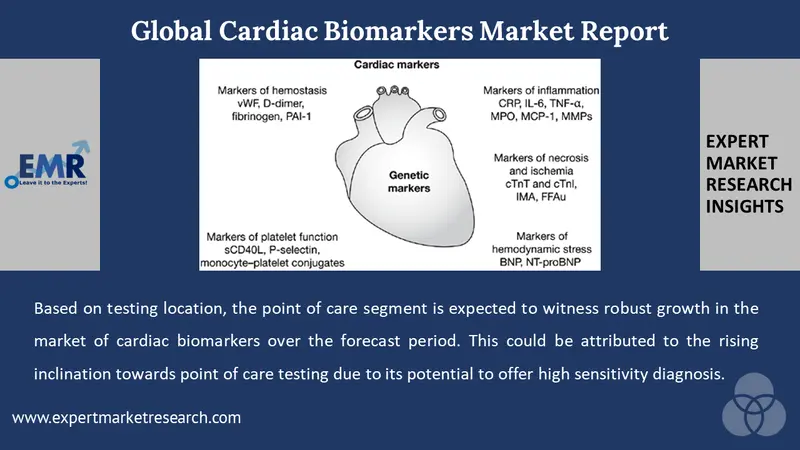

Based on testing location, the point of care segment is expected to witness robust growth in the market of cardiac biomarkers over the forecast period. This could be attributed to the rising inclination towards point of care testing due to its potential to offer high sensitivity diagnosis. The improved patient management owing to rapid turnaround of results in a user-friendly manner without wasting time is accelerating the development of the market. The point of care offers high-quality biomarker measurements for diverse clinical settings, including acute care, outpatient clinics, clinical research centres, homes, rural areas, and the developing world. The point of care testing facilitates rapid treatment decisions and reduces the pressure on emergency departments. They enable widespread access to affordable cardiac diagnostics as it leads to reduction in overall hospital and laboratory facility costs.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Cardiac biomarkers are used to diagnose critical heart conditions by evaluating the heart functioning of a patient. The biomarkers include enzymes, hormones or proteins that show up in the blood under severe stress or any injury and the test measure these cardiac biomarkers to find the seriousness of heart disease.

Market Breakup by Biomarker Type

Market Breakup by Indication

Market Breakup by End User

Market Breakup by Testing Location

Market Breakup by Region

The pandemic bolstered the market for cardiac biomarkers due to the impact of COVID 19 on cardiovascular systems, which led to the rising application of biomarkers in diagnosis and treatment. The increasing cases of cardiac diseases worldwide due to unhealthy lifestyle changes are providing impetus to the market development of cardiac biomarkers. As per the World Health Organisation estimates, approximately 17.9 million people died from cardiovascular diseases in 2019, representing 32% of overall global deaths. The growing awareness about the reliable diagnosis that cardiac biomarkers offer to prevent heart diseases and the developing healthcare infrastructure play a critical role in expanding the market of cardiac biomarkers. The government initiatives to improve the diagnosis and treatment of cardiovascular diseases and the rising approvals of biomarker tests by organisations like the United States Food and Drug Administration is also invigorating the market of cardiac biomarkers. The increasing diagnostic tests offered by market players and the rapid development of novel biomarker tests to support clinicians in cardiac risk identification are expected to augment the market over the forecast period.

The report gives a detailed analysis of the following key players in the global cardiac biomarkers market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global cardiac biomarkers market attained a value of nearly USD 12.47 Billion.

The market is assessed to grow at a CAGR of 9.90% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach almost USD 32.05 Billion by 2035.

The major market drivers include the rising importance of cardiac biomarkers in treating heart diseases, developing healthcare infrastructure, and the expansion of point of care facilities.

The key market trends guiding the growth of the market include the increasing cases of heart diseases, government initiatives in approving the biomarker diagnostic tests, and development of novel cardiac biomarker tests by market players.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The significant biomarker types of cardiac biomarkers include Creatine Kinase -MB (CK-MB), Troponins (T and I), Myoglobin, Brain Natriuretic Peptide (BNPs) or NT-proBNP, and Ischemia Modified Albumin (IMA), among others.

The various indications of the market, include myocardial infarction, congestive heart failure, acute coronary syndrome, and atherosclerosis, among others.

The major end users of the market include hospitals and speciality clinics.

The different testing locations of cardiac biomarkers, include point of care and laboratory testing.

The major players in the market are F. Hoffmann-La Roche Ltd, Beckman Coulter, Inc., Creative Diagnostics, Bio-Rad Laboratories, Inc., and bioMérieux SA, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Biomarker Type |

|

| Breakup by Indication |

|

| Breakup by End User |

|

| Breakup by Testing Location |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share