Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global clinical IT market was valued at USD 8.49 Billion in 2025, driven by the increasing demand for remote monitoring across the globe. The market is anticipated to grow at a CAGR of 12.50% during the forecast period of 2026-2035, with the values likely to reach USD 27.57 Billion by 2035.

Base Year

Historical Period

Forecast Period

In April 2023 , Epic and Microsoft joined forces to utilize generative AI to improve EHRs. This collaboration includes incorporating the Microsoft Azure OpenAI Service into Epic's EHR system, improving features such as interactive data analysis and natural language queries. Such collaborations are expected to boost market value in the forecast period.

The World Health Organization states that chronic diseases result in around 41 million deaths annually, making up 74% of total global deaths. Increasing disease prevalence will contribute to elevated market demand for clinical IT solutions.

In July 2024 , Ochsner Health's investment branch establishes a USD 10 million fund to support early-stage health companies in Louisiana. A surge in investments is amongst the major market trends.

Compound Annual Growth Rate

12.5%

Value in USD Billion

2026-2035

*this image is indicative*

Clinical IT is the use of information technology in healthcare to enhance clinical processes and patient care. It includes systems like electronic health records (EHRs), clinical decision support systems (CDSS), and telemedicine platforms to manage patient data and improve workflows. Medical data storage, retrieval, and analysis call for strong systems from providers.

Healthcare professionals depend on clinical IT to address the challenges of healthcare services and patient-focused care needs. Efficiently storing, retrieving, and analyzing medical data is vital for minimizing administrative burdens, and errors, as well as enhancing diagnoses and treatments.

Technological Advancements Drive Increased Demand in the Market Growth

The global clinical IT market is experiencing growth due to technological advancements like AI, ML, cloud computing, IoT, blockchain, and telemedicine. These advancements are revolutionizing healthcare delivery by transforming data management, enabling predictive analytics, improving data accessibility and storage, facilitating real-time patient monitoring. In April 2023 , Epic and Microsoft joined forces to utilize generative AI to improve EHRs. This collaboration includes incorporating the Microsoft Azure OpenAI Service into Epic's EHR system, improving features such as interactive data analysis and natural language queries. For instance, a study in 2024 estimated that AI will transform the healthcare sector through electronic health records. It will allow data extraction from unstructured sources, enhancing clinical decision-making, and enabling real-time access to patient information.

Growing Prevalence of Chronic Diseases to Boost Global Clinical IT Market Demand

The World Health Organization reports that chronic diseases, also known as non-communicable diseases, result in around 41 million deaths annually, making up 74% of total global deaths. Chronic diseases such as diabetes, heart disease, and cancer need continuous observation and care, backed by strong clinical IT platforms. Approximately 20 million new cancer diagnoses and 9.7 million fatalities were recorded in 2022. The growing number of chronic illnesses is fueling the expansion of the global market for the clinical IT.

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

Growing Need for Big Data Analytics

Big data analytics is transforming the market by managing a large amount of data. The data from various sources such as EHRs and clinical trials can be analyzed easily which helps to healthcare providers to predict outcomes and prepare personalized treatment for an individual. It enhances operational efficiency, aids clinical decision-making, and fosters innovation in healthcare delivery and research.

Increased Focus on Patient-Centered Care

Healthcare services to suit the specific needs and preferences of each patient is amongst major market trends. Clinical IT systems, such as patient portals and mobile health apps helps to improve communication and ensures the patient feedback and values in treatment. Tailored treatment strategies based on data analysis and digital medical records enhance patient satisfaction and well-being.

Growing Demand for Remote Patient Monitoring

The increase in remote patient monitoring is transforming the global market. Remote patient monitoring (RPM) enables healthcare providers to track patients continuously in non-clinical environments, providing advantages to individuals with chronic illnesses, post-surgery recovery requirements, and the elderly population. Utilizing remote monitoring devices for tracking vital signs leads to better patient health management, decreased readmissions, increased patient involvement, and improved treatment compliance.

Rising Government and Private Funding

Governments are funding into healthcare IT infrastructure to enhance the quality and availability of care. These funds are provided for initiatives such as EHR, telemedicine, and data standards to encourage the adoption of clinical IT. Investors in the healthcare industry, including venture capitalists, are also funding to establish AI in healthcare with an aim to enhance data management, diagnostics, and personalized medicine. This is speeding up research efforts and transforming how healthcare services are provided. For instance, in July 2024 , Ochsner Health's investment branch established a USD 10 million worth Ochsner Louisiana Innovation Fund to support early-stage health companies in Louisiana. The fund looks for companies with creative business models and effective leadership that match Ochsner's focus on value-based care, digital transformation, and community health.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market Breakup by Product

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

Market Segmentation Based on Products to Witness Growth

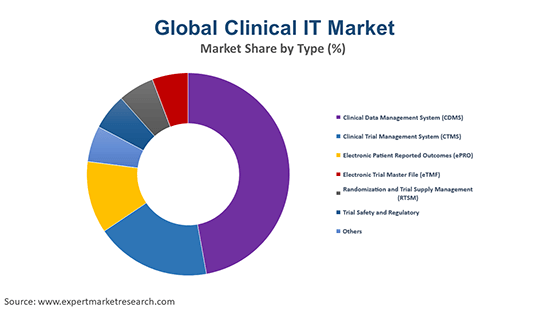

Based on the product, the market is divided into clinical trial management system (CTMs), clinical data management system (CDMs), electronic trial master file (eTMF), electronic data capture (EDC), randomization and trial supply management (RTSM), electronic patient reported outcomes (ePRO), and others. Electronic data capture (EDC) is expected to dominate the market because they can simplify data collection and management for clinical trials. It helps in enhancing precision, minimizing mistakes, and enabling immediate data retrieval to accelerate the trial procedure. Their connection to other tools and data analysis skills are essential for meeting regulatory requirements and conducting effective research.

Market Share Based on End User

End users of the market include hospitals and clinics, insurance companies, research and development organizations, government agencies, and others. Among these, hospitals and clinics are expected to lead the market during the forecast period. Hospitals and clinics use clinical IT system for patient record management, workflow improvement, and care coordination enhancement. The combination of electronic health records, clinical decision support systems, and telehealth platforms improves the patient outcomes and operational efficiency. These systems play a crucial role in securely handling large quantities of patient information in healthcare environments.

Based on region, the market report covers North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

North America is expected to dominate the market with its sophisticated healthcare infrastructure, widespread use of EHRs, and substantial investments in healthcare IT. The increase in adoption of EHRs is rising significantly in the United States. As per Health IT reports, until 2021, nearly 9 out of 10 U.S.-based physicians had adopted EHR. The market growth is additionally driven by the region's emphasis on patient-focused care and regulatory requirements.

Europe is also poised to have a significant market share because of support from the government, strong research and development (R&D), and the digitalization of healthcare. The market in the Asia-Pacific region is rapidly expanding due to increased healthcare spending, adoption of digital health, expansion of healthcare facilities, large population, and an increase in chronic diseases.

The key features of the market report include patent analysis, grant analysis, funding, and investment analysis as well as strategic initiatives including recent partnerships and collaborations by the leading players. The major companies in the market are as follows:

IQVIA Holdings Inc (IQVIA) was founded in 1982 and is based in North Carolina, U.S. The company offers information, technology solutions, and clinical research services to healthcare companies. Its IQVIA CORE solution utilizes data, technology, and analytics to provide actionable insights for improved healthcare outcomes, leveraging industry expertise in diseases, regions, and scientific advancements.

Oracle Corporation, based in Austin, Texas, is a multinational computer technology company. In September 2023 , Oracle introduced new enhancements to its healthcare solutions, including cloud-based EHR capabilities, generative AI services, public APIs, and back-office improvements tailored for the healthcare sector.

OpenClinica is a proprietary open-source program designed for collecting electronic data and managing clinical data during clinical trials. OpenClinica’s electronic data capture (EDC) platform provides interactive electronic case report forms (eCRFs), streamlining data capture and allowing researchers to gather improved data more efficiently.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market Clario, Inc., Cognizant Technology Solutions Corporation, Dassault Systemes, McKesson Corporation, Parexel International (MA) Corporation, and Signant Health.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share