Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global cocoa market size reached around USD 25.48 Billion in 2025. The market growth can be attributed to the robust growth of the e-commerce sector, rising demand for cocoa-based products, increasing focus on sustainability, and technological advancements and innovations.

Base Year

Historical Period

Forecast Period

The global cocoa market is driven by rising demand of cocoa as a raw material in food and beverage industry along with other industry verticals like cosmetics and pharmaceuticals. The market is seeing exponential growth, driven by rising consumer demand for premium, sustainable, and ethically sourced cocoa. This growth is further fuelled by the increasing popularity of high-quality chocolate products and the expanding market for premium cocoa.

Additionally, industry regulations and environmental concerns are prompting a shift toward more sustainable practices. The EU's Deforestation Regulation, set to take effect on December 30, 2025, is compelling cocoa producers to adopt deforestation-free practices, enhancing traceability, transparency, and compliance within the supply chain. These changes are expected to attract eco-conscious consumers and investors, driving expansion in the premium cocoa market.

As 2025 approaches, the cocoa market is shifting towards greater sustainability, with an emphasis on traceability and transparency across supply chains. In February 2025, Johnvents Group revealed plans to ramp up production of its Premium Cocoa Products (Ile-Oluji) from 13,000 to 30,000 metric tonnes annually. This expansion is set to elevate the company as a major player in the processed cocoa sector while aiming to support 150,000 farmers by 2030. The action will also solidify Nigeria’s standing as a leading exporter of processed cocoa globally. By supporting sustainable farming methods and improving the traceability of its supply chains, the cocoa industry is positioning itself to meet the increasing demand for ethically sourced, high-quality products, ensuring sustained growth in a competitive global market.

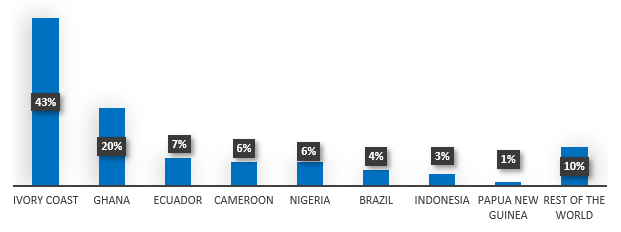

Figure: Production of Cocoa Beans Globally, 2021-2022

With the increasing demand for sustainable, ethical, and traceable products, the cocoa market is embracing new growth prospects. Programs like Fairtrade certification and the Cocoa & Forests Initiative (CFI) are boosting transparency and traceability, helping cocoa producers in Ghana and Côte d’Ivoire gain access to premium markets.

These initiatives not only support farmers and ensure regulatory compliance but also promote sustainable practices, offering manufacturers a competitive edge in a market driven by changing consumer preferences. With accelerating demand for sustainable, ethical and traceable cocoa products.

Advancements in agroforestry and regenerative agriculture offer a major opportunity for cocoa market growth, improving both productivity and environmental sustainability. These practices help restore ecosystems, reduce carbon footprints, and boost biodiversity, all of which contribute to higher cocoa yields. OFI’s Cocoa Compass strategy, which aims to plant 15 million trees by 2030, underscores its commitment to transforming cocoa farming into a more sustainable and resilient industry.

The average chocolate consumption amounts to 0.9 kg per year, this growing demand for chocolate is a key factor driving the expansion of the cocoa market, as cocoa is essential in chocolate production. Beyond its role in confectionery, cocoa’s antioxidant, moisturising, and nourishing qualities are increasing its value in cosmetics, personal care, and pharmaceuticals. As these industries continue to grow, cocoa’s versatile applications open new opportunities, broadening the market for producers and driving higher demand across various sectors.

Investments in advanced and state-of-art processing facilities are further accelerating the demand in cocoa market. For instance, in June 2024, ADM announced the construction of new cocoa processing plant in Kuamsi, Ghana. The investment not only caters towards the surging demand in cocoa production but also support local cocoa farmers and boosts regional economic development, positioning Ghana as a key player in the global cocoa market.

Increasing investments in the agricultural sector are playing a significant role in driving economic growth and enhancing the cocoa market. These investments support initiatives to improve processing capacity and sustainability across the industry. For instance, British International Investment provided USD 40.5 million in financing to Johnvents Group in February 2025, enabling the company to expand its Ile-Oluji plant's cocoa processing capacity from 13,000 to 30,000 tons annually. This expansion is expected to contribute significantly to the growing demand in the cocoa market, as highlighted in recent cocoa market analysis.

Cocoa derivatives, like cocoa butter and cocoa powder, are predominantly used in cosmetic industry, in products like, skein creams, lotions, hair shampoos, perfumes and hair conditioners. For instance, in 2024. Foschini launched Luella Beauty makeup range. The range along with being highly pigmented contains plants-based ingredients like shea butter, cocoa butter, jojoba and coconut oil which helps in skin nourishment.

Along with this cocoa butter has significant application in products like cakes, ice creams, lattes and hot chocolate where they are attributed for enhancing creamy texture for these products. This growing demand of cocoa for these industries is significantly contributing to the overall growth in cocoa market.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The Expert Market Research’s report titled “Global Cocoa Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Cocoa Product Type

Cocoa butter remains the dominant segment in the global cocoa market, leading both in size and growth rate. Its significant role in chocolate production, where it is essential for delivering smooth textures and rich flavours, continues to drive demand. Furthermore, the increasing consumer preference for sustainable and premium products has led to higher usage of cocoa butter within the cosmetics and personal care industries, where it is prized for its moisturising and antioxidant properties. Several key partnerships in this space are further helping in growth of the market. For instance, In 2024, Barry Callebaut acquired Cocoa Horizons to strengthen its ethical cocoa sourcing , enhancing both sustainability and supply chain transparency. Concurrently, Cargill and L'Oréal formed a partnership to launch a premium, fair-trade cocoa butter line, promoting sustainable practices and addressing deforestation issues in cocoa production. These strategic initiatives cement cocoa butter’s pivotal role in driving market expansion.

Market Breakup by Cocoa Application

Food and Beverage as a application segment dominate the cocoa market. Among Food and beverages, confectionary segment remains the most significant one, driven by high chocolate demand, keeping in mind the risisng of chocolate confectionery demand, in 2024, Cargill increased the capacity of its coatings and fillings plant by 60% in Netherlands. Moving forward dairy sector benefits from the cocoa’s role in flavoured milk products and ice creams. Further the bakery segment is driven by use of cocoa in range of bakery products such as cakes, pastries, thus expanding the market reach. Beyond food, the application if various cocoa products is rapidly being seen in the cosmetics and pharmaceuticals sector. Here the cocoa is formulated to be used in skincare products and heath supplements. As these sectors expand, the cocoa market is poised for continued growth across diverse applications.

Market Breakup by Region

The Europe cocoa market is the largest globally, driven by strong demand in the confectionery, bakery, and dairy sectors. Leading players like Hershey and Mondelez are prioritising sustainable sourcing to meet growing consumer demand for ethical and premium products. Europe remains at the forefront of this market, where ethical sourcing and premium cocoa are significant growth drivers, particularly through initiatives such as Fairtrade certification. On the other hand, the Asia Pacific region is the fastest growing, fueled by rising chocolate consumption in China and India. This growing demand positions Asia Pacific as a key player in the global cocoa market's expansion.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Surging Demand in Cocoa Butter in is driving Growth in the Cocoa Product Market

Cocoa butter holds a dominant position in the global cocoa products market, accounting for 61.1% of the market share in 2024, additionally the butter segment is projected to be the fastest growing segment, with CAGR of 4.93% in forecast period of 2023 to 2034. As the largest segment, it plays a pivotal role in chocolate production and is increasingly sought after in the cosmetics and personal care industries due to its moisturising and antioxidant properties.

Surging Growth in the Food and Beverages Driven by Consumer Preferences

The Food and Beverages segment is the largest in the global cocoa market, accounting for 91.3% of the total market share in 2024. This segment's dominance is a result of the increasing demand for cocoa in confectionery, bakery, and dairy products. The rise of cocoa use in premium and artisanal cocoa based items is one for the driving factor for food and beverage segment dominance. Along with this, consumer growing preference for ethically sources cocoa have further fuelled the cocoa market.

Cocoa products rich antioxidant and moisturising properties make it an ideal product to be used in skincare and personal care products. Along with this, cocoa products find their niche for their inclusion in pharmaceutical applications, such as the lipid -lowering effects of cocoa butter have been investigated to exhibit lipid -lowering properties. hence, the cosmetics and pharmaceuticals segment is the fastest growing segment in the global cocoa market with CAGR of 4.64% during forecast period of 2023 to 2034, positioning it as key factor in the cocoa market expansion.

Europe’s Cocoa Boom Driven by Strong Demand of High -Quality Products

Europe dominated the global cocoa market, accounting for 36.9% of the total market share in 2024. This region leads due to the strong demand for high-quality cocoa in the confectionery and premium chocolate sectors. European consumers' preference for ethically sourced and sustainable cocoa products is significantly reshaping the market dynamics. Keeping the sustainability factor in mind, PRONATEC opened its first organic processing factory in Switzerland, this factory was responsible for processing around 7,056 MT of cocoa from June 2022 to June 2023. Major other companies in the region, such as Nestlé and Mars, continue to prioritise sustainable cocoa sourcing, driving further cocoa market expansion.

Latin America is the fastest-growing region in the global cocoa market, driven by its favourable agroforestry heritage and ideal growing conditions. Countries like Brazil and Mexico are enhancing their cocoa production, benefiting from the region’s rich agricultural potential. For instance, 500,000 hectares of high yield cocoa farms are estimated to be in Brazil in next 10 years which will have capacity of producing 1.6 million tons of cocoa. Further, The region's cocoa market expansion is supported by investments in both production and export infrastructure, further boosting its capacity to meet the growing global demand for high-quality, sustainable cocoa products.

Key players in the global cocoa market are working to expand production to meet rising global demand while maintaining sustainable and efficient practices. They are investing in agricultural technology, including precision farming and agroforestry, to boost cocoa yield per hectare and lessen environmental impact. Major producers are also using sustainable farming methods, making sure they follow regulations like the EU's deforestation-free cocoa sourcing rule. Additionally, companies are improving supply chain transparency with blockchain technology to trace cocoa from farm to product. This ensures ethical sourcing. They are also focusing on enhancing farmer livelihoods by funding training programs and providing better access to high-quality inputs. By adopting these practices, cocoa producers aim to increase efficiency, lower costs, and satisfy the growing consumer demand for premium, sustainable cocoa.

Barry Callebaut AG was founded in 1996 and is based in Zurich, Switzerland. It is one of the world’s top makers of high-quality cocoa and chocolate products. The company offers a variety of solutions for food manufacturers and professional chocolate users. Its large product range, commitment to sustainability, and technological improvements have made Barry Callebaut an important player in the global cocoa and chocolate market.

TOUTON S.A. was founded in 1987 and is based in Paris, France. The company plays a significant role in the cocoa and coffee industries by sourcing, processing, and trading cocoa beans and other raw materials. TOUTON S.A. has established a strong reputation for its commitment to sustainability and traceability, making it an important partner in the cocoa supply chain.

Olam Food Ingredients (OFI) was founded in 2020 and is based in Singapore. The company is a major global supplier of ingredients like cocoa, coffee, nuts, and spices. With a wide sourcing network and a commitment to sustainable practices, OFI is essential in providing high-quality cocoa products to food manufacturers around the world. It drives innovation and supports the growth of the global cocoa market.

Cemoi Group was founded in 1947 and is headquartered in Perpignan, France. As one of Europe’s largest chocolate manufacturers, Cemoi Group specialises in producing high-quality chocolate and cocoa products for industrial, retail, and food service sectors. With a focus on sustainability and innovation, the company is committed to offering premium cocoa solutions while promoting fair trade and environmentally responsible practices. Cemoi Group’s strong market presence and dedication to quality make it a prominent player in the global cocoa and chocolate industry.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the cocoa market are Cargill Incorporated, Cocoa Processing Company Limited (CPC), ECDM Agroindustrial Corp., Pronatec AG, Blommer Chocolate Company, and Crown of Holland Limited, among others.

• Comprehensive quantitative analysis of global cocoa market trends.

• Region-wise and segment-wise breakdown for accurate market forecasting.

• Insights into key drivers, challenges, and emerging industry opportunities.

• Competitive landscape profiling of top cocoa companies.

• Supply chain analysis with technological and infrastructure developments.

• Trusted industry insights backed by real-world data and expertise.

• Customised reports tailored to your specific business needs.

• Up-to-date trends and forecasts across global cocoa sectors.

• Extensive coverage of emerging and established logistics markets.

Unlock valuable insights by downloading a free sample of the Global Cocoa Market Report. Stay ahead with expert analysis of market trends, growth drivers, and strategic forecasts. Learn how key players are shaping the future of global cocoa sector and gain a competitive edge in this evolving sector.

Middle East and Africa Cocoa Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 25.48 Billion.

The key players in the market report include Barry Callebaut AG, Touton S.A., Olam Food Ingredients (OFI), Cemoi Group, Cargill Incorporated, Cocoa Processing Limited (CPC), ECOM Agroindustrial Corp. Limited, and Pronatec AG. Bloomer Chocolate Company, Crown of Holland, among others.

Cocoa Butter is the dominant segment in the cocoa market, driven by its excellent functional properties, versatility, and strong market demand.

The key strategies driving growth in the cocoa production market include innovations in sustainable farming practices, the development of high-quality cocoa varieties, and the adoption of agroforestry techniques. Expansion into emerging markets, particularly in Asia and Latin America, is also boosting cocoa production, while addressing growing global demand. Additionally, sustainable sourcing initiatives and traceability through blockchain technology are enhancing transparency and ethical practices within the supply chain. Strategic partnerships and investments in local farming communities are crucial for ensuring long-term supply and improving farmer livelihoods.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| Report Features | Details |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Trade Data Analysis |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share