Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global data storage market size was valued at USD 265.73 Billion in 2025. The industry is expected to grow at a CAGR of 15.10% during the forecast period of 2026-2035 to reach a value of USD 1084.41 Billion by 2035. The market growth is driven by the continued emphasis on high-capacity storage product development, which has resulted in huge investments on research and development to cater to the explosive generation of data.

Major hard-drive manufacturers in the data storage market are now challenging the limits of storage density to serve the needs of enterprise, cloud, and AI workloads. For instance, Seagate launched its 30TB Exos and IronWolf Pro hard drives based on HAMR in July 2025, offering capacities of up to 36 petabytes within a rack, and it is a milestone in shrinking the data center footprint and cost per terabyte.

Along with new product offerings, new innovations are also being initiated and invested in by various vendors. Seagate recently invested an amount of 135 million USD in its research center in Europe for photonics, focusing on the development of 100 TB hard drives by 2030. Such initiatives contribute towards boosting the data storage market development.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

15.1%

Value in USD Billion

2026-2035

*this image is indicative*

Companies are increasing their adoption of storage solutions specific to AI and new workload patterns, leading vendors to expand their innovations in the data storage market. For instance, in April 2025, Lenovo started a major refresh of its data storage offerings with the launch of 21 new ThinkSystem and ThinkAgile models designed to meet AI, virtualization, and scalability demands, with these solutions being liquid-cooled HCI solutions and turnkey AI Starter Kits. These developments exemplify how vendors are catering to the changing demands enterprises have with respect to performance, efficiency, and flexibility with data storage solutions.

All-flash and hybrid solutions that offer efficient performance serve as a major growth indicator for organizations aiming to provide real-time analytics and AI applications. In November 2025, IBM released an enhancement to its Storage Scale System 6000, including all-flash expansion enclosures that use 122TB QLC flash drives, increasing full support for a single rack to 47PB. The solution is expected to enhance capacity and performance for data-intensive applications in an enterprise setting, which clearly highlights the relevance of future solutions in the data storage market.

Partnerships between storage vendors and tech companies can also aid in faster innovations and better market entry. In October 2025, a distribution partnership was announced between a company named OpenDrives and a company known as Versatile Distribution Services or VDS. According to the partnership, the intention is to improve the delivery or deployment of the Atlas software-defined storage solutions by OpenDrives. By leveraging the storage know-how of OpenDrives and the channel distribution expertise of VDS, customers can now more easily purchase the solutions.

The growth of the global data storage market is being fueled by growing investments for research and development of products that focus on artificial intelligence. Many organizations have been enhancing regional research and development centers for speeding up innovation related to HPC and intelligence storage architectures. Artificial In December of 2025, DDN announced that it has inaugurated an entirely new research and development center based in Pune, India. Also, it is focusing its efforts there on enhancing artificial intelligence and HPC storage solutions and supporting Make in India.

Enhanced distribution channels enable storage providers to expedite entry in the data storage market and enhance customer acquisition. In October 2025, OpenDrives made an announcement on a distribution agreement with Versatile Distribution Services (VDS) for simplified access to the Atlas storage product lines. This move helps storage channel partners to easily obtain pre-integrated hardware and software platforms. This arrangement brings to light how storage manufacturers leverage channel growth plans for easy adoption of innovative storage technology.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Data Storage Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Storage Architecture

Key Insights: The data storage market comprises has different forms of storage, such as, file and object-based storage and block storage. These have different purposes for enterprises. File and object storage solutions from vendors such as Qumulo, Cloudian, and Hitachi Vantara focus on unstructured data, hybrid cloud integration solutions, and metadata-intensive architectures for AI and analytics. The block storage offerings of Pure Storage, NetApp, and IBM FlashSystem are designed with low latency and high performance required in databases and real-time systems. The latest hybrid integrations of Hitachi Vantara's Virtual Storage Platform One show how companies integrate storage capabilities.

Market Breakup by Storage Type

Key Insights: The demand for the enterprise data storage market is driven through flash solutions (Pure Storage FlashBlade), cloud solutions (AWS S3 and Azure Blob Storage), software-defined solutions (VDURA and DataCore), and HDD solutions (Seagate Exos and Ultrastar from WD). On the consumer side, SSD solutions (SK Hynix 245TB PCIe 5.0), USB drives, cards, and HDDs continue to acquire market share through retail channels for their use in consumer applications involving portable and large-capacity storage.

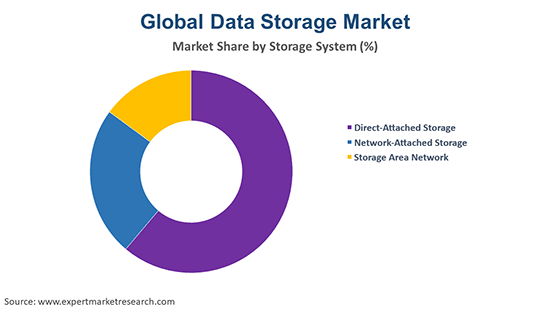

Market Breakup by Storage System

Key Insights: The demand for direct-attached storage (DAS), network-attached storage (NAS), and storage area network (SAN) is driven by different needs. For instance, DAS is provided by companies like TerraMaster and Synology, is useful for high-throughput access. The NAS storage is provided by Synology DiskStation and OpenDrives Atlas, used for file sharing. Other types of storage are provided by Dell EMC, Hewlett Packard Enterprise, and IBM, mainly useful for block storage. Another recent development is OpenDrives Astraeus which is gaining traction in the data storage market for its use in cloud workflows.

Market Breakup by End Use

Key Insights: End-use applications that the data storage market serves include media and entertainment, education, IT & telecom, defense and aerospace, BFSI, cloud service providers, among others. While media organizations use scalable object and file storage solutions available with Cloudian and Qumulo for high-definition content, BFSI and telecomm industries opt for secure high availability solutions available with IBM FlashSystem and Hitachi Vantara for storage requirements. Cloud service providers like AWS, Microsoft Azure, and Google Cloud expand distributed storage capabilities to cater to enterprise requirements worldwide.

Market Breakup by Region

Key Insights: North America has emerged to be a leading destination propelling the data storage market growth owing to the increasing storage adoption globally due to the investments by cloud hyperscalers and AI leaders such as AWS and Microsoft, Google Cloud, and innovators such as Pure Storage and NetApp. Europe is focused on the development of secure and compliant storage offerings by the likes of HPE, IBM, and Hitachi Vantara. Asia Pacific is growing with investments by Huawei Cloud, SK Hynix SSDs, and new-age OEMs. Latin America as well as the Middle East & Africa market is adopting due to local data centers and hybrid models by global system integrators.

By storage architecture, file and object-based storage

Storage files and object-related solutions are picking up pace in the data storage market expansion due to the increase in unstructured data being generated by artificial intelligence, IoT, and media-related workloads in enterprises. To address this requirement, storage manufacturers are enhancing object storage solutions with cloud-native scalability and metadata-centric designs. In March 2024, NetApp announced an update to its ONTAP Object Storage solutions, which would allow seamless integration with hybrid cloud environments and artificial intelligence workflows.

The need for block storage solutions is consistently rising for performance-intensive applications such as databases and ERP systems, especially for virtualized infrastructures. Vendors have been working to enhance NVMe-based block solutions for lower latency and better throughput. For instance, in September 2024, IBM announced improvements to its FlashSystem solutions and unveiled cyber-resilient NVMe block storage solutions meant for transaction-heavy business applications.

By storage type, enterprise – software-defined storage shows robust growth

Software-defined storage is witnessing notable demand in the data storage market for its hardware independence and scalability in storage system designs. Vendors continue to invest in solutions for containerized and AI applications. In June 2024, Red Hat announced that it is enhancing its OpenShift Data Foundation offerings to better integrate software-defined storage in hybrid cloud and Kubernetes environments. This is to help enterprises better utilize their storage and reduce lock-in to infrastructure.

On the other hand, the adoption of HCI is increasing due to the growing requirement for simplified data center management and the integration of computation and storage resources. Companies are also making their HCI solutions more robust for supporting edge and AI applications. In May 2025, Nutanix introduced new functionality for the Nutanix Cloud Platform that provides enhanced scalability and performance for storage-intensive apps that require the data center.

By storage system, direct-attached storage records higher preference

The data storage market trends observe notable growth as direct-attached storage is highly preferred for local workload processing with dedicated high-speed access, which finds applications in edge computing and video production. Storage vendors continue to upgrade their direct-attached storage offerings with higher capacity and faster interfaces. In February 2024, OWC (Other World Computing) announced the release of their ThunderBlade X12 direct-attached storage solutions with high-speed NVMe interfaces geared towards professional applications.

Storage area networks play a pivotal role in corporate environments, especially for bigger enterprises. SAN vendors have initiated the expansion of storage through NVMe, focusing on automation. In August 2024, Hewlett Packard Enterprise added more features to its HPE Alletra Storage MP storage area network, announcing enhanced automation and performance for high-priority tasks.

By end use, BFSI sector shows robust growth

BFSI sector accounts for a substantial share of the data storage market owing to the increasing adoption of reliable and high-performance storage solutions, which serve the purpose of transaction processing and government regulations. Storage solutions providers are shaping storage solutions according to financial workloads. In October 2024, Oracle enhanced its storage, named OCI Block Volume, by launching high-performance storage levels, which are beneficial for financial services workloads.

The media and entertainment sector needs storage that is scalable for high-resolution videos, VFX, and content distribution. The companies are launching storage solutions that are optimized for media workflows. Quantum, in January 2025, made improvements in the StorNext file system. The changes incorporate advancements that allow media companies to efficiently handle large amounts of content.

By region, North America leads the market share

North America continues to be an important data storage industry due to hyperscale cloud growth and enterprise digitization. Businesses are pouring significant investments into local storage infrastructure. In April 2024, Microsoft declared additional Azure data center investments in the United States, featuring new local storage capacity for artificial intelligence computing workloads. Such investments enhance local cloud data storage services.

The Asia Pacific market is undergoing increased growth in terms of storage requirements owing to cloud adoption and digital economies. Companies are increasing their presence in this market to cater to the increasing demand in this region. Alibaba Cloud in July 2024 announced its expansion of its cloud storage infrastructure in Southeast Asia.

Major global data storage market players are gearing up for diversification of portfolios and technology upgradation by major players to cater to dynamically changing business and consumer needs. Major data storage players are now concentrating on investment in high-capacity hardware, NVMe-based solutions, and software-defined solutions to accelerate AI, business analytics, and hybrid cloud applications. Partnerships and integration of ecosystems are also being utilized by major players to improve workability among different environments, especially in the cloud market.

At the same time, data storage companies are focusing on growth related to geographic expansion and investments aimed at serving the demand of hyperscale data centers, enterprises, and Edge. Companies are also increasing manufacturing facilities and research and development centers and data centers in various geographies and acquiring companies with capabilities that complement their offerings. Sustainability and energy efficiency are getting highlighted as key strategic themes.

IBM Corporation is a multinational technology firm established in 1911 and headquartered in Armonk, New York, United States of America. It provides a diverse range of information technology solutions for enterprises such as hybrid cloud, artificial intelligence-based platforms, and highly advanced data storage solutions to global businesses.

NetApp, Inc. is a data infrastructure firm established in 1992 and headquartered in San Jose, California, in the United States of America. NetApp, Inc. deals in cloud-integrated data storage solutions, data management software, and solutions for hybrid cloud.

Microsoft Corporation, a global tech firm, was established in 1975, with its headquarters in Redmond, Washington, United States. It deals in various products and services such as cloud computing through Azure, enterprise software, and storage solutions for data.

Pure Storage, Inc. is an American firm that operates within the technology sector and was established in 2009 and is headquartered in Santa Clara, California. It primarily develops all-flash data storage solutions and subscription-based storage solutions that can be used for enterprises and cloud computing.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Dell Inc., and Samsung Electronics, among others.

Explore the latest trends shaping the Global Data Storage Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global data storage market trends 2026.

United States Data Center Storage Market

Philippines Data Center Storage Market

Next-Generation Data Storage Market

Vietnam Data Center Storage Market

Latin America Data Storage Market

Brazil Data Storage Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 15.10% between 2026 and 2035.

Key strategies driving the market include product innovation, adoption of cloud and hybrid storage models, strategic partnerships, R&D investments in AI-ready storage, and regional infrastructure expansion.

The key trends of the market include the increasing research and development activities for the development of smart technologies and increasing volume of media data transfer.

The major regions in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The leading storage architectures in the market are file and object based storage and block storage.

The significant storage types in the market are enterprise storage and consumer storage. Enterprise storage can be further segmented into flash storage, cloud based storage, hard disk drive (HDD), software defined storage, and hyper-converged infrastructure, among others. Consumer storage type includes optical disks, memory cards, USB flash drives, solid state devices, and hard disk drives (HDD), among others.

The various storage systems in the market include direct-attached storage, network-attached storage, and storage area network.

The major end uses in the market are media and entertainment, education, IT and telecommunications, defence and aerospace, banking, financial services and insurance (BFSI), and cloud service providers, among others.

The key players in the market include IBM Corporation, NetApp, Inc., Microsoft Corporation, Pure Storage, Inc., Dell Inc., and Samsung Electronics, among others.

In 2025, the global data storage market reached an approximate value of USD 265.73 Billion.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 1084.41 Billion by 2035.

Major challenges that the global data storage market face includes high infrastructure and energy costs, data security risks, regulatory compliance requirements, hybrid cloud complexity, and cost management pressures.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Storage Architecture |

|

| Breakup by Storage Type |

|

| Breakup by Storage System |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share