Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global e-cigarette market reached a value of USD 21.53 Billion in 2025. The e-cigarette market is further expected to grow at a CAGR of about 13.00% in the forecast period of 2026-2035 to reach a value of about USD 73.09 Billion by 2035.

Base Year

Historical Period

Forecast Period

The 2023 National Youth Tobacco Survey by the FDA and CDC reported that 7.7% of youth used e-cigarettes, highlighting growing youth engagement in the market. This trend suggests a significant potential consumer base for the e-cigarette industry, raising concerns and calls for stricter regulations.

In fiscal year 2024, Imperial Brands achieved a net income of £2.62 billion, surpassing expectations. The company’s tobacco alternatives segment saw a 26% growth, contributing 8% to total revenue. This underscores the growing profitability of tobacco alternatives, especially in the e-cigarette market.

Philip Morris International’s stock hit an all-time high following its fourth-quarter results, with a 7% year-over-year revenue increase to USD 9.7 billion. The company’s success reflects the expanding demand for its alternative products, including e-cigarettes, driving financial growth and investor confidence.

Compound Annual Growth Rate

13%

Value in USD Billion

2026-2035

*this image is indicative*

The global e-cigarette market is led by the North America region. The increasing trend of do-it-yourself (DIY) e-liquid is also creating positive market prospects by combining different aromas according to consumer preference requirements, with the implementation of various flavoured variants and easy product availability through online retail portals. The demand is likely to continue growing due to multiple factors, including the growing number of female smokers, technological advancements, as well as comprehensive research and development (R&D).

Since e-commerce trends are increasing, online distribution is gaining momentum as a strong distribution channel. Most ex-smokers need a high degree of nicotine concentration, so the pods would possibly typically come with the stronger nicotine oil (nicotine oil) electric liquids, enabling them to raise blood's nicotine's peak concentration and becoming a common alternative to the traditional electronic liquid.

The e-cigarette market is expanding due to rising demand for nicotine salt e-liquids, the growth of disposable e-cigarettes, increasing health awareness encouraging smokeless alternatives, and advancements in technology offering greater product customisation and improved user experience.

The global e-cigarette market has experienced significant growth due to the increasing demand for nicotine salt e-liquids. These products offer a smoother vaping experience and faster nicotine absorption, resembling the sensation of traditional cigarettes. Manufacturers are quickly adapting to this demand, leading to rapid innovation in nicotine salt-based solutions. Nicotine salts, created by combining nicotine with acids, reduce pH levels to prevent throat irritation, allowing for higher nicotine concentrations. While this offers smoother vaping, it may also increase the risk of side effects from higher nicotine delivery.

Disposable e-cigarettes are gaining popularity due to their convenience and ease of use, appealing to both new and seasoned users. With no refilling or maintenance required, these products have become a dominant trend in the market. Their affordability, sleek designs, and availability in various flavours have further bolstered their appeal. In January 2025, MR FOG introduced its NOVA disposable vape, featuring a 2.01-inch TFT colour display and three adjustable modes (ECO, BOOST, and TURBO), setting a new benchmark for performance and sophistication in the industry.

As public awareness of smoking's harmful effects rises; more smokers are turning to e-cigarettes as a safer alternative. E-cigarettes are perceived as less harmful than traditional tobacco products, driving their increasing popularity. This shift towards smokeless options is expected to continue influencing global market growth. In October 2024, a study revealed that one million people in England vape despite never having smoked regularly, a significant rise from 2021. Experts have called for stricter regulations, particularly around marketing and product design, to address concerns about the increasing use among young people and non-smokers.

Technological innovations are reshaping the e-cigarette market, with manufacturers introducing devices that provide improved performance, extended battery life, and enhanced customisation options. Features like temperature control and adjustable airflow allow users to personalise their vaping experience, driving market growth. In 2025, innovations such as AI-powered e-cigarettes that optimise settings for flavour and battery life, solar-powered pods, and synthetic nicotine-based e-liquids were introduced. These advances, combined with mobile app connectivity and graphene-coil technology, promise to enhance user satisfaction and fuel the market’s expansion, particularly among experienced vapers.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

E-cigarettes are battery-powered equipment containing a liquid, which can be inhaled by people as a vapour by heating the liquid. They are also referred to as e-cigs and vapes. The vapour inhaled can contain nicotine and aromatic and flavouring agents.

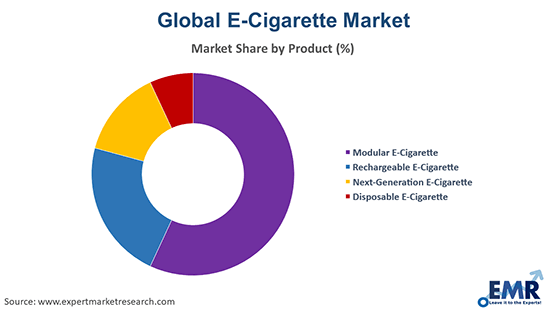

Based on product, the e-cigarette market can be divided into the following:

On the basis of flavour, the industry can be divided into the following:

Based on battery mode, the e-cigarette market can be categorised as follows:

On the basis of distribution channel, the industry can be divided as follows:

On the basis of region, the industry can be divided as follows:

The rising number of smokers worldwide is driving the global e-cigarette market. The smokers, however, are becoming more conscious of the negative effects of regular cigarettes, causing them to turn to e-cigarettes as a better option. Therefore, the increasing desire among the consumers to quit smoking tobacco products has helped to raise e-cigarettes sales. The industry for e-cigarettes has been further driven by product advancements, including the introduction of new generation e-cigs offering consumers versatility in terms of strength and refill. The conveniently available mod and pod vapes also have a positive impact on the growth of the global e-cigarette market.

The report gives a detailed analysis of the following key players in the global e-cigarette market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds:

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global e-cigarette market reached a value of USD 21.53 Billion in 2025.

The market is projected to grow at a CAGR of nearly 13.00% in the forecast period of 2026-2035.

The market is estimated to reach a value of about USD 73.09 Billion by 2035.

The major drivers of the market include rising disposable incomes, increasing population, and the rising awareness among consumers about the ill-effects of traditional cigarettes.

The rising desire among the consumers to quit smoking tobacco products and rising population of smokers are expected to be key trends guiding the growth of the market.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market.

Next-generation e-cigarette, modular e-cigarette, rechargeable e-cigarette, and disposable e-cigarette are the dominant products in the market.

Tobacco, botanical, fruit, and sweet, among others are the leading flavours of e-cigarette in the market.

The automatic e-cigarettes and manual e-cigarette are the various battery modes available in the market.

Specialty e-cigarette shops, online, supermarkets and hypermarkets and tobacconist, among others are the leading distribution channels in the market.

The key players in the global e-cigarette market are Philip Morris Products S.A., British American Tobacco Plc, Japan Tobacco, Inc., and ITC Limited, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Flavour |

|

| Breakup by Battery Mode |

|

| Breakup by Distribution Channel |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share