Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global tobacco market was valued at USD 914.41 Million in 2025. The industry is expected to grow at a CAGR of 2.10% during the forecast period of 2026-2035 to reach a value of USD 1125.64 Million by 2035. The addictive nature of nicotine continues to be a major driver boosting the demand for tobacco across the world.

Once consumers begin smoking or using tobacco, quitting often proves challenging, leading to habitual consumption. This persistent demand ensures repeat purchases and provides manufacturers in the global tobacco market with a steady and reliable revenue stream.

According to the World Health Organization, around 80% of the 1.3 billion tobacco users worldwide live in low- and middle-income countries, where rapid urbanization and limited public health infrastructure amplify the challenge of reducing dependence. In these regions, rising disposable incomes and exposure to aspirational lifestyles often increase the uptake of both traditional and reduced-risk products, while nicotine’s addictive properties lock consumers into long-term usage.

Moreover, the persistence of consumption across diverse income brackets demonstrates that while product formats may evolve, the essential drivers of urbanization, convenience, and chemical dependence ensure stable demand. In addition to this, tobacco companies continue to introduce new products positioned as alternatives or lifestyle enhancements, the cycle of accessibility, stress relief, and dependence is likely to ensure steady demand in the tobacco market.

Base Year

Historical Period

Forecast Period

Around 80% of the 1.3 billion tobacco users worldwide reside in countries with low to middle incomes.

In 2020, tobacco usage was prevalent among 22.3% of the global population, with 36.7% of men and 7.8% of women engaging in its consumption.

According to World Health Organization (WHO), the tobacco usage rate is the highest in the South-East Asian Region, standing at 26.5%, while the European Region closely follows with a rate of 25.3%.

Compound Annual Growth Rate

2.1%

Value in USD Million

2026-2035

*this image is indicative*

| Global Tobacco Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 914.41 |

| Market Size 2035 | USD Million | 1125.64 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 2.10% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 2.7% |

| CAGR 2026-2035 - Market by Country | India | 3.1% |

| CAGR 2026-2035 - Market by Country | Brazil | 2.6% |

| CAGR 2026-2035 - Market by Type | Roll Your Own | 2.4% |

Regulatory approval is propelling the growth of nicotine pouches in the global tobacco market. In January 2025, the U.S. Food and Drug Administration (FDA) authorized the marketing of 20 ZYN nicotine pouch products following an extensive scientific review, marking the first time such products have received clearance under the PMTA pathway. This decision provides legitimacy to the category, reassuring both consumers and investors of their reduced-risk profile compared to cigarettes and smokeless tobacco. Such regulatory recognition strengthens market confidence and paves the way for wider adoption of reduced-risk nicotine tobacco products.

Science-backed harm reduction initiatives are significantly supporting the market growth. Consumers and regulators are showing more interest in alternatives that carry lower health risks than traditional cigarettes. Scientific evidence helps build trust in smokeless products like e-cigarettes, heated tobacco, and nicotine pouches. A strong example is BAT’s Omni™ platform, launched in September 2023, which brings together independent studies and company research. It highlights the reduced-risk potential of smokeless products, builds consumer confidence, and supports wider adoption in the market.

Heated tobacco industry is gaining momentum as innovation and research deliver products that replicate the taste and satisfaction of traditional cigarettes without combustion. Companies are enhancing flavor, customization, and convenience through advanced heating systems, making these products more appealing to adult consumers seeking alternatives to smoking. For example, in May 2025, Japan Tobacco Inc. launched Ploom AURA along with EVO heated tobacco sticks in Japan, supported by a JPY 650 billion investment in reduced-risk products through 2027, highlighting how technology is reshaping demand in the heated global tobacco market.

Strategic expansion of global tobacco companies into emerging and high-growth markets, particularly in low- and middle-income countries is boosting the market growth. In March 2024, Philip Morris International’s announced plans to open a new cigarette factory in Tanzania which highlights how tobacco companies are targeting regions with rising populations. These markets offer untapped consumer bases, less stringent regulations, and cost-effective production advantages, enabling companies to scale operations rapidly. Such expansion strategies in Africa, Asia, and Latin America significantly support the global tobacco market growth, fueling both sales volume and long-term market presence.

Leveraging regulatory loopholes and lobbying has emerged as a core strategy sustaining the tobacco market growth. Companies actively seek to shape or weaken tobacco control frameworks, allowing smoother entry for products like heated tobacco and nicotine pouches. For instance, lobbying in the UK aimed at securing lighter regulation for IQOS reflects how policy influence underpins market expansion. Similarly, during Europe’s menthol ban, firms promoted IQOS “Menthol starter kits” to retain consumers, while legal threats to the UK’s 2023 smokefree generation bill highlight the industry’s determination to protect market access.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Tobacco Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Cigarettes hold the largest share of the market, driven by strong consumer loyalty, established distribution networks, and continued demand in emerging economies with high population growth and urbanization fuel sales. Roll-your-own tobacco is one of the fastest-growing categories, supported by price-sensitive consumers and younger demographics in Europe and Asia who value affordability and customization. Cigars and cigarillos show steady growth as premium lifestyle products, appealing to consumers seeking exclusivity and indulgence. Others, including smokeless tobacco, are expanding in regions where cultural acceptance and shifting preferences encourage adoption.

Market Breakup by Region

Key Insight: Asia Pacific leads the global tobacco market, driven by its large population base, rising disposable incomes, and widespread cultural acceptance of smoking across countries like China, India, and Indonesia. North America holds a significant share, supported by strong sales of reduced-risk products, such as e-cigarettes and heated tobacco devices, alongside established cigarette consumption. Europe is experiencing steady growth, influenced by premiumization trends and the rising popularity of roll-your-own tobacco. Latin America and the Middle East and Africa are emerging markets, with growth underpinned by young populations and expanding retail distribution networks.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By type, cigarettes represent the largest market share

Cigarettes account for a notable revenue share of the market strongly driven by consumer loyalty to full-flavor blends, particularly Virginia tobacco across many key regions. Smokers often associate full-flavor products with greater satisfaction and consistency, making them the preferred choice over lighter alternatives. This preference shapes product development and brand strategies, as companies aim to meet demand with blends that replicate familiar taste profiles. For instance, in 2024 Imperial Brands launched Paramount in the United Kingdom, offering full-flavor Virginia blends at value pricing to attract adult smokers seeking both quality and affordability.

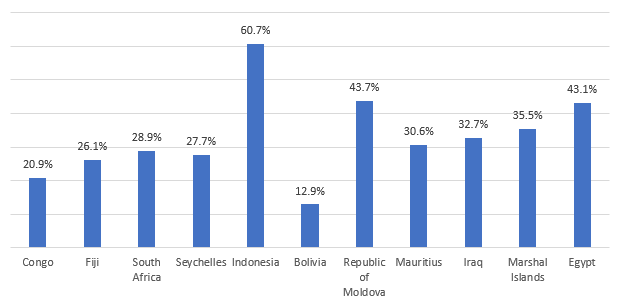

Figure: Trends in daily tobacco smoking among males (age 15+ yrs) in selected countries with largest increase in prevalence

The roll-your-own (RYO) segment is witnessing notable growth in the global tobacco market fueled by the strong appeal of ultra value options that balance affordability with trusted quality. Price-conscious consumers, especially in markets with rising living costs, increasingly prefer RYO formats as they allow customization while keeping expenses lower than ready-made cigarettes. Established companies are expanding recognized cigarette brands into RYO to capture loyal users and meet this demand. For instance, in November 2024, JTI introduced Mayfair Gold Rolling Tobacco in the UK at an ultra-value price point, reinforcing how affordability and brand trust drive adoption.

By region, Asia dominates the market

Asia Pacific leads the global tobacco market growth, driven by widespread consumption and deep-rooted smoking habits. China alone accounts for annual tobacco use exceeding 2 million tons, underscoring the scale of its cigarette industry and consumer reliance on smoking. India also plays a pivotal role, ranking first in the WHO South-East Asia Region for the number of tobacco users. Together, these major economies highlight the entrenched cultural and social acceptance of tobacco products, ensuring Asia Pacific’s continued growth.

Meanwhile, North America is experiencing fast growth due to the rising adoption of e-cigarettes which contain tobacco extracts. E-cigarattes emerged as the most used tobacco product among middle and high school students in the United States in 2024. 1.63 million students (5.9%) reported e-cigarette use, including 410,000 middle school students (3.5%) and 1.21 million high school students (7.8%). This surge highlights the growing preference for vapor-based alternatives over traditional cigarettes, driving manufacturers to innovate product lines and strengthen their presence in the region’s evolving tobacco landscape.

| CAGR 2026-2035 - Market by | Country |

| India | 3.1% |

| China | 2.6% |

| Brazil | 2.6% |

| Mexico | 2.2% |

| Australia | 1.9% |

| Japan | 1.6% |

| USA | XX% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

| France | XX% |

| Italy | XX% |

| Saudi Arabia | XX% |

Global tobacco companies are actively diversifying their portfolios to include both traditional and next-generation products, focusing on satisfying evolving consumer preferences. Leading players, such as Philip Morris International, British American Tobacco, and JT International are investing heavily in heated tobacco, e-cigarettes, and nicotine pouch innovations, aiming to provide reduced-risk alternatives alongside conventional cigarettes. Their strategies include extensive research and development, strategic acquisitions, and partnerships to strengthen product offerings. Prominent global tobacco market players also focus on branding and targeted marketing campaigns to retain loyal consumers while attracting new users in emerging and mature markets.

In addition to product innovation, tobacco companies are expanding their global distribution networks and leveraging digital platforms to enhance market reach. Major tobacco companies such as KT&G and Imperial Brands emphasize premium and value-based product lines to cater to diverse demographics, balancing affordability with quality. Retailer support programs, promotional initiatives, and competitive pricing are employed to drive adoption. Moreover, firms are navigating regulatory frameworks strategically, ensuring compliance while actively engaging with governments and stakeholders to influence policies, enabling smoother entry into the global tobacco market for new products and sustained growth across regions.

KT&G Co., Ltd., headquartered in Daejeon, South Korea, was established in 1899 and has grown into one of the country’s largest tobacco companies. It offers a wide range of cigarettes, cigars, and smokeless products, combining traditional manufacturing expertise with innovative approaches to reduced-risk products, while maintaining a strong domestic and international presence.

Philip Morris International Inc., founded in 1847 and headquartered in New York, the United States, is a leading global tobacco company. Known for its iconic cigarette brands, it has also expanded into heated tobacco and reduced-risk products, with a strategic focus on innovation and international market leadership.

British American Tobacco p.l.c., established in 1902 with headquarters in London, the United Kingdom, operates in over 180 markets worldwide. The company offers both traditional cigarettes and next-generation products, investing heavily in research and development to support its portfolio of reduced-risk alternatives and maintain global market influence.

JT International SA, a subsidiary of Japan Tobacco Group, was established in 1999 and is headquartered in Geneva, Switzerland. The company provides a diverse portfolio of cigarettes, heated tobacco products, and other tobacco-related offerings, leveraging technology and consumer insights to expand its global footprint while catering to evolving adult smoker preferences.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the global tobacco market include Imperial Brands PLC, ITC Limited, PT. Gudang Garam Tbk, Scandinavian Tobacco Group A/S, Universal Corporation, China Tobacco International (HK) Company Limited, among others.

Explore the latest trends shaping the Global Tobacco Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Get your free sample report or contact our team for customized consultation on global tobacco market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 914.41 Million.

The market is projected to grow at a CAGR of 2.10% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 1125.64 Million by 2035.

Key strategies driving the market include expansion into emerging markets, product innovation in traditional and reduced-risk categories, targeted marketing, technological advancements in heated tobacco, and strategic navigation of regulations.

The key regional markets for tobacco are the North America, Europe, Asia Pacific, Latin America and Middle East and Africa.

The types of tobacco are cigarettes, roll your own, cigars, and cigarillos, among others.

The key players in the market include KT&G Co., Ltd., Philip Morris International Inc., British American Tobacco p.l.c., JT International SA, Imperial Brands PLC, ITC Limited, PT. Gudang Garam Tbk, Scandinavian Tobacco Group A/S, Universal Corporation, China Tobacco International (HK) Company Limited, and other players in the tobacco industry.

Asia Pacific holds the largest market share due to its large population, deep-rooted smoking culture, and rising disposable incomes.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share