Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global e-commerce fulfillment services market attained a value of USD 112.30 Billion in 2025 and is projected to expand at a CAGR of 9.20% through 2035. The market is further expected to achieve USD 270.77 Billion by 2035. Rising cross border e-commerce is driving demand for fulfillment providers offering localized warehousing, customs integration, and faster last mile execution, enabling global brands to scale without building region-specific logistics infrastructure.

Labor shortages across logistics hubs are pushing fulfillment companies to accelerate warehouse automation adoption. At the same time, rising return volumes from the apparel and electronics sectors are compelling providers to redesign reverse logistics workflows. Such factors are reshaping the e-commerce fulfillment services market growth dynamics. Companies that reduce manual handling and process returns efficiently are protecting profit margins. Brands increasingly select partners based on operational resilience rather than price. This is strengthening long term contracts and increasing technology investment across fulfillment service portfolios.

Moreover, third party fulfillment providers are offering distributed warehousing, automation, and software led orchestration. According to the e-commerce fulfillment services market analysis, more than 60% of orders in major United States metro areas were delivered within one day in 2024. In May 2025, Amazon announced plans to launch Same-Day Delivery in 20 new locations across Europe, including places like Augsburg, Metz, and Bergamo, by 2026, supported by AI driven inventory placement systems. Such developments are underscoring how proximity-based fulfillment is becoming a competitive necessity rather than a premium feature.

The global industry is increasingly shaped by automation depth and data visibility. Leading providers are investing in robotics, goods to person systems, and AI driven demand forecasting to reduce unit handling costs. For example, in March 2025, ABB expanded its portfolio of robotic solutions for logistics and e-commerce supply chains with the addition of two new AI-powered functional modules to its Item Picking family. Retailers are also prioritizing partners that can support rapid SKU expansion and omnichannel order flows, sustaining overall demand in the e-commerce fulfillment services industry. Fulfillment companies are redesigning facilities to support returns processing and customization. These enhancements improve margins while addressing rising service expectations from brands operating across marketplaces and direct channels.

Base Year

Historical Period

Forecast Period

In 2021, global e-commerce sales surpassed USD 5 trillion.

79% of e-commerce companies use a third-party logistics company for at least one channel of fulfillment.

It is anticipated that 51% of shoppers will adopt for same-day delivery by 2025.

Software solutions are used by 65% of eCommerce businesses for order fulfillment.

Compound Annual Growth Rate

9.2%

Value in USD Billion

2026-2035

*this image is indicative*

Automation is transforming fulfillment service economics. Providers are deploying autonomous mobile robots and automated storage systems to reduce labor dependency. Fulfillment companies are integrating robotics with warehouse management software to enable higher throughput and lower error rates. For example, Zepto's supply chain became fully automated across its national network, enabling faster processing and improved efficiency in December 2025. Automation also supports scalability during peak seasons and providers offering configurable automation gain competitive advantage. This trend in the e-commerce fulfillment services market is shifting capital allocation toward technology rather than physical infrastructure expansion.

Regionalization is emerging as a core strategy in the e-commerce fulfillment services market dynamics. Brands want inventory closer to consumers, while governments are investing in regional logistics infrastructure to reduce congestion. This has resulted in a greater number of fulfillment providers opening smaller hubs near demand centers to improve delivery speed and lower shipping costs. For example, in August 2023, Shiprocket Fulfillment officially announced the inauguration of three state-of-the-art warehouse facilities strategically located in Gurgaon, Mumbai, and Bangalore, in India. Providers are using data analytics to position inventory dynamically.

Omnichannel retail is increasing fulfillment complexity as retailers now require unified order processing across online and physical channels. Fulfillment providers are integrating systems to handle ship from store and click and collect models. Fulfillment firms are adapting workflows to support multiple delivery paths. For example, XY Retail launched XY Omni, a new omnichannel solution enabling seamless online and in-store integration in October 2023. Providers offering seamless integration with retailer ERP systems are gaining traction in the e-commerce fulfillment services market.

Returns management is a growing focus area for major market players. High return rates are impacting fulfillment profitability and providers are investing in automated inspection and resale workflows. Governments are encouraging circular economy practices through waste reduction policies. This aligns well with fulfillment companies that enable faster resale of returned goods. In November 2024, CIRRO Fulfillment announced a partnership with Loop to improve its returns and reverse logistics network. Providers offering value recovery services are differentiating themselves, leveraging such e-commerce fulfillment services market opportunities. Fulfillment firms that optimize returns are improving margins and sustainability outcomes simultaneously.

Technology partnerships are reshaping the competitive landscape in the e-commerce fulfillment services industry. Fulfillment providers are collaborating with software firms to enhance visibility and control. Cloud based platforms enable real-time tracking and analytics. For example, Amazon India announced the expansion of its Multi-Channel Fulfillment (MCF) offerings, enhancing automation capabilities and payment options for sellers and D2C brands in December 2024. Fulfillment companies using proprietary platforms lock in clients, while data transparency improves planning and reduces disputes. This trend is shifting fulfillment services toward platform-based business models with recurring revenue streams.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

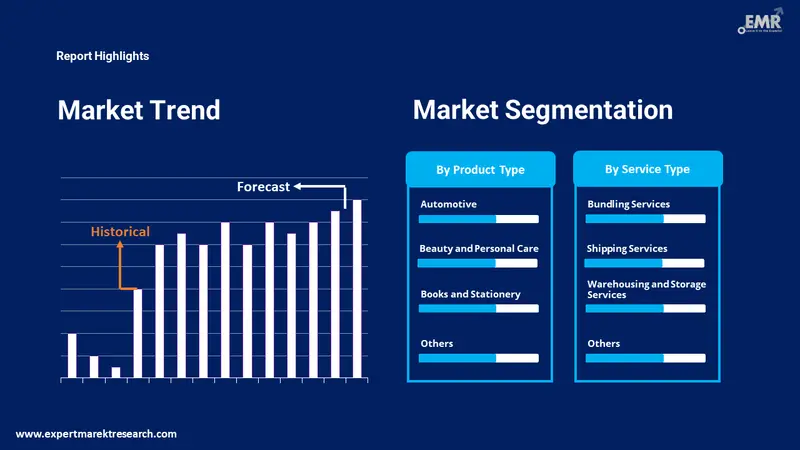

The EMR’s report titled “Global E-Commerce Fulfillment Services Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Key Insight: Product type segmentation analyzed in the e-commerce fulfillment services market report is shaped by operational intensity and order behavior. Consumer electronics lead the market due to high shipment frequency and return handling needs while the beauty and personal care category is expanding its share as DTC brands scale faster. Clothing and footwear depend heavily on reverse logistics efficiency while home and kitchen appliances require space optimization and careful handling. On the other hand, automotive fulfillment focuses on spare parts availability and speed, books and stationery offer steady volumes with predictable demand and sports and leisure categories fluctuate seasonally.

Market Breakup by Service Type

Key Insight: Warehousing and storage services dominate the market due to inventory localization requirements. On the other hand, shipping services remain critical for delivery reliability. For example, Apollo group's logistics services arm Apollo Supply Chain announced the launch of a new comprehensive e-commerce fulfilment and shipping service for D2C (direct-to-consumers) brands in January 2024. Bundling services are growing as brands demand customization and promotional flexibility. Other services support specialized workflows.

Market Breakup by Region

Key Insight: North America registers as the regional dominant e-commerce fulfillment services market due to advanced logistics networks and high service expectations. Asia Pacific is also gaining rapidly popularity, driven by expanding e-commerce penetration. Europe focuses on efficiency and sustainability alignment. Latin America shows steady development with improving infrastructure, while the markets in Middle East and Africa are emerging with selective adoption.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

By product type, consumer electronics account for the largest market share due to high order velocity and returns complexity

Consumer electronics holds the largest share of the e-commerce fulfillment services market revenue due to high shipment volumes and strict handling requirements. Products such as smartphones, accessories, and home electronics demand fast delivery and secure packaging. As a result, fulfillment providers are investing in automation and quality control to reduce damages. Reverse logistics capability has become critical due to higher return rates. This has made brands require real-time tracking and serialized inventory control. Fulfillment firms offering value-added testing and refurbishment gain preference.

The beauty and personal care category represents the fastest-growing product type within the - e-commerce fulfillment services market dynamics due to rising direct-to-consumer brands. These products require temperature control and compliance handling. Fulfillment providers are adding climate-controlled zones and batch tracking, whiile subscription models increase shipment frequency. For example, Flipkart, in India, expanded its beauty category by launching several Korean skincare brands, including Faceshop and Beauty of Joseon in September 2025.

By service type, warehousing and storage services dominate the market driven by inventory localization needs

Warehousing and storage services capture a substantial share of the market as e-commerce brands prioritize inventory positioning. Fulfillment providers expand multi-node warehouse networks as the proximity to customers reduces delivery time. Storage services now include inventory analytics and demand forecasting. Seasonal overflow storage adds flexibility as warehousing supports omnichannel fulfillment. For example, companies like RGX Group are boosting Canada’s e‑commerce expansion by offering flexible 3PL warehousing and fulfillment services since January 2026.

Bundling services present significant e-commerce fulfillment services market opportunities as brands seek differentiated delivery experiences. Kitting and customization are increasingly becoming central to promotion and subscription-based e-commerce models. Fulfillment providers are expanding assembly, labeling, and branded packaging capabilities to support campaign-driven launches. By outsourcing bundling activities, brands reduce internal labor pressure and shorten go-to-market timelines. Speed and order accuracy remain non-negotiable, especially during promotional peaks. Providers are embedding kitting directly into core warehouse workflows rather than treating it as an add-on service.

North America secures the leading position in the market due to mature e-commerce infrastructure and fulfillment density

North America dominates the e-commerce fulfillment services market due to dense consumer demand and advanced logistics networks. Fulfillment providers operate extensive multi-state warehouse footprints, while consumer expectations for same day delivery drive regionalization. Fulfillment providers are bundling customs brokerage, documentation, and returns processing into unified service offerings. For example, Walmart launched new multichannel logistics and cross‑border fulfillment services enabling sellers to fulfill orders from any e‑commerce channel via Walmart’s supply chain, including Asia‑United States import and unbranded global shipping solutions in August 2024.

The e-commerce fulfillment services market in Asia Pacific observes exponential growth due to expanding penetration. Brands across Asia Pacific are seeking scalable fulfillment models without committing capital to owned assets. High urban density is supporting the rise of micro-fulfillment centers closer to consumers. Fulfillment providers are responding by expanding regional hubs and localized networks. Cross-border e-commerce is increasing demand for country-specific fulfillment, customs handling, and last-mile coordination.

The competitive landscape of the market is shaped by speed, automation, and network depth. Leading e-commerce fulfillment service companies are prioritizing regionalized warehouses, robotics, and AI-based inventory placement to cut delivery times. Sustainability metrics and labor optimization are becoming secondary differentiators influencing procurement decisions and capital allocation across modern fulfillment networks globally today for large retailers.

E-commerce fulfillment services market players are also focusing on value-added services such as kitting, light assembly, and same-day processing. Enterprise clients increasingly favor partners that offer data visibility and flexible contracts. Small-scale providers find opportunities by specializing in niche categories or regional coverage. Companies that balance cost control with service innovation are better positioned to secure long-term, multi-year fulfillment agreements.

Founded in 1994 and headquartered in Washington, United States, Amazon.com, Inc. operates the world’s largest e-commerce fulfillment network. The company uses robotics, predictive analytics, and same-day hubs to support sellers. Amazon’s Fulfillment by Amazon service enables merchants to access Prime delivery standards. The firm continues investing in micro-fulfillment and returns automation. Its scale allows rapid experimentation with delivery models.

Established in 2001 and headquartered in Michigan, United States, eFulfillment Service, Inc. focuses on outsourced fulfillment for mid-sized online retailers. The company provides order processing, inventory management, and returns handling. It supports multi-channel sellers through platform integrations. The firm targets brands seeking cost efficiency without large network complexity.

Founded in 1979 and headquartered in California, United States, Ingram Micro, Inc. serves global e-commerce fulfillment through technology-driven logistics. The company combines distribution, cloud platforms, and fulfillment services. It supports large enterprises with complex SKU portfolios. Ingram Micro focuses on automation and data integration. Its fulfillment solutions connect vendors, retailers, and marketplaces.

Founded in 2001 and headquartered in Las Vegas, United States, ShipNetwork operates fulfillment centers across North America. The company focuses on fast shipping and order accuracy. ShipNetwork supports e-commerce brands with warehousing, pick-pack, and returns services. It emphasizes regional distribution for shorter delivery times and integrates with major e-commerce platforms.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Red Stag Fulfillment, ShipBob, Inc., Shipfusion Inc., Xpert Fulfillment, Sprocket Express Plainville, MA, and FedEx Corporation, among others.

Unlock the latest insights with our e-commerce fulfillment services market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

E-Commerce Fulfillment Services Companies

Third-Party Logistics Services Demand Growth

Last-Mile Delivery Solutions Demand Analysis

Warehouse Automation And Robotics Demand

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 112.30 Billion.

The market is projected to grow at a CAGR of 9.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 270.77 Billion by 2035.

Stakeholders are investing in automation, expanding regional networks, developing proprietary software, strengthening retailer partnerships, improving returns workflows, and targeting niche categories while building flexible contracts to secure recurring revenue streams.

Key trends aiding market expansion include the deployment of latest technology, growing concentration of fulfillment centres near metropolitan regions, and increasing sales of consumer electronics on e-commerce platforms.

Major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

E-commerce fulfillment services refer to all the operations that take place at an e-commerce company or provider post receiving an order like checking inventory, packing items, transporting orders to the customer’s shipping destination, and handling returns and exchange.

The four major types of order fulfillment are: in-house, outsourced, hybrid and drop shipping.

The key service types include bundling services, shipping services, and warehousing and storage services, among others.

The key players in the market include Amazon.com, Inc., eFulfillment Service, Inc., Ingram Micro, Inc., ShipNetwork, Red Stag Fulfillment, ShipBob, Inc., Shipfusion Inc., Xpert Fulfillment, Sprocket Express Plainville, MA, and FedEx Corporation, among others.

Companies face margin pressure, labor shortages, rising return volumes, technology integration complexity, customer expectations for speed, and continuous capital investment requirements while competing against large platforms with pricing leverage dominance.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Service Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share