Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The El Salvador waterproofing market size reached a value of nearly USD 13.40 Million in 2025. The market is projected to grow at a CAGR of 7.00% between 2026 and 2035 and reach around USD 26.36 Million by 2035.

Base Year

Historical Period

Forecast Period

In 2023, the El Salvador government invested USD 5.8 billion for the development of road infrastructure. The rising construction activities, including the development and expansion of roads and bridges, support the growth of the waterproofing market.

Sika AG, The Sherwin-Williams Company and Aditivos de El Salvador SA de CV are a few of the major companies in the market.

The rising demand for sustainability is fueling the adoption of eco-friendly waterproofing solutions.

Compound Annual Growth Rate

7%

Value in USD Million

2026-2035

*this image is indicative*

El Salvador has a tropical climate comprising a wet and dry season. Changing weather and climatic conditions can cause cracks in building walls, leading to water leakage. Waterproofing systems help prevent such cracks and leakages on rooftops, walls, and floors, among others. Moreover, the demand for non-toxic and VOC-free waterproofing solutions is expected to rise in popularity owing to rising health and environmental concerns in the forecast period.

Some of the factors driving the El Salvador waterproofing market growth are the increasing construction activities and the growth in the tourism sector. Construction is vital to El Salvador's economy, accounting for over 12% of the GDP. Rising investment in private and public construction projects, including the expansion of roads and highways such as the Los Chorros Highway project in 2023, aids the market growth.

Rising construction activities; the robust growth of the tourism sector; energy efficiency offered by waterproofing solutions; and benefits provided by waterproofing solutions are aiding the El Salvador waterproofing market expansion

Construction is vital to El Salvador's economy, accounting for over 12% of the GDP, along with real estate. The rising construction activities, including the development and expansion of roads and bridges, support the growth of the El Salvador waterproofing market development.

Favourable government initiatives, such as the Housing and Dignified Life Program (PROVIDA) for low-income families to access loans for housing, support the growth of the waterproofing market in El Salvador.

As El Salvador witnesses steady tourism growth, the country's hotels, restaurants, and recreational sites are expected to expand in number. Such developments are likely to drive the demand for waterproofing solutions.

Waterproofing the ceiling, foundation, and walls is essential for homeowners to reduce their energy bills. Water leakages increase the energy consumed for heating, cooling, and lighting homes. The need to lower carbon footprint by reducing energy consumption also contributes to the market growth.

Waterproofing insulates buildings from UV rays, reducing their temperature and aiding in utility bill savings by lowering air conditioning costs. Additionally, it significantly reduces the damage to the roof caused by water leakages, reducing the expenditure on maintenance and repair.

The El Salvador hospitality sector is expected to experience consistent expansion as a result of the country's growing tourism industry. In 2023, El Salvador recorded 3 million international tourists. These advancements are expected to fuel the need for waterproofing products.

Furthermore, the surge in loan disbursements in El Salvador, specifically for home acquisition, and construction projects encompassing residential, industrial, commercial, and service buildings, as well as the urbanisation of land, has positively impacted the El Salvador waterproofing market. The rising urbanisation, housing and infrastructure developments and the inclusion of new facilities for water supply, schools, bridges, and roads, support the demand for waterproofing solutions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

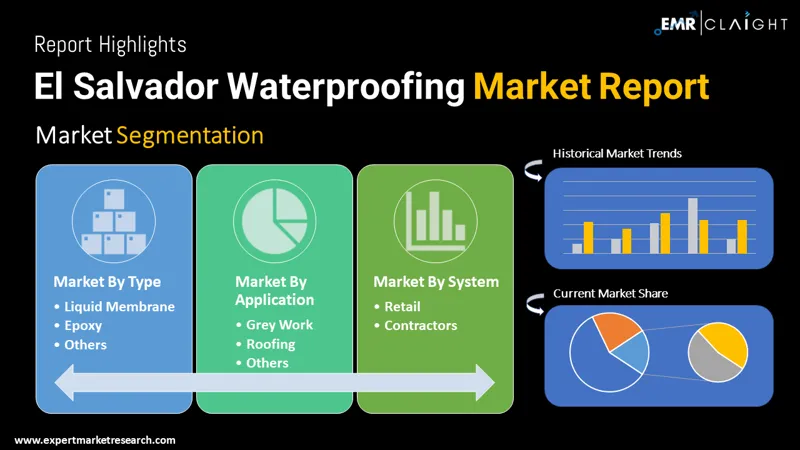

El Salvador Waterproofing Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Application

Market Breakup by End Use

Liquid waterproofing membranes are expected to dominate the El Salvador waterproofing market share due to the consumer need for waterproof basements

Liquid waterproofing membranes are polymer-based systems that can be applied by hand, using a roller or trowel, or by spraying onto exposed surfaces. These membranes cure into a seamless rubber coating devoid of seams or joints, preventing water ingress. The demand for such membranes is driven by homeowners refurbishing their basements to create living spaces and commercial space owners investing in watertight basements to protect valuable assets.

Epoxy resins are renowned for their remarkable waterproofing capabilities, characterised by their low permeability to water and ability to establish a robust moisture barrier. These resins exhibit exceptional strength and durability, rendering them highly suitable for a wide range of waterproofing applications. El Salvador’s climate conditions create demand for epoxy resins in residential and commercial sectors.

Cementitious waterproofing is predominantly used for wastewater and potable water facilities. These membranes can resist the strongest chemical attacks occurring in wastewater structures. The significant investment of USD 40 million in the construction of Ilopango water treatment plant, further necessitates the employment of such membranes, propelling the El Salvador waterproofing market expansion.

Thermoplastic polyolefin (TPO) membranes provide consumers with the dual benefits of waterproofing and heat insulation, as they are heat-reflective. They are an energy-efficient roofing system that can reduce a building’s internal cooling costs by around 25 – 35%. Consumers’ growing demand for energy-efficient waterproofing solutions creates demand for thermoplastic membranes.

Major players in the El Salvador waterproofing market are increasing their collaboration, partnership, and research and development activities to gain a competitive edge

Sika AG, headquartered in Switzerland founded in 1910, is a renowned company in speciality chemicals, and holds a prominent position worldwide. In El Salvador, Sika AG operates through its subsidiary, Sika El Salvador S.A. de C.V., which serves as the local representative for marketing and distributing in the country. The company provides a variety of waterproofing solutions to meet the needs of different markets. These solutions include products designed specifically for pools, jacuzzis, planters, bathrooms, and kitchens, among others.

The Sherwin-Williams Company, headquartered in the United States, and founded in 1866, offers a diverse portfolio of waterproofing products to cater to the specific needs of the market. These products are available under renowned brands such as H&C, Sherwin-Williams, Loxon, and MAB among others. The company's offerings encompass a wide range of solutions, including Loxon XP waterproofing masonry coating, and H&C colourtop water-based solid colour concrete stain, among others.

Headquartered in El Salvador and founded in 1955, Aditivos de El Salvador SA de CV offers a comprehensive range of waterproofing products within its portfolio to cater to market demands. These products, such as ADI 1 PLUS, Aditecho, Primer, ADI 101, Aditron, and Adipared, among others.

Headquartered in El Salvador and founded in 2008, Reflex SA de CV has been part of a consortium of Salvadoran companies specialising in non-metallic mineral processing. The company's portfolio encompasses a variety of waterproofing solutions, such as Decoblack outdoor grey, Decoblack outdoor white, Imprex, ColorCret with sand, and ColorCret without sand.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the El Salvador Waterproofing market include Lanco Manufacturing Corp., Sur Química, SA, Köster Bauchemie AG, Schluter-Systems KG, Fester (Henkel Capital, SA de CV), and Mapei SPA, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was nearly USD 13.40 Million.

The market is assessed to grow at a CAGR of 7.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 26.36 Million by 2035.

The major drivers include government initiatives for housing for low-income households, the expanding construction sector, and government investments in infrastructure development.

The key trends include growing demand for energy-efficient waterproofing solutions and growth of the tourism sector.

The different types of waterproofing include liquid membrane, cementitious membrane/integral waterproofing, bituminous/asphalt membrane, thermoplastic membrane and epoxy.

The major applications of waterproofing include grey work, roofing, flooring, wet zones, and finishing and facades.

The major players in the market include Sika AG, The Sherwin-Williams Company, Aditivos de El Salvador SA de CV, Reflex SA de CV, Lanco Manufacturing Corp., Sur Química, SA, Köster Bauchemie AG, Schluter-Systems KG, Fester (Henkel Capital, SA de CV), and Mapei SPA, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share