Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global electrolytic manganese dioxide market attained a value of USD 1.96 Billion in 2025 and is projected to expand at a CAGR of 6.90% through 2035. The market is further expected to achieve USD 3.82 Billion by 2035. Battery manufacturers increasingly require tightly controlled EMD specifications, pushing producers to invest in process refinement, impurity reduction, and long-term qualification programs rather than volume-oriented production strategies.

Battery OEMs are setting stricter material acceptance criteria, which benefits producers with substantial electrolytic control and traceable performance consistency. Concurrently industrial chemical users are turning towards EMD for oxidation and catalytic processes, where the reliability of a batch directly affects yields. Vendors who can provide customized grades and technical assistance are getting a better position in the market by signing long-term agreements.

The electrolytic manganese dioxide market is being transformed through product upgradation, which is linked with capacity rather than merely volume-led expansion. Companies like Tosoh Corporation are upgrading battery-grade manganese dioxide lines to support the higher purity levels demanded by alkaline and new lithium battery manufacturers. In September 2025, BASF, with WELION New Energy, delivered first mass-produced cathode active materials for semi-solid-state batteries, boosting safety and energy density. Moreover, EMD grades with particle morphology control are becoming the preferred choice for long-cycle applications, especially for industrial batteries.

Chinese EMD producers are adjusting operating rates as downstream battery manufacturers delay spot procurement in favor of contract-based sourcing. Production discipline is becoming a lever for margin protection. Rather than simply increasing volumes, suppliers are aligning their output with qualification cycles from battery and chemical customers. In March 2025, Giyani Metals’ demo plant in Johannesburg produced its first battery-grade high-purity manganese oxide, advancing EV battery material supply efforts. This electrolytic manganese dioxide market trend has lessened short-term volatility and deepened dependence on multi-quarter supply contracts, notably in Asia-Pacific. Buyers are currently focusing more on technical documentation and performance validation than on price-cutting discussions.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

6.9%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Electrolytic Manganese Dioxide Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 1.96 |

| Market Size 2035 | USD Billion | 3.82 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 6.90% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 8.0% |

| CAGR 2026-2035 - Market by Country | India | 9.1% |

| CAGR 2026-2035 - Market by Country | China | 7.6% |

| CAGR 2026-2035 - Market by Application | Batteries | 7.7% |

| CAGR 2026-2035 - Market by Application | Water Treatment | XX% |

| Market Share by Country 2025 | UK | 3.7% |

Suppliers of electrolytic manganese dioxide are adapting their product lines to stricter battery-grade requirements. Instead of considering the generic chemical composition, battery manufacturers now evaluate EMD on the basis of discharge efficiency, stability of the crystal structure, and impurity levels, accelerating the electrolytic manganese dioxide market value. In February 2026, Frontier Rare Earths signed a strategic technology supply and offtake agreement with Carester and secured USD 20 million from the Industrial Development Corporation for Zandkopsdrift DFS. United States and European government-supported battery localization schemes are indirectly strengthening this trend by putting an emphasis on material traceability and supply chain performance assurance.

The electrolytic manganese dioxide market observes a slight change in the focus of investments into the production of EMD which are no longer output oriented but rather process upgrades. In December 2025, MOIL Limited announced plans to boost manganese production with its new high-speed shaft project at Balaghat and ferro manganese facility. Firms like Tosoh are replacing electrolytic control systems and gaining better batch to batch consistency of particle morphology. These improvements cut waste points of the next user in the production chain. The improvements are being marketed by the producers as benefits or features to the product, rather than the capacity of the plant.

Localization policies of the battery supply chain are pressuring EMD manufacturers to reconsider their regional presence. Rather than constructing isolated factories, most businesses are opting for collaborations with local chemical processors or battery material companies. Such partnerships help to decrease the regulatory risk and speed up the qualification process. EMD sourcing in Europe and North America is increasingly associated with compliance requirements. In February 2026, Firebird Metals Ltd signed a manganese ore supply MoU, accelerating development of its proposed MnSO₄ and Mn₃O₄ plant in China. By collaborating through teamwork, producers can get support for long-term industrial contracts, broadening the electrolytic manganese dioxide market scope.

New battery chemistries based on manganese-rich cathodes are opening a niche market for tailored EMD formulations. Manufacturers collaborate with R&D departments to fine-tune the electrolytic parameters for enhanced ion mobility and structural stability. However, these innovations remain on a small scale but are of strategic importance. This trend in the electrolytic manganese dioxide market benefits producers with flexible production setups and technical depth. In February 2023, Umicore started industrializing its high-lithium, manganese-rich HLM cathode materials, targeting commercial EV production by 2026.

Environmental scrutiny is influencing EMD production strategies. Producers are investing in energy-efficient electrolytic processes to reduce operating intensity. Firms are also piloting modified pathways that lower waste generation and simplify downstream treatment, creating new electrolytic manganese dioxide market opportunities for growth. These changes support compliance with tightening industrial regulations. In January 2026, scientists developed a manganese-based catalyst that efficiently transforms carbon dioxide into formate, outperforming many precious metal alternatives.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Electrolytic Manganese Dioxide Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

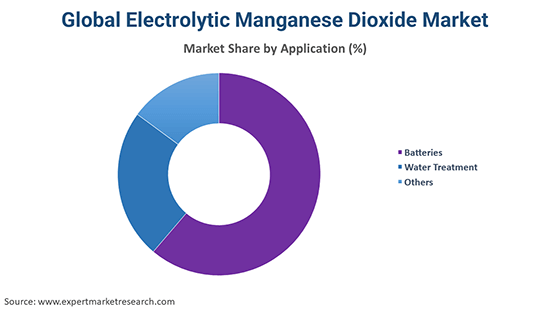

Market Breakup by Application

Key Insight: The electrolytic manganese dioxide market spans across batteries, water treatment, and other industrial uses. Batteries lead due to qualification depth and long replacement cycles. In August 2025, Nano One upgraded its cathode material production with a new agitator, increasing output capacity by 50% and enhancing efficiency. Water treatment gains momentum, relatively faster, as oxidation reliability becomes critical, while other applications include chemicals and specialty oxidation processes.

Market Breakup by Region

Key Insight: Asia Pacific leads the electrolytic manganese dioxide market revenue growth due to integrated manufacturing ecosystems and established supplier relationships. North America grows at the fastest pace as localization and supply security reshape sourcing decisions. Europe follows a compliance-driven approach focused on traceability. Latin America remains limited but serves niche industrial demand. The Middle East and Africa show selective usage tied to water and chemical applications.

By application, batteries accounts for a significant share of the market due to qualification stability and long-term supply contracts

Batteries continue to be the main application, with electrolytic manganese dioxide being integral to both alkaline and specialty battery formulations. Battery makers opt for EMD as it delivers reliable discharge performance, with a controlled crystal structure. Major battery manufacturers are now progressively tying up suppliers with multi-year contracts following long qualification cycles. Product development is focused on purity consistency rather than aggressive capacity. Producers are refining electrolytic parameters to reduce trace metal contamination and stabilize morphology. In April 2025, Maxell started mass production of its new high-capacity CR2032S manganese dioxide coin battery, extending wireless device performance by ~11%.

As per the electrolytic manganese dioxide market report, water treatment plays a major role in the selection of EMD applications and are expected to grow rapidly due to their role in oxidation and contaminant removal systems. Operators of municipal and industrial water systems need materials that exhibit consistent reaction in order to keep system performance without variations. Repeated cycles of oxidation using electrolytic manganese dioxide have demonstrated a highly controlled performance of the process.

Asia Pacific dominates production due to integrated supply chains and qualification depth

Asia Pacific continues to be the leading regional industry for electrolytic manganese dioxide because of the concentration of its battery manufacturing and chemical processing infrastructure. Manufacturers gain from being close to their customers at the downstream stage, which helps them to cut down on the time of product approval and facilitates logistics. Regional suppliers often integrate upstream manganese processing with electrolytic operations. Asia Pacific suppliers also respond faster to specification changes sought by battery OEMs. In January 2025, SK On disclosed research on lithium manganese-rich layered oxide cathode material with competitive energy density potential for future solid-state batteries.

North America represents the fastest-growing region as battery supply chains shift toward regional sourcing. Manufacturers are under pressure to reduce import exposure and improve traceability. This has increased interest in locally produced or regionally qualified EMD. North American buyers demand detailed documentation and process transparency. This favors suppliers with strong technical service capabilities. Growth in the electrolytic manganese dioxide market in North America is majorly supported by industrial policy alignment.

| CAGR 2026-2035 - Market by | Country |

| India | 9.1% |

| China | 7.6% |

| Canada | 6.5% |

| UK | 6.3% |

| France | 5.4% |

| USA | XX% |

| Germany | XX% |

| Italy | XX% |

| Japan | 4.8% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Competition in the market is shifting toward specification control and qualification depth. Leading electrolytic manganese dioxide market players are prioritizing process stability over volume expansion. Battery-grade consistency has now become the main differentiator. Producers are investing in electrolytic precision and impurity management. Long approval cycles favor suppliers with strong technical service teams. Water treatment applications are opening parallel opportunities, especially for oxidation-focused grades.

Regional sourcing strategies are also reshaping competition. North American and European buyers seek traceable supply chains. Electrolytic manganese dioxide companies that integrate testing, documentation, and customer validation are gaining significantly better market positions. The competitive field is narrowing as smaller producers struggle to meet tightening specifications.

Tosoh Hellas A.I.C was set up in 1973 with its main office in Thessaloniki, Greece. The company is engaged as a niche manufacturer of electrolytic manganese dioxide for battery and industrial uses. The company offers high-purity EMD grades with a well-controlled particle structure. Tosoh supports customers through detailed qualification assistance and electrochemical validation.

Mesa Minerals Limited was founded in 1984 and is headquartered in Australia. The company is focused on manganese resource development with downstream potential for EMD supply. Mesa targets integrated value chains by aligning manganese extraction with battery material requirements. Its approach centers on feedstock quality optimization rather than the immediate production scale.

Tronox Holdings plc was established in the year 2006 and is currently based in Connecticut, United States. The company operates across advanced material segments with expertise in chemical processing. In the EMD space, Tronox leverages its process engineering capabilities and global operational footprint.

Founded in 1987, with its main office located in Surrey, Canada. American Manganese supports supply chain localization efforts by aligning with North American battery strategies. Its approach centers on technical development rather than commodity production. The company positions itself as a technology-driven contributor to future EMD supply ecosystems.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Qingdao BassTech Co., Ltd, among others.

Unlock the latest insights with our electrolytic manganese dioxide market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

United States Electrolytic Manganese Dioxide Market

Energy Storage Raw Materials Supply Chain

Primary Battery Manufacturing Equipment Investment

Manganese Processing And Refining Technologies

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 1.96 Billion.

The market is projected to grow at a CAGR of 6.90% between 2026 and 2035.

Stakeholders are prioritizing qualification readiness, investing in process control, forming regional partnerships, strengthening technical support teams, and aligning product development closely with evolving battery and water treatment requirements.

The key trends guiding the growth of the global electrolytic manganese dioxide market include the growing technological advancements and increased investment in research and development activities by the major players.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

Batteries and water treatment, among others, are the major electrolytic manganese dioxide applications in the market.

The key players in the market include Tosoh Hellas A.I.C., Mesa Minerals Limited, Tronox Holdings plc, American Manganese Inc., and Qingdao BassTech Co., Ltd, among others.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach USD 3.82 Billion by 2035.

Companies face tightening specification requirements, long qualification cycles, rising compliance expectations, and pressure to localize supply chains without overinvesting in capacity or compromising process stability.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share