Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global energy management systems market attained a value of USD 72.33 Billion in 2025 and is projected to expand at a CAGR of 14.00% through 2035. The market is further expected to achieve USD 268.14 Billion by 2035. Rising regulatory focus on emissions and decentralized renewable energy is boosting demand for cloud-based EMS solutions across industrial and utility sectors.

The global market is rapidly evolving as vendors roll out next-gen platforms integrating IoT, cloud, and AI to meet growing demand for energy efficiency in buildings and utilities. In September 2025, Stem, Inc. expanded its footprint with standalone storage and solar-plus-storage control optimization by introducing the PowerTrack Energy Management System. The move extends the company’s strong footing in the commercial and industrial segment, where United States C&I developers and major community solar asset owners already rely on the PowerTrack platform for portfolio-wide optimization, redefining the energy management systems market trends and dynamics.

Demand is rising because organizations face tighter energy regulations, volatile power prices, and increasing pressure to decarbonize. EMS vendors are responding with solutions that offer real-time monitoring, predictive analytics, and automation for active control of load, storage, and usage. In July 2025, PowerHut introduced its next-generation smart energy management platform, featuring AI-driven optimization and real-time monitoring. In parallel, advances in edge-AI, cloud scaling, and sensor networks are transforming EMS from optional add-ons into core requirements for factories, commercial campuses, and utilities planning, thereby adding to the energy management systems market value.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

14%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Energy Management Systems Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 72.33 |

| Market Size 2035 | USD Billion | 268.14 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 14.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 16.1% |

| CAGR 2026-2035 - Market by Country | India | 18.5% |

| CAGR 2026-2035 - Market by Country | China | 15.5% |

| CAGR 2026-2035 - Market by Component | Software | 16.0% |

| CAGR 2026-2035 - Market by Solution | Demand Response Management | 15.7% |

| Market Share by Country 2025 | Germany | 4.5% |

Global decarbonization mandates are pushing industrial and commercial facilities to prove measurable energy reductions rather than verbal sustainability claims. Governments tying incentives and compliance credits to real-time reporting are making EMS a key requirement. In July 2025, Schneider Electric announced the launch of Zeigo Hub by Schneider Electric, a powerful new digital platform designed to help organizations decarbonize their supply chains at scale. When regions enforce carbon pricing or mandatory ESG disclosures, companies with large energy footprints immediately pivot toward EMS to automate monitoring, peak-shaving and load control. This energy management systems market trend is visible across utilities, cold-chain warehouses, and corporate campuses that need verifiable emissions performance.

Enterprises rely on onsite renewable energy, and as distributed solar, wind and battery banks scale, operating without an EMS becomes highly inefficient. Firms deploying behind-the-meter solar and storage systems need EMS to orchestrate charge-discharge cycles, minimize curtailment, and optimize export decisions. In September 2025, Senkron Digital announced the rollout of a next-generation Energy Management System (EMS) engineered for hybrid renewable energy plants that incorporate battery storage. Large campuses, industrial parks and logistics hubs integrate energy orchestration for mixed loads including HVAC, EV chargers and process equipment, contributing to the overall energy management systems market growth.

EMS platforms are gradually transforming into intelligent execution systems that make predictive decisions using digital twins and edge-AI. Factories and hyperscale buildings adopt EMS with equipment-level twins to simulate energy usage before commands are issued, avoiding downtime and overshoot. Edge-AI reduces latency by processing data inside the facility rather than depending entirely on the cloud, which is crucial for high-speed industrial loads. In January 2025, Israel-based SolarEdge rolled out a new controller product in Europe, the company’s smart energy manager for residential solar, as the business targets energy management systems market opportunities.

Procurement teams are redirecting sustainability budgets away from manual audits and consultancy into EMS deployments that guarantee continuous savings. CFOs favor EMS because it produces measurable outcomes such as peak demand reduction, avoided penalties and longer equipment life. In May 2025, Schneider Electric announced a landmark multi-year initiative dedicated to building a new kind of integrated ecosystem for sustainability and energy management. Board-level pressure around Scope 1 and Scope 2 emissions reporting also amplifies EMS relevance because automated energy telemetry simplifies disclosures. This trend in the energy management systems market indicates that sustainability is becoming financially accountable, and EMS is the framework enabling organizations to prove tangible operational results every quarter.

As factories and commercial buildings electrify heating, mobility assets, and material-handling systems, their energy intensity grows exponentially, increasing the value of centralized EMS control. High-power EV chargers, all-electric compressed air systems, electric boilers and robotic production lines require precision load scheduling to avoid instability and peak tariffs, redefining the energy management systems market dynamics. In September 2024, TeraHive announced the launch of three smart energy solutions, namely the TeraHive Energy Suite, Charging Station Management Solution, and Enterprise Energy Management. Smart building platforms are merging with EMS to enable occupancy-aware ventilation, automated lighting baselines, and predictive HVAC staging.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Energy Management Systems Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Key Insight: Industrial EMS anchors the majority of the energy management systems market revenue due to direct linkage between energy optimization and production continuity in high-power facilities. Building EMS expands its market share at a considerable speed because commercial spaces now treat automation and ESG reporting as inseparable. Home EMS grows popular as residential electrification, and smart-appliance ecosystems mature, especially where rooftop solar or EV chargers influence household consumption patterns. The others category cover niche deployments like microgrids, campuses, and utility feeders that require adaptable control logic.

Market Breakup by Component

Key Insight: As per the energy management systems market report, software leads the overall demand growth as decision intelligence and automated control determine the functional value of EMS across sites and assets. Sensors gain much momentum since energy orchestration depends on deeper visibility across granular energy touchpoints. Batteries gain traction when organizations pursue peak shaving or backup power within a single EMS ecosystem. Controllers maintain relevance where deterministic communication with field devices is necessary for safety and reliability. Display devices support operational transparency and compliance audits, especially in regulated facilities.

Market Breakup by Solutions

Key Insight: Demand Response Management accounts for a significant share in the energy management systems market because energy flexibility and tariff avoidance deliver immediate financial impact. Carbon Energy Management accelerates its growth in the market because emissions data and compliance scoring now influence investor confidence and supply-chain eligibility. Utility Billing and Customer Information Systems serve organizations managing multi-tenant or multi-site operations where transparent cost allocation and automated invoicing prevent disputes and inefficiencies.

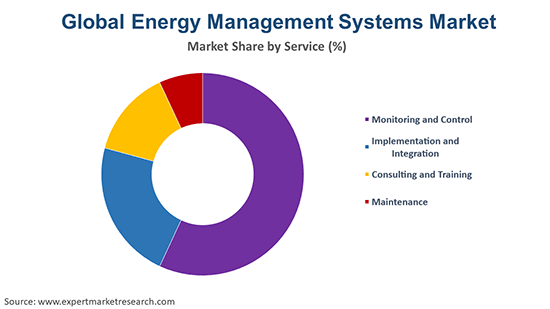

Market Breakup by Services

Key Insight: Across all the services considered in the report, monitoring and control dominates because organizations rarely trust automation without strong visibility, alarm handling, and operator override paths. Implementation and integration services expand quickly as enterprises standardize EMS across multiple plants, campuses, and regions. Consulting and training engagements help energy managers translate raw EMS data into workable strategies, operating procedures and investment roadmaps understood by finance teams, widening the energy management systems market scope. Maintenance contracts, including remote diagnostics and periodic performance tuning, keep systems aligned with evolving tariffs, equipment changes and cybersecurity requirements.

Market Breakup by Industry

Key Insight: Manufacturing dominates EMS demand because plant operators treat energy performance as a controllable production parameter. Power and energy organizations are accelerating adoption to better coordinate renewables, storage assets, and flexible loads under stricter reliability expectations. Telecom and IT players use EMS to manage high-density data halls and network sites where uptime and cooling loads dominate. Healthcare facilities prioritize EMS for patient comfort, infection control, and resilient backup power. Retail and education deploy EMS to manage large, dispersed estates, boosting the energy management systems market penetration.

Market Breakup by Region

Key Insight: Regional energy management systems market dynamics indicate that North America leads the market in terms of adoption through advanced automation maturity, tighter efficiency regulation and strong service ecosystems. Europe emphasizes decarbonization roadmaps, green building standards, and grid flexibility, driving EMS into buildings and distributed energy projects. Asia Pacific grows fastest as new industrial corridors, megacities and infrastructure investments integrate EMS into early design blueprints. Latin America increasingly targets EMS for grid stability, commercial centers, and energy-intensive industries facing tariff volatility. The Middle East and Africa adopt EMS around large-scale infrastructure, desalination, and district cooling schemes.

Industrial EMS register the largest share of the market due to real-time energy orchestration across complex, power-intensive operational environments

Industrial EMS dominates the market because high-consumption facilities treat energy as a production variable rather than a utility expense. Manufacturers, chemical processors, mining sites and logistics hubs require sequencing, power-quality oversight, and machine scheduling. In July 2024, GreenPowerMonitor (GPM) launched an advanced EMS platform, designed specifically for renewable power plants. EMS platforms used in industrial setups integrate directly with PLCs, SCADA, and process control systems to optimize power flows without interrupting output.

Building EMS observes rapid growth in the energy management systems market because commercial real estate portfolios increasingly automate HVAC, lighting, elevators, and EV charging points for efficiency and comfort without manual intervention. Facility teams track occupancy and indoor climate metrics to dynamically modulate loads and avoid waste during off-peak hours.

By component, software emerges as the dominant component due to centralized analytics and automated load control across diverse energy assets.

Software remains dominant in the energy management systems market dynamics, interpreting energy patterns and executing optimization decisions across equipment, storage and loads. Facility and plant operators rely on analytics modules for demand forecasting, tariff optimization, and fault recognition. Scalable cloud deployment allows multi-site enterprises to maintain unified oversight rather than isolated monitoring. In June 2024, ABB launched ABB Ability OPTIMAX 6.4, the latest version of its flagship digital energy management and optimization system, to provide coordinated control of multiple industrial assets and processes.

Sensors are expanding at the fastest pace because modern EMS platforms rely on high-resolution data from equipment, occupancy patterns, temperature conditions, production lines, and electrical panels to function effectively. As facilities shift toward predictive energy control, companies deploy granular sensing across motors, refrigeration systems, boilers, pumps, and distribution boards. The rise of edge computing accelerates adoption because sensors now pre-process signals for real-time decisions without cloud latency.

Demand Response Management leads the solution category because enterprises prioritize tariff avoidance and peak-load incentives through dynamic grid participation

Demand Response Management accounts for the largest share of the market revenue because enterprises are aggressively reducing peak-time penalties and monetizing grid-support incentives. Facilities use EMS to adjust non-critical loads when utilities trigger demand-response windows, preserving performance without operator intervention. In July 2025, Constellation and GridBeyond collaborated to use GridBeyond’s AI-powered predictive analytics platform to help B2B customers cut costs by reducing energy use during peak periods.

Carbon Energy Management opens up several lucrative energy management systems market opportunities as enterprises now measure success in emissions reduction and not just electricity savings. EMS modules convert energy usage into verified carbon data across Scope 1 and Scope 2 categories, simplifying investor and regulatory reporting. Facilities integrate carbon-intensity forecasts, scheduling high-load operations when cleaner power is available on the grid or when onsite renewables have surplus output.

By services, monitoring and control services dominate the market due to continuous optimization demands

Monitoring and control services dominate EMS projects because they deliver immediate operational improvements. Enterprises first test these services by monitoring granular visibility of loads, equipment behavior, and building conditions before committing to more advanced automation modules. Accordingly, service providers design dashboards, alert workflows, and rule-based controls that align with site procedures. In June 2025, Valmet announced plans to supply a Valmet DNA Energy Management solution to Alva's new heat production units, heat accumulators, and combined heat and power (CHP) plants.

Implementation and integration services gain major momentum in the energy management systems market as EMS value depends on how deeply platforms connect with existing automation, metering, and business systems. Integrators map electrical topologies, process flows, and building hierarchies into a single data model. They also coordinate upgrades to meters, gateways, and controllers as common protocols for reliable operation.

By industry, manufacturing leads the energy management systems demand growth as intensity and uptime pressures grow

Manufacturing is the dominant industry for EMS because energy spend directly influences unit costs, yield stability, and equipment reliability. Plants operate energy-intensive assets such as compressors, furnaces, chillers, motors and robotics, which create complex load profiles across shifts and product combinations. EMS services connect to production planning systems and line controls, so energy baselines can be linked with specific SKUs or recipes. This allows managers to identify inefficient runs, schedule heavy loads outside peak tariffs, and justify upgrades with operational evidence.

Power and energy represents the fastest-growing energy management systems market category, by industry, because utilities, IPPs and grid operators must orchestrate increasingly decentralized assets. Control rooms deploy EMS capabilities to coordinate conventional generation, renewables, storage and flexible demand resources in real time. Detailed visibility into substations, feeders, and customer programs allow planners to maintain reliability while deferring to expensive network reinforcements.

By region, North America dominates EMS adoption owing to mature digital infrastructure

North America represents the dominant market because it combines mature digital infrastructure with large installed bases of energy-intensive facilities. Industrial plants, data centers, healthcare networks, and commercial campuses already operate sophisticated automation systems, making EMS a logical requirement. Service providers in the region have strong experience integrating with building automation, SCADA, DER and market platforms, which shortens implementation cycles.

The fast expansion of the Asia Pacific energy management systems market is mainly supported by industrialization, urbanization, and electrification, which are all occurring almost simultaneously. Manufacturers, property developers and infrastructure operators are deploying new facilities at scale, often specifying EMS from day one instead of retrofitting later. Rapid expansion of renewables and distributed resources also drives utility sectors to manage more volatile load patterns.

| CAGR 2026-2035 - Market by | Country |

| India | 18.5% |

| China | 15.5% |

| USA | 12.5% |

| Australia | 11.0% |

| France | 11.0% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

| Italy | 9.8% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Competition in the market is centering on who can turn fragmented meters, building controls and industrial assets into a single, software-driven platform that changes energy outcomes in real time. Established energy management system companies and newer cloud-native vendors are competing to embed AI, digital twins, and grid-interactive functions, so customers move from static dashboards to continuous optimization, and verified savings. Players see big opportunities in electrifying factories, data centers, and commercial campuses, where EMS can manage renewables, storage, and flexible loads together.

Service-heavy models are also gaining momentum, with energy management systems market players offering design, integration, and 24/7 remote operations centers to hold performance guarantees over multi-year contracts. Vendors that link EMS with carbon accounting, demand response markets and equipment health analytics are best placed to win strategic, portfolio-wide rollouts from industrial groups, utilities and large real estate owners seeking resilient operations.

Mitsubishi Electric Corporation, established in 1921 and headquartered in Tokyo, Japan, serves the energy management systems market through building automation, factory automation, and grid-focused digital offerings. Its EMS-related portfolios combine advanced controls, inverters and supervisory software that help customers coordinate HVAC, lighting, and distributed energy resources.

Delta Electronics, Inc., founded in 1971 and headquartered in Taiwan, addresses the energy management systems market with power electronics, building automation, industrial energy solutions and data center infrastructure. Its EMS capabilities enable customers to orchestrate loads, storage, and EV charging.

General Electric Company, established in 1892 and headquartered in Boston, United States, serves the market primarily through its GE Vernova and GE Digital businesses. These units provide grid, plant, and asset-level optimization platforms that connect turbines, generators, substations and industrial loads.

Schneider Electric SE, founded in 1836 and headquartered in Rueil-Malmaison, France, positions itself as a specialist in digital automation and energy management. Its EcoStruxure platform brings together building systems, industrial controls, microgrids and data centers under one EMS-ready architecture.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include ABB Ltd., and Honeywell International Inc., among others.

Unlock the latest insights with our energy management systems market trends 2026 report. Discover regional growth patterns, consumer preferences, and key industry players. Stay ahead of competition with trusted data and expert analysis. Download your free sample report today and drive informed decisions in the market.

Anesthesia Information Management Systems Market

Hospital Asset Management Systems Market

Medical Document Management Systems Market

Transportation Management Systems Market

Israel Transportation Management Systems Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 14.00% between 2026 and 2035.

Key strategies driving the market include standardizing architectures, investing in AI analytics, partnering with integrators, and structuring contracts around savings, emissions and participation in demand-response.

The key trends guiding the market growth include the increasing demand for energy efficient systems and the technological advancements and innovations.

The major regions in the market are North America, Latin America, Europe, the Middle East and Africa, and the Asia Pacific.

The major types of the product are home EMS, building EMS, and industrial EMS, among others.

The significant components of energy management systems are sensor, software, batteries, controller, and display devices, among others.

The various solutions considered in the market report are demand response management, carbon energy management, and utility billing and customer information system, among others.

The different segments based on service of the product considered in the market report are monitoring and control, implementation and integration, consulting and training, and maintenance.

The several industries considered in the market report are manufacturing, power and energy, telecom and IT, healthcare, retail, and education, among others.

The key players in the market include Mitsubishi Electric Corporation, Delta Electronics, Inc., General Electric Company, Schneider Electric SE, ABB Ltd., and Honeywell International Inc., among others.

In 2025, the market reached an approximate value of USD 72.33 Billion.

Vendors struggle with long sales cycles, fragmented legacy infrastructure, cybersecurity exposure, shortage of EMS-skilled engineers, and pressure to prove verifiable savings while aligning solutions with changing regulations and sustainability commitments.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Component |

|

| Breakup by Solution |

|

| Breakup by Services |

|

| Breakup by Industry |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share