Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Europe bioLPG market size reached around 468.48 KMT in 2025. The market is estimated to grow at a CAGR of 19.80% during 2026-2035 to reach a volume of 2852.72 KMT by 2035.

Base Year

Historical Period

Forecast Period

The European Union (EU) has a 2030 target of a 55% net reduction in greenhouse gas emissions, which is driving the adoption of green alternatives like BioLPG.

The EU Commission has published a REPowerEU plan to reduce dependency of Russian fossil fuel by 2030 and cut gas imports.

The EU has set forth an ambitious proposal to significantly increase the presence of Solid Aviation Fuel (SAF) in aviation fuel sales. The aim is to raise it from 2% in 2025 to over 70% by 2050.

Compound Annual Growth Rate

19.8%

Value in KMT

2026-2035

*this image is indicative*

BioLPG serves as a green substitute for fossil-fuel-based LPG, aiding the decarbonisation of transportation, residential, industrial, and petrochemical sectors. BioLPG is presently manufactured in France, Italy, Spain, Sweden, and the Netherlands.

Due to its identical chemical composition to conventional LPG, bioLPG possesses the ability to be stored, blended, and utilised just like traditional LPG. It acts as an efficient drop-in replacement for existing LPG applications, such as transportation fuel, which is leading to the Europe bioLPG market expansion.

Strategic bioLPG supply partnerships in Europe aimed at decarbonising the economy aid the availability of bioLPG across the region.

The shifting economic landscape in the UK and EU towards biofuels and sustainable aviation fuels is propelling HVO-based pathways to the forefront as a key market driver for bioLPG production.

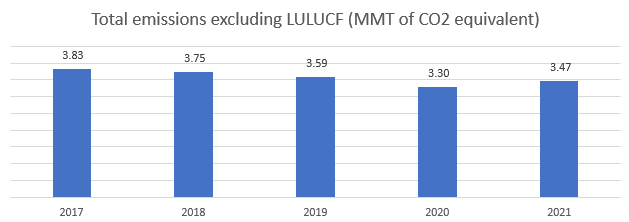

Figure: European Union Green House Gas Emission (2000-2021); MMT (Total emissions excluding LULUCF (MMT of CO2 equivalent)

Table: Strategic Alliances in the Europe BioLPG Market

| Date | Description |

| November 2022 | Friedrich Scharr KG, a German multi-energy fuel distribution group entered a Research Funding and Collaboration Agreement with BioLPG LLC to develop renewable LPG (bioLPG) technology. The collaboration aims to develop the GTI Energy renewables-sourced, green LPG (“bioLPG”) Cool LPG technology and for preparation of bioLPG production at scale within the next few years. |

| October 2022 | Green LG Energy and BioLPG LLC entered into a significant agreement to increase funding for the development of renewable bioLPG technology, aiming to contribute to the decarbonization of LPG sourcing in Italy and Europe. The collaboration underscores their commitment to producing affordable and green bioLPG at scale to meet energy demands while aligning with global emissions reduction targets. |

| February 2021 | UGI International established an exclusive partnership with Ekobenz, a bioLPG producer, giving UGI exclusive rights to Ekobenz's bioLPG supply in Europe. This collaboration enhances UGI International's sustainable fuels portfolio, aligning with its decarbonization strategy and commitment to the Paris Agreement's net-zero global economy goals while addressing customers' carbon reduction needs. |

Increasing importance of decarbonisation; rising number of initiatives for environmental safety and security; rising research and development activities; and existing building stock for bioLPG production are impacting the Europe bioLPG market growth

| Date | Company | Event |

| Jan 2023 | Eni | Eni, the Italian oil and gas giant, launched Eni Sustainable Mobility, consolidating its existing biomethane operations and other sustainable transport-related products. |

| Oct 2022 | Eni | Eni held a meeting with Tuscany's president, Eugenio Giani, along with the mayors of Livorno and Collesalvetti, Luca Salvetti and Adelio Antolini, respectively, to confirm their exploration of constructing a new bio-refinery at Eni's Livorno industrial site. |

| Aug 2022 | SHV Energy | SHV Energy, through its Italian subsidiary Liquigas, finalised an agreement to acquire the LPG heating business unit of the SIGLI group. |

| Trends | Impact |

| Decarbonisation targets | Governments across Europe are striving to achieve decarbonisation amid the growing concerns about climate change. In support of this, various initiatives and plans are being introduced to significantly reduce carbon emissions, leading to the adoption of renewable fuel sources such as BioLPG. |

| Research and development | Research and development (R&D) efforts in the field of bioLPG are witnessing a notable increase. R&D activities to enhance bioLPG production processes, explore new feedstock options, improve efficiency, and expand its applications, aid the advancement of the Europe bioLPG market. |

| Existing building stock for bioLPG in Europe | In Europe, there are approximately 2 million LPG boilers that can lock-into lower carbon dioxide emissions cost-effectively. Households can avoid the expenses and inconveniences associated with switching to a new heating system as bioLPG can be easily combusted in existing LPG boilers. |

| Government initiatives supporting bio-fuel production | In April 2023, the European Parliament and Council negotiators reached a provisional deal on the RefuelEU Aviation rules. Under the agreement, at least 2% of aviation fuels will be sustainable from 2025, with this share increasing every five years to reach 70% by 2050. Investment in new plants for producing sustainable aviation fuels (SAF) is expected to increase the production of bioLPG as a by-product. |

As the HVO (Hydrotreated Vegetable Oil) process is currently the dominant method for commercial bioLPG production, manufacturers are actively investing in research and development efforts. These initiatives aim to investigate alternative sources for bioLPG procurement, such as exploring the potential of microbial synthetic pathways for biopropane production through fermentation.

Rural property owners who reside off-grid and seek eco-friendly heating solutions might discover substantial initial cost savings by transitioning to LPG/bioLPG, in comparison to other low-carbon alternatives like heat pumps or biomass boilers.

Over the last five years, commercial bioLPG production via hydroprocessing has experienced steady double-digit growth, driven by a growing number of refinery conversions and the emergence of greenfield biofuels initiatives.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Europe BioLPG Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Application

Market Breakup by Region

Based on application, the industrial sector accounts for a significant Europe BioLPG market share

Substituting oil with LPG and bioLPG in low-temperature industrial processes, like vehicle manufacturing and the food industry, can provide cost-effective and lasting emission savings. A combination of bioLPG and electric motors within hybrid systems offers a dual advantage by not only enhancing air quality but also establishing a reliable solution for the reduction of emissions.

For businesses like rural hotels and restaurants, transitioning from heating oil to bioLPG provides a simple and effective method to reduce emissions without the need for extensive building renovations. Further, replacing oil consumption with bioLPG can offer a cost-effective solution for old and historic buildings.

BioLPG is the ideal cost-effective heating solution for rural homes in EU, where over 40 million rural households lack access to the gas grid. With fossil fuels and wood being their primary heating sources, bioLPG has the potential to drive decarbonisation.

The applications of bioLPG in the transportation sector are expected to increase in the coming years. Autogas leads as the top alternative fuel in the EU, comprising 3% of all alternative fuels and serving 8 million vehicles. With 250 million passenger cars on the road, which have an average lifespan of 11 years (up to 17 years in Eastern Europe) and considering that EU legislation primarily focuses on emissions from new cars with delayed effects, converting existing vehicles to Autogas is a cost-effective means to expedite the reduction of emissions from road transport.

The market players are differentiating themselves through diverse raw material sourcing, advanced technologies, and customer-centric activities for superior customer value

| Company | Founded | Headquarters | Services |

| Neste Oyj | 1948 | Keilaranta, Finland | The company offers an extensive range of offerings in various segments including sustainable aviation, renewable road transportation, renewable and recycled plastics, marine solutions, fossil products, and raw materials, among others. |

| TotalEnergies | 1924 | Courbevoie, France | Specialising across various energy sectors, including oil, biofuels, natural gas, green gases, renewables, and electricity. |

| Ekobenz Sp.z.o.o | 2006 | Lublin, Poland | Provides BioLPG, liquid hydrocarbons and aromatic biohydrocarbons. |

| Galp Energia, SGPS, S.A. | 1999 | Lisbon, Portugal | The company specialises in BioLPG production |

Other notable players operating in the Europe bioLPG market include Compañía Española de Petróleos, S.A. (CEPSA), and ENI Spa, among others.

Liquefied petroleum gas produced from biomaterials has held legal recognition as a green compliance option in the German heating sector. Furthermore, the German government aims to replace fossil-based raw materials with renewable alternatives to the greatest extent possible by 2050. In September 2023, Germany's lower house of parliament successfully passed a bill to phase out oil and gas heating systems, aligning with the nation's goal to achieve climate neutrality by the year 2045.

The Dutch central government supports the development of technologies for producing biomass energy through its Stimulation of Sustainable Energy Production and Climate Transition (SDE++) grant scheme.

The National Energy and Climate Plan (NECP) is Belgium’s main energy and climate policy document that focuses on increasing the use of renewable energy in transportation and electricity generation. The NECP approved the Belgian government’s plans to increase the share of biofuels in the transportation sector from an average of 5.5% in 2017 to 13.9% in 2030 in the NECP for 2021 – 2030.

Europe LPG Market

Africa CNG and LPG Vehicle Market

Peru LPG Market

Spain LPG Market

LPG Market

LPG Cylinder Market

LPG Vaporiser Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The Europe bioLPG market attained a volume of 468.48 KMT in 2025.

The market is estimated to grow at a CAGR of 19.80% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a volume of 2852.72 KMT by 2035.

The key drivers of the bioLPG market are the increasing refinery conversions and greenfield biofuels projects, increasing research and development activities, rising environmental consciousness and depletion of natural resources, and growing energy demands.

The key trends guiding the growth of the market include rapid advancements in technology and stringent government measures to achieve decarbonisation goals.

The major regional markets are France, Germany, Italy, Spain, Sweden, the United Kingdom, the Netherlands, and Belgium, among others.

The different applications include industrial, transport, household, HoReCa, offices, and others.

The key players in the market include Neste Oyj, TotalEnergies, Ekobenz Sp.z.o.o, Galp Energia, SGPS, S.A., Compañía Española de Petróleos, S.A. (CEPSA), and ENI Spa, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share