Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Europe biosimilar market reached a value of USD 11.43 Billion in 2025 driven by the extended application of biosimilars in managing various chronic conditions across the region. The market is further expected to grow at a CAGR of 12.80% between 2026-2035 to reach a value of almost USD 38.12 Billion by 2035.

Base Year

Historical Period

Forecast Period

The increasing adoption of biosimilars in oncology and autoimmune treatments is expected to drive substantial growth, with expanding product offerings and improving healthcare accessibility across Europe.

Regulatory advancements and the streamlining of approval processes by the European Medicines Agency (EMA) will further accelerate market entry, fostering competition and broadening treatment options for patients.

As patient awareness and acceptance of biosimilars continue to rise, the market is poised for sustained expansion, helping to reduce healthcare costs while offering effective alternatives to high-priced biologics.

Compound Annual Growth Rate

12.8%

Value in USD Billion

2026-2035

*this image is indicative*

Biosimilars are biologic medical products that are highly similar to an approved reference biologic, with no clinically meaningful differences in terms of safety, efficacy, and quality. These products are made from living organisms and are used to treat various conditions such as cancer, autoimmune diseases, and diabetes. Biosimilars offer a more affordable alternative to expensive biologic therapies, making treatments more accessible to patients. Their development follows rigorous regulatory guidelines to ensure they meet the same standards as their reference products. The growing adoption of biosimilars helps reduce healthcare costs while expanding treatment options for patients.

Rising Incidence of Chronic Diseases

The growing demand for affordable biologics and the increasing healthcare burden due to chronic conditions like psoriasis and inflammatory bowel disease are key drivers of the biosimilar market in Europe. For instance, in July 2024, STADA and Alvotech launched Uzpruvo®, the first approved biosimilar to Stelara® in Europe, across a majority of European countries. This launch follows the expiration of the reference molecule patent, offering patients access to a life-altering treatment for conditions in gastroenterology, dermatology, and rheumatology. As national price approvals are secured, Uzpruvo® is expected to increase competition and reduce healthcare costs in the region, ultimately driving the growth of the biosimilar market. Over the forecast period, the expanding access to high-quality, cost-effective treatments is poised to fuel significant market growth.

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Europe Biosimilar Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Molecule

Market Breakup by Manufacturing Type

Market Breakup by Indication

Market Breakup by Country

Infliximab to Lead the Market Share by Molecule

Infliximab holds the largest market share due to its extensive use in treating auto-immune conditions such as rheumatoid arthritis and Crohn’s disease. Its affordability compared to branded biologics has driven widespread adoption, supported by growing regulatory approvals. The increasing prevalence of auto-immune diseases and ongoing cost-containment measures in healthcare systems further boost its market value. Infliximab is expected to remain dominant during the forecast period, benefiting from rising awareness about biosimilars and the introduction of more advanced formulations that enhance treatment efficacy and patient compliance.

Europe Biosimilar Market Segmentation by Manufacturing Type to Witness Significant Growth

In-house manufacturing dominates the market share by manufacturing type as it allows manufacturers to maintain stringent control over production quality, scalability, and costs. Leading biosimilar companies heavily invest in proprietary manufacturing facilities to meet rising demand efficiently. The growing emphasis on ensuring uninterrupted supply chains, compliance with European regulatory standards, and technological advancements in bioprocessing bolster this segment's growth. During the forecast period, in-house manufacturing is expected to drive the market by enabling innovation and reducing dependency on external contractors, thereby ensuring better cost-effectiveness and reliability in biosimilar production.

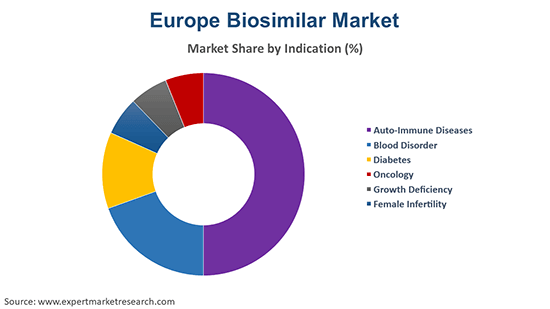

Auto-Immune Diseases to Hold a Major Share of the Market

The auto-immune diseases segment leads the Europe biosimilar market segment on the basis of indication, driven by the high incidence of conditions like rheumatoid arthritis, psoriasis, and ulcerative colitis. Biosimilars such as infliximab and etanercept have gained significant traction in this therapeutic area, offering cost-effective alternatives to originator biologics. Increased healthcare expenditure and greater patient access to biosimilars, aided by favourable government policies, propel this segment’s dominance. Looking ahead, the rising adoption of biosimilars for treating chronic auto-immune diseases is expected to sustain growth, supported by advancements in therapeutic formulations and patient-focused healthcare solutions.

Germany will likely hold the largest market share in the European market due to its advanced healthcare infrastructure, supportive regulatory environment, and strong demand for cost-effective treatments. The country has made significant investments in biosimilar adoption, particularly through its healthcare reimbursement system, which incentivises the use of biosimilars. Germany's well-established pharmaceutical sector and the presence of leading biotech companies further contribute to its market leadership. Additionally, Germany's central role in the European Union's regulatory processes allows for quicker market access for biosimilars. As the largest economy in Europe, Germany is poised to continue driving the market with its emphasis on high-quality, affordable biologic therapies.

The key features of the market report comprise patent analysis, grants analysis, funding and investment analysis, clinical trials analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:

Headquartered in New York, USA, Pfizer, Inc. was established in 1849. A global leader in pharmaceuticals, it offers a diverse portfolio including biosimilars, vaccines, oncology treatments, and more. In the European biosimilar market, Pfizer focuses on developing high-quality biosimilars to address conditions like rheumatoid arthritis, oncology, and diabetes. Its prominent biosimilars include infliximab (Inflectra) and somatropin (Ruxience). With a commitment to increasing access to affordable medicines, Pfizer plays a significant role in the expansion and development of biosimilar therapies in Europe.

Founded in 2002 and headquartered in Incheon, South Korea, Celltrion Inc. is a major player in the global biosimilars market. Known for pioneering the development of monoclonal antibody biosimilars, its portfolio in Europe includes biosimilars for autoimmune diseases and oncology, such as infliximab (Remsima) and trastuzumab (Herzuma). Celltrion has built a strong presence in Europe, focusing on making high-quality biologics more accessible. Its advanced manufacturing technologies and extensive regulatory expertise support its growth in the European biosimilar market, enhancing the affordability and availability of key biologic treatments.

Established in 1996 and headquartered in Basel, Switzerland, Novartis AG is a global healthcare leader with a broad portfolio spanning pharmaceuticals, generics, and biosimilars. In Europe, its biosimilars division, led by its Sandoz division, is a key player in the biosimilar market. Novartis’ biosimilars include treatments for oncology, immunology, and ophthalmology, such as rituximab (Rixathon) and pegfilgrastim (Ziextenzo). With a focus on expanding access to critical biologics, Novartis remains committed to increasing the availability of biosimilars, contributing to the overall market growth in Europe.

Founded in 1980 and headquartered in Thousand Oaks, California, USA, Amgen is a global biotechnology company renowned for its innovative biologics and biosimilars. In Europe, Amgen focuses on expanding its biosimilars portfolio, including products for oncology and rheumatoid arthritis. Key biosimilars include infliximab (Amgevita) and etanercept (Benepali). With a commitment to high-quality biologic medicines, Amgen continues to lead the European biosimilars market, providing affordable alternatives to patients and ensuring greater access to effective treatments across various therapeutic areas.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Eli Lilly and Company, Samsung Bioepis, Sanofi SA, Dr. Reddy’s Laboratories Ltd., and Boehringer Ingelheim.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Molecule |

|

| Breakup by Manufacturing Type |

|

| Breakup by Indication |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,699

USD 2,429

tax inclusive*

Single User License

One User

USD 4,299

USD 3,869

tax inclusive*

Five User License

Five User

USD 5,799

USD 4,949

tax inclusive*

Corporate License

Unlimited Users

USD 6,999

USD 5,949

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share