Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The biosimilar market size attained a value of USD 28.81 Billion in 2025. The market is likely to grow at a CAGR of 17.60% during the forecast period of 2026-2035, likely to attain a value of USD 145.75 Billion by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

17.6%

Value in USD Billion

2026-2035

*this image is indicative*

In June 2023, Samsung Bioepis and Biogen Inc. announced the launch of BYOOVIZ™ (ranibizumab-nuna) in the United States. The biosimilar referencing LUCENTIS® (ranibizumab)I is priced 40% lower than its biologic. It offers affordable and effective treatment to rental disorder patients. BYOOVIZ™ is also the first ophthalmology biosimilar launched in the United States, which is aimed at enhancing the accessibility of anti-VEGF treatments.

In June 2023, Amgen announced that its biosimilar to Rituxan®, RIABNI™ (rituximab-arrx), was approved by the US FDA to treat all available Rituxan® indications. The approval marks a significant advancement for providing quality and affordable treatment options to adults suffering from rheumatoid arthritis. Hence, the increasing biosimilar approvals by government bodies are favouring the biosimilars market growth.

In May 2023, Biocon Biologics and Viatris announced the availability of Abevmy® (bBevacizumab) in Canada. Abevmy® is a biosimilar to Roche’s Avastin® (Bevacizumab) and is the companies’ third biosimilar in the country. The biosimilar has been approved for four oncology indications by Health Canada and expands the accessibility to affordable biologics for cancer care.

In May 2023, Sandoz introduced ‘Act4Biosimilars’, a global initiative to address health inequality and inequity. The initiative would increase patients’ access to advanced medicines by improving the accessibility, approvability, affordability, and accessibility of biosimilars. Such initiatives are likely to favour the biosimilars market growth.

In March 2023, Samsung Bioepis and Biogen Canada Inc. announced that the biosimilar referencing LUCENTIS®I (ranibizumab), BYOOVIZ™, was approved by Health Canada. This would enable its use in the affordable treatment of retinal vascular disorders and as an anti-VEGF (vascular endothelial growth factor).

In February 2023, Biocon Biologics announced the acquisition of the biosimilar assets of Viatris to create one of the leading vertically-integrated and global companies. The acquisition would enable Biocon to gain Viatris’ portfolio of in-licensed biosimilar assets and accelerate its commercialisation strategy for biosimilars. Such mergers and acquisitions are accelerating the biosimilars market development.

In February 2023, Pfizer Inc. announced that its supplemental application for the interchangeability of ABRILADA™ (adalimumab-afzb) with Humira® (adalimumab) was accepted for review by the FDA. The interchangeability designation would enable ABRILADA™ to support the growing use of biosimilars while broadening the accessibility to quality and affordable treatment for chronic inflammatory issues.

Biosimilars refer to biologic products that have the same active properties as biologic drugs. They are integral in reducing healthcare costs and enhancing patient outcomes. Biosimilars are effective, safe, and cost-effective, due to which they are increasingly used as substitutes for biologics. Moreover, due to the impact of the COVID-19 pandemic and the rising focus on boosting the accessibility of critical drugs, the development of biosimilars is increasing.

Evolving Regulatory Environments

The evolving regulatory environments in countries like Japan, the United States, and China are boosting the approval of biosimilars.

Cost-Effectiveness of Biosimilars

Biosimilars are cost-effective and expand the accessibility of biological medicines, due to which their demand is increasing.

Growing Approvals of Interchangeable Biosimilars

Leading health authorities such as the FDA are increasingly approving interchangeable biosimilars to enhance the treatment accessibility of patients with serious medical conditions.

Increasing R&D Activities

Several companies are investing in R&D activities to drive innovations in biosimilars development while reducing the overall cost of biosimilars manufacturing.

Misinformation Regarding the Safety and Efficacy of Biosimilars

The widespread misinformation regarding the safety, science, and efficacy of biosimilars can create confusion and reduce their adoption.

Complex Manufacturing of Biosimilars

The manufacturing of biosimilars is complicated and tedious and requires extensive R&D activities, which is likely to pose a challenge to the market.

Regulatory Challenges of Biosimilars

Various regulatory challenges are associated with biosimilars due to the unavailability of reference products, issues with interchangeability, lack of resources, and problems associated with their quality.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Biosimilars Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Market Breakup by Drug Class

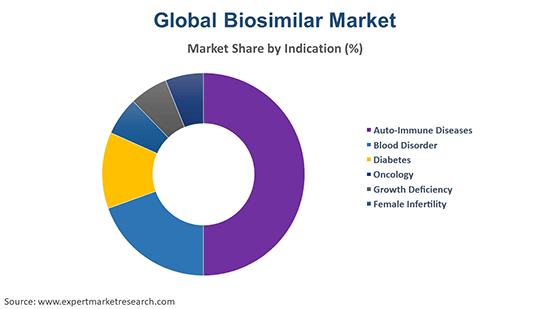

Market Breakup by Indications

Market Breakup by Procedure

Market Breakup by Region

The oncology segment represents a considerable share of the market for biosimilars due to the growing prevalence of cancer. The increasing attempt by governments and pharmaceutical companies to reduce costs associated with cancer treatment is also boosting the demand for biosimilars. Furthermore, the surging clinical trials of biosimilars in cancer treatment are likely to offer lucrative growth opportunities to the biosimilars market.

The growth of the auto-immune diseases segment can be attributed to the growing prevalence of chronic issues such as multiple sclerosis, inflammatory bowel disease (IBD), and rheumatoid arthritis, among others. This, in turn, is likely to boost the demand for biosimilars on account of their quality treatment and cost-effectiveness.

The rising cases of type 2 diabetes and the increasing demand for affordable life-saving insulin and other drugs are propelling the growth of the diabetes segment. The segment of the biosimilars market is further fuelled by the growing awareness regarding the efficacy and safety of biosimilar insulins and the surging approvals of interchangeable biosimilar insulins.

The blood disorder segment is being aided by the growing incidences of sickle cell anaemia, leukaemia, and lymphoma, among others. Hence, the rising availability of biosimilars of critical biologics used in the treatment of such issues is augmenting the biosimilars market growth. Meanwhile, the growing use of biosimilars in growth hormone treatment is anticipated to aid the growth deficiency segment. The female infertility segment, in addition, is expected to be bolstered by the growing fertility issues and the increasing availability of biosimilar fertility treatments.

The market is growing on account of the rising use of molecules like insulin glargine, infliximab, etanercept, epoetin alfa, somatropin, filgrastim, follitropin alfa, and rituximab, to reduce healthcare costs. The increasing attempt to boost the accessibility to such molecules is anticipated to bolster the market growth.

Epoetin alfa accounts for a significant biosimilars market share owing to the growing use of its biosimilar in the treatment of anaemia, cancer, and chronic renal failure. Various health authorities are increasingly approving the use of biosimilars in surgical procedures for reducing the requirement for blood cell transfusions.

The demand for Insulin glargine is surging due to the rising prevalence of diabetes in adults, geriatrics, and children. Insulin is a life-saving drug for diabetics, which is boosting the demand for insulin glargine to lower the cost of insulin and enhance its accessibility. Moreover, health organisations such as the FDA are approving the use of insulin glargine biosimilars interchangeably, which is likely to aid the biosimilars market development.

The biosimilars of rituximab are increasingly used to treat leukaemia, autoimmune disorders, and lymphomas owing to their cost benefits and optimal quality. With the growing attempts to boost the accessibility of cancer treatment, various clinical trials and studies to enhance the efficiency of rituximab is expected to grow.

Various key players are increasingly outsourcing the manufacturing and development of biosimilars due to superior expertise and services provided by contract manufacturers. With the growing demand for real-world evidences to ensure the regulatory compliances of biosimilars, the contract manufacturing segment is likely to witness a healthy growth.

The in-house manufacturing segment is being supported by the increasing investments in the manufacturing capacities by the leading biosimilars market companies. For instance, in December 2020, Celltrion announced its plans to invest about $453 million in expanding its R&D and manufacturing site in Songdo, South Korea, to aid the biosimilars pipeline.

Europe holds a considerable share in the market for biosimilars on account of the establishment of solid frameworks for biosimilars adoption. The increasing approvals of biosimilars and the introduction of various initiatives to expand biosimilars competition by governments and purchasers are also aiding the market.

Several countries within Europe like Germany are also encouraging the prescriptions of biosimilars to enhance savings in the healthcare sector, which is augmenting the biosimilars market growth. Moreover, governments in the region are reducing unnecessary clinical data requirements for the approval of biosimilars to facilitate their launch.

The market in North America is witnessing robust growth due to the surging awareness regarding the safety, efficacy, and cost-effectiveness of biosimilars. The extensive adoption of biosimilars in oncology applications in the United States and Canada is further augmenting the market expansion. The growing utilisation of biosimilars in diabetes and ophthalmology treatment is further invigorating the market. In addition, some of the leading biosimilars market trends include the approval of interchangeable biosimilars and the increasing competition through the introduction of new biosimilars.

The increasing manufacturing of biosimilars in countries such as India and South Korea, among others, is expected to fuel the market in the Asia Pacific. With the rising healthcare costs associated with critical biologics, there is a growing approval of biosimilars to drive meaningful cost savings for both patients and healthcare organisations.

Countries such as Japan, Malaysia, and Australia, among others, are likely to address their biosimilars regulatory and legal framework and increase their approval. The rising acceptance of biosimilars in various countries like India, Japan, South Korea, and China, among others, is anticipated to lead to a surge in biosimilar launches over the forecast period. Furthermore, the biosimilars market development can be associated with the introduction of biosimilars for the treatment of various diseases and the rising availability of real-world data regarding their efficacy.

The comprehensive EMR report offers an in-depth biosimilars market assessment that is based on the Porter's five forces model and provides a SWOT analysis.

The report provides a detailed analysis of the following leading companies in the market while covering their latest developments like mergers, acquisitions, investments and expansion plans as well as competitive landscape.

Pfizer Inc. is one of the leading pharmaceutical companies that discovers, manufactures, and develops healthcare products, including innovative vaccines and medicines. The company aims to advance prevention, wellness, cures, and treatments for challenging critical diseases. In 2021, the company’s medicines and vaccines were used by approximately 1.4 billion people. Moreover, it initiated 13 clinical studies in 2021.

Celltrion Inc. is a pharmaceutical company based in Korea that introduced the "antibody biosimilar". It has broken ground in a number of previously unexplored areas, and it aims to expand as a global biopharmaceutical company. With sales in more than 90 countries and a production capacity of 190,000 litres, the company has a workforce of 2145 and revenue of USD 153 billion. Moreover, it is significantly boosting R&D activities to increase the biosimilars market demand.

Novartis AG is a pharmaceutical company that aims to extend and improve people’s lives by reimaging medicine. Its products are utilised by about 800 million people across the globe. With more than 108,000 employees, the company aims to deliver and discover new treatments and therapies. Its leading companies include Sandoz, Gyroscope Therapeutics, and Advanced Accelerator Applications.

AMGen Inc. is one of the major biotechnology companies. It focuses on areas with large unmet medical needs and uses its expertise to develop solutions offering improved health outcomes. It operates in over 100 countries in the world, and its breakthrough medications have helped millions of people combat critical illnesses.

Teva Pharmaceutical Industries Ltd. is a major generic drug and biopharmaceutical company. It is also a global leader in active pharmaceutical ingredients and speciality pharmaceuticals. The company has a presence in more than 60 markets globally and has a portfolio of approximately 3,000 medicines. With over 55 manufacturing facilities in more than 30 countries, the company serves nearly 200 million people every day.

Samsung Bioepis is a biopharmaceutical company that is focused on maximising the value of biosimilar products and medicines. It also aims to revolutionise the delivery of biologic therapeutics to patients as well as the biosimilars market. It employs more than 900 employees and oncology, immunology, ophthalmology, haematology, gastroenterology, and endocrinology are among the six major therapeutic areas of the company.

Biocon Ltd. is a global pharmaceutical company with a widespread presence all over the globe in over 120 countries. It is a pioneer in defining affordable and innovative approaches to treat diabetes, cancer, and autoimmune diseases. It has four major lines of business - biosimilars, generics, novel biologics, and research services, and employs over 12,000 people across the globe.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Pegfilgrastim Biosimilars Market

United States Biosimilars Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global biosimilar market was valued at USD 28.81 Billion in 2025.

The market is expected to grow at a CAGR of 17.60% from 2026 to 2035 to reach a value of USD 145.75 Billion by 2035.

Biosimilars are likely to enhance innovations in the healthcare sector and increase the development of innovative drugs. Further, by boosting competitiveness between the key players, they are expected to enhance the accessibility to critical biologics and lower healthcare costs.

Biosimilars are made from biologic sources whereas generic drugs use chemicals as their primary sources. Moreover, biosimilars require special approval to be considered interchangeable while generic drugs are automatically interchangeable with biologics.

The market is being aided by the growing prevalence of various chronic diseases, the rising use of biosimilars in cancer treatment, and the increasing demand for cost-effective treatment methods.

The global biosimilars market is estimated to grow at a CAGR of 17.60% between 2026 and 2035.

The market is anticipated to be supported by the increasing research and development (R&D) activities, the surging approvals of biosimilars, and the growing introduction of new biosimilars.

Some of the major benefits of biosimilars include enhanced cost-effectiveness and efficacy of critical biologics. They also enable the reallocation of resources to other patient care requirements by providing affordable treatment options and improving treatment outcomes.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major molecules of biosimilars in the market are infliximab, insulin glargine, epoetin alfa, etanercept, filgrastim, somatropin, rituximab, and follitropin alfa.

The significant manufacturing segments in the market include contract and in-house manufacturing.

The various indications in the market for biosimilars are auto-immune diseases, blood disorder, diabetes, oncology, growth deficiency, and female infertility.

The major players in the market are Pfizer Inc., Celltrion Inc., Novartis AG, AMGen Inc., Teva Pharmaceutical Industries Ltd., Samsung Bioepis, and Biocon Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product Type |

|

| Breakup by Drug Class |

|

| Breakup by Indications |

|

| Breakup by Procedure |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 3,299

USD 2,969

tax inclusive*

Single User License

One User

USD 5,499

USD 4,949

tax inclusive*

Five User License

Five User

USD 6,999

USD 5,949

tax inclusive*

Corporate License

Unlimited Users

USD 8,199

USD 6,969

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share