Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Europe bone cement market was valued at USD 234.42 Million in 2025 driven by the growing elderly population, increased R&D in orthopedic solutions, and continuous innovations in bone cement formulations in the region. It is expected to grow at a CAGR of 5.70% during the forecast period of 2026-2035 and reach a value of USD 408.08 Million by 2035.

Base Year

Historical Period

Forecast Period

Increasing elderly population and advancements in bone cement formulations are some of the factors influencing market dynamics significantly.

One of the major market trends is the growing demand for antibiotic-loaded bone cement that contains antibiotics to prevent post-surgical infections.

The market share is impacted by the high incidence of sports injuries and the rising demand for minimally invasive surgical procedures in Europe.

Compound Annual Growth Rate

5.7%

Value in USD Million

2026-2035

*this image is indicative*

Bone cement is defined as a component used as a filler or fixer of bone when a patient suffers from a fracture or some kind of bone injury. Bone cement can be adhered inside a body in its powdered or liquid form and can last up to 15 to 20 years.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The high demand for orthopedic procedures and the presence of advanced healthcare infrastructure significantly elevate the Europe bone cement market value in the forecast period. The market is expected to witness substantial growth in the coming years supported by the increasing elderly population and advancements in bone cement formulations. In addition, calcium phosphate cement (CPC) is experiencing high market demand due to its biocompatibility and osteoconductive and is poised to aid the expansion of the global bone cement market . Other factors that influence the market dynamics in Europe include the increasing use of bone cement in outpatient settings for various surgical procedures and the rising demand for minimally invasive surgeries.

Rising Introduction of Innovative Bone Cement Solutions to Affect the Market Landscape Significantly

The rising introduction of bone cement products in Europe with improved properties such as higher viscosity, faster setting times, and enhanced biocompatibility are projected to stimulate market growth in the coming years. For instance, Kyphon VuE™ cement developed by leading medical device company Medtronic plc is a high-viscosity radiopaque polymethyl methacrylate (PMMA) cement with augmented barium particles. This bone cement product is quick to harden and facilitates fluoroscopic visualization of cement flow during vertebral augmentation procedures. Such advancements in bone cement solutions are not only ensuring optimal handling performance but also helping in achieving better surgical outcomes and patient safety. Thus, the continuous innovation in bone cement products, stimulated by significant R&D investments by the market players, is propelling the growth of the market in Europe.

The market is witnessing several trends and developments to improve the current scenario in North America. Some of the notable trends are as follows:

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

"Europe Bone Cement Market Report and Forecast 2026-2035" offers a detailed analysis of the market based on the following segments:

Market Breakup by Product

Market Breakup by Application

Market Breakup by End User

Market Breakup by Region

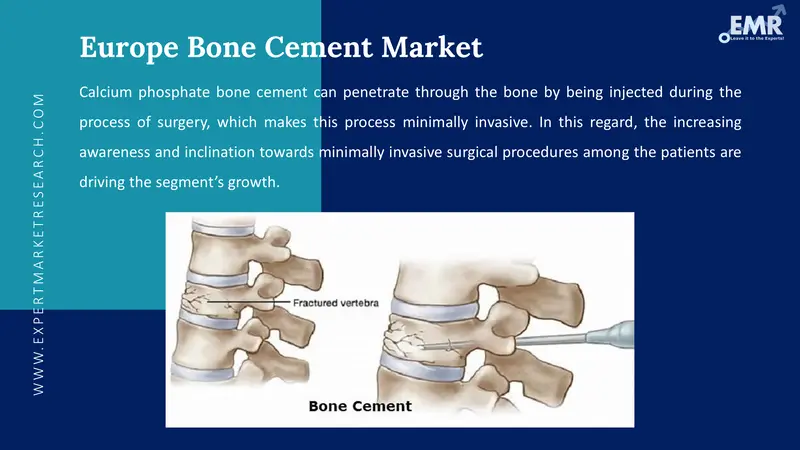

Market Segmentation Based on Product is Anticipated to Witness Substantial Growth

Based on products, the market is divided into calcium phosphate cement (CPC), glass polyalkenoate cement and polymethyl methacrylate (PMMA) cement. The calcium phosphate cement (CPC) segment, holds a significant share in the Europe bone cement market. Calcium phosphate bone cement can penetrate through the bone by being injected during the process of surgery, which makes this process minimally invasive. In this regard, the increasing awareness and inclination towards minimally invasive surgical procedures among patients are driving the segment’s growth.

In the Europe bone cement market, calcium phosphate cement is a widely used compound to treat bone fracture due to its self-setting properties, osteoconductivity, easy mouldability, and excellent biocompatibility. Meanwhile, the heightened application of polymethyl methacrylate (PMMA) cement in vertebroplasty and arthroplasty is further fuelling the growth of the Europe market for bone cement.

Kyphoplasty Segment Covers a Significant Market Share

Application areas of bone cement include kyphoplasty, arthroplasty and vertebroplasty. The kyphoplasty segment accounts for a healthy share of the market. This procedure aims at improving spine health and provides comfort to patients suffering from spinal injuries. The increasing prevalence of traumatic spinal cord injuries induced by transport-related accidents across countries like Spain and Germany is propelling the Europe bone cement demand to facilitate kyphoplasty.

In addition, the increasing geriatric population in the region is further fuelling the cases of bone injuries, which elevates the market value. Moreover, the increasing complaints of joint pain and fractures, owing to the increasing inclination towards adventure and sports, is expected to boost the demand for bone cement in arthroplasty and vertebroplasty.

Based on the region, the market is segmented into the United Kingdom, Germany, France, Italy, and others. The United Kingdom holds a substantial market share, owing to the increasing elderly population that has a higher incidence of joint-related issues. Increased R&D related to orthopedic solutions in the region further supports the market growth. Moreover, the rising strategic collaborations among key market players and favorable government policies also aid the market expansion in the United Kingdom market.

Germany is also one of the major bone cement markets in Europe, benefitting from significant healthcare expenditure and robust healthcare policies supporting the adoption of advanced medical technologies, including bone cement products.

The key features of the market report comprise the patent analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:

Johnson & Johnson MedTech (Depuy Synthes) is a leading market player and offers an extensive portfolio of orthopedic solutions, including bone cement for various surgical applications. The company is actively engaged in research and development initiatives to improve its bone cement formulations.

Medtronic plc is one of the key players in the bone cement market in Europe. It is known for its advanced bone cement solutions for orthopedic and spinal surgeries. The company leverages strategic partnerships to expand its presence and product offerings.

Arthrex, Inc., a manufacturer of minimally invasive orthopedic products, significantly contributes to the Europe bone cement market growth. Its advanced bone cement formulations, known for its reliability and strong fixation properties, are widely used for joint reconstruction and repair.

Cardinal Health, Inc., a global manufacturer, and distributor of medical products, has a strong presence in the market. It provides a range of medical supplies, including high-quality bone cement solutions. The company is focused on improving its supply chain to ensure the availability of bone cement products across Europe.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market include Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, DJO, LLC, Globus Medical, Inc., and Heraeus Medical LLC.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by End User |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Supplier Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,699

USD 2,429

tax inclusive*

Single User License

One User

USD 4,299

USD 3,869

tax inclusive*

Five User License

Five User

USD 5,799

USD 4,949

tax inclusive*

Corporate License

Unlimited Users

USD 6,999

USD 5,949

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share