Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The face wash market attained a value of USD 32.72 Billion in 2025. The industry is expected to grow at a CAGR of 4.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 48.43 Billion.

Sustainable sourcing and organic certification are complementing the face wash market, helping brands to differentiate in crowded marketplaces whilst attracting health-conscious millennials and Generation Z consumers. In September 2024, UpCircle’s launched eco-friendly line deployed apricot stones and coffee grounds to craft effective cleansers. These features enhance brand trust and visibility, mainly amongst consumers seeking clean, ethical skincare. With the intensifying competition, such commitments are helping brands stand out and build long-term customer loyalty.

The surging awareness of skin sensitivity and allergic reactions is leading to the demand for hypoallergenic, fragrance-free, and gentle face washes. Consumers with sensitive and reactive skin are seeking mild formulations that cleanse without irritation. Major brands are catering to this need with dermatologist-recommended products containing soothing ingredients. In January 2025, South Korea’s AESTURA introduced its ATOBARRIER® 365 Foaming Cleanser at Sephora across 400+ U.S. stores to cater to sensitive skin individuals. This trend is also driven by increased pollution, harsher climates, and widespread skin concerns.

Personalized skincare is another rising trend in the face wash market, with consumers seeking products tailored to their unique skin type, concerns, and lifestyle. Brands are using online quizzes, AI skin diagnostics, and subscription models to deliver customized cleansers. For instance, Proven Skincare uses an in-depth online quiz to assess skin type, lifestyle, and concerns. Personalization also enhances user satisfaction and loyalty for addressing acne, dryness, or sensitivity more precisely, fuelled by rising desire for more control over skincare routines, making the market more dynamic and customer centric.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4%

Value in USD Billion

2026-2035

*this image is indicative*

Consumers are increasingly preferring products formulated with natural, organic, and plant-based ingredients due to growing awareness of chemical sensitivities and environmental impacts, adding to the face wash market revenue. This trend is driving innovation towards clean beauty, free from parabens, sulphates, and synthetic fragrances. For instance, in February 2022, Colgate-Palmolive launched its natural Palmolive face care products, including face foams and gels by blending essential oils with botanicals for a premium regimen.

The expansion of e-commerce platforms as well as social media marketing is significantly driving sales in the face wash market. Online retail allows consumers to access a broader variety of products, including niche and international brands. Supporting with industry reports, over 2.77 billion people across the world shopped online in 2025. This has urged brands to target video tutorials, digital ads and user-generated content to engage consumers. The convenience of subscription models and home delivery are further favouring the market growth.

The rising skin concerns across the world is propelling the demand for specialized anti-acne skin care, adding to the face wash market value. As per industry reports, acne affected 20.5% of the global population in 2024. Products containing salicylic acid, benzoyl peroxide, and tea tree oil are popular among teenagers and adults. Brands are continuously innovating to deliver effective acne-fighting formulations with minimal irritation. The rise of adult acne and hormonal skin issues is also expanding the market. This segment is critical for growth as consumers prioritize clear, blemish-free skin and preventive skincare routines.

Sustainability is shaping the face wash market outlook driven by the rise in product development and packaging choices. Consumers are preferring brands that deploy biodegradable, recyclable, and refillable packaging to limit the environmental impact. Many companies are adopting minimalistic designs as well as avoid plastic-heavy containers. In October 2023, WOW Skin Science launched its Vitamin C Face Wash in a paper tube to mark a significant step in sustainable packaging. Eco-conscious approaches align with broader global trends towards responsible consumption while attracting environmentally aware consumers.

Advances in cosmetic science are fostering developments in the face wash market to offer multifunctional benefits, such as exfoliation, hydration, and anti-aging. Technologies, such as encapsulation are facilitating controlled release of actives by enhancing efficacy and skin tolerance. New ingredient combinations are also incorporated to improve skin health beyond cleansing. In July 2024, Olay introduced Cleansing Melts, available in formulations with hyaluronic acid, vitamin C, and retinol to offer targeted skincare benefits and unique cleansing experience. These innovations are responding to the rising consumer demand for products offering more than basic cleansing, positioning face washes as integral parts of holistic skincare regimens.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Face Wash Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

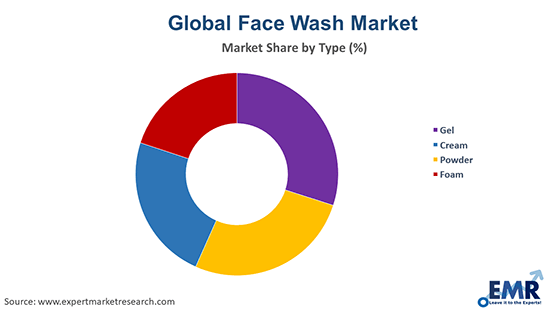

Market Breakup by Type

Key Insight: The rising gel-based face wash demand can be attributed to its versatility and suitability for oily, acne-prone, and combination skin types. These formulations are lightweight, non-greasy, and often enriched with active ingredients, making way for innovations. In December 2024, Fenty Skin introduced the Cherry Dub Pore Purify’r gel cleanser, formulated to refine pores and balance oily skin. Gel cleansers are particularly favored in warm, humid regions including Southeast Asia and parts of North America. The popularity of gels is further bolstered by dermatologists recommending them for deep pore cleansing without over-drying the skin.

Market Breakup by Product Type for Specific Skin

Key Insight: The oily skin segment dominates the face wash market owing to the high prevalence of excess sebum production, especially in tropical and humid climates. Consumers are seeking oil-control solutions to prevent clogged pores, acne, and shine. As per industry reports, acne affects up to 50 million Americans annually. Face washes with ingredients, such as salicylic acid, tea tree oil, and charcoal are in high demand, driving innovations. The need for deep cleansing and matte finishes drives continuous product innovation, making this the most commercially active skin type in the market.

Market Breakup by Region

Key Insight: The Asia Pacific leads the face wash market, driven by its massive population, rising disposable incomes, and heightened beauty consciousness, mainly in India, China, South Korea, and Japan. Brands, such as Himalaya, VLCC, and L'Oréal investing heavily in regional research and product innovation. In February 2025, Nivea entered the facial skincare segment with its new Luminous line introduced in India, featuring face washes to enhance skin radiance. The region’s fast-expanding e-commerce infrastructure is also making face washes easily accessible, cementing Asia Pacific as the fastest-growing segment.

Foam & Cream Face Wash to Witness Huge Adoption

Foam face washes have grown widely popular, particularly among consumers with normal to oily skin for offering a rich lather that feels refreshing. These face washes use surfactants to create a foaming action that helps lift away dirt and excess oil. Several major brands are increasingly coming up with strong foam-based offerings. In June 2024, Cetaphil introduced a new gel-to-foam cleanser formulated to enhance all 15 essential ceramides in the skin. Foam cleansers are also favoured in Asian markets, especially South Korea and Japan, due to their association with softness and brightening effects.

The cream-based face wash industry is growing steadily, as they are formulated primarily for dry and sensitive skin types, focusing on hydration and skin barrier support. These face washes contain moisturizing agents, such as glycerine, ceramides, and aloe vera. CeraVe and Nivea have popular cream cleansers that clean without stripping the skin of natural oils. Cream face washes are also critical in colder regions including Europe and North America, where skin dehydration is common. With gentle nature, the segment has emerged ideal for winter and for daily use to cater to individuals with delicate skin.

Anti-Acne & Dry Skin Face Wash to Gain Traction

Anti-acne face wash market is closely linked with oily and teenage skin concerns. As acne affects a broad demographic, brands are investing heavily in this category. In April 2024, SkinMedica launched an Acne Clarifying Treatment and Pore Purifying Gel Cleanser to treat acne while maintaining the skin’s natural barrier. These products typically feature antibacterial and exfoliating agents, such as benzoyl peroxide, niacinamide, and tea tree extract. With social media raising awareness about skin health, consumers are increasingly choosing targeted anti-acne products over general-purpose cleansers.

Face washes for dry skin are garnering preference as they focus on hydration and barrier protection. Products in this category prioritize gentle, non-stripping ingredients. Brands such as CeraVe and Nivea have established trust with formulations specifically made for dry and sensitive skin. This segment gains traction during colder months and in regions with dry climates including Europe and North America. As consumers grow cautious about harsh cleansers, the demand for moisturizing, soap-free face washes is continuing to rise steadily.

Rising Face Wash Usage in North America & Europe

North America face wash market expansion is fuelled by high consumer spending, established skincare routines, and the strong presence of global brands. Regional consumers are favouring dermatologically tested, fragrance-free, and cruelty-free products, leading to widespread demand for clean and clinically backed skincare. In October 2023, U.S.-based PanOxyl® introduced a 2% salicylic acid Clarifying Exfoliant and a 0.1% Adapalene Gel, both dermatologist-developed to treat and prevent persistent acne. Innovation in packaging and formula transparency is also shaping the market trends.

Europe is contributing to the global face wash market with its preference for natural and organic skincare. Germany, France, and the United Kingdom are driving the demand through sustainability-focused choices and the strong culture of skincare. Brands such as L'Oréal and The Body Shop are also catering to this eco-conscious consumer base. Germany is also largely benefitting from established organic standards, robust certification frameworks, and high consumer trust. Highly regulated EU cosmetic laws and animaltesting bans further encourage ecofriendly formulations, adding to the regional market growth.

Key players in the face wash market are adopting several key strategies to stay competitive and meet the evolving consumer needs. With product innovations, brands are introducing formulations to target specific skin concerns. Natural and organic ingredients are increasingly used to appeal to health-conscious consumers. Marketing strategies emphasize digital engagement, leveraging influencers, social media, and targeted advertising to reach younger demographics. Companies also expand their product lines and offer a range of variants in different price segments to cater to diverse income groups.

Strategic collaborations, retail partnerships, and e-commerce optimization are vital to improving product availability and visibility. Additionally, sustainability initiatives, such as recyclable packaging and cruelty-free testing, are gaining importance as consumers are becoming more environmentally aware. Multinational and domestic brands are also investing in localized R&D and branding to align with regional skincare preferences, further strengthening their presence in emerging markets.

Established in 1991 and headquartered in Mumbai in India, Procter & Gamble Home Products Private Limited functions as a major Procter & Gamble Company’s subsidiary. The company specializes in home and personal care products, including cleaning agents, laundry detergents, grooming products, and hygiene solutions for daily use.

Founded in 1933 with its headquarters in Mumbai, India, Hindustan Unilever Limited is the global Unilever group’s subsidiary offering a broad range of products in foods, cleaning agents, beverages, personal care, and water purifiers. The company focuses on sustainability and innovation in consumer goods for Indian households.

L’Oréal S.A., established in 1909 and headquartered in Clichy, France, is a frontrunner in beauty and cosmetics delivering skincare, haircare, makeup, and fragrance segments. The brand operates via multiple subsidiaries and invests significantly in research and development to cater to the evolving consumer preferences and beauty trends.

Godrej Consumer Products Limited, formed in 2001 and headquartered in Mumbai, provides an assortment of consumer goods, focusing mainly on personal care, hair care, household insecticides, and hygiene products. The company has a strong presence in emerging markets in Asia, Africa, and Latin America.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the face wash market are Himalaya Drug Company Private Limited, and Shiseido Co. Ltd, among others.

Unlock critical insights into the face wash market trends 2026 with our detailed report. Download your free sample today to explore comprehensive data, competitive analysis, and growth opportunities. Stay ahead in the evolving skincare industry by leveraging expert market research to inform your strategic planning and product development. Don’t miss out on this essential resource!

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 4.00% between 2026 and 2035.

Key strategies driving the market include product innovation with natural and targeted ingredients, expanding digital marketing and e-commerce presence, strategic partnerships for brand visibility, regional market expansion, and sustainability initiatives. These approaches enhance consumer engagement, address diverse skin needs, and boost competitive advantage globally.

The key trends aiding the market include growing demand for natural and organic ingredients, customisation and personalisation, sustainable and eco-friendly packaging solutions, and inclusion of advanced ingredients.

North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa are the leading regions in the market, with the Asia Pacific accounting for the largest market share.

The cream and gel segment is the dominant type in the market.

The market can be classified based on product types for specific skin into dry skin, oily skin, anti-acne, normal skin, combination skin, and sensitive skin.

The key players in the market report include Procter & Gamble Home Products Private Limited, Unilever Limited, L’Oreal S.A, Godrej Consumer Products Limited, Himalaya Drug Company Private Limited, and Shiseido Co. Ltd, among others.

In 2025, the market reached an approximate value of USD 32.72 Billion.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 48.43 Billion by 2035.

The oily skin segment dominates the market owing to the high prevalence of excess sebum production, especially in tropical and humid climates.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Product Type for Specific Skin |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share