Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global fish farming market attained a value of USD 342.86 Billion in 2025. Farmers are adopting eco-friendly approaches to minimise waste and reduce their ecological footprint, thereby supporting the market. The industry is expected to grow at a CAGR of 5.70% during the forecast period of 2026-2035 to attain a value of USD 596.85 Billion by 2035. Increasing food production needs, along with technological advancements that promote more efficient and eco-friendly practices, are fueling demand for fish farming.

Base Year

Historical Period

Forecast Period

The Department of Agriculture, Fisheries, and Forestry reported that Australia's seafood consumption reached 350,000 tonnes in the 2021-22 period. drives the demand for sustainable and locally sourced fish, supporting the growth of the fish farming market. As consumer preference shifts towards sustainable seafood options, the need for efficient, environmentally-friendly fish farming practices rises. This trend boosts the market, encouraging investment in aquaculture to meet the increasing demand for fish products.

The UK Government stated that in the fiscal year ending 2022, the average weekly spending by households on fish and fish products was GBP 3.00. This encourages the growth of the fish farming market, as local production can meet consumer preferences for fresh, sustainable fish. Increased spending on seafood supports investment in aquaculture, ensuring a stable supply of fish to cater to domestic needs.

Industry reports indicate that fish production for 2021-22 totalled 16.24 million tonnes, which includes 4.12 million tonnes from marine sources and 12.12 million tonnes from aquaculture. This highlights the growing reliance on fish farming to meet global seafood demand. As marine sources face limitations, aquaculture is emerging as a key solution, driving the market's expansion. This shift towards sustainable farming practices supports long-term market growth and investment in aquaculture technologies.

Compound Annual Growth Rate

5.7%

Value in USD Billion

2026-2035

*this image is indicative*

Fish farming, or pisciculture, is a type of aquaculture focused on breeding fish in enclosed spaces for commercial purposes, primarily for food. The fish farming market is experiencing growth as this practice can occur in controlled freshwater or saltwater environments, including ponds, tanks, and net pens in rivers, lakes, or oceans. In India, the Ministry of Fisheries, Animal Husbandry & Dairying reports that the fisheries sector supports over 28 million fishers and farmers, making India the third-largest fish producer globally, contributing about 8% of total fish production.

Sustainability is a crucial driver of growth in the fish farming industry. Increasing food production needs, along with technological advancements that promote more efficient and eco-friendly practices, are fueling demand for fish farming. Farmers are reducing their dependence on wild-caught fish for feed, improving waste management, and embracing integrated multi-trophic aquaculture (IMTA), which enhances environmental sustainability. In September 2024, a new project off Abu Dhabi's coast launched an AI program using sea cages at Delma Island to improve aquaculture and provide valuable ecosystem insights for sustainable food sourcing.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The fish farming demand drives economic growth by generating jobs and encouraging development, especially in coastal and rural regions. Innovations in technology improve farming methods and feed efficiency, making aquaculture more productive and environmentally friendly. Farmed fish offer vital nutrients, including omega-3 fatty acids, which promote healthier diets. In October 2024, Singapore's Umami Bioworks partnered with South Korean K-Cell Biosciences and WSG to establish a sustainable production pipeline for cultivated seafood in South Korea. Their collaboration, formalized by a September Memorandum of Understanding (MOU), seeks to create scalable systems for cell-grown seafood as a sustainable alternative to traditional fishing.

Aquaculture is one of the key trends in the fish farming market, which serves as a sustainable alternative to wild-caught fish. This helps reduce overfishing and enables natural fish populations to regenerate. Various farming techniques enhance biodiversity, while fish farming also helps preserve traditional practices and supports local communities, enriching cultural heritage and fostering social unity. In Vietnam, particularly in the Mekong Delta, catfish aquaculture plays a significant role in both the economy and local culture. Communities there rely on age-old methods, and events like the Catfish Festival in Can Tho celebrate the cultural importance of fish in local cuisine and identity.

Sustainability and environmental practices, regulatory support and policy initiatives, and rising demand for seafood are driving the fish farming market.

The fish farming sector is increasingly prioritising sustainability to address environmental challenges. Methods such as integrated multi-trophic aquaculture (IMTA) and responsible feed sourcing are becoming standard practices. Farmers are adopting eco-friendly approaches to minimize waste and reduce their ecological footprint, thereby boosting the fish farming market revenue. This focus on sustainability not only meets consumer preferences for environmentally responsible products but also aids in the conservation of marine ecosystems. Regulatory bodies are intensifying the enforcement of sustainability standards, encouraging innovation in the industry while ensuring a balance between economic development and ecological health. In Vietnam, the Mangroves and Markets project, launched by SNV Netherlands Development Organisation and the International Union for Conservation of Nature, aims to promote sustainable shrimp farming through farmer training, mangrove replanting, and assistance with carbon market certification.

Technological innovations are profoundly changing the fish farming industry. The fish farming market dynamics and trends are being enhanced by key advancements such as automated feeding systems, water quality monitoring sensors, and AI-driven predictive analytics, all of which are boosting operational efficiency and productivity. Genetic enhancements in fish breeding contribute to quicker growth and greater disease resistance, thereby increasing aquaculture profitability. Additionally, data analytics and IoT technologies equip farmers with real-time information for optimized resource management. The Department of Fisheries in India emphasizes that Recirculating Aquaculture Systems (RAS) represent a sustainable and eco-friendly approach to fish farming, effectively recycling 90–97% of the water used. RAS filters water to eliminate waste and uneaten food, allowing for improved control over critical water quality parameters like temperature, oxygen levels, and pH, thereby enhancing overall farming conditions. As these technologies continue to advance, they hold the promise of further increasing both the sustainability and profitability of the industry.

Governments across the globe are increasingly acknowledging the role of aquaculture in ensuring food security and fostering economic growth. Numerous countries are establishing supportive policies and regulatory frameworks for fish farming, including subsidies, research funding, and training initiatives for farmers. These efforts aim to enhance local production and decrease reliance on imports, thereby boosting fish farming industry revenue. Furthermore, regulations emphasising sustainability and biosecurity are being introduced to promote responsible practices in the industry. This regulatory backing creates a favourable environment for growth and innovation in aquaculture. In the EU, stringent regulations govern aquaculture to ensure sustainability, food safety, and animal welfare. The Common Fisheries Policy (CFP) outlines guidelines for fish farming, prioritizing environmental protection and resource management, while the EU Aquaculture Strategy advocates for sustainable growth and practices that lessen environmental impact.

Rising global seafood demand is a key driver behind the growth of the fish farming market. With an increasing preference for seafood as a source of lean protein, global seafood consumption has surged. As wild fish stocks face depletion due to overfishing, aquaculture is becoming the primary solution to meet the rising demand for seafood. The FAO estimates that aquaculture now accounts for around 50% of all fish consumed globally, with projections showing it could supply two-thirds of the world's fish needs by 2030. This shift to farmed fish is vital for sustainability, ensuring a steady and reliable source of seafood while reducing the pressure on wild populations. As consumer preferences for responsibly farmed fish increase, the fish farming industry is adapting to meet these demands with more efficient, eco-friendly practices, further boosting market growth.

Population growth is a significant driver of the fish farming market, as the expanding global population increases the demand for affordable, protein-rich food. According to the United Nations, the global population is projected to reach 9.8 billion by 2050, a 25% increase from current levels. This rapid growth in population will create greater demand for food, particularly protein sources like fish, which are a cost-effective alternative to other animal proteins.

Fish is a highly sought-after source of protein due to its nutritional benefits, including essential omega-3 fatty acids, vitamins, and minerals. It is also more environmentally efficient to produce compared to land-based livestock, requiring less water, land, and feed. This makes fish an attractive food source in a world with growing concerns about sustainability and resource limitations.

As the middle class expands in emerging economies, particularly in Asia and Africa, disposable incomes are rising, leading to an increased preference for animal-based proteins like fish. In fact, the FAO reports that the global fish consumption has more than doubled over the last 50 years, and with the world population set to grow, this trend is expected to continue.

The global fish farming industry faces several key market restraints. Environmental concerns such as water pollution and habitat destruction increase regulatory scrutiny and operational costs. Diseases pose economic threats, necessitating costly biosecurity measures. Rising production costs for feed and energy challenge profitability, while complex regulatory compliance adds to operational burdens.

Intense fish farming market competition from wild-caught and lower-cost imports pressures local producers. Changing consumer perceptions about sustainability can affect demand. Additionally, limited access to technology, climate change risks, supply chain disruptions, and investment barriers further hinder growth. These factors require strategic responses from stakeholders to ensure sustainability and profitability.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Fish Farming Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

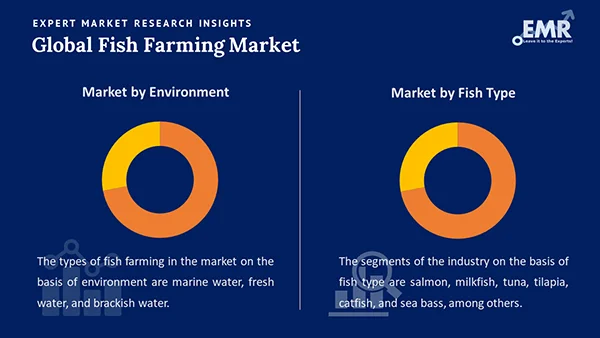

Market Breakup by Environment

Market Breakup by Fish Type

Market Breakup by Region

Market Analysis by Environment

Marine water aquaculture facilitates the cultivation of various fish species, including high-value types like salmon and tuna, which boosts market profitability. It creates ideal growth conditions, resulting in quicker growth rates. Additionally, many marine species can tolerate higher salinity, contributing to healthier stock, while abundant nutrients enhance integrated farming practices. The strong global demand for marine fish also presents substantial export opportunities in the fish farming market. In July 2023, Morocco launched its first marine hatchery to strengthen its aquaculture sector, aiming to produce up to 30 million high-quality fry of species like sea bream and sea bass. Covering 2.28 hectares, this hatchery represents a key investment of MAD 120 million ($12.3 million) to ensure a steady supply of fry for the industry.

Freshwater fish farming generally involves lower operational costs, making it more accessible for small-scale farmers. It facilitates better management of water quality and temperature, which helps minimize disease risks. This type of aquaculture supports popular species like tilapia and catfish and aligns well with sustainable practices, enhancing efficiency. Additionally, strong local demand for freshwater fish lowers transportation costs and improves product freshness, contributing to the fish farming demand growth. Uttar Pradesh received the best state award in the inland fisheries category, according to a state government official. This award was presented at the Global Fisheries Conference 2023 held in Ahmedabad, Gujarat, on November 21, coinciding with World Fisheries Day.

Market Analysis by Fish Type

Salmon is highly sought after worldwide due to its taste and nutritional benefits, driving strong demand in the fish farming market. Rich in omega-3 fatty acids and protein, it appeals to health-conscious consumers. Its efficient feed conversion and rapid growth in controlled environments enhance profitability, and various farming methods provide flexibility for producers. Industry reports indicate that global salmon production reached approximately 2.5 million tons in 2021, translating to between 288 and 674 million fish. Norway is the largest producer, contributing over 50% of the world's salmon supply, while Chile follows with a 27% share of global production.

Catfish farming offers low operational costs, making it accessible for small-scale farmers and contributing to local economic growth. Catfish are resilient and adaptable, thriving in various water conditions, which simplifies management. Their rapid growth allows for quicker harvests, and strong local demand, coupled with sustainable practices, boosts profitability and resource efficiency, driving growth in the fish farming market. In 2021, catfish producers in the United States reported sales of USD 421 million, a 12% increase from USD 377 million in the previous year, according to the USDA’s National Agricultural Statistical Service. The leading states Mississippi, Alabama, Arkansas, and Texas accounted for 97% of total U.S. sales.

Europe Fish Farming Market Analysis

Europe is at the forefront of fish farming demand, with significant contributions from Germany, Italy, and France. In Italy, aquaculture focuses on a limited number of species, including mussels, clams, rainbow trout, sea bass, and sea bream, and employs various farming methods tied to local traditions. According to the European Union, 67% of EU aquaculture production occurs in France, Greece, Spain, and Italy, with shellfish making up over half of the total production, while marine and freshwater fish account for about 21% and 28%, respectively.

North America Fish Farming Market Trends

The North American fish farming market value is supported by key players such as Marine Harvest USA, Clear Springs Foods, Cermaq Canada, and AquaBounty Technologies. This sector fosters technological advancements that improve farming methods and disease management while preserving cultural heritage and aiding environmental restoration. In June 2024, the IDRC collaborated with the Canadian government to launch AQUADAPT, a CAD 23 million initiative aimed at enhancing small-scale aquaculture's climate resilience and sustainability. The partnership seeks to develop nature-based solutions to sustainably manage aquatic ecosystems, including climate-resilient shrimp production and eco-friendly fish feeds made from otherwise wasted ingredients.

Asia Pacific Fish Farming Market Insights

In India, companies like Aquaculture Technologies India Ltd. (ATIL), Hatcheries & Farms Pvt. Ltd., Nandani Aquaculture, and Avanti Feeds illustrate the growth of the fish farming market share in the Asia-Pacific region. Innovations in aquaculture improve resource efficiency, support the cultivation of various species, and enhance nutrition, fostering sustainable practices that meet consumer demands and promote better health through protein-rich fish. According to the USDA, China was the largest seafood producer in 2022, with production anticipated to reach 67.5 million metric tons (MMT), up from 66.9 MMT in 2021, driven by a 1.2 per cent increase in aquaculture production.

Latin America Fish Farming Market Analysis

Key markets in the region include Brazil, Mexico, and Argentina, where demand for fish farming is high. The Latin American fish farming market is growing as it contributes to rural economies by creating jobs and improving livelihoods, particularly in coastal areas. Additionally, it enhances food security by ensuring a consistent supply of nutritious fish for the increasing population. According to the latest annual report from Brazil's fish-farming association, the country produced 887,029 metric tons (MT) of farmed fish in 2023, reflecting a 3.1 per cent increase from 2022 and a 53.2 per cent rise from the 578,800 MT produced a decade ago.

Middle East and Africa Fish Farming Market Driving Factors

The African fish farming market is experiencing growth as governments in Egypt, Ethiopia, and Morocco implement regulations to promote aquaculture. This sector supports the cultivation of various fish species to meet local demands, improves resource efficiency through advanced techniques, and integrates with agriculture to enhance climate resilience. In 2021, Liberia produced 25,444 metric tons of fish while importing 55,000 tons. Ghana produced 400,000 tons but imported over 600,000 tons. Nigeria's production reached 1.2 million metric tons, with imports of 2.4 million metric tons. Cameroon produced 300,130 metric tons against an annual demand of 450,000 metric tons, and Gabon produced 29,000 metric tons, importing 50,000 metric tons.

Innovative startups in fish farming enhance the industry through technological advancements, sustainable practices, and increased profitability. They explore niche markets, provide training for farmers, and attract investment, all while promoting eco-friendly methods and improving operational efficiency, ultimately contributing to the sector's growth and diversification.

BlueNalu: BlueNalu focuses on producing seafood directly from fish cells, offering a sustainable alternative to traditional fishing. Their innovative cell-cultured fish aims to meet consumer demand for seafood while reducing environmental impact and preserving marine ecosystems.

eFishery: eFishery offers smart feeding technology for aquaculture, enabling farmers to optimise feed usage and reduce waste. Their innovative system uses IoT devices to monitor fish behaviour and automate feeding, enhancing efficiency and profitability for fish farmers.

Key players in fish farming market prioritise environmental stewardship and responsible practices to guarantee high-quality seafood while safeguarding fish welfare and local ecosystems. They emphasise innovation by adopting advanced technologies that improve efficiency and sustainability. Dedicated to fulfilling global seafood demand, these firms support marine health and align with initiatives for sustainable food production and responsible sourcing.

Alpha Group Ltd.: Founded in 2006 and based in Malaysia, it is a key player in aquaculture, specializing in fish and shrimp farming. The company emphasizes sustainable practices and employs advanced technologies to enhance production efficiency, addressing the increasing global demand for seafood.

Cermaq Group AS: Established in 2011 and headquartered in Oslo, Norway, it focuses on salmon farming. The company is dedicated to sustainability, incorporating responsible practices into its operations to ensure high-quality seafood while safeguarding the environment and promoting the welfare of fish and local ecosystems.

Cooke Aquaculture Inc.: Founded in 1985 and located in Blacks Harbour, Canada, is a leading seafood producer specializing in sustainable fish farming and processing. With a commitment to innovative practices, the company provides high-quality seafood while bolstering local economies and encouraging healthier eating habits.

Leroy Seafood Group ASA: Established in 1899 in Bergen, Norway, is one of the country’s largest seafood companies, primarily focusing on salmon and various fish products. The company emphasizes sustainability and innovation, promoting responsible aquaculture practices to ensure quality production and enhance food security.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the fish farming market reached an approximate value of USD 342.86 Billion.

The market is assessed to grow at a CAGR of 5.70% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 596.85 Billion by 2035.

The major market drivers are technological advancements in fishing equipment, increased initiatives to boost aqua farming, growing health consciousness among consumers, and the surging protein demand from livestock and fisheries across the world.

The key trends of the market are the rising global food demand, increasing fishing operations in Asian countries, and changes in people's food consumption patterns.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The different environments of fish farming are marine water, fresh water, and brackish water.

The key players in the market are Alpha Group Ltd., Cermaq Group AS, Cooke Aquaculture Inc., and Leroy Seafood Group ASA, among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Environment |

|

| Breakup by Fish Type |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share