Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global fleet management market was valued at USD 30.05 Billion in 2025. The industry is expected to grow at a CAGR of 14.30% during the forecast period of 2026-2035 to reach a value of USD 114.37 Billion by 2035. The market growth is mainly influenced by the strategic partnerships and alliances as fleet operators and solution providers seek to deliver broader, integrated capabilities across regions and service domains.

Collaboration allows firms to combine complementary strengths, from full-service leasing and mobility solutions to managed services that enhance operational efficiency, thereby creating more compelling value propositions for multinational and enterprise clients. For example, in March 2025, Element Fleet Management and Arval celebrated 30 years of their global alliance, underscoring how long-standing strategic partnerships support fleet electrification planning and mobility solutions across 55 countries and 4.5 million vehicles. This is further helping clients deploy tailored strategies at both local and global scales. Similarly, integrated service offerings have expanded through partnerships such as Verizon Connect’s collaboration with managed services from Verra Mobility in 2025, which extends operational services, including tolling and regulatory support, to a broader base of fleet customers. These alliances collectively enhance service breadth and strengthen competitive positioning in an increasingly connected market.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

14.3%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Fleet Management Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 30.05 |

| Market Size 2035 | USD Billion | 114.37 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 14.30% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 16.5% |

| CAGR 2026-2035 - Market by Country | India | 18.9% |

| CAGR 2026-2035 - Market by Country | China | 15.8% |

| CAGR 2026-2035 - Market by Component | Solution | 15.6% |

| CAGR 2026-2035 - Market by End Use | Transportation and Logistics | 16.3% |

| Market Share by Country 2025 | UK | 3.5% |

The global fleet management market is driven by increased investment and strategic acquisitions as companies aim to scale service offerings and integrate complementary capabilities. In March 2025, Fleetio secured over USD 450 million in Series D funding and acquired maintenance platform Auto Integrate, creating a combined entity valued at over USD 1.5 billion and serving more than 8 million vehicles with streamlined maintenance workflows. This infusion of capital and consolidation enables fleet operators to access unified solutions that reduce downtime and improve operational efficiency, reinforcing competitive positioning.

Sustainability mandates and electrification goals are significantly influencing fleet management growth, prompting capital allocation to EV-focused platforms that offer integrated solutions. In August 2025, Macquarie Asset Management raised $405 million for Vertelo, a fleet electrification solutions platform in India, representing a substantial investment in charging infrastructure, energy management, and EV fleet services to support clean transportation. Such funding accelerates the adoption of electric fleets and reflects broader industry shifts toward lowering emissions and meeting regulatory targets through scalable, green mobility solutions.

Predictive maintenance technologies are emerging as a key growth driver in the global fleet management market, enabling operators to shift from reactive repairs to proactive vehicle health management. In October 2025, Webfleet and Questar Auto Technologies launched an AI-powered Predictive Vehicle Health Management solution that applies machine learning to identify potential vehicle failures in advance. By enabling early maintenance planning and reducing unexpected downtime, such innovations help lower total cost of ownership and improve fleet availability, supporting wider adoption of AI-driven fleet platforms.

Innovative product launches tailored to fleet needs are expanding market growth as operators seek solutions that improve compliance, safety, and operational visibility. In November 2025, Samsara introduced a commercial navigation solution designed for United States trucking fleets that accounts for weight restrictions, bridge heights, and hazmat regulations, offering enhanced routing precision and regulatory compliance. Specialized software like this enables operators to prioritize route safety and efficiency, addressing sector-specific challenges and facilitating adoption of advanced fleet management technologies.

Vendor rankings and industry recognition are critical growth drivers in the global fleet management market, as they validate technology investments, build customer trust, and influence procurement decisions among fleet operators. For example, in December 2025, Samsara was ranked No. 1 in fleet management on the G2 platform for all of 2025, based on verified customer reviews that highlight satisfaction, usability, and market presence. This leadership status reinforces customer confidence in AI-driven safety and operations solutions and strengthens Samsara’s competitive differentiation, encouraging broader adoption of advanced fleet technologies.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Fleet Management Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Component

Key Insights: The market for fleet management solutions grows with an increased need for comprehensive services and solutions. Professional services are offered by Accenture and Deloitte, whereas managed services are offered by Verizon Connect and Samsara. Solution offerings include asset management, performance, safety & compliance, risk, and operations management solutions. Oracle Corporation announced an agreement with E2Open in December 2024 to improve real-time logistics operations with increased visibility into fleet operations.

Market Breakup by Development Type

Key Insights: Fleet management solutions can be adopted in the on-demand pattern, on purchase pattern, and a combination of the two in the form of hybrid solutions. On demand solutions in the form of cloud Sahs systems include solutions like the Samsara Cloud and the Verizon Connect Fleet. On purchase solutions in the form of Sahs systems include the Teletrac Navman Director. Hybrid solutions include the Geotab’s MyGeotab system. Trimble and SAP came together in July of 2025 to leverage the power of the ERP system and the management of the fleet.

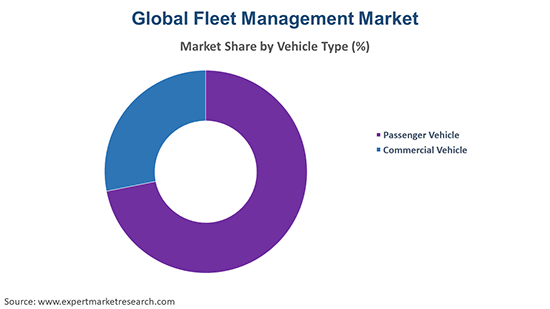

Market Breakup by Vehicle Type

Key Insights: Fleet management systems range from passenger car-based fleets to commercial fleets. Passenger car-based fleets employ Geotab GO9, Verizon Connect Passenger Solution, and Fleetio Essentials. On the other hand, commercial fleets such as heavy-duty and delivery fleets use Samsara Commercial Telematics, Omnitracs XRS, and Teletrac Navman Director. Notably, this need led a collaboration between Volvo and Zonar, extending telematics solution support to commercial fleets as of August 2025, as the two companies improved OEM level visibility and diagnostic capabilities of heavy-duty commercial fleets across the world.

Market Breakup by End-Use

Key Insights: Fleet solutions are widely used in retail, BFSI, energy, government, transport & logistics, mining and construction, pharmaceutical, and other sectors. In transport and logistics, Trimble TMW Suite and Samsara Connected Operations Cloud are used for freight planning and visibility. In government and BFSI, Verizon Connect is known for its widespread use for compliance and life cycle management. In energy and mines, rugged product offerings from Teletrac Navman are used for safety and increased uptime, while pharmaceutical companies utilize cold chain monitoring capabilities available in advanced telematics offerings for quality compliance.

Market Breakup by Region

Key Insights: Regional adoption patterns for fleets are different for North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Leaders in North America are Samsara, Geotab, and Verizon Connect, whose product lines are focused on analytics and compliance. Multi-country optimization and sustainability solutions are in favor of Webfleet and Trimble solutions in Europe. The Asia Pacific region has been boosted by partnerships and expansions by Fleet Complete and Verizon Connect. In June 2025, Teletrac Navman entered Colombia, improving telematics in Latin America.

By components, managed services are gaining traction

The managed services for fleet management are also gaining popularity, where companies are outsourcing their complex operational processes, like maintenance scheduling, data analysis, and monitoring for compliance, to third-party companies with special know-how. Companies like Verizon Connect Managed Services, Samsara Professional Services, and Fleetio's Shop Network help manage and reduce operational burden for companies. To mark its expansion for this part of the industry, Siemens announced Depot360® Home Charging Reimbursement in April 2025 to enable fleets to combine their charging expenses with their data from telematics on managed services for better EV economics.

Performance management systems assist fleet managers in tracking KPIs related to fuel efficiency, driver performance, and asset use to manage their businesses optimally. The performance management systems available online are Teletrac Navman TN360, Samsara Fleet Performance, and Geotab Analytics, which offer reports and notifications to put telematics data into perspective. Mentioning innovation, Teletrac Navman introduced OEM Telematics integration in July 2025 to enable fleet operators to integrate factory-installed telematics systems into the TN360 system to provide enhanced performance analysis data without the need to install hardware.

By development type, on purchase category witnesses notable uptake

In relation to purchase, fleet management software is applicable within large businesses that need complete data ownership, personalization, as well as interaction with internal systems like ERP and data regulatory compliance software. Systems such as Teletrac Navman Director, Fleetio Enterprise Edition, among others, are premises-based, providing businesses with complete system sovereignty. One of the signs of growth within the sector is Fleet Rocket’s extension of their GPS coverage to 54 carriers as of October 2025.

Hybrid models of deployment therefore allow flexibilities between the agility of the cloud and the need to control from an in-house environment, thus allowing fleets to handle scalability and security to an extent. Services from firms such as Geotab MyGeotab, Trimble Fleet Edge, and Verizon Connect Hybrid Solutions allow scalability and flexibility in the ingestion of data from the cloud and an internal environment based on the IT strategy. To complement this, Mercedes Benz Connectivity Services launched in May and June 2025 new additions to their partnerships to allow telematics data to enter platforms such as Way Data Technologies.

By vehicle type, passenger vehicles show robust growth

In the passenger vehicle market, the key drivers of fleet management include the safety of the drivers, route optimization, and cost-effective solutions for businesses and passenger cars rented for specific purposes. Services such as the Geotab GO9, the Verizon Connect Passenger Solutions, and the Fleetio Essentials enable real-time tracking and analytics specific to lighter vehicles. Showing innovation in products, in October 2025, Netstar has recently demonstrated its STARtag asset tracking solutions and AI dash cam solutions at the Mobility Live 2025 event.

Commercial fleets of vehicles including heavy-duty trucks and courier van fleets require effective approaches to routing, Hours of Service regulation compliance, as well as commercial fleet uptime. The top solutions include the XRS solution from Omnitracs, the Samsara Commercial Telematics solution from Samsara Labs, as well as the TN360 solution from Teletrac Navman. This August 2025, EROAD has strengthened the world-wide relationships it has with both HERE Technologies and Geotab. The update enhances commercial fleet navigation support as well as support for electric vehicles.

By end use, energy sector generates substantial revenue

Fleet management in the energy industry revolves around safety and vehicle uptime in both field and plant operations. The solutions available in this industry include Teletrac Navman Director, Samsara Safety, and Trimble TMW Suite. These enable energy industry fleets to adhere to required regulations and allow them to efficiently manage their operations in far-off and hard-to-reach destinations. Aligning with this spirit of innovation, Bluedot introduced its new product lines, including Shared Private Chargers at NAFA I&E Expo 2025. These allow energy and utility industry fleets to easily adopt depot charging infrastructure without spending on new infrastructure.

In transport and logistics fleets, these applications of technology emphasize efficiency, regulatory compliance, and visibility of freight. Solutions like GPS Insight, Trimble TMW Suite, or Samsara Connected Operations Cloud enable transportation companies to make better use of routes. In this background, Koch Disruptive Technologies participated in a funding of USD 40 million for Optimal Dynamics in May 2025, furthering artificial intelligence-enabled routes optimization tools, as well as freight matching tools, that directly enhance transport fleets.

By Region, North America leads the market growth

North America continues to lead the adoption of fleet management solutions related to AI, safety, and government regulations. Vendors like Samsara, Geotab, and Teletrac Navman extend the strengths of their solutions related to augmented analytics, predictive maintenance, and optimisation for hybrid fleets. To support the growth in AI-enabled fleet management tools for the focus areas of safety, regulation, and assets in the logistics and construction verticals, Motive Technologies announced its IPO filing in the United States in December 2025.

The Europe fleet management market is experiencing growth due to efforts by service providers who are broadening integrated, subscription, based fleet and device management platforms to meet the needs of operations that are scalable, compliant, and cost-efficient. Enterprises are progressively focusing on innovation-led markets that have a robust digital infrastructure for the localization of support and the speeding up of the adoption process. As an example, in 2025, Fleet made an announcement regarding its expansion in the Netherlands, which, in turn, deepens its European presence and provides Dutch businesses with the transient use of a complete fleet and device solution, backed by local teams and extensive lifecycle management capabilities.

| CAGR 2026-2035 - Market by | Country |

| India | 18.9% |

| China | 15.8% |

| UK | 13.1% |

| USA | 12.8% |

| Germany | 11.8% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 9.9% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The players in the global fleet management market are concentrating on innovation at the platform level, data analytics, and cloud scalability in their offerings in order to address the requirements of the customers. They are also focusing on increasing the use of analytics in AI, predictive maintenance activities, as well as real-time visibility in their offerings in order to enhance efficiency. They are also concentrating on investments in product modularity in their offerings.

Current leading fleet management solution providers are now committed to further augmenting their competitive differential by means of expanding their reach, portfolios, and other ecosystems. In this regard, solution providers, along with original equipment manufacturers, telematic providers, as well as other mobility solution providers, are now increasingly working together to provide comprehensive solutioning in the realm of compliance, electrification, as well as management. Acquisitions as well as venture capital outlays are also being directed at accelerating innovation, portfolios, as well as growth in commercial, government, as well as enterprise fleets.

Founded in the year 1968 and headquartered in Paris, France, ALD Automotive Pvt Ltd has come out as a worldwide leader in fleet management and related mobility services. The firm provides full-service leasing and mobility services to various corporates and public sector entities in different zones.

Arval BNP Paribas Group has been established since 1989 in Rueil-Malmaison, France. The service provider focuses on vehicle leasing as well as complete fleet management services to support clients in their mobility plans and data solutions.

The firm has headquarters in Amsterdam, Netherlands, and it was founded back in 1963 as a worldwide entity that focuses on the leasing of fleets of vehicles alongside telematics integration, sustainability advice, as well as managing the overall life cycle for different clients from institutions and companies.

Wheels, Inc. operates from Des Plaines, Illinois in the United States of America. The company was established in 1939. The company offers customized fleet management services and mobility solutions for their clients. The services also comprise a vehicle supply, management of maintenance activities, analysis, and consultation that assist in optimizing the efficiency of the fleet and managing the associated costs.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the market include Volkswagen Financial Services, among others.

Explore the latest trends shaping the Global Fleet Management Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global fleet management market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the global fleet management market reached an approximate value of USD 30.05 Billion.

The market is projected to grow at a CAGR of 14.30% between 2026 and 2035.

By 2035, the market is expected to attain a value of USD 114.37 Billion.

Key strategies driving the market include expanding cloud-based and AI-enabled fleet platforms to improve real-time visibility, safety, and operational efficiency. Market players are also focusing on strategic partnerships, electrification support, and integrated managed services to deliver end-to-end fleet solutions across regions and vehicle types.

The key trends guiding the market growth include the growing adoption of wireless technologies and innovative solutions to optimise fleet management and the introduction of affordable fleet management solutions.

The major regional markets for fleet management are North America, Europe, Asia Pacific, Latin America, Middle East, and Africa.

The major deployment types considered in the market report include on-purchase, on-demand, and hybrid.

The various end uses of fleet management include retail, BFSI, energy, government, transportation and logistics, mining and construction, and pharmaceutical, among others.

The significant vehicle types in the market are passenger vehicle and commercial vehicle.

The major components in the market are services and solutions.

The key players in the market include ALD Automotive Pvt Ltd, Arval BNP Paribas Group, LeasePlan, Wheels, Inc., and Volkswagen Financial Services, among others.

The global fleet management market faces challenges related to high implementation costs, data integration complexity, and varying regulatory requirements across geographies. Additionally, cybersecurity risks, data privacy concerns, and the need to manage mixed fleets during electrification transitions continue to pressure fleet operators and solution providers.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Component |

|

| Breakup by Deployment Type |

|

| Breakup by Vehicle Type |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share