Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The GCC basmati rice market reached a value of USD 1.69 Billion in 2025 and is projected to grow at a CAGR of 2.30% over the forecast period between 2026-2035 to reach a value of USD 2.12 Billion by 2035. The market is driven by a growing South Asian expatriate population, which sustains strong cultural and culinary demand for aromatic, long-grain rice.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

2.3%

Value in USD Billion

2026-2035

*this image is indicative*

| GCC Basmati Rice Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 1.69 |

| Market Size 2035 | USD Billion | 2.12 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 2.30% |

| CAGR 2026-2035 - Market by Region | UAE | 2.5% |

| CAGR 2026-2035 - Market by Region | Qatar | 2.2% |

| CAGR 2026-2035 - Market by By Type | Raw | 2.6% |

| CAGR 2026-2035 - Market by By Nature | Brown | 2.7% |

| 2025 Market Share by Region | Saudi Arabia | 38.1% |

Rice is an essential part of the Middle East cuisine and is a staple food, along with wheat, specifically in the GCC nations. Among the various varieties, basmati rice is known to be the most common variant produced mainly in the foothills of the Himalayas. Basmati rice is commonly used in a variety of delicious dishes containing layers of rice, meat, sauces as well as dried fruits. It has made the GCC countries the main importers of basmati rice from Asian countries, including India and Pakistan. Saudi Arabia is the leading regional market in the GCC region, accounting for a significant share of the total consumption. It can be due to the Kingdom's large consumer base relative to the rest of the region.

The absence of rice production in the GCC nations and the increased demand for higher quality of the product amongst consumers in the region, contribute significantly to the potential for growth in the GCC basmati rice market. The high density of expatriates from Asia in the region is another significant explanation for the increase in demand for the product. Increasing urbanisation rates, demographic change, as well as inflating income levels are anticipated to further fuel the product consumption in the GCC region.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Basmati rice is a thick, slender, aromatic rice, usually from the Indian subcontinent. It is a rare type of long grain rice from the Indian subcontinent, which has a floral aroma as well as a nutty flavour. It is available in two colours: white and brown. It has a low level of fat, is gluten-free, and has a low to moderate glycaemic index. It is also rich in vitamins, minerals, copper, calcium, potassium, magnesium, zinc, proteins, amino acids, and folic acid, and contains less sodium and no cholesterol. Because of its distinct taste and presence, it is used as the main ingredient for preparing a wide range of rice-based dishes around the globe, particularly in the GCC region.

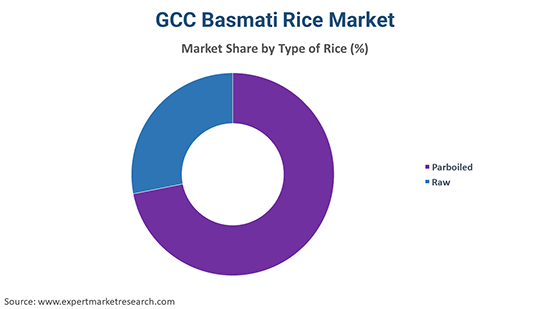

On the basis of the type of rice, the market has been categorised as follows:

Based on the pack size, the market has been segmented as follows:

Based on the country of origin, the market has been divided into the following:

Market Breakup by Region

| CAGR 2026-2035 - Market by | Region |

| UAE | 2.5% |

| Qatar | 2.2% |

| Kuwait | 2.1% |

| Saudi Arabia | XX% |

| Bahrain | XX% |

| Oman | XX% |

The GCC basmati rice market is mainly driven by the rise in the product demand. Unsuitable weather conditions have contributed to a shortage of rice production that has contributed to a rise in imports of basmati rice from South Asian countries. Due to a lack of physical activity, the growing prevalence of obesity, as well as other lifestyle disorders, in the region has led to a rise in health consciousness amongst the masses. As a result, basmati rice is increasingly being included in their daily diet due to the low-fat content and high nutritional value of the product. In addition, the increasing population of Asian expatriates has also increased the demand for high-quality rice, further boosting the market growth.

The report gives a detailed analysis of the key players in the GCC basmati rice market, covering their competitive landscape, capacity, and latest developments like mergers, acquisitions, and investments, expansions of capacity, and plant turnarounds. The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The GCC basmati rice market reached a value of USD 1.69 Billion in 2025.

The major drivers of the market include rising disposable incomes, increasing population, growing Asian ex-pat population, and the rising demand for rice.

The rising health-consciousness, the growing prevalence of obesity, and the increasing import activities are the key trends guiding the market.

Saudi Arabia, United Arab Emirates, Kuwait, Oman, and Qatar, and Bahrain are the major countries in the market.

The significant types of rice in the market are parboiled and raw.

The various pack sizes of basmati rice considered in the market report include retail packaging and institutional packaging.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment

|

| Breakup by Type of Rice |

|

| Breakup by Pack Size |

|

| Breakup by Country of Origin |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share