Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global glycine market size was valued at USD 3.03 Billion in 2025. The industry is expected to grow at a CAGR of 7.20% during the forecast period of 2026-2035 to reach a value of USD 6.07 Billion by 2035. Sustainability-driven innovation and strategic partnerships are propelling the market expansion.

Glycine producers are adopting greener production methods as the chemical industry faces pressure to decarbonize. Beyond conventional petrochemical routes, companies are expanding into biotechnological and fermentation-based processes that align with sustainability goals and ESG standards.

In April 2023, Ajinomoto entered into a joint research and development agreement with the biotech start-up Logomix Inc., merging Ajinomoto’s amino-acid fermentation technology with Logomix’s genome-engineering platform to create a sustainable amino-acid production method with less carbon footprint.

Moreover, in January 2024, Evonik was awarded the European Responsible Care® Award for its industrial-scale biotechnological process innovatively producing rhamnolipid glycolipids, biodegradable, and highly pure, to be the most environmentally friendly. Evonik also demonstrates this pledge to the environment by inaugurating the first plant for the production of biobased biosurfactants in Slovakia that makes rhamnolipids from renewable corn-derived feedstock.

These moves by the major players in the glycine/amino-acid industry to reduce their carbon footprint, collaborate, and scale up their operations to make sustainable products is a prominent trend in the global glycine market, which is responsible for the substantial growth.

Base Year

Historical Period

Forecast Period

The Asia Pacific region is expected to dominate the market over the forecast period.

The increasing use of copper glycinate in animal feed is one of the key market trends.

The pharmaceutical sector is expected to constitute a major portion of the global glycine market size.

Compound Annual Growth Rate

7.2%

Value in USD Billion

2026-2035

*this image is indicative*

The global glycine market is seeing strong demand from the pharmaceutical industry, where glycine is used as a stabilizer and excipient in drug formulations. For example, in April 2023, Ajinomoto entered a research and development collaboration with biotech start-up Logomix Inc. to develop a sustainable, high-purity amino-acid production method via microbial fermentation. This agreement not only advances greener production but also positions Ajinomoto to supply pharmaceutical-grade glycine more efficiently, supporting long-term growth.

Consumer interest in health and wellness is increasing demand for glycine in supplements, particularly for sleep, muscle recovery, and metabolic support. In the glycine industry, this trend is reinforced by expanding research and production capacity: Ajinomoto’s joint research and development with Logomix in April 2023 aims to produce sustainable amino acids, including glycine, for high-value applications. By tapping into biotechnology-driven production, manufacturers can scale glycine supply to meet the rising nutraceutical demand.

Glycine is gaining traction in animal nutrition due to its benefits for gut health and metabolic efficiency. In the global glycine market landscape, one of the most significant moves came in November 2023, when Evonik formed a joint venture with Shandong Vland Biotech, called Evonik Vland Biotech, to develop gut-health feed additives (probiotics and amino acid–based solutions). At the China Feed Industry Expo in April 2024, the JV introduced key products like SpeoCare™ T60 and GutPlus® Virsorb, signaling a concrete strategy to embed glycine/amino-acid functionality deeper into animal feed.

As clean-label and natural ingredient trends grow, glycine is being adopted in food, beverage, and personal care products for its multifunctionality. This is supported by strategic moves; for example, according to a food-grade glycine market report, Ajinomoto and Evonik formed a strategic partnership in January 2025 to secure and jointly develop high-purity food-grade glycine for flavor and functional applications. This collaboration underscores how glycine producers are aligning with consumer demand for clean, high-quality ingredients.

Glycine’s chemical versatility is driving its adoption in technical and industrial applications, such as corrosion inhibitors, coatings, and herbicide precursors. Additionally, major chemical companies are consolidating and scaling. To cite an instance, Newtrend Group, for instance, reported a significant increase in glycine production capacity, from ~2,970 tons to ~4,061 tons per year between 2023 and 2024. This capacity expansion reflects rising industrial demand as glycine continues to be a key building block in engineered chemistry markets.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

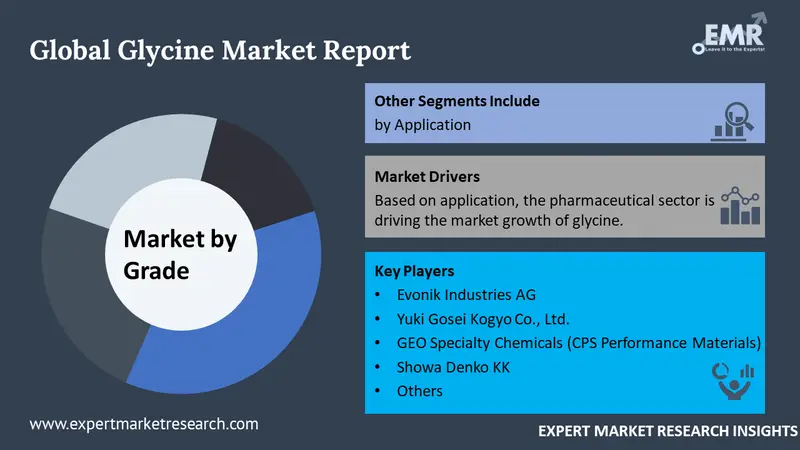

The EMR’s report titled “Global Glycine Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Grade

Key Insights: Across food-grade, pharmaceutical-grade, and technical-grade categories, glycine manufacturers are expanding capacities, improving purification technologies, and adopting more sustainable production methods. Food-grade suppliers are aligning with clean-label and fortified nutrition trends by offering higher-purity formulations. Pharmaceutical-grade producers are enhancing crystallization control and regulatory compliance to support injectable and excipient demand. Technical-grade players are optimizing large-scale processes for agrochemicals, metal finishing, and industrial uses. Together, these strategies reflect the market’s focus on efficiency, customization, and long-term sustainability.

Market Breakup by Application

Key Insights: The glycine market demand is rising through its surging application across sectors such as cosmetic and personal care, pharmaceuticals, agrochemicals, food and beverage, and other industries, each of them contributing to the market expansion with the innovations targeted for their specific needs. In the field of personal care, companies are formulating biodegradable, low-irritation products to satisfy the clean-label trend. Pharmaceutical players produce high-purity and cGMP-compliant glycine for injectables and biologics. The use of agrochemicals is increasing as glycine-based intermediates become more efficient to crop protection, while food and beverage applications become more functional and fortified to meet consumer wellness trends.

Market Breakup by Region

Key Insights: The glycine market shifts and expands worldwide as the key players adjust their portfolios according to the regional demand patterns. In the United States and Canada, increased standards for pharmaceuticals and nutrition are the main factors that lead to the wider use, thus supporting the activities of the two companies: Evonik, with its extremely pure REXIM® amino-acid portfolio, and GEO Specialty Chemicals, with its USP-NF offerings. Sustainability becomes the main driver of Europe's progress, while the Asia Pacific region is expanding at the highest rate owing to companies such as Ajinomoto and Yuki Gosei Kogyo, which are scaling food-grade and fermentation-based glycine. The industrial, food, and personal-care sectors are the main contributors to the Latin America and MEA regions’ growth.

By grade, strong demand is observed for pharmaceutical-grade glycine

Pharmaceutical-grade glycine producers are elevating their cGMP-compliant production to meet the sharply rising demand of high-purity glycine for injectables, infusion solutions, and APIs. As a result, Evonik, for instance, raised its pharmaceutical glycine capacity by 50% and is planting a new facility in Nanning, China, to back up this extension. Through the more refined purification processes and the provision of several crystal forms, firms are not only ensuring regulatory compliance and meeting very strict customer specifications, but they are also positioning themselves for sustainable growth in the healthcare amino acid market.

The food-grade glycine market sees companies expanding high-purity production lines and switching to fermentation-based manufacturing to meet the demand for functional foods and wellness products. Producers are ramping up research and development to create cleaner, bio-based glycine that is environmentally friendly and helps achieve sustainability goals by cutting down the use of the petrochemical route. This transition is in line with clean-label and fortified-nutrition trends, which give manufacturers the opportunity to improve product quality, lower their environmental footprint, and customize glycine for the next-generation supplement and beverage sectors.

By applications, food & beverage category records high demand

Food and beverage glycine demand keeps increasing as consumers desire functional, clean-label, and wellness-oriented products. To meet the evolving trends, manufacturers are investing in fermentation-based production and higher-purity formulations, while they also consider fortified nutrition and protein-enriched applications. Companies are creating versatile glycine materials for beverages, snacks, and supplements to not only attract consumers with the improved taste but also increase stability and health benefits. This strategic emphasis reflects the shift towards the evolving consumer preferences and sustaining the quality of product offerings, fueling the global glycine market revenue.

Glycine, in the pharmaceutical sector, is mostly used as an excipient, stabilizer, and buffering agent in injectables and biologics. To satisfy rigorous regulations, players in the market are upgrading purification processes, increasing production lines GMP-compliant, and innovating with the customized crystalline forms. Initiatives also involve enhancing supply chains of high-purity pharmaceutical-grade glycine and adopting production methods that are environmentally friendly. These measures guarantee quality, efficacy, and safety that are stable enough to be used in downstream applications and thus, leading the companies to be in a position to meet the rising global demand in therapeutics and sterile formulations.

By region, North America shows robust growth

North America is becoming more and more significant as the demand of the pharmaceutical, nutraceutical, and food-processing industries increases, which is pushing companies to keep a constant supply of high purity. Regional manufacturers are upgrading QA systems while taking global procurement for granted to stabilize their input costs. One of the main reasons for this is the continuous increase in glycine imports from China to the United States, which is clearly visible in the United States trade data and thus it is confirming the area's reliance on international producers.

Asia Pacific continues to hold a dominant position in glycine market due to the availability of inexpensive raw materials, large-scale production clusters, and the rapidly growing downstream sectors such as agrochemicals, pharmaceuticals, and food ingredients. Companies in China and Japan are ramping up their technical- and pharma-grade production capacities to meet both the domestic and export market demand. According to market estimations, Asia Pacific is the major consumer of technical-grade glycine worldwide with a strong agricultural demand base.

Major glycine market players are expanding their capacities and upgrading their technology. Pushing capacity expansions and technology upgrades are the dominant tactics of players to meet a demand that is rising rapidly in the pharmaceuticals, food, and industrial sectors. Companies are shifting their focus to high-purity and speciality grades while at the same time making the production processes more efficient and less costly through their optimization. To produce innovative and eco-friendly products as well as to strengthen supply chain resilience, the uptake of strategic partnerships and joint R&D activities is becoming more popular among the different entities that are collaborating.

Moreover, many glycine companies do not only consider product diversification but also put a strong emphasis on sustainability. They have adopted eco-friendly production methods, are exploring bio-based fermentation, and have launched new functional formulations that can be utilized in various areas of application. The primary tactics are sustained quality enhancements, adherence to regulations, and employment of sophisticated purification technologies. Through the integration of innovation with market demand and ESG priorities, business players want to elevate their position in the market and at the same time secure a steady inflow of growth opportunities in the glycine market.

An expert in specialty chemicals, especially amino acids like glycine, Evonik Industries AG is a global leader. The company that was founded in 2007 and has its head office in Essen, Germany, is focusing on pharmaceutical, nutrition, and industrial applications as innovation-driven solution areas, and also she is leveraging sustainable production technologies to be a market leader.

Yuki Gosei Kogyo Co., Ltd. build their factory and office in 1950 and since then it is in Tokyo, Japan. The business is a leader in the production of chemical-intermediates and fine chemicals. It also manufactures amino acids for the food and the industrial sectors. The company promotes high-quality manufacturing and uses up-to-date technology to satisfy the needs of the domestic as well as the global glycine markets.

GEO Specialty Chemicals division of CPS Performance Materials is located in Houston, USA. It was founded in 1990 and is engaged in the production of specialty chemicals used in various industrial applications. One of its wide ranges of products is glycine-based ones. The company is committed to sustainable manufacturing and is providing tailor-made solutions to customers around the world.

Founded in 1939 and headquartered in Tokyo, Japan, Showa Denko KK is a leading chemical company offering advanced materials and specialty chemicals like glycine. The emphasis for the company is on research and development-driven innovations and global expansion, thus serving pharmaceutical, food, and industrial sectors.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Explore the latest trends shaping the Global Glycine Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on global glycine market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 7.20% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of around USD 6.07 Billion by 2035.

Key strategies driving the market include expanding production capacity, developing high-purity and pharma-grade glycine, improving cost efficiency, and forming partnerships to enhance global distribution and sustainability.

The key trends aiding the market expansion include the increasing demand for glycine in animal feed and as a flavour masking agent, its increasing use in the cosmetics industry, and the increasing demand for pharmaceutical grade glycine.

The major regions in the market are North America, Latin America, the Middle East and Africa, Europe, and the Asia Pacific.

The major grades of glycerine include food grade, pharmaceutical grade, and technical grade.

The major applications of glycerine include cosmetics and personal care, pharmaceutical, agrochemical, and food and beverage, among others.

The key players in the market include Evonik Industries AG, Yuki Gosei Kogyo Co., Ltd., GEO Specialty Chemicals (CPS Performance Materials), Showa Denko KK, and several other regional manufacturers.

In 2025, the global glycine market reached an approximate value of USD 3.03 Billion.

The global glycine market faces major challenges such as raw material volatility, strict regulatory requirements, competition from low-cost suppliers, and supply chain constraints for high-purity grades.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Grade |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share