Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global glycol ethers market reached a volume of 3.20 MMT in 2025. The market is expected to grow at a CAGR of 4.50% in the forecast period of 2026-2035 to reach a volume of 4.97 MMT in 2035.

Base Year

Historical Period

Forecast Period

The performance of the paint industry is heavily dependent on the construction sector.

From 2019 to 2030, China will lead in growth contribution to global construction output, followed by India, contributing 32.5% and 13.3%, respectively, due to its rapid urbanization and government policies related to promoting infrastructure.

The United States also accounted for 12% of global growth in construction output, aiding the growth of glycol ethers market.

Compound Annual Growth Rate

4.5%

Value in MMT

2026-2035

*this image is indicative*

| Global Glycol Ethers Market Report Summary | Description | Value |

| Base Year | MMT | 2025 |

| Historical Period | MMT | 2019-2025 |

| Forecast Period | MMT | 2026-2035 |

| Market Size 2025 | MMT | 3.20 |

| Market Size 2035 | MMT | 4.97 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.50% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.3% |

| CAGR 2026-2035 - Market by Country | India | 6.0% |

| CAGR 2026-2035 - Market by Country | China | 5.1% |

| CAGR 2026-2035 - Market by Type | P-Series | 5.0% |

| CAGR 2026-2035 - Market by Application | Paints and Coatings | 5.2% |

| Market Share by Country 2025 | Germany | 4.6% |

Due to the growth of the construction industry across the world, the paints and coatings industry is growing at a rapid rate. This again promotes the usage of paints in such constructions and building projects. The glycol ethers market is also driven by the growing automobile industry. The explicit use of paints and coatings in the automobiles industry provides further impetus to the glycol ethers demand growth. These industries are growing faster in developing countries like India and China, where the demand for glycol ethers is also mushrooming. The increase in demand for water-based surface coatings further drives the growth of the demand for the chemical.

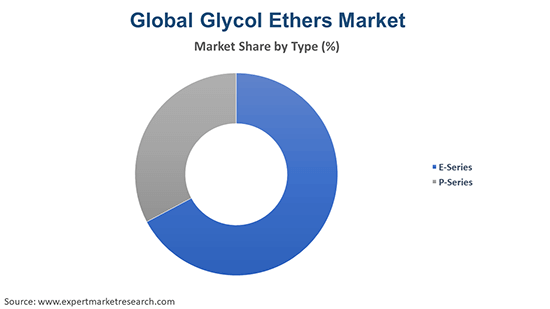

Glycol ethers are a class of solvents based on alkyl ethers of propylene glycol or ethylene glycol. Applications in the production of cleaners for floor, glass, oven, carpet, and others include the use of such compounds. Their uses depend on the types of these glycol ethers. P-series glycol ethers are primarily used in aerosol paints, adhesives, cleaners, and other products, while the e-series glycol ethers help in the production of cosmetic products, sunscreen, inks, dyes, and other products.

The demand from automotive and aerospace, focus on sustainability, and technological advancements are a few factors shaping the glycol ethers market dynamics and trends.

This demand is also driven by the increasing demand for glycol ethers in automotive and aerospace industries due to their use in antifreeze formulations and cleaning products. This key trend in the glycol ethers market shows that improved performance and efficiency are being pushed increasingly in these sectors.

Key trends in the market involve a growing trend toward greener, sustainable products. Companies are developing glycol ethers with low toxicity that are biodegradable for regulation compliance and environmental concerns in view of global sustainability.

The application of advanced technology in the case of glycol ether production is sure to lead to a more efficient and cost-effective process. Innovations support the rise in market growth and competitive pricing, thereby leading to better glycol ethers market opportunities.

Another remarkable trend is the expansion of glycol ethers within the pharmaceutical and cosmetic industries. This happens because, in light of good solubility and stability, glycol ethers are increasingly employed in the field as solvents and carriers for the formulation of medicines, cosmetics, and personal hygiene products. Increasing demand from consumers for high-quality, multifunctional products and the requirement for advanced formulation further in these sectors accounts for the glycol ethers industry growth. These uses are expected to continuously see a rise in the demand for glycol ethers, as health and personal care become more important.

Glycol Ethers Find Increasing Uses In The Cosmetics And Paints And Coating Sectors.

Glycol ethers act as a chemical solvent in the cosmetics industry. During the period from 2018 to 2023, the global beauty market experienced numerous ups and downs. The year 2018 saw a healthy growth of 5%, which proved that there was great demand from consumers, along with the rigorous expansion within the industry. There was an uptrend moving into 2019, with a slight increase to 5.5%, pointing out the constant interest shown by consumers in the beauty category. 2020, however, was a massive turning point with an 8% decline; this was due to the global COVID-19 pandemic that had disrupted supply chains and forced store closures, with consumer purchasing behavior changed drastically.

The year 2021 marked the beginning of the recovery period, as it witnessed a remarkable growth of 8%, with the market recovering from the slump in the previous year. Much of this resurgence can be credited to relaxed lockdowns, increased online sales, and better attention paid toward self-care and beauty routines during the pandemic. This momentum didn't dissipate in the next two years, as 2022 and 2023 continued this trend with 6% and 8% growth respectively. This turned out to be a significant trend of the glycol ethers market.

Glycol ethers in paints and coatings ensure good flow and leveling of paint. The Philippines and Australia follow with 3.8 percent and 1.9 percent respectively, reflecting the newfound interest in construction to underpin economic growth in the area. The other important contributions come from Germany and Canada with 1.5 percent and 1.4 percent respectively, showing stable construction activities buttressed by advanced economies.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Global Glycol Ethers Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

The two types of glycol ethers are:

Glycol ethers find their end-uses in the following sectors:

Based on region, the market can be segmented into:

As per glycol ethers market analysis, E-series type has been the leading type of glycol ethers in the historical period of 2019-2025, but now p-series type is garnering more demand from consumers and is likely to surpass e-series as the dominant type in the coming years. In the downstream industry, paints and coating account for almost half of the global demand. The supply market is led by the Asia Pacific, accounting for nearly 40% of the global glycol ethers supply. Europe and North America follow the Asia Pacific region as the other major supply market of the product.

The Asia Pacific is the fastest-growing consumer market for the product owing to the growing end-use industries like paints and coatings and household care products, among others. The rising GDP is also supporting the growth of the regional market. The household care industry in the Asia Pacific is growing at a rapid rate owing to the growing awareness about hygiene among consumers. Increased use of paints and coatings in the region due to the ever-increasing construction and automobiles industry is providing further impetus to the glycol ethers market growth. The glycol ethers industry in Asia Pacific is thus the leading consumer market.

| CAGR 2026-2035 - Market by | Country |

| India | 6.0% |

| China | 5.1% |

| UK | 4.1% |

| USA | 4.0% |

| Germany | 3.7% |

| Canada | XX% |

| France | XX% |

| Italy | XX% |

| Japan | 3.1% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

The region imports a considerable volume of the product from North America and Europe due to a shortage of capacity corresponding to the rising demand. The Asia Pacific also significantly relies on Sadara Chemical Company in the Middle East for imports since 2018, when the latter started commercial production.

The glycol ethers industry in North America imports a large quantity of the p-series type. The imports primarily take place due to the demand for the product being higher than the supply capacity. It imports from Europe, which possesses a surplus volume of p-series. Other significant importers of the product are China, Taiwan, and Italy, among others. North America, especially the United States, is a major exporter of e-series owing to the excess supply capacity of this type of the chemical. It heavily exports e-series to the Asia Pacific region.

The key companies in the glycol ethers market are going to venture into such fields as sustainable production, low-toxicity products development, and manufacturing process innovation for excellent efficiency with the view to meet demand within the most diverse sectors.

The Dow Chemical Company, more than 120 years old and was founded in 1897 in Midland, Michigan, operates within the scope of ethylene glycol ethers and propylene glycol ethers. The purpose of these products is to serve different applications, including coatings, cleaning, and industrial processes, among others.

Jiangsu Dynamic Chemical Co. Ltd, a supplier company that was established in the year 2002 and located in Jiangsu Province, China, supplies a range of glycol ethers, which include ethylene, butyl, propylene, and recently in their stocks, propylene glycol methyl ether. With that background, the company has served clients in the automobile, paint, and chemical sectors.

LyondellBasell Industries N.V., incorporated in 2007 with its headquarters located in Houston, Texas, manufacturing plant. The company manufactures glycol ethers, including ethylene glycol monobutyl ether and propylene glycol ether, used in the manufacture of coatings, cleaning agents, and servicing industrial processes.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players profiled in the glycol ethers market report includes BASF SE, Shell Chemicals, and Sasol Limited, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The global glycol ethers market reached a volume of 3.20 MMT in 2025.

The market is expected to grow at a CAGR of about 4.50% in the forecast period of 2026-2035.

The major drivers of the market are rising disposable incomes, increasing population, rising demand for end-use products, and growing construction industry.

The growing chemical intermediates market and increasing investments for expansion of facilities are key trends expected to support the market in the coming years.

North America, Latin America, Middle East and Africa, Europe, Asia Pacific are the other major regions in the global glycol ethers market.

The leading types of glycol ethers in the market are E- series and P- series.

The significant applications of glycol ethers in the market are paints and coatings, chemical intermediates, solvents, and brake fluid, among others.

The major players in the market are The Dow Chemical Company, Jiangsu Dynamic Chemical Co., Ltd., LyondellBasell Industries N.V., BASF SE, Sasol Limited and Shell Chemicals, among others.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach 4.97 MMT by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share