Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Iberian sandwich panel market was valued to reach a market size of USD 323.07 Million in 2025. The industry is expected to grow at a CAGR of 5.20% during the forecast period of 2026-2035. The market is driven by the increasing demand for energy-efficient buildings, rising construction activities, and growing adoption of sustainable materials in the industrial and commercial sectors. These sectors are the key drivers of the Iberian sandwich panel market, thus aiding the market to attain a valuation of USD 536.36 Million by 2035.

Base Year

Historical Period

Forecast Period

The growing construction sector is driving the Iberian sandwich panel market. Portugal’s construction output rose by 5.10% in December 2024 year-over-year, reflecting steady growth. Increasing demand for energy-efficient materials and expanding urbanisation further boost the adoption of sandwich panels in residential, commercial, and industrial projects.

Sandwich panels play a critical role in enhancing thermal insulation and overall building comfort. For fire protection requirements that exceed the capabilities of PIR core boards, mineral wool core panels provide an effective solution. Recognising the need for advanced solutions, in November 2024 Huurre Ibérica has launched its innovative HI-QuadCore 2.0 FK DUAL panel, which optimises both fire protection and thermal efficiency in industrial and commercial buildings, aiding Iberian sandwich panel market growth.

Companies are enhancing their product portfolio, supply chain, and market competitiveness through acquisitions. In May 2024, ArcelorMittal Construction acquired Italpannelli SRL (Italy) and Italpannelli Ibérica SA (Spain), strengthening its presence in Spain and Portugal and driving growth in the Iberian sandwich panel market.

Compound Annual Growth Rate

5.2%

Value in USD Million

2026-2035

*this image is indicative*

The Iberian sandwich panel market continues to grow with increasing demand for energy-efficient buildings in this region. Energy-efficient building construction is driving the market. In 2023, Spain accounted for 8.2% of the EU’s net greenhouse gas emissions, highlighting the need for sustainable building solutions.

Innovations in sandwich panel technology are reshaping the Iberian construction and industrial sectors, driving demand for high-performance, energy-efficient, and sustainable solutions. The integration of flexible solar sheets into sandwich panels is revolutionizing building materials by enabling on-site renewable energy generation, reducing dependence on traditional energy sources. This development is particularly relevant in Spain and Portugal, where high solar exposure makes photovoltaic-integrated building materials a viable solution for energy-efficient construction, expanding the demand for sandwich panels.

Furthermore, government investment in the construction sector is aiding the demand for sandwich panels in the Iberian Peninsula. In line with this, Spanish government allocated USD 1.08 billion (EUR 1.0 billion) for affordable, energy-efficient rental housing under the 2021-2026 National Recovery and Resilience Plan (NRRP).

In the Iberian Peninsula, government investments and initiatives towards sustainable construction are driving the demand for the sandwich panel market. For instance, in Spain, the government’s plan to renovate 500,000 homes by 2026 with a USD 7.2 billion (EUR 6.8 billion) EU-backed budget supports energy-efficient building upgrades. Similarly, in Portugal, the government introduced a USD 112 million home energy efficiency program in 2023 covering 85% of costs for upgrades like insulation and photovoltaic panels.

Furthermore, the growing popularity of prefabricated structures accelerates demand, as modular construction cuts build times by 30-50%, reduces delays, and improves cost-effectiveness through automation, quality control, and efficient material supply, making sandwich panels a preferred choice for modern construction.

Technological advances, increasing partnerships, and regulatory compliance accelerate the Iberian sandwich panel market development.

The growing emphasis on energy-efficient building construction is a key factor driving the growth of Iberian sandwich panel market, as developers seek high-performance, sustainable materials to meet stringent environmental regulations. In 2023, Spain contributed 8.2% of the European Union’s total net greenhouse gas emissions, underscoring the urgent need for eco-friendly construction solutions that can reduce carbon footprints and improve energy efficiency.

Innovations in sandwich panel technology, including flexible solar sheets, improved insulation, and fire-resistant cores, are driving growth in the Iberian market by enhancing performance and sustainability.

Sandwich panels are a top choice in modern construction, as modular building techniques reduce construction time by 30-50%, minimize project delays, and enhance cost efficiency. This is achieved through automated manufacturing, strict quality control, and optimized material supply chains, ensuring faster assembly, reduced labor costs, and minimal material wastage.

The Iberian sandwich panel market development is supported by the expansion in construction sector in this region. The construction industry accounted for 10% of Spain's GDP in 2019, but following the COVID-19 pandemic shutdown, the industry shrank to 2012 levels. This had a significant impact on the market, as construction activity slowed down, reducing the demand for building materials.

The latest trend in the Iberian sandwich panel market for include the growing housing investment, and sustainable construction practices.

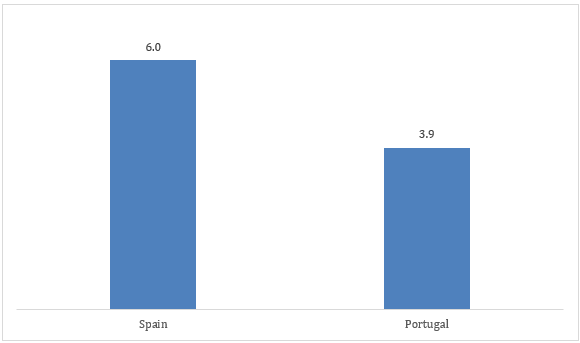

In 2023, housing investment accounted for 6.0% of Spain’s GDP and 3.9% of Portugal’s GDP. This increasing demand for housing across the region naturally translates into a rising need for construction materials, such as sandwich panels. These panels, known for their energy efficiency and ease of installation, are in high demand for new residential and commercial buildings. As investments in housing grow, so too does the demand for advanced building materials, driving the Iberian sandwich panel market expansion.

The construction sector has a significant environmental impact, accounting for 50% of material extraction, 35% of waste generation, and 5-12% of national greenhouse gas emissions. The adoption of sandwich panels in construction helps address these issues by promoting material efficiency, reducing waste, and supporting the circular economy. These panels are designed to be energy-efficient, improving the thermal insulation of buildings and reducing the need for heating and cooling.

Figure: Investment in housing, 2023 (in % of GDP)

There is a rising need for energy-efficient and sustainable construction materials in Europe, driven by the EU’s stringent energy regulations. EU countries must achieve cumulative end-use energy savings for the entire obligation period (2021-2030), equivalent to new annual savings of at least 0.8% in 2021-2023, 1.3% in 2024-2025, 1.5% in 2026-2027, and 1.9% in 2028-2030. Sandwich panels, known for their superior insulation properties, present an opportunity to meet this demand.

The rising construction sector in the Iberian Peninsula is driving the adoption of sandwich panels. In 2023, construction continued to be a significant contributor to Spain’s economy, accounting for 10% of GDP in terms of GFCF and 5% in terms of GVA. This growth in construction activity is boosting the demand for sandwich panels, known for their efficiency and insulation properties, as they are increasingly used in energy-efficient building projects.

Ongoing innovations in sandwich panel materials, such as improvements in insulation capabilities, fire resistance, and durability, open new opportunities for manufacturers to cater to a broader range of industries, including commercial, industrial, and residential sectors. Companies such as Huurre, Invespanel, and Kingspan Group Plc are incorporating such practices. In 2024, Huurre has launched the HI-QuadCore 2.0 FK DUAL, an innovative sandwich panel designed to offer high performance in building, with certified fire resistance and high thermal efficiency, aiding sandwich panels demand.

Iberian sandwich panel market challenges include rising raw material costs and competition from alternatives.

The increasing cost of raw materials, such as steel and insulation core materials, impacts the production costs of sandwich panels. For example, hot-rolled coil prices in Europe have risen to EUR 615-625 per metric ton due to year-end buying and mills' efforts to recover revenue. Fluctuations in insulation core materials and polymer costs also pose a challenge, adding uncertainty to expenses. This surge in steel prices, along with material cost variability, leads to higher manufacturing costs, squeezing profit margins and making it harder to offer competitive pricing.

“Iberian Sandwich Panel Market Report and Forecast 2026 and 2035” offers a detailed analysis of the market based on the following segments:

Breakup by Type

Breakup by Skin Material

Breakup by Technology

Breakup by Application

Breakup by End Use

Breakup by Country

By Type Analysis

As per the Iberian sandwich panel market analysis, PUR/PIR is expected to hold a significant share. PUR panels have an R (thermal resistance) value of 5-7.1 per inch, while PIR has an R-value ranging between R7 and 7.2 per inch. Additionally, PUR panels, made of closed cell structure and hard polyurethane foam, are increasingly being adopted in lightweight construction and building applications.

By Skin Material Analysis

Steel is expected to hold a significant share in the Iberian sandwich panel market. Players are investing in research to develop recycled steel sandwich panels. In October 2024, Kingspan became Spain and Portugal's first sandwich panel producer to use ArcelorMittal’s organic coated XCarb® recycled and renewably produced steel. The product is a result of a partnership focused on producing construction solutions with a reduced carbon footprint.

By Technology Analysis

Discontinuous sandwich panel production lines are suitable for producing customised products that cannot be continuously produced or for which the production volume is not high enough to invest in continuous equipment.

By Application Analysis

Wall panels is expected to hold a significant share in the Iberian sandwich panel market. The growth of the sandwich wall panels market is being driven by the increasing use of innovative lightweight products in residential and commercial buildings. In July 2023, INEGI launched lightweight composite wall panels designed for better thermal and acoustic comfort.

By End Use Analysis

Commercial is expected to hold a significant share in the Iberian sandwich panel market. PIR (polyisocyanurate) sandwich panels offer excellent thermal insulation and fire resistance, making them ideal for commercial buildings such as offices and hotels. In fact, investment in the Spanish hotel sector reached USD 4.55 billion, which was 36% of the total investment in the country.

In 2023, Portugal recorded 30 million tourist arrivals, up from 28.4 million in 2022, resulting in nearly 70 million overnight stays.

Spain Iberian Sandwich Panel Market Dynamics

Sandwich Panel is gaining traction in the Spain sandwich panel market due to the growth of energy-efficient homes. In Spain, it is a legal requirement for homes to have an energy label that indicates their level of energy efficiency, ranging from A (most efficient) to G (least efficient). The country is placing increasing emphasis on meeting the European Union's target for all existing homes to achieve at least a D rating by 2033.

Portugal Iberian Sandwich Panel Market Dynamics

Sandwich Panel is gaining traction in the Portugal sandwich panel market due to the rising demand for modular housing. In 2024, Portugal faced a shortage of over 136,000 homes. Modular homes are emerging as a viable solution to help Portugal overcome its housing crisis, offering speed of construction, sustainability, and more affordable costs.

The speed and efficiency of modular construction can cut costs by 20% and shorten project timelines by 20-50%. Since sandwich panels are crucial components of modular construction, the growing demand for modular houses positively impacts the market.

The Iberian sandwich panel market players are concentrating in developing new products, offering services and technical support to gain competitive edge.

- Founded in 1962, and headquartered in Spain, HIEMESA is a prominent group of companies engaged in the fabrication, transformation, commercialisation, and distribution of steel products across Spain. The company offers following sandwich panel products which includes deck panel, façade panel, and tile panel, among others.

Founded in 1965, and headquartered in Ireland, Kingspan is a global leader in high-performance insulation and building envelope solutions for the construction industry. The company has a strong global presence, operating over 212 manufacturing sites across more than 80 countries. With a workforce exceeding 22,000 employees, it continues to expand its reach, delivering high-quality products and innovative solutions to diverse markets worldwide.

Founded in 1988, and headquartered in Italy, Isopan is a global leader in the manufacturing of insulating metal panels for walls and roofs. As part of the joint venture between Manni Group and Marcegaglia. The company offers various special products, walls and roof sandwich panels of different insulating materials which includes mineral wool sandwich panels and polyurethane foam sandwich panels.

Headquartered in Spain, ALPHAPANEL is a Spanish company focused on innovation, design, development, and manufacturing of thermal and sanitary insulation products, with a particular emphasis on sandwich panels. The company offers various cool room, façade and deck sandwich panels of different materials.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Iberian sandwich panel market are THERMOCHIP, S.L.U, METECNO Group, MASTER PANEL S.L, PANELAIS PRODUCCIONES S.A., Fábrica da Barca (FTB), IRMALEX SA and EUROPERFIL, S.A.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the Iberian sandwich panel market reached an approximate value of USD 323.07 Million.

The market is projected to grow at a CAGR of 5.20% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 536.36 Million by 2035.

The major drivers of the Iberian sandwich panel market include increasing construction activities, demand for energy-efficient building solutions, and the growing need for lightweight, durable materials. Government regulations promoting sustainability and energy conservation also support market growth.

Key trends in the Iberian sandwich panel market include the rising adoption of eco-friendly panels, integration of advanced insulation technologies, and a shift towards custom-made solutions.

The major countries in the market are Spain and Portugal, among others.

The various types considered in the market report are PUR/PIR, mineral wool, expanded polystyrene (EPS), and others.

The various end uses considered in the market report are residential, commercial, and industrial.

The major applications considered in the market report are wall panels and roof panels.

The major players in the market are GRUPO HIEMESA SL, Kingspan Group Plc, Isopan S.p.A, ALPHAPANEL, THERMOCHIP, S.L.U, METECNO Group, MASTER PANEL S.L, PANELAIS PRODUCCIONES S.A., Fábrica da Barca (FTB), IRMALEX SA and EUROPERFIL, S.A., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Skin Material |

|

| Breakup by Technology |

|

| Breakup by Application |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share