Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The market size of chairs in India reached a value of approximately USD 883.93 Million in 2025. The market is expected to grow at a CAGR of 7.60% between 2026 and 2035, reaching a value of USD 1838.83 Million by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.6%

Value in USD Million

2026-2035

*this image is indicative*

A chair is a type of furniture designed for comfortably seating one individual at a time. Chairs usually have four legs and can have arm rests and a support for the back and are available in a variety of designs and materials for different environments. The increasing global population and growing urbanisation along with the expanding corporate sector are heightening the demand for chairs in residential, commercial, and hospitality end uses.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Rising technological advancements in chairs such as development of chairs with features like built in USB ports and wireless charging support, among other innovations, is further contributing to the growth of the chair market in India.

Moreover, people in India are becoming conscious of the environmental impact of the products they use, which is increasing the demand for chairs made from sustainable materials such as reclaimed wood or recycled plastic.

In April 2024, The Sleep Company, which is India’s leading brand for comfort solutions, launched new chairs under the brand ‘ErgoSmart’, which are designed keeping humans body language in mind. These chairs feature company’s patented SmartGRID technology which provides even pressure distribution, more comfort, and improved postures. This new launch can help The Sleep Company to almost double its market share of chairs within two years.

An Expanding Construction Sector and Rising Startup Ecosystem Aid the Market Growth

The rising population growth, urbanisation, and expanding commercial activities presents a dynamic landscape for the market of chairs in India. United Nations projects India’s population to be 1.64 Bn by 2047. An estimated 600 million people are likely to be living in urban centres by 2030, creating a demand for 25 million additional mid-end and affordable units. In the third quarter of 2023, the construction sector in India experienced significant growth, expanding by 13.3% compared to the same period in 2022. This robust growth also represented a 7.9% increase from the previous quarter, making a substantial contribution to the country's GDP. There was a notable 24% increase in the launch of new residential projects, reflecting strong demand in the real estate market. The buoyant construction sector not only drives economic growth but also boosts demand for various products, including chairs and can positively impact the chair business market in India.

The Startup India initiative, launched by the Government of India in 2016, is a comprehensive program aimed at fostering entrepreneurship and supporting new ventures across various sectors in India. A growing number of startups in India can also increase the India chair market value. As of December 2023, the Department for Promotion of Industry, and Internal Trade (DPIIT) recognised startups in India stood at 1,17,254. Maharashtra led the country with 5,801 startups in 2023, demonstrating its position as a robust entrepreneurial hub. Gujarat followed with 3,291 startups in 2023, a significant increase from 2,262 in 2022, reflecting strong growth. As per India chair industry analysis, Delhi had 3,150 startups, maintaining its status as a key player in the startup ecosystem. Karnataka showed impressive growth, rising from 1,566 startups in 2019 to 3,032 in 2023, indicating effective support policies and a thriving entrepreneurial environment. Overall, India saw a surge in startups from 10,604 in 2019 to 34,779 in 2023, highlighting rapid development in its startup ecosystem.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

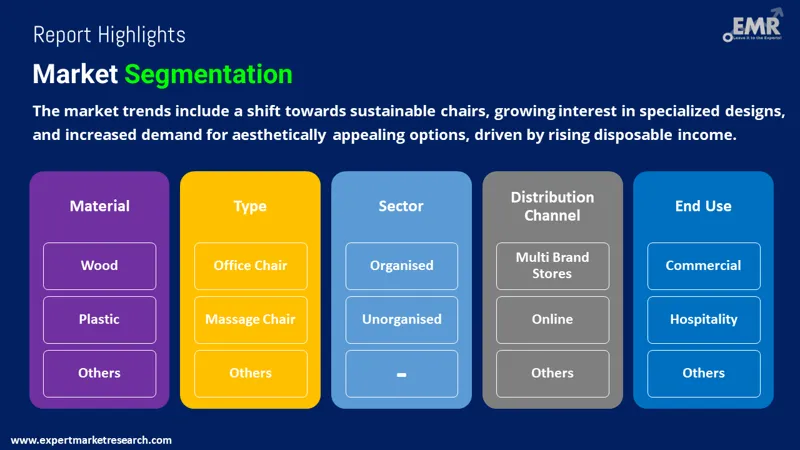

The EMR’s report titled “India Chair Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Material

Market Breakup by Type

Market Breakup by Sector

Market Breakup by Distribution Channel

Market Breakup by End Use

Market Breakup by Region

The penetration of the internet and the rising popularity of online gaming have boosted the demand for gaming chairs, which is thereby increasing the demand for India chair market. By March 2022, the number of gamers in India jumped to 507 million, a 12% rise from 450 million in the previous year, with 24% of these gamers being paying users. This surge in the gaming population underscores the growing market for gaming accessories and furniture, highlighting the diverse factors driving the demand for chairs in India.

Commercial end uses account for a sizable share of the market owing to the growth of corporate sectors and increasing number of startups in the country. Expansion of the commercial sector supported by economic growth in India are increasing the chair demand in offices, waiting areas, restaurants, and malls, among other applications. An adequate number of comfortable chairs aid consumers in being comfortable while visiting commercial establishments and can also add an aesthetic appeal by corresponding with the rest of the décor of the space.

The comprehensive EMR report provides an in-depth assessment of the market based on the Porter's five forces model along with giving a SWOT analysis. The report gives a detailed analysis of the following key players in the India chair market, covering their competitive landscape and latest developments like mergers, acquisitions, investments, and expansion plans.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The chair market size in India reached a value of approximately USD 883.93 Million in 2025 and is expected to increase over the forecast period.

The market is expected to grow at a CAGR of 7.60% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 1838.83 Million by 2035.

The key drivers in the market are growing urbanisation, rising population, and increasing prevalence of work from home.

The key trends of the market are increasing preference for sustainable chairs, interest in specialised chairs, growing disposable income, and rising demand for aesthetically appealing chairs.

The various materials in the chairs market in India are wood, plastic, and metal, among others.

The primary types of chairs in the market are regular use chair, gaming chair, office chair, and massage chair, among others.

Key players in the India chair market, according to the report, are Godrej & Boyce Manufacturing Company Limited, Inter IKEA Systems B.V., Wakefit Innovations Pvt. Ltd., Nilkamal Limited, Cello World Private Limited, Durian Industries Limited, Wipro Enterprises (P) Ltd, Supreme Industries Ltd., Usha Shriram Enterprises Pvt. Ltd., and Damro Furnitures Pvt. Ltd., among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Material |

|

| Breakup by Type |

|

| Breakup by Sector |

|

| Breakup by Distribution Channel |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share