Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global construction market size reached a value of approximately USD 14.45 Trillion in 2025. The market is projected to grow at a CAGR of 6.50% between 2026 and 2035, reaching a value of around USD 27.12 Trillion by 2035.

Base Year

Historical Period

Forecast Period

Australia's construction industry generates around $162 billion annually, making up about 10% of the nation's GDP, as per ABS data.

Saudi Arabia has 138,114 construction companies, according to the Ministry of Municipal and Rural Affairs' analysis.

The U.S. Census Bureau reports that U.S. construction spending rose to $1,978.7 billion in 2023, up from $1,848.7 billion in 2022.

Compound Annual Growth Rate

6.5%

Value in USD Trillion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The construction market is further bolstered by increasing private sector investments and growing foreign investments in emerging nations. Additionally, governments are heavily supporting and funding large-scale construction projects, exemplified by initiatives such as the CHIPS Act, the Inflation Reduction Act, and various infrastructure investment programs in countries like the U.S. and India and other countries to boost the construction industry.

The expansion of the construction market is also driven by increasing industrialization and the development of smart cities. Furthermore, the rise in domestic manufacturing activities and the adoption of new technologies, such as mobile platforms, robotics, AI, and IoT in the construction industry are fuelling this growth.

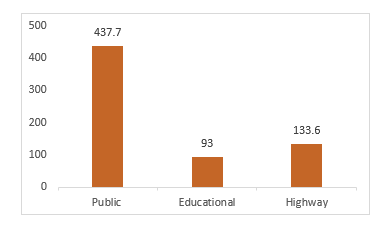

According to the U.S. Census Bureau, US construction spending is increasing thus boosting the construction industry market size.

UNITED STATES CONSTRUCTION STATISTICS, 2023, IN $ BILLION

Increasing adoption of building information modelling (BIM), the rise of modular construction, emphasis on green building practices, technological advancements and automation are the major trends impacting the construction industry growth rate.

Companies like Autodesk and Trimble offer comprehensive BIM solutions, enabling real-time collaboration, 3D project visualization, and construction process simulation, improving project coordination and reducing construction costs.

With the industry seeking efficiency, modular construction grows, especially in residential and commercial projects. Companies like Katerra and Skender showcase their time, safety, and waste reduction benefits.

Turner Construction Company and Skanska integrate renewable energy, water-saving tech, low-VOC paints, sustainable wood, recycled steel, and energy-efficient insulation, adhering to green building standards like LEED and BREEAM.

Construction firms incorporate automation, robotics, and AI into their equipment and processes. Drones and autonomous vehicles aid site surveying and material delivery, with AI-powered software aiding project planning and quality control.

Governments' increasing emphasis on constructing net-zero buildings contributes to a positive outlook for the construction market. France's Climate and Resilience Law, effective from 2021-2026, aims to hasten the green transition, including revising thermal regulations for new buildings.

According to the World Bank, construction's inclusion in France's GDP, accounting for 16.8%, has consequently stimulated construction market growth.

Based on construction market research, technological progress like virtual and augmented reality, digital twins, blockchain, laser scanning, and 3D printing are creating opportunities in the sector. These innovations create lightweight, high-strength components, predict decisions based on real-world conditions, enhance procurement strategies, and improve collaboration, communication, and safety.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Construction Type of Construction Insights

The global building construction market offers numerous benefits, including job creation and economic growth. It fosters technological innovation and sustainable practices, driving the development of energy-efficient buildings. The sector also promotes urbanisation and infrastructure development, improving living standards. The ABS reports that the seasonally adjusted estimate for February 2025 showed a 1.0% rise in private sector houses, totalling 9,203. Furthermore, the overall value of residential buildings increased by 5.0%, reaching USD 9.65 billion. As demand for properties grows, building construction boosts both local and global economies, attracting investment and improving community living standards.

Heavy and civil engineering construction provides essential infrastructure like roads, bridges, and utilities, improving transportation and connectivity globally. It supports economic development by creating jobs and enhancing productivity. The sector contributes to the development of sustainable cities by incorporating advanced technologies for smarter infrastructure solutions. Additionally, investments in heavy and civil engineering projects attract international collaboration and bolster national economic resilience, providing long-term benefits to societies worldwide.

Construction End-Use Sector Insights

Commercial construction plays a pivotal role in the global market by fostering economic growth and creating jobs. It supports the development of office spaces, retail outlets, and industrial facilities, which are essential for businesses to thrive. This sector attracts significant investments and drives urban development, enhancing infrastructure. The European Commission states that the construction industry plays a crucial role in the EU economy, offering 18 million direct jobs and contributing approximately 9% to the EU's GDP. It also generates new employment opportunities, fosters economic growth, and addresses social, climate, and energy challenges.

Residential construction is a vital component of the global economy, providing essential housing and contributing to urban development. It meets the rising demand for homes driven by population growth and urbanisation. This sector generates employment, stimulates local economies, and drives innovation in construction methods and materials. Additionally, residential projects improve living standards, providing quality housing for communities worldwide. As a result, residential construction not only supports economic growth but also enhances the quality of life and community well-being.

Construction Type of Contractor Insights

Large contractors play a key role in the global construction market by managing large-scale projects that drive infrastructure development and economic growth. They bring significant investment, advanced technology, and expertise, ensuring the efficient delivery of complex developments. These contractors create numerous jobs, foster innovation, and support robust supply chains. In October 2024, Saudi Arabia began constructing The Mukaab, a 400-metre cube-shaped building in Riyadh, set to become the world's largest structure. This project, costing USD 50 billion, is part of the New Murabba district, which will feature over 25 million square metres of space and 104,000 homes, blending innovation and sustainability.

Small contractors are vital in the global construction market, offering flexibility, innovation, and specialised services. They often take on more localised or niche projects, contributing to community development and regional growth. Small contractors help promote healthy competition and provide tailored, customer-focused solutions. By creating job opportunities and focusing on residential, maintenance, or renovation work, they ensure diversity in the construction sector, supporting the overall growth and adaptability of the industry in a highly competitive global market.

The commercial sector drives growth in the global construction industry market size by creating spaces for businesses to operate, thereby boosting local economies.

Commercial construction fosters job creation, economic growth, and urban landscape improvement. It elevates property values, generates tax revenues, and offers modern amenities, enhancing local services, attracting tourists, fostering community, and presenting business opportunities.

According to Statistics Canada, non-residential construction increased by 0.6% to $49.8 billion in 2023, marking two consecutive yearly rises.

Residential construction satisfies increasing housing demands, creates new neighbourhoods, promotes social cohesion, and boosts local economies through related services and trades. It facilitates homeownership, addresses affordable housing needs, and offers energy-efficient homes. Moreover, it enhances local infrastructure, diversifies housing options, stimulates real estate market growth, and expands the local tax base through property taxes.

According to ABS, new residential construction values surged by 19.4% in Australia in January 2024, reaching a total of $7.14 billion.

Industrial construction spurs local and regional economic expansion, including the development of heavy construction equipment machinery and the electric motor sector, offering consistent and sustained employment prospects. It amplifies manufacturing capacities, refines logistics, and fortifies local infrastructure. Integrating advanced technologies amplifies export potential, yields substantial tax revenues, promotes community investments, and advocates sustainable practices.

As per the World Bank in 2022, the industrial sector (inclusive of construction) contributed 53.2% to Saudi Arabia's GDP.

Education and research construction fosters academic and research advancement, offers spaces for public engagement, and creates employment in both construction and academia. It yields lasting societal advantages through education, drives technological innovation, improves access to quality educational facilities, and strengthens research capabilities. Moreover, it stimulates local economies, draws students and professionals, and modernizes educational infrastructure and resources.

According to the Australian Bureau of Statistics, there were 4,086,998 students enrolled in 9,629 schools across Australia in 2023.

Medical and healthcare infrastructure development boosts accessibility to contemporary medical amenities, enriches community health and welfare, and generates employment opportunities in construction and healthcare domains. It furnishes cutting-edge medical resources and technology, spurs economic growth through healthcare expenditure, delivers specialized medical care, fosters medical advancement and exploration, and facilitates venues for community health initiatives. Moreover, it enhances emergency and intensive care facilities while advocating for sustainable and environmentally conscious healthcare methodologies.

In 2019, statistics from the Central Bureau of Health Intelligence (CBHI) revealed a combined count of 23,581 Government Hospitals and 22 Central Government Hospitals.

North America Construction Market

North America’s construction market benefits from advanced technology, high-quality infrastructure, and a strong demand for both residential and commercial projects. The region fosters innovation in sustainable construction practices and energy-efficient designs. It also attracts significant investments due to its stable economic environment and robust regulatory framework, contributing to urban development, job creation, and a high standard of living. According to Statistics Canada, total investment in building construction for January 2025 reached USD 22.1 billion, marking a 1.8% monthly increase. Non-residential capital expenditures rose by 5.6% annually to USD 256,250.7 million.

Europe Construction Market

Europe’s construction market benefits from a focus on sustainability, energy-efficient building practices, and cutting-edge technology. The region prioritises green building certifications, such as BREEAM and LEED, which drive environmentally conscious construction. Europe’s strong regulatory frameworks and skilled workforce further support infrastructure development. The construction sector also benefits from significant public investments, particularly in transportation, residential housing, and urban renewal projects. This focus on innovation and sustainability helps Europe lead in eco-friendly construction practices, attracting both local and international investments.

Asia Pacific Construction Market

Asia Pacific’s construction market benefits from rapid urbanisation, a growing population, and strong demand for both residential and commercial properties. The region is witnessing large-scale infrastructure projects, including transportation networks, smart cities, and renewable energy initiatives. With emerging economies like China and India driving growth, the sector sees vast opportunities for investment and job creation. China is the largest construction market globally, significantly influenced by shifts in government regulations and policies. Estimates suggest that total investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will amount to approximately 27 trillion yuan (USD 4.2 trillion).

Latin America Construction Market

Latin America’s construction market benefits from significant investments in infrastructure, particularly in transport, energy, and residential projects. The region's growing middle class drives demand for modern housing and urban development, boosting the residential sector. Government initiatives aimed at improving infrastructure and energy efficiency contribute to economic growth. The construction industry benefits from international collaboration and foreign investment, fostering innovation in building practices and materials. As urbanisation increases, Latin America presents expanding opportunities for construction firms in both public and private sectors.

Middle East and Africa Construction Market

The Middle East and Africa’s construction market benefits from large-scale infrastructure projects driven by rapid urbanisation and significant investments, particularly in the Gulf Cooperation Council (GCC) countries. These regions focus on developing iconic landmarks, smart cities, and large residential complexes. Energy and transport sectors are key drivers, supported by oil and gas revenues. Saudi Arabia’s construction market has become a leading force in the Middle East and North Africa, valued at an estimated USD 70.33 billion in 2024 and expected to grow to USD 91.36 billion by 2029. This expansion is driven by the government’s significant investments in infrastructure as part of the Vision 2030 National Development Plan.

Competitive landscape is characterised by market players directing their attention towards automated construction machinery, incorporating digital platforms, expanding into emerging markets, and aiming at developed nations.

HOCHTIEF Aktiengesellschaft, established in 1898 and situated in Essen, Germany, is a leading firm in building and infrastructure construction. Focusing on civil engineering, supervision, consulting, and infrastructure development, HOCHTIEF delivers an extensive array of services.

VINCI SA, founded in 1899 and headquartered in Paris, France, actively engages in the engineering, construction, and operation of infrastructure projects, encompassing roads, bridges, airports, and seaports. The company also extends its expertise to the energy, water, and waste management sectors.

China Communications Construction Company Limited, established in 1978 and based in Beijing, China, specializes in constructing roads, bridges, airports, seaports, and rail networks. Additionally, it offers engineering, procurement, and construction (EPC) services for power plants and water treatment facilities.

Bouygues SA, founded in 1952 and located in Paris, France, provides a diverse range of services, including the construction of residential, commercial, and industrial projects, such as roads, bridges, and airports.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

“Construction Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by End-Use Sector

Market Breakup by Type Of Construction

Market Breakup by Type of Contractor

Market Breakup by Region

Available Customizations:

We're here to assist you with tailored insights and solutions to ensure you have all the data you need for your strategic decisions.

Expert Market Research provides tailored reports to meet your unique business requirements. If you cannot find what you're looking for, please contact us at [email protected] or you can submit this form Request Customization.

Countries' NDCs (Nationally Determined Contributions) have included building-focused initiatives, submitted between September 2021 and 2022, specifically targeting the building and construction sector.

| Country | Description of measures relevant to buildings |

| Sri Lanka | Implement compulsory building energy efficiency regulations between 2021 and 2022. Develop sector-specific databases for eco-certification systems, minimum performance standards, energy efficiency labelling programs, green structures, and building management systems. |

| Türkiye | New constructions must comply with energy performance standards. Tax benefits are offered for the use of low-energy building materials. |

| Jordan | Embrace environmentally friendly building regulations. Retrofit public buildings for improved energy efficiency. Enhance building resilience by upgrading insulation. Encourage the use of energy-efficient appliances. |

| Iraq | Government and commercial buildings utilise LED lighting. Implement energy efficiency labels and green building regulations. Deploy smart meters. Integrate solar photovoltaic systems into buildings. |

| Mozambique | Revise building codes to enhance resilience. Implement micro-generation of energy in both commercial and residential structures. Enhance energy efficiency and advocate for the use of energy-efficient appliances. |

| Egypt | Country hosting COP27. Advocate for renewables and energy efficiency in both new and existing constructions. Expand energy efficiency labelling initiatives. Implement voluntary guidelines for green buildings. |

THE GDP SHARE OF COUNTRIES IN THE CONSTRUCTION SECTOR, 2023

| Country | GDP PERCENTAGE |

| India | 9% |

| USA | 4.5% |

| Canada | 7.4% |

| Australia | 10% |

United Kingdom Construction Market

South Korea Construction Market

Australia Construction Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market size of construction industry was valued at USD 14.45 Trillion in 2025.

The market is projected to grow at a CAGR of 6.50% between 2026 and 2035.

The revenue generated from the construction market is expected to reach USD 27.12 Trillion in 2035.

The increasing adoption of building information modelling (BIM), the rise of modular construction, emphasis on green building practices, technological advancements and automation are the major trends impacting the construction industry growth rate.

The market is categorised according to the end use, which includes commercial, residential, industrial, education and research, public, private, medical and healthcare and others.

The market key players are ACS, ACTIVIDADES DE CONSTRUCCIÓN Y SERVICIOS, S.A., HOCHTIEF Aktiengesellschaft, VINCI SA, China Communications Construction Company Limited, Bouygues SA, STRABAG International GmbH, Power Construction Corporation of China, China State Construction Engrg. Corp. Ltd., Skanska AB, Ferrovial SE, Fluor Corporation, PCL Constructors Inc., Eiffage S.A. (Eiffage Construction), Bechtel Corporation, Kiewit Corporation, Lennar Corporation, D.R. Horton, Inc., CIMIC Group, Shimizu Corporation, Lendlease Group, CapitaLand Limited, L&T Engineering & Construction Division, Tata Projects Ltd, Hindustan Construction Company, China Railway Engineering Corporation, Yunnan Zhiling Construction Engineering Co., Ltd., Bechtel Corporation, and Zhejiang Yijian Construction Group Co, among others.

The market is broken down into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa.

The Asia-Pacific region is the fastest-growing region in the global Construction market, driven by rising demand across industrial, automotive, and power sectors.

The construction sector presents extensive prospects for advancing innovation, fostering sustainable progress, and expanding infrastructure.

Factors such as economic downturns, regulatory obstacles, and fluctuations in material expenses serve as constraints on the demand for the construction sector.

The top five companies in the construction market are Fluor Corporation, PCL Constructors Inc., Eiffage S.A. (Eiffage Construction), Bechtel Corporation, and Kiewit Corporation.

North America had the largest share of the market.

The heavy and civil engineering construction category dominated the market.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| Report Features | Details |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by End-Use Sector |

|

| Breakup by Type Of Construction |

|

| Breakup by Type of Contractor |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share