Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India ink cartridge market was valued to reach a market size of USD 1194.46 Million in 2025. The industry is expected to grow at a CAGR of 7.30% during the forecast period of 2026-2035. The market is driven the rising adoption of inkjet printers, increasing demand for printing in the commercial sectors, and governmental initiatives to boost local production. These sectors are the key drivers of the India ink cartridge market, thus aiding the market to attain a valuation of USD 2416.40 Million by 2035.

Base Year

Historical Period

Forecast Period

Inkjet printers are favoured for home use due to their compact size, affordability, and superior capability in producing vibrant graphics and colour photos. For infrequent or low-volume printing, such as occasional school reports or photos, a high-quality inkjet printer offers a cost-effective solution. The adoption of these printers aids the demand for ink cartridges.

Indian consumers are highly cost-sensitive, driving demand for remanufactured ink cartridges, which offer a budget-friendly alternative to expensive OEM (Original Equipment Manufacturer) cartridges. These remanufactured cartridges are recycled from original ones, refilled, and tested to ensure quality and performance comparable to new cartridges. Priced around 30-60% lower than OEM versions, they provide significant cost savings for individuals, small businesses, and enterprises with high printing needs.

To encourage local manufacturing under the ‘Make in India’ initiative and reduce reliance on imports, the Indian government imposed an 11% basic customs duty (BCD) and a 1% cess on imported printer cartridges, ink cartridges, and toner cartridges in October 2024. This policy aims to stimulate domestic production by making imported cartridges more expensive, thereby creating a favorable environment for Indian manufacturers and remanufacturers.

Compound Annual Growth Rate

7.3%

Value in USD Million

2026-2035

*this image is indicative*

The Indian government facilitates local manufacturers in marketing and selling domestically produced ink cartridges through the Government e-Marketplace (GeM), supporting the ink cartridge market expansion.

Inkjet printers are relatively affordable, making them a practical choice for MSMEs with limited budgets. They offer low initial investment costs compared to other types of printers like laser printers, which is crucial for smaller businesses trying to manage operational costs.

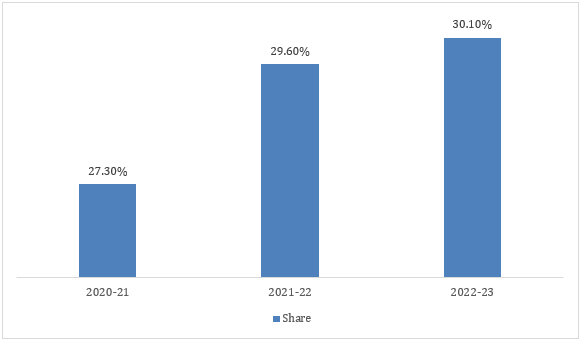

The Gross Value Added (GVA) by MSMEs in India’s GDP was 27.3% in 2020-21 and rose to 30.1% in 2022-23. Furthermore, Inkjet printers are popular in the commercial sector to help businesses grow by producing high-quality and personalised content. The rising adoption of inkjet printers aids the demand for ink cartridges. In 2024, India's office market expanded, with leasing activity across 7 cities, including Bengaluru, Chennai, and Delhi NCR, increasing by 22.6% y-o-y.

High-yield toner cartridges are gaining popularity due to their printing efficiency and cost savings. Extra high-yield toner cartridges can bring down cost per page for high-volume print jobs. By 2028, India is projected to become the 3rd largest print advertising market globally, presenting opportunities for printer cartridges.

Figure: Share of MSME GVA in India GDP (%)

The Indian ink cartridge market development is supported by the rapid advancements and the launch of inkjet printers by leading players. For instance, in May 2024, Canon India launched six advanced large-format printers, including a new 7-colour imagePROGRAF GP series, designed for the graphic arts market. These printers utilize the innovative LUCIA PRO II pigment ink to deliver exceptional print quality.

Eco-friendly ink cartridges are gaining popularity due to consumers' growing focus on sustainability. Ink cartridge manufacturers are capitalising on this trend to gain a competitive edge. In May 2024, Mimaki Engineering announced the global launch of eco-friendly carton ink cartridges that replace traditional plastic with a sustainable paper alternative.

The ability to purchase ink cartridges and inkjet printers through online channels has become a major driver in the market. E-commerce platforms offer convenience, variety, and competitive pricing, allowing consumers to easily compare products, read reviews, and make informed purchasing decisions from the comfort of their homes. By 2030, India's consumer digital economy is expected to become a USD 1 trillion market up from USD 537.5 billion in 2020.

Growth of MSMEs, development of environmental-friendly ink cartridge, and growth in office leasing activities are driving India ink cartridge market growth.

Inkjet printers are used for its affordability and cost-effectiveness. The growth in small and medium enterprises creates potential opportunities for the ink cartridge market in India. During FY 2023-24 to 2024-25, 2,372 Micro enterprises and 17,745 small enterprises scaled up to medium enterprises.

The ability to purchase ink cartridges and inkjet printers through online channels has become a major driver in the market. E-commerce platforms offer convenience, variety, and competitive pricing. Several companies, including HP India Sales Pvt Ltd, Canon India, and Brother International (India) Pvt. Ltd, are selling ink cartridges through e-commerce platforms in India.

Eco-friendly cartridges are gaining popularity due to consumer consciousness. In June 2024, Mimaki Engineering has launched carton ink cartridges for its eco-solvent printers, maintaining exceptional performance while greatly reducing environmental impact. By replacing plastic with paper, Mimaki has cut plastic usage per cartridge by 68%.

The growth in office leasing activities aids the demand for inkjet printers, thereby boosting the growth of India ink cartridge market. Offices require a variety of print jobs, from text-heavy documents like reports and contracts to color-rich materials such as presentations, marketing collateral, and charts. Inkjet printers, equipped with ink cartridges, offer excellent versatility in printing high-quality text and color images, making them ideal for the diverse requirements of an office environment. India's office market achieved remarkable growth in 2024, with gross leasing activity across the top seven cities reaching a record-breaking 77.22 million square feet.

The latest trend in the India ink cartridge market for include the growing demand for recycled or remanufactured ink cartridges.

Remanufactured cartridges offer huge savings of up to 50% as compared to OEM printer cartridges. Remanufactured ink cartridges are recycled, refurbished, and refilled versions of original cartridges. These cartridges undergo a cleaning, refilling, and testing process to ensure quality and performance. Remanufactured ink cartridges reduce landfill waste by extending the life of printer cartridges. As a result, producers can capitalize this trend to gain competitive edge in the market and reduce their carbon footprint.

Leading manufacturers are actively investing in research and development to produce eco-friendly ink cartridges by incorporating a higher percentage of bio-renewable raw materials while minimizing heavy metals and volatile compounds. For instance, in 2024, Mimaki Engineering, a manufacturer of industrial inkjet printers, announced the global launch of its carton ink cartridges. This move replaces traditional plastic cartridges with environmentally friendly paper alternative, marking a significant stride towards sustainability in the industry.

The increasing adoption of inkjet printers, which heavily rely on ink cartridges, for marketing and branding across various commercial settings has significantly driven the growth of the India ink cartridge market. Furthermore, the increasing number of companies is expected to drive the demand. According to August 2024 report, Maharashtra, Delhi, West Bengal, Uttar Pradesh, and Karnataka became the top five state in terms of company registration, with registration reaching 5,27,889, 4,17,087, 2,41,728, 1,97,968, and 1,84,971, respectively.

Established cartridge refilling franchises are expanding across India. For instance, Cartridge World operates as a cartridge refilling franchise in India. Additionally, Re-Feel and Cartex are few other prominent cartridge refilling franchisees operating in India. Since printer cartridges are consumables, there is a recurring need for replacements. Given their high cost, both individuals and large corporations seek quality alternatives. This creates significant growth opportunities in the cartridge refilling market.

The Indian market has seen instances of counterfeit ink toners and cartridges, which pose risks such as sub-standard print quality, printer malfunctions, and increased operational costs. As part of HP India’s Anti-Counterfeiting and Fraud (ACF) Program, HP India, with the support of law enforcement authorities in India, seized approximately 440,000 counterfeit HP products worth USD 3.6 million between November 2022 and October 2023. The majority of these counterfeit products were toner and ink cartridges. Additionally, inkjet printers can be easily replaced with laser printers, reducing the demand for ink cartridges.

The EMR’s report titled “India Ink Cartridge Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

Market Breakup by Material

Market Breakup by Sector

Market Breakup by End Use

Market Breakup by Region

Market Analysis by Type

Original is expected to hold a significant share in the India ink cartridge market due to its superior quality.

One of the key market drivers for original ink cartridges is their seamless compatibility with printers. By using the same high-quality ink, they deliver consistently superior print results, ensuring customers receive exceptional performance and reliability. In October 2024, to reduce reliance on imports and encourage domestic manufacturing in India, the government implemented an 11% basic customs duty, along with a 1% cess, on printer, ink, and toner cartridges. The move aims to foster local production as part of ‘Make in India’ initiative by reducing dependence on foreign suppliers.

Market Analysis by Cartridge Material

As per the India ink cartridge market analysis, plastic is expected to hold a significant share by material to reduce the reliance on new petroleum-based materials.

Ink cartridges are encased in plastic, with additional plastic components incorporated into their internal structure. High-density polyethylene (HDPE) is commonly used in ink cartridges due to its excellent heat and water resistance, as well as its recyclability. By 2035, India’s plastic waste recycling rate is projected to increase to approximately 11%, up from 8% in 2024.

Market Analysis by Sector

Organised sector is expected to hold a significant India ink cartridge market share by sector due to the presence of prominent refilling companies.

Prominent players in the organised market include Epson India Pvt Ltd, Canon India, HP India Sales Private Limited, and Brother International (India) Pvt. Ltd.

Market Analysis by End Use

Commercial segment is expected to hold a significant share in the India ink cartridge market report by end use due to the growth of small and medium enterprises in India.

The increasing need for reliable printing solutions in businesses drives the demand for inkjet printers that significantly rely on ink cartridges. For instance, in February 2024, HP launched a comprehensive range of wireless inkjet printers, OfficeJet Pro, tailored specifically to address the printing needs of small and medium sized businesses.

The publishing industry’s shift to short-run, on-demand printing, drives inkjet printing demand. In February 2025, Kyocera Document Solutions India partnered with TechNova, to expand its inkjet printing solutions, reinforcing the market for cost-effective and flexible printing solutions.

North India Ink Cartridge Market Dynamics

Ink cartridge market is gaining traction in the North India ink cartridge market due to the growing presence of print media publications.

The rise in registered periodicals, with 21,660 in Uttar Pradesh and 16,445 in Delhi in 2023, reinforces the importance of print media. This growth fuels higher printing demand, driving the ink cartridge market as publishers and businesses require reliable, high-quality printing solutions.

East India Ink Cartridge Market Dynamics

Ink cartridge market is gaining traction in the East India ink cartridge market due to increasing publishing activities. The demand for ink cartridges in East India is being driven by the growing number of registered companies in the region. In August 2024, West Bengal had a total of 241,728 registered companies, while Bihar had 61,745. As the number of companies continues to rise, there is a corresponding increase in printing needs across the media, education, and government sectors, thereby boosting the reliance on high-quality, cost-effective ink cartridges.

West India Ink Cartridge Market Dynamics

Ink cartridge market is gaining traction in the West India ink cartridge market due to increasing investment in advanced printing technology.

In April 2024, Insight Print Communications announced its plans to install eight inkjet Atexco web presses in Pune, Nagpur, and other markets in India. The printers will be based on the water-based inkjet technology with the highest print quality.

Gross leasing volumes for offices in West India is constantly growing, providing an opportunity for ink cartridges. The gross leasing volume for Mumbai and Pune increased from7.33 and 5.60 in CY 2023 to 10.26 and 6.88, respectively. during CY 2024.

South India Ink Cartridge Market Dynamics

Ink cartridge market is gaining traction in the South India ink cartridge market due to booming IT and startup ecosystem. The booming IT and startup ecosystem fuels high-volume printing needs for business documentation, driving increased consumption of reliable, cost-efficient ink cartridges in offices and enterprises across these states. As per August 2024 report, the total number of companies registered in Tamil Nadu and Telangana stood at 2,00,472 and 1,62,130, respectively.

The India ink cartridge market players are concentrating in developing new products, technological advancements and remanufactured cartridges to gain competitive edge.

Founded in 19888, headquartered in India, HP is a subsidiary of HP Inc., which is one of the leading technology companies globally, providing a wide range of hardware and software products and services. The company primarily offers two types of ink cartridges including Standard Capacity Ink Cartridges and High-Capacity Ink Cartridges.

Founded in 2006, headquartered in Maharashtra, India, Brother International (India) Pvt. Ltd., a subsidiary of Brother International Ltd is a leading global brand known for its innovative solutions in print and imaging, labelling, and sewing markets. The company offers a wide range of ink cartridge products, all of which meet stringent ISO testing standards for page yield, ensuring high-quality performance and reliability.

Founded in 2000, headquartered in Karnataka, India, Epson India Pvt. Ltd. delivers high-quality printing, imaging, and projection solutions tailored for homes, businesses, and commercial enterprises. Committed to exceeding customer expectations, the company has built a strong reputation for innovation, reliability, and value. The company offers a various ink cartridge products including Cyan Ink Cartridge (110ml), and Magenta Ink Cartridge (110ml), among others.

Founded in 2004, headquartered in Uttar Pradesh, India, ColorJet is India's largest manufacturer of digital inkjet printers, recognized globally for its commitment to technological innovation and customer-centric approach. The company offers majorly two type of ink cartridges namely Premium Eco and Premium Eco II.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the India ink cartridge market are Printech Solutions India Private Limited and Condot Systems pvt. Ltd.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the India ink cartridge market reached an approximate value of USD 1194.46 Million.

The market is projected to grow at a CAGR of 7.30% between 2026 and 2035.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 2416.40 Million by 2035.

The major drivers include growing demand for affordable printing solutions, increased adoption of digital printing in businesses, rising educational activities, and the expansion of e-commerce platforms.

Key trends include a shift towards eco-friendly cartridges, growth in online sales, innovations in ink efficiency, and a rise in demand for high-yield cartridges catering to budget-conscious consumers and businesses.

The major regions in the market are North India, East India, South India, and West India.

The various types of ink cartridges are original and recycled.

The various sectors considered in the market report are organised and unorganised.

The end use industries considered in the market report are commercial, government agency, and residential.

The major players in the market are HP India Sales Private Limited, Brother International (India) Pvt. Ltd., Epson India Pvt Ltd., ColorJet India Limited, Printech Solutions India Private Limited and Condot Systems pvt. Ltd.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Cartridge Material |

|

| Breakup by Sector |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share