Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India pre-school/childcare market was valued at USD 5.59 Billion in 2025. Rising disposable incomes in Tier II and Tier III Indian cities are prompting millennial parents to seek structured early education options, fuelling expansion of branded preschool and childcare chains. As a result, the market is expected to grow at a CAGR of 10.50% during the forecast period of 2026-2035 to reach a value of USD 15.17 Billion by 2035.

The market is undergoing a significant transformation driven by urbanisation, dual-income households, and increasing awareness of early childhood development. According to the Ministry of Women and Child Development, around 3.5 crore children in the 0-6 age group benefit from the government’s Integrated Child Development Services (ICDS) scheme, indicating strong government attention. However, a substantial share of the urban population now seeks private alternatives offering structured curricula and global exposure.

Innovative models are reshaping the India pre-school/childcare market dynamics. Preschool firms like Footprints and Safari Kid have introduced AI-based child progress tracking and CCTV-enabled parental access, offering transparency and personalisation. Meanwhile, NEP 2020 has underscored the importance of foundational learning, recommending play-based methods in the early years, which has catalysed private sector participation. India's National Early Childhood Care and Education (ECCE) Policy further supports this with strategic frameworks.

Another notable trend in the market is hybrid pre-schooling. Platforms like KLAY and Amelio have introduced flexible modules integrating digital and physical spaces, ideal for parents in tier-1 cities juggling hybrid work. These initiatives highlight how convenience and personalisation are becoming the key areas of focus in India's evolving early learning ecosystem.

Base Year

Historical Period

Forecast Period

In 2021-22, pre-schools in India received an admission of around 9.5 million children.

Around 68% of the preschools in India are in the unorganised sector, but there has been a rise in the branded preschools as well.

As of 2023, there were around 25,300 private preschools registered in the country.

Compound Annual Growth Rate

10.5%

Value in USD Billion

2026-2035

*this image is indicative*

Urban parents have increasingly demanded real-time updates and personalisation. In response, pre-schools like EuroKids and KLAY have launched mobile apps for live video feeds, health tracking, and digital attendance logs, boosting the India pre-school/childcare market growth. Start-ups are embedding AI to track milestones and behavioural patterns, offering predictive insights to educators and guardians. These innovations are drawing attention from venture capitalists, fuelling the emergence of technology-first learning spaces. This trend, accelerated by post-pandemic safety concerns, is helping centres maintain trust and ensure consistent engagement with families across India’s metro cities.

India's National Education Policy 2020 has formally recognised pre-primary education as essential, laying a framework that aligns early learning with a national curriculum, boosting the India pre-school/childcare market opportunities. The Ministry’s ICDS modernisation under Mission Poshan 2.0 is digitising nearly 13.9 lakh Anganwadi centres. These developments have sparked collaborations between private players and the government to professionalise and upgrade childcare services. For example, the Delhi government’s partnership model for private pre-schoolers within school premises is gaining traction. These reforms aim not only at increasing enrolments but also raising the quality bar through teacher training and infrastructure funding.

In a push for employee retention and diversity, corporates are partnering with daycare brands to offer on-site childcare, accelerating the India pre-school/childcare market development. Firms like Infosys and TCS have enabled this model with providers like Amelio, ensuring care is within office campuses. Post-pandemic, hybrid setups are increasing demand for near-office and flexible daycares. This workplace-centric approach is seeing government reinforcement as well, with the Maternity Benefit (Amendment) Act mandating crèches for organisations with over 50 employees. This blend of compliance and care convenience is driving rapid expansion in the segment, especially in metro cities and IT parks.

Smaller cities are witnessing a surge in budget-friendly and franchised models. Chains like Kidzee and Little Millennium are rapidly franchising in cities like Bhubaneswar, Indore, and Patna. With lower real estate costs and rising middle-class awareness, these regions offer a lucrative proposition. Government’s smart city push is improving infrastructure, indirectly supporting India pre-school/childcare market penetration. Many pre-schools in these towns offer multilingual programmes tailored to local cultures, appealing to aspirational parents looking for affordable global education prospects. This localisation strategy combined with low entry costs is making franchise-based expansions highly viable.

Preschools are shifting from rote-learning to experience-based curriculums. Preschool companies like Safari Kid are integrating STEAM education including Reading, Writing, Math, Public Speaking, Art and Physical Development, from early years. Sensory learning environments, with music zones, nature play, and mindfulness corners, are emerging as key differentiators. With NEP encouraging mother-tongue instruction till Grade 5, many centres are introducing multilingual modules, blending English, Hindi, and regional languages. This new wave of curriculum diversification aligns with global standards and supports holistic development.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India Pre-School/Childcare Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Facility

Key Insight: The market can be categorised into full-day care, half-day care, after-school care, and emergency/crisis care. Full-day care thrives in metro cities with longer work hours and corporate support. After-school care is surging, due to the rising demand for structured engagement beyond school. Half-day care finds favour among homemakers or families seeking early exposure without extended separation. Emergency care, though niche, is growing with app-based bookings, supporting parental flexibility.

Market Breakup by Ownership

Key Insight: Ownership categorisation considered in the India pre-school/childcare industry report indicates a clear urban-rural divide. Private institutions flourish in metro cities with customised offerings and tech-enabled models, while public centres hold rural ground, often backed by government schemes. NGOs increasingly partner public setups to improve quality. Private chains expand via franchise and mobile apps, whereas public providers focus on reach and affordability. Though objectives differ, both sectors are converging on quality enhancement, child safety, and learning outcomes, creating hybrid public-private cooperation opportunities in future.

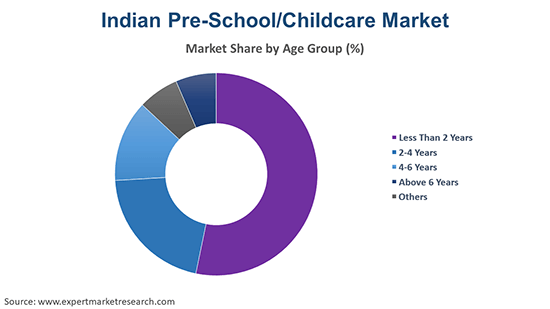

Market Breakup by Age Group

Key Insight: The 2–4 years group dominates the pre-school/childcare market in India due to curriculum alignment and parent expectations of learning. The under-2 years age group is growing fast, influenced by workforce shifts and lifestyle changes. The 4-6 years category supports school readiness with a focus on structured cognitive tasks. Meanwhile, above-6 years age group care often caters to after-school needs, especially for working parents. Each group demands different infrastructure with engagement tools, pushing providers to modularise offerings and fine-tune curriculums per age milestone.

Market Breakup by Location

Key Insight: The market report has been divided into standalone centres, school premises, and office spaces. Standalone centres dominate the market due to operational freedom and franchise viability. School premises-based preschools provide continuity for students transitioning into formal schooling. Childcare within office premises is a niche category, although it is rapidly growing due to government mandates and corporate HR initiatives, boosting the India pre-school/childcare market value. Each location model is optimised around parent convenience, real estate economics, and the nature of the service being offered.

Market Breakup by Major Cities

Key Insight: The demand for India's pre-schools and childcare market is rapidly growing across major cities like Delhi-NCR, Bengaluru, Hyderabad, Chennai, Mumbai, Kolkata, and the rest of India, driven by unique regional factors. In Delhi-NCR, the demand is fueled by the increasing number of working parents and a focus on early childhood education. Bengaluru sees growth due to its tech-driven environment, leading to a demand for specialized learning programs, thereby driving the India pre-schools/childcare market growth. In Hyderabad, rising income levels and dual-income households boost the sector. Cities like Mumbai and Kolkata benefit from high urbanization, while Chennai sees growth due to traditional family structures embracing modern education concepts. Rest of India is witnessing urban migration, enhancing childcare demand.

Market Breakup by Region

Key Insight: Regionally, South India leads the Indian market owing to the rising demand for bilingual and technology-first centres. North India is witnessing rapid growth due to large metro cities and affluent tier-2 cities. West and Central India show strong franchise activity, particularly in cities like Ahmedabad, Nagpur, and Bhopal. East India, while relatively underpenetrated, is attracting attention through low-cost franchising and growing urbanisation. Each region exhibits varied demand patterns, shaped by language preference, economic conditions, and parent awareness. This has led to diversified growth strategies, ranging from digital hybrid models in the South to budget-focused formats in Central and East India.

By Facility, Full Day Care Accounts for the Dominant Share of the Market

Full-day care remains the dominant in the Indian market due to the rise in nuclear families and working parents. Operating typically from 9 a.m. to 6 p.m., these centres combine structured learning with meals, rest, and socialisation. Players like KLAY, Ipsaa, and Footprints cater to premium urban demand with CCTV access and real-time app updates. Corporates also prefer full-day childcare models for on-campus deployment, supporting employee productivity. NEP 2020's focus on early childhood education has led to improved curriculums within these centres. Customisable schedules, nutritional programmes, and activity-based learning have made this format the go-to option for urban professionals, impacting the India pre-school/childcare market revenue.

After-school care is emerging as the fastest-growing category, especially in urban hubs with dual-income households. Centres operate between 2 p.m. and 7 p.m., offering tutoring, art, language, and play. Childcare providers like Amelio and Mindseed are diversifying into this niche, offering STEM clubs and coding classes for early learners. Increasing academic pressure and lack of safe play areas have made these structured after-school options popular. With over 70% of school-going children in metro cities lacking adult supervision post-school hours, this category is gaining traction. Many providers also offer pick-up from schools, gamifying learning and keeping children creatively occupied until parents return from work.

By Ownership, the Private Category is Gaining Significant Traction in the Indian Market

Private pre-schools occupy the dominant share of the Indian market. Chains like EuroKids, Little Elly, and Hello Kids are pioneering personalised curriculums, technology integration, and parent engagement tools. Franchising enables scalability with quality assurance, especially in tier-2 cities. Investments from private equity firms are fuelling innovation and infrastructure upgrades. The private sector also enjoys flexibility in curriculum design and teacher recruitment, giving it an edge over standardised public models. With growing aspirations for globalised early education, private centres are embedding international pedagogies like Montessori and Reggio Emilia, appealing to new-age Indian parents seeking global readiness from early years.

Public early education, powered by Anganwadis, is seeing modernisation under Mission Poshan 2.0., accelerating the pre-school/childcare demand in India. While still fragmented, digital dashboards, biometric attendance, and play-based teaching are being introduced. These centres serve low-income households, particularly in rural and semi-urban areas. Government incentives and NGO partnerships are bridging learning gaps. States like Tamil Nadu and Karnataka piloted preschool classrooms within public schools with trained facilitators. Despite resource challenges, public centres offer scalability and reach. Policy emphasis and funding for early childhood development, like budget hikes under ICDS, are gradually making public ownership more competitive.

By Age Group, the 2–4 Years Category Registers the Major Share of the Market

The 2–4 years category is the dominant age group in the market. Children in this stage begin structured learning, foundational language, and cognitive development. Most NEP-compliant curriculums begin at this level, making it central to both public and private offerings. Pre-schools like EuroKids, Kangaroo Kids, and Safari Kid focus their main programmes on this age group. Sensory rooms, interactive play, and audio-visual storytelling are commonly used to engage this group.

The less than 2 Years segment is the fastest-growing age group within the preschool/childcare market in India, as modern parents increasingly opt for early care due to shorter maternity leaves and nuclear setups. Providers like KLAY and Amelio have created infant care modules including feeding, sleep tracking, and milestone logging through digital apps. Centres are using IoT-enabled devices for temperature and hygiene monitoring to ensure infant well-being. Government encouragement via workplace crèche mandates has made infant care services vital, especially within IT parks and co-working spaces.

By Location, the Standalone Category Occupies a Substantial Share of the Market

Standalone centres remain the dominant location, particularly in metro cities and tier-1 cities. These allow flexibility in curriculum, space design, and branding. Preschools like Kidzee and Bachpan have built expansive networks using this format. Operators can customise learning environments with sensory zones, gardens, and digital classrooms. The model appeals to franchisees due to manageable capex and scalable neighbourhood presence. Standalone units also accommodate hybrid care models like flexible timings and emergency bookings. Their autonomy enables faster integration of new learning technologies and design innovations. This segment is supported by increasing interest in personalised care and curriculum independence, particularly among mid-income and premium urban consumers.

Childcare located within or near office premises is the fastest-growing category, strengthening the India pre-school/childcare demand forecast. Increasing compliance with the Maternity Benefit (Amendment) Act, 2017 is prompting corporates to adopt on-site childcare. Preschool chains like Amelio and Ipsaa have scaled such models in collaboration with IT firms and MNCs. These centres offer convenience and secure environments, thereby boosting workforce productivity and retention. They typically include custom programmes, live app updates, and trained staff tailored for professional parents. Office premises-based preschools blend accessibility with high safety standards and cater to the new hybrid work culture.

By Region, South India Holds the Leading Position in the Market

South India typically holds significant market share due to the presence of cities such as Bangalore and Chennai where rapid urbanisation and presence of high-end pre-schools are boosting growth. The increased penetration of branded pre-schools throughout Tier 1 and Tier 2 cities, combined with a growing population income in urban areas also increase the India pre-school/childcare industry revenue. The burgeoning presence of key market players such as EuroKids and KLAY Schools in these cities offers easy access to upper-class and middle-class families to enrol their children in the top institutes of the country.

North India is also expected to witness significant growth due to the presence of prominent preschool and childcare providers in the NCR region. The rise of nuclear families and single parents in big cities due to job purposes further fuels category growth and positively impacts the demand forecast. In addition, the growing change in the Indian education sector, together with a rising awareness about the value of early childhood education, will further boost this regional market in India during the forecast period.

The India preschool/childcare market players like EuroKids, Footprints, KLAY, and Safari Kid are focusing on technology integration, parent transparency, and curriculum innovation. The rise of edu-franchising offers low-cost scalability while preserving curriculum quality. AI-based learning paths, IoT-monitored infant care, and parent dashboards are emerging as standard offerings. Players are tapping into corporate partnerships and real estate collaborations to increase reach and reduce overheads.

Emerging India preschool/ childcare companies are targeting tier-2 and tier-3 cities with vernacular-first, culturally contextual modules. International curriculum adoption like Reggio Emilia and Montessori is being indigenised. The sector offers opportunities in content creation, app development, and teacher skilling. Demand for integrated services including nutrition, transport, and developmental tracking, is prompting consolidation and cross-sector partnerships. Market leaders are also investing in R&D to create evidence-backed child development frameworks.

Founded in 2003, Kidzee is one of the most prominent preschool chains in Asia. This institute follows the ILLUME curriculum which focuses on child-centric and self-paced learning. This institute offers structured programmes for fostering the proper growth of the kids in preschool as well as kindergarten.

Founded in 2005, Bachpan is one of the most popular preschool chains in India with around 1200 branches worldwide. It offers features such as smart classrooms and Speak-O-Kit which educates kids through innovative and audio-visual training methods to enhance their learning experience.

Founded in 2001, Eurokids is another major market player in India pre-school/childcare industry which boosts around 1000 centres in India. It offers an EUNOIA curriculum which can help young learners achieve emotional, social, and cognitive development to help them adjust well in school later on.

Founded in 1989, SHEMROCK is one of the first playschool chains in India, recognised for having invented a dynamic and kid-friendly learning approach that has revolutionised the idea of early childhood education. The school has over 550 branches across India, Nepal, and Bangladesh, and 70+ branches in the Delhi-NCR region.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are Hello Kids Education India Pvt., and Little Millennium, among others.

Explore the latest trends shaping the India pre-school/childcare market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on India pre-school/childcare market trends 2026.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 10.50% between 2026 and 2035.

Key strategies driving the market include investing in franchise expansion, integrating parent-tech tools, aligning curriculum with NEP, training multi-lingual educators, and partnering with corporates for office-based models.

The key trends guiding the market include the increasing penetration of branded pre-schools in tier-II and tier-III cities, a growing population in urban areas, and rising demand for well-trained pre-school services with professionally trained workers.

North India, West and Central India, South India, and East India are the major regions in the market.

Full day care and after school care are the leading facilities in the market.

The significant ownership segments of pre-school/childcare considered in the market report include public and private.

The major age groups considered in the market report are less than 2 years, 2-4 years, 4-6 years, and above 6 years, among others.

The leading locations of pre-school/childcare are standalone, school premises, and office premises.

Delhi-NCR, Bengaluru, Hyderabad, Chennai, Mumbai, Kolkata, and rest of India are the major cities in the market.

The key market players include Kidzee, Bachpan, Eurokids, Shemrock, Hello Kids Education India Pvt., and Little Millennium, among others.

In 2025, the India pre-school/childcare market reached an approximate value of USD 5.59 Billion.

The key challenges are low staff-to-child ratio, fragmented regulations, inconsistent curriculum quality, and high attrition of trained caregivers limit scalability and quality assurance, especially in tier-2 and rural settings across India.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Facility |

|

| Breakup by Ownership |

|

| Breakup by Age Group |

|

| Breakup by Location |

|

| Breakup by Major cities |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share