Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The India facility management (FM) market was valued at USD 3.14 Billion in 2025. The market is expected to grow at a CAGR of 10.49% during the forecast period of 2026-2035 to reach a value of USD 8.51 Billion by 2035.

The Indian facility management market is driven by the rapid rise of integrated township projects, which demand bundled services like security, landscaping, waste management, and maintenance, thus creating steady, long-term contracts and boosting demand for organized facility management providers. Furthermore, the country’s strong infrastructure drive with the Smart Cities Mission pushing for advanced, tech-enabled services across public and private assets, has fuelled heavy demand. Government initiatives like Gati Shakti and Make in India are fuelling expansion in logistics parks, manufacturing units, and Special Economic Zones (SEZs) all requiring structured FM services.

The India facility management market is shifting towards outcome-based models. Clients now demand KPIs on energy efficiency, turnaround time, and predictive maintenance. Notably, the Bureau of Energy Efficiency's PAT (Perform, Achieve, Trade) scheme has prompted facility managers towards integrating energy auditing and management systems. AI-driven asset monitoring, IoT-powered HVAC controls, and sensor-based waste segregation have become basic offerings. For example, Delhi International Airport has adopted integrated FM with real-time monitoring of utility usage and waste flow, boosting sustainability metrics significantly.

At the enterprise level, demand for integrated facility management (IFM) is witnessing traction among IT parks, BFSI, and large-scale industrial setups. Meanwhile, startups like Facilio and Enviro are deploying cloud-based platforms for real-time facilities command centres. The market is evolving past labour-heavy contracts to technology-augmented, compliance-led operations. As India pushes for a USD 5 trillion economy, facility management is expected to play a pivotal role in ensuring scalable and sustainable built environments.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

10.49%

Value in USD Billion

2026-2035

*this image is indicative*

Technology is transforming traditional FM into a data-rich, insight-led operation. Adoption of IoT, AI, and automation is enabling proactive maintenance, resource tracking, and reduced energy usage, boosting the India facility management market dynamics. Infosys' Pune campus, for instance, uses predictive maintenance through AI-powered sensors to reduce HVAC failures. Startups like Smarten Spaces and Falcon Smart are offering integrated dashboards that allow centralised command over multi-site facilities. These tools are increasingly preferred for meeting SLAs and ESG goals. The Ministry of Power's Energy Efficiency Services Limited (EESL) is actively collaborating with FM firms to deploy energy-saving devices across government and commercial buildings.

Environmental sustainability has become a contract prerequisite. Large facilities are under pressure to reduce their carbon footprint and prove compliance with ESG standards. The India Cooling Action Plan (ICAP), launched by MoEFCC, is driving facility operators to adopt green cooling and HVAC retrofits, boosting the India facility management market trends and dynamics. Godrej & Boyce, for example, upgraded its manufacturing units with smart meters and solar integration, reducing energy cost by a significant extent. LEED and GRIHA certifications are becoming default targets. FM service providers are using green chemicals, biodegradable consumables, and rainwater harvesting systems to align with client sustainability frameworks.

The hybrid working model has made space optimisation a critical FM function. Businesses are redesigning real estate to support rotating teams, requiring flexible cleaning, occupancy analytics, and smart security. Companies in the India facility management market like JLL India have introduced hot-desking support, contactless access, and digital concierge services. This shift is also increasing demand for mobile-based incident reporting, tenant experience platforms, and workspace reservation tools. In cities like Bengaluru and Hyderabad, co-working spaces are contracting tech-heavy FM services to improve operational transparency.

With India’s infrastructure pipeline touching nearly USD 1.5 trillion under the National Infrastructure Pipeline (NIP), demand for structured FM in public assets is booming. Airports, railways, and metro hubs require high-compliance and tech-integrated solutions, accelerating the growth of the Indian facility management market. Smart streetlighting and digital signages under AMRUT 2.0 require remote facility monitoring. Urban civic bodies are also outsourcing FM for cleanliness, CCTV upkeep, and e-waste handling. Private players like Voltas and Sodexo are winning contracts by showcasing automated, low-cost models tailored for large-scale public infrastructure.

A visible trend in the India facility management market is the shift toward asset-light FM contracts where clients outsource manpower and end-to-end responsibility. This includes inventory ownership, service design, and tech stack deployment. Facility managers are also offering on-demand FM models, particularly in malls and hospitals, where service load fluctuates. Players like Quess Corp are piloting subscription-based FM offerings that bundle maintenance, hygiene, and compliance audits. For startups and SMEs, this model reduces CAPEX while improving service predictability.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “India Facility Management Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Services

Key Insight: The India facility management market, by service segmentation includes soft services, technical services, pest control, support services, security, cleaning, hospitality, and niche tasks under ‘others’ section. While soft services dominate the industry due to scale and frequency, technical services are gaining momentum owing to automation, net-zero goals, and real-time monitoring needs. Pest control is evolving with eco-friendly chemicals and digital mapping, while security is adopting AI surveillance and remote guarding. Hospitality-linked services are growing their shares in premium commercial realty. The ‘others’ category includes façade cleaning, indoor air quality audits, and smart parking management, gaining traction among ESG-conscious property developers.

Market Breakup by Sector

Key Insight: The facility management market in India is broadly split into organised and unorganised providers. Organised players dominate the industry in urban and industrial hubs due to regulatory demands, while the unorganised sector thrives in informal housing and rural belts. Organised FM firms excel in automation, ESG alignment, and SLA governance. Unorganised providers, though fragmented, are innovating through affordable digital tools and localised solutions. Formal vendors are entering untapped regions while informal ones are becoming more compliant, and skill focused.

Market Breakup by Spending Pattern

Key Insight: As per the India facility management market report, the spending pattern segmentation is split between outsourced and in-house models. Outsourced FM leads the market due to flexibility, expertise, and technology integration, while in-house management is growing among clients valuing control and customisation. Outsourced partners offer bundled services with SLA commitments, ideal for scalable enterprises. In contrast, in-house FM is becoming more efficient due to tools like CAFM and better-trained teams. A hybrid model is gaining preference, where organisations outsource certain roles while retaining others for core oversight.

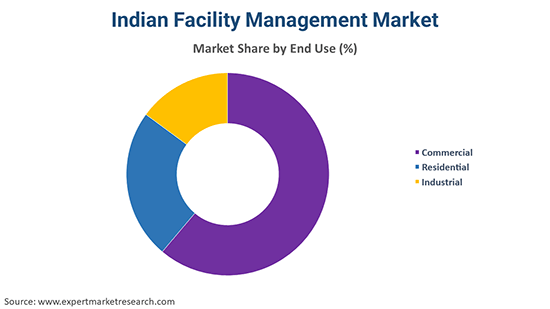

Market Breakup by End Use

Key Insight: The India facility management industry spans across commercial, residential, and industrial end users. While commercial spaces dominate the market due to high compliance and continuous usage, residential FM is growing with urban housing and premium apartment demand. Industrial FM focuses on uptime and statutory compliance. Commercial clients look for technology integration and SLAs, while residential societies seek affordability, app-based service tracking, and reliability. FM players are segmenting offerings to suit end-user priorities including custom dashboards for office campuses, sustainability audits for factories, and community management tools for residential spaces.

Market Breakup by Region

Key Insight: South India leads the facility management industry, driven by a strong technology-oriented client base and proactive regional policy support, while East India is emerging with new infrastructure needs. North India, with cities like Delhi and Lucknow, experiences steady FM usage in government and real estate sectors. Western zones, including Gujarat and Maharashtra witness growing FM demand from financial sectors.

By Services, the Soft Services Segment Accounts for the Largest Share of the Market

Soft services, including cleaning, security, and landscaping, hold the largest share in the India facility management market. These services remain essential across commercial, retail, and residential setups. With rising expectations on hygiene and touchpoint sanitisation post 2020, the soft services are evolving. Companies like BVG India now use robotic sweepers and UV-based disinfection tools in malls and airports. Soft services are also gaining technology augmentation through workforce tracking apps and customer feedback analytics. Integration of biometric attendance, AI-based patrolling, and robotic floor cleaning are adding efficiency to traditionally labour-heavy operations.

Technical services, particularly those involving MEP (mechanical, electrical, plumbing) and HVAC systems, are growing rapidly due to the surge in automated buildings and energy-efficient retrofits. Facility managers in India are increasingly adopting IoT sensors and digital twins to maintain asset health in real time. IT parks, pharma labs, and data centres are contracting players for uptime-focused SLAs. For instance, Capgemini’s offices in India now feature centralised energy monitoring through FM partners.

By Sector, the Organised Segment Registers the Maximum Share of the Market

The organised sector significantly boosts the India facility management market revenue growth due to rising formalisation, FDI inflows, and regulatory pressure. Large enterprises, SEZs, and government facilities prefer vendors with ISO, OHSAS, and ESG certifications. Organised firms offer better technology integration, SLA adherence, and compliance support. Players like Dusters Total Solutions provide custom tech dashboards and trained staff for diverse industry needs. Organised FM services also enable data traceability and faster incident closure, attracting B2B clients.

Despite lower revenue share, the unorganised sector is growing fast in Tier-2 and Tier-3 cities. Here, cost-sensitive clients prefer local vendors for basic FM tasks like cleaning and security. On the other hand, micro facility management providers in India are adopting mobile attendance apps, WhatsApp-based work orders, and low-cost automation to meet SME client demands. Startups like UrbanClap (now Urban Company) offer semi-formal FM packages to housing societies and small offices. Skill India and PMKVY are also upskilling FM staff, which is slowly upgrading vendor offerings in the informal sector.

By Spending Pattern, the Outsourced Category Clocks in Maximum Share of the Market

Outsourced facility management continues to dominate in India due to its scalability, cost predictability, and access to expertise. Large corporations, co-working spaces, and industrial zones now prefer outsourcing for functions like MEP servicing, cleaning, and integrated security. FM partners bring specialised tools, technology platforms, and trained personnel, reducing the in-house burden, boosting the overall facility management demand in India. Companies like Infosys and HCL outsource critical maintenance and compliance functions across campuses. Outsourcing also allows easier SLA enforcement and quick vendor replacement.

In-house facility management market in India is witnessing rapid resurgence, especially among premium residential complexes, healthcare institutions, and government buildings. The trend is driven by a desire for tighter control, data privacy, and alignment with internal SOPs. Gated communities in Delhi NCR and Mumbai now hire FM teams directly to ensure service consistency. Government PSUs have also begun in-house FM sourcing to align with internal HR policies and reduce dependency on vendors. Technologies such as CAFM platforms and mobile work order systems are enabling efficient in-house execution.

By End Use, the Commercial Segment Secures a Substantial Share of the Market

The commercial segment serves as the core driving factor of the India facility management market development. Corporates demand end-to-end services, from HVAC maintenance to robotic cleaning and contactless visitor management. Firms like Colliers and CBRE provide bundled FM offerings pan-India. Energy audits, workspace hygiene, and green certifications are increasingly embedded in commercial FM contracts. Moreover, BFSI and IT sectors expect zero downtime and predictive analytics. The REIT boom is also fuelling demand for compliant, high-uptime facility services. FM vendors now provide tenant engagement platforms and AI-based energy optimisation as standard in commercial engagements.

The residential segment is witnessing sharp growth in the India facility management market, driven by urbanisation and premium gated communities. High-rise societies in Mumbai, Bengaluru, and Pune are now demanding tech-enabled services, ranging from app-based complaint redressals to CCTV-integrated visitor tracking. Builders are collaborating with FM firms during the pre-handover phase itself, ensuring better asset lifecycle management. Platforms like MyGate and ApnaComplex are enabling FM through resident apps, payment dashboards, and digital circulars.

The Southern Region Holds the Leading Position in the Market

South India leads in facility management adoption, particularly in cities like Bengaluru, Hyderabad, and Chennai. These hubs are home to IT campuses, industrial parks, and large-format retail, all requiring full-spectrum FM services. The region also witnesses early adoption of technology like smart metering and AI surveillance. Karnataka’s state policies actively support digitised FM for public infrastructure. Tamil Nadu’s Smart City projects, especially in Coimbatore and Madurai, are expanding outsourced FM contracts for civic services. Moreover, Chennai’s port-based economy drives demand for MEP-heavy FM in logistics.

East India is fast gaining momentum in the facility management market. Tier-2 cities like Bhubaneswar, Ranchi, and Guwahati are witnessing infrastructure upgrades under schemes like Smart Cities Mission and AMRUT. These are opening new opportunities for FM players in government, healthcare, and hospitality sectors. Kolkata, in particular, is seeing a spike in demand for green-certified FM solutions across offices and hotels. The surge in warehousing around Odisha and Jharkhand is creating need for tech-enabled FM with safety and fire compliance.

Leading India facility management market players are focusing on technology integration, ESG alignment, and sector-specific expertise. There has been a noticeable shift from labour-centric models to outcome-based contracts, where uptime, energy savings, and tenant satisfaction matter most. Many players now invest in CAFM systems, robotic automation, and predictive maintenance platforms to improve service efficiency. For example, real-time dashboards, mobile ticketing, and SLA compliance alerts are becoming standard. Emerging opportunities lie in Tier-2 cities, affordable housing, healthcare infrastructure, and green-certified buildings. India facility management companies are also offering value-added services like energy benchmarking, IAQ (Indoor Air Quality) testing, and e-waste handling to stand out. Some are building modular FM solutions for startups, hospitality chains, and warehousing units. The integration of BMS (Building Management Systems) with AI analytics is becoming a key focus area. Partnerships with Proptech firms and energy auditors are helping FM companies expand their relevance beyond maintenance.

Dusters Total Solutions Services Pvt. Ltd., established in 1994 and headquartered in Bengaluru, caters to diverse sectors such as IT, hospitality, and retail by offering integrated FM solutions. The company combines traditional manpower services with smart technologies like CAFM (Computer-Aided Facility Management) and app-based workforce management. Their IFM model includes housekeeping, landscaping, and MEP services, helping large enterprises meet compliance and sustainability benchmarks while enhancing efficiency across multi-location assets.

BVG India Limited, founded in 1993 and based in Pune, is one of the largest FM providers in India, serving government buildings, industrial plants, and hospitals. The company is known for its wide-ranging offerings including mechanical maintenance, horticulture, fire safety, and emergency management. BVG integrates automation and AI tools to improve operational consistency and reduce energy use.

CLR Facility Services Pvt. Ltd., headquartered in Pune and established in 2007, offers tailored FM services to sectors like BFSI, education, and pharma. Their strength lies in technical services, with a focus on energy-efficient building management, HVAC optimisation, and water treatment. CLR also runs employee skilling programmes in collaboration with NSDC to meet the demand for certified FM professionals.

Orion Security Solutions Pvt. Ltd., founded in 2005, specialises in manned guarding and electronic surveillance solutions. It caters primarily to commercial complexes, infrastructure projects, and government facilities. Orion integrates AI-driven analytics and facial recognition into its security services, enhancing real-time risk detection and incident response. The firm also offers smart visitor management and drone surveillance.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the market are CSK Facility Management Pvt. Ltd., Checkmate Group, ISS Facility Services India Pvt. Ltd., Handiman Services Limited, A La Concierge Services Pvt. Ltd., UrbanClap Technologies India Pvt Ltd., and HouseJoy, among others.

Explore the latest trends shaping the India Facility Management Market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customized consultation on India Facility Management Market trends 2026.

United Kingdom Facility Management Market

North America Facility Management Market

United States Facility Management Market

South Korea Facility Management Market

Argentina Facility Management Market

Australia Facility Management Market

ASEAN Facility Management Market

Europe Facility Management Market

Chile Facility Management Market

Facility Management Market

India Landscaping Services Market

India Building Automation Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 10.49% between 2026 and 2035.

Key strategies driving the market include adopting tech-integrated service models, prioritising ESG KPIs, upskilling staff, redesigning procurement for outcomes, and fostering public-private alliances to scale FM across smart cities, industrial corridors, and infrastructure assets.

The key challenges are labour dependency, fragmented regulations, underpriced bidding, slow tech adoption in Tier-2 markets, and resistance to value-based contracts, impacting service quality, compliance, and long-term digital transformation efforts.

The major regional markets are North, South, West and East India.

The major services of facility management in the Indian market are soft services, technical services, pest management services, support service, cleaning, security, and hospitality, among others.

The significant sectors of facility management considered in the market report include organised sector and unorganised sector.

In-house and outsourced are the various spending patterns considered in the market report.

The several end uses of facility management are commercial, residential, and industrial.

The major players in the market are Dusters Total Solutions Services Pvt. Ltd., BVG India Limited, CLR Facility Services Pvt. Ltd., Orion Security Solutions Pvt. Ltd., CSK Facility Management Pvt. Ltd., Checkmate Group, ISS Facility Services India Pvt. Ltd., Handiman Services Limited, A La Concierge Services Pvt. Ltd., UrbanClap Technologies India Pvt Ltd., and HouseJoy, among others.

In 2025, the India facility management market reached an approximate value of USD 3.14 Billion.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Services |

|

| Breakup by Sector |

|

| Breakup by Spending Pattern |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share