Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Indonesia cold chain logistics market size reached a value of nearly USD 5.57 Billion in 2025. The market is projected to grow at a CAGR of 9.60% between 2026 and 2035 to reach around USD 13.93 Billion by 2035.

Base Year

Historical Period

Forecast Period

The demand for cold chain logistics is rising in Indonesia as a result of the country's expanding demand for processed food and fish, drugs, and pharmaceuticals.

PT. Dua Putera Perkasa, MGM Bosco Logistics, and PT Sukanda Djaya are a few of the major companies in the market.

The expansion of retail and restaurant chains across Indonesia is positively impacting the cold chain sector.

Compound Annual Growth Rate

9.6%

Value in USD Billion

2026-2035

*this image is indicative*

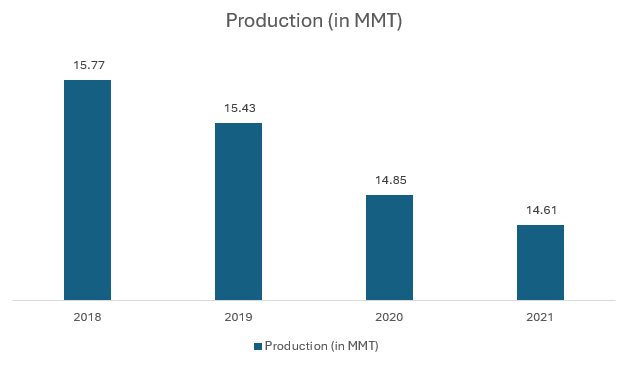

Indonesia has an abundance of fish reserves due to its archipelagic location. The total surface area of Indonesia's 411 marine protected areas, which include parks, reserves, and marine conservation zones, is 284,100 square kilometres. The developing fisheries sector is supporting the market for cold chain logistics for efficient and reliable transportation of fish to different regions across the country.

One of the factors driving the Indonesia cold chain logistics market growth is the country's expanding demand for processed food. The rise in the number of refrigerated warehouses, spurred on by the country's growing perishables demand, is one of the key market trends.

Figure: Aquaculture Production in Indonesia, in MMT (2018-2021)

Necessitates the requirement of compliant handling and a professional distribution network to ensure the safe delivery of products.

An increasing demand for meat products, fish, seafood, and vegetables, fuelled by economic growth, contributes to the need for efficient storage and transport.

Digitisation and adoption of IoT in the cold chain logistics sector can significantly enhance the monitoring and handling of products.

The country’s logistics sector constitutes shipping and international freight forwarders. As a result, there is a growing need for refrigerated vehicles within the logistics sector.

The rising adoption of online grocery and food delivery, fuelled by the expanding e-commerce along with the developing pharmaceutical sector, is contributing to growth in the cold chain logistics sector in Indonesia.

In 2021, with a market capitalisation of USD 24.3 billion, Indonesia was the largest foodservice market in Southeast Asia. In Indonesia, KFC, McDonald's, and Pizza Hut are the three largest multinational fast-food brands operating in the foodservice industry. In order to guarantee the safe delivery of goods at their intended locations, the growth of restaurant chains and the existence of several retail network outlets dispersed across different places mandate the need for compliant handling and a professional distribution network.

Furthermore, the rising adoption of online grocery and food delivery, fuelled by the expanding e-commerce, along with the developing pharmaceutical sector, is contributing to the Indonesia cold chain logistics market growth. With an e-commerce business revenue of USD 51.9 billion in 2022, Indonesia ranked first among the ASEAN countries with 52% stake in total.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Indonesia Cold Chain Logistics Market Report and Forecast 2026-2035 offers a detailed analysis of the market based on the following segments:

Market Breakup by Business Type

Breakup by Temperature

Market Breakup by Technology

Market Breakup by End-Use

Cold storage is expected to hold a significant market share due to the rising number of online orders and transactions in the food and beverages sector.

Cold storage dominates the Indonesia cold chain logistics market share. This can be attributed to the expanding fisheries sector in Indonesia, which is driving the need for more cold storage facilities to prolong the shelf life of products. Fish available for consumption was 35.26 kg/capita in 2021, and the fishing sector contributed 2.77 per cent of the country's GDP.

Meanwhile, the robustly growing chemicals, pharmaceuticals, and foods and beverages, among others, are surging the demand for cold chain transport solutions. Key players are adopting innovative technologies that can identify potential issues, enable data-driven decision-making, and drive traceability and transparency, further enhancing the efficiency of cold chain transport.

The adoption of air-blown storage is significantly increasing due to its precision, low operating costs, and energy efficiency

Air-blown storage is widely used as it increases the speed of air generated from airblown systems, which makes them effective in cooling, cleaning, blowing off, and removing or regulating moisture in the cold chain. The precision, energy efficiency and low operating costs offered by air-blown technology are driving its adoption in the food and beverage sector for cooling purposes.

The meat, fish, and seafood sector dominates the Indonesia cold chain logistics market share

The meat, fish and seafood sector dominates the market as the country is a major exporter of fish. Further, high domestic consumption of fish also aids the demand for cold chains. According to industry reports, in 2022, Indonesia’s fishery and marine exports reached a value of USD 5.71 billion.

Meanwhile, in the bakery and confectionery sector, cold chain logistics is essential to ensure the safety, optimal quality, and freshness of baked goods. Cold chain management is also integral to ensuring safety and compliance, customer trust, maintaining consistent quality, and extending shelf life.

Operates a cutting-edge cold storage warehouse in the Cipendawa industrial area. Outfitted with advanced technology, the company’s facility maintains temperatures as low as -25 degrees Celsius.

Offers a strong infrastructure to tackle cold chain logistics hurdles, encompassing refrigerated warehouses and a fleet of over 940 refrigerated trucks furnished with GPS.

Sources products globally and efficiently distributes them across 18 direct and 18 indirect distribution points.

Furnishes a range of supply chain solutions, spanning from transportation and storage to intricate operations, delivering end-to-end resolutions to distinct industry needs.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the Indonesia cold chain logistics market include CKL Indonesia Raya (CKL Cargo), YCH Group, TITAN Containers A/S, and PT Perintis Sempurna Bersama (Coldspace), among others.

Cell and Gene Therapy Cold Chain Logistics Market

United Kingdom Cold Chain Logistics Market

Saudi Arabia Cold Chain Logistics Market

Australia Cold Chain Logistics Market

Peru Cold Chain Logistics Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market value was approximately USD 5.57 Billion.

The global market is projected to grow at a CAGR of 9.60% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach around USD 13.93 Billion by 2035.

The major drivers include the expansion of retail and restaurant chains, increasing demand for processed food, and technological advancements.

The key trends include the expansion of multinational fast-food brands in the foodservice sector and the rising adoption of online grocery and food delivery.

The different business types include cold storage and cold chain transport.

The major end users of cold chain logistics include fruits and vegetables, meat, fish, and sea food, bakery and confectionery, dairy and frozen desserts, and drugs and pharmaceuticals, among others.

The major players in the market include PT Dua Putra Perkasa Pratama, PT Mulia Bosco Logistik (MGM Bosco Logistics), PT Sukanda Djaya, Kiat Ananda Group, CKL Indonesia Raya (CKL Cargo), YCH Group, TITAN Containers A/S, and PT Perintis Sempurna Bersama (Coldspace), among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Business Type |

|

| Breakup by Temperature |

|

| Breakup by Technology |

|

| Breakup by End-Use |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share