Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global industrial filtration market size was valued at USD 42074.60 Million in 2025. The industry is expected to grow at a CAGR of 4.63% during the forecast period of 2026-2035. The market is driven by the global industrial growth and stringent environmental regulations. These sectors are the key drivers of the global industrial filtration market, thus aiding the market to attain a valuation of USD 66157.98 Million by 2035.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

4.63%

Value in USD Million

2026-2035

*this image is indicative*

| Global Industrial Filtration Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 42074.60 |

| Market Size 2035 | USD Million | 66157.98 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.63% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 7.0% |

| CAGR 2026-2035 - Market by Country | India | 8.1% |

| CAGR 2026-2035 - Market by Country | China | 6.7% |

| CAGR 2026-2035 - Market by Type | Air | 6.8% |

| CAGR 2026-2035 - Market by Filter Media | Activated Carbon/Charcoal | 7.2% |

| Market Share by Country 2025 | France | 3.0% |

The global industrial filtration market continues to grow due to the expansion of manufacturing in emerging economies and other sectors such as chemicals, pharmaceuticals, food and beverage, oil and gas, and automotive.

The increasing adoption of advanced filtration technologies, including nanofiltration and ultrafiltration, is transforming industrial filtration by offering higher efficiency, improved contaminant removal, and enhanced sustainability. These technologies enable precise separation of particles, bacteria, and dissolved solids, making them ideal for applications in water treatment, pharmaceuticals, food and beverage processing, and chemical manufacturing. Furthermore, the growth of manufacturing in emerging economies is increasing the demand for industrial filtration systems to ensure efficiency and prevent contamination.

The IMF’s projection of a 3.3% global growth in 2025 and 2026 indicates an expanding industrial sector. This growth will likely drive the demand for global industrial filtration solutions, as industries seek to enhance efficiency, meet environmental standards, and manage the rising need for pollution control amid higher production activities.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The global industrial filtration market development is supported by the expansion in automotive manufacturing, food and beverages sector and chemical sector.

With global chemical production expected to grow by 3.5% in 2025, there will be an increasing demand for efficient filtration systems to manage the rising production volumes and meet stringent environmental standards. This growth presents a significant opportunity for the industrial filtration demand to provide advanced filtration solutions that support the chemical industry's need for enhanced process efficiency, waste management, and regulatory compliance.

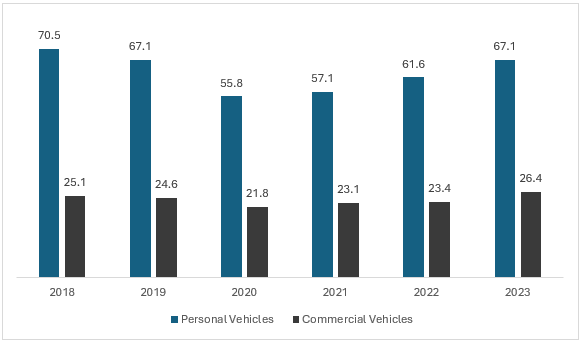

The surge in automotive production creates a greater demand for industrial filtration systems to maintain production efficiency, control emissions, and meet environmental standards. The global automotive production witnessed a 10% increase in 2023 as compared to 2022, accounting for a total production of 93.5 million units globally, highlighting significant growth in the automotive sector.

Figure: Global Automotive Manufacturing (in Million Units), 2018-2023

Technological advances, extensive application in end use sectors, and regulatory compliance drive the growth of global industrial filtration market.

The expansion of manufacturing in emerging economies is driving a surge in demand for industrial filtration systems, as industries prioritize operational efficiency, regulatory compliance, and contamination control. Rapid industrialization in sectors such as food and beverage, pharmaceuticals, chemicals, automotive, and electronics is increasing the need for high-performance filtration solutions to maintain product purity, equipment longevity, and workplace safety.

Growing adoption of advanced filtration technologies like nanofiltration and ultrafiltration coupled with the introduction of self-cleaning filters that boosts efficiency are making these solutions appealing to industries.

The top 10 oil producers in 2023, led by the United States, Saudi Arabia, and Russia, accounted for 73% of global oil output, reflecting strong growth in the energy sector. As oil production expands, the need for industrial filtration systems rises to support efficient extraction, processing, and refining operations. This increasing demand creates significant opportunities for the global industrial filtration market, as industries seek advanced filtration solutions to enhance operational efficiency, equipment longevity, and environmental compliance in the energy sector.

The industrial filtration market analysis observes an increasing demand for sustainable, biodegradable, and recyclable materials. Coverage of all environmental impacts such as the utilization of renewable resources to create filters has gained attention from the production field. Companies like Pall Corporation are increasingly integrating eco-friendly materials into their filtration systems. The trend is well established, particularly in regions with a focus on food and beverage and pharmaceuticals, where along with filtration efficiency, sustainable practices are relevant.

Rising industrialisation in emerging markets is driving the demand for advanced filtration systems as manufacturing industries grow and need to maintain production efficiency while complying with environmental regulations. This is supported by the fact that World Industrial Production (IP) growth accelerated to 2.0% in 2024, compared to 0.9% in 2023, with 3.3% growth in emerging market and developing economies (EMDEs).

Advancements in filtration technologies create opportunities to enhance product offerings and performance. In 2023, K&N Engineering launched a new industrial group offering high-performance, sustainable air filtration solutions for data centers and critical infrastructure. Their reusable air filters reduce costs, lower energy consumption, and provide significant sustainability benefits.

Sustainability has become a key factor driving the demand for industrial filtration products. Companies are increasingly looking for solutions that can help minimise their environmental footprint. Filtration systems that reduce water wastage, improve energy efficiency, and reduce harmful emissions present significant growth opportunities in the market. For instance, Dupure is leading the way by using durable, recyclable, and eco-friendly materials in their filtration systems, meeting the growing demand for sustainable solutions.

Global industrial filtration market challenges include high energy consumption and supply chain disruption.

As industries face increasingly stringent environmental regulations, the need to reduce environmental impact has become more critical. Traditional industrial air filtration systems, however, have often been energy-intensive, leading to higher operational costs and a larger carbon footprint. This presents a challenge for companies striving to meet environmental standards while maintaining efficiency and reducing costs.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

“Industrial Filtration Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of type, the market can be divided into the following:

On the basis of filter media, the market can be divided into the following:

On the basis of product, the market can be divided into the following:

On the basis of application, the market can be divided into the following:

Based on region, the market can be segregated into:

Market Analysis by Type

Industrial air filtration is set to witness significant growth driven by sectors like manufacturing, automotive, and HVAC. The automotive sector, in particular experienced a 10% year-on-year growth in motor vehicle production in 2023, highlighting the rising demand for efficient and cleaner technologies. This growth in the automotive sector is expected to further drive the need for advanced air filtration solutions, supporting the overall market expansion.

Market Analysis by Filter Media

Non woven fabric is set to witness significant growth in the global industrial filtration market. Nonwoven technology has significantly enhanced the characteristics of technical textiles in recent years, improving durability, breathability, water repellency, fire retardancy, antimicrobial properties, and barrier performance. In 2023, the production capacity of nonwovens in North America reached 5.713 million tons, marking a 4 % increase or 230,000 tons compared to the previous year, according to a report by the Association of the Nonwovens Fabrics Industry.

Market Analysis by Product

Cartridge filter segment led the global industrial filtration market by product. Cartridge filters are essential for dust collection in industries like sandblasting, food processing, cattle feed handling, welding, pigments, chemicals, and engineering workshops.

Cartridge filters have advantages such as enhanced visibility, maintaining air quality, preventing contamination, and ensuring compliance with safety and hygiene standards.

Market Analysis by Application

The automotive industry relies on filtration to protect equipment, tools, and machinery from contaminants in fluids and gases, ensuring optimal performance and longevity. High-quality industrial filters are essential for maintaining clean systems, preventing damage, and supporting efficient operations across various automotive applications.

North America Industrial Filtration Market Dynamics

Industrial filtration is gaining traction in the North American industrial filtration market due to strict air quality standard in this region. In 2024, the U.S. EPA lowered the PM2.5 annual limit to 9 µg/m³, while Canada maintains stricter CAAQS limits of 8.8 µg/m³ annually and 27 µg/m³ over 24 hours. These regulations are driving higher demand for industrial filtration in North America.

| CAGR 2026-2035 - Market by | Country |

| India | 8.1% |

| China | 6.7% |

| UK | 5.6% |

| USA | 5.4% |

| Australia | 4.8% |

| Canada | XX% |

| Germany | XX% |

| France | XX% |

| Italy | 4.3% |

| Japan | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Europe Industrial Filtration Market Dynamics

The Europe industrial filtration market is expanding due to tightened government regulations. A revised Industrial Emissions Directive implemented in 2024 strengthened air quality regulations, targeting a 40% decrease in key pollutants by 2050. This shift, affecting 75,000 industrial installations, is driving growth in the industrial filtration market as industries work to comply with stricter standards.

Strict air quality standards in Germany drive demand for high-efficiency filtration solutions, reflected in recent partnerships. Germany's Mann+Hummel invested in M-Filter Group in 2023, enhancing its offerings in HEPA filters, oil/hydraulic filters, and air ventilation solutions for industrial applications.

Asia Pacific Industrial Filtration Market Opportunities

The Asia Pacific industrial filtration market is expanding due to the growth in industrial manufacturing. The region is home to major and emerging manufacturing hubs like China, India, Indonesia, and Thailand. Its cumulative value-added manufacturing grew from USD 4.61 trillion in 2018 to USD 5.50 trillion in 2023 at a CAGR of 3.59% reflects the increasing demand for industrial filters.

Foreign companies are investing in China's industrial sector, bringing in advanced technologies. For example, OFI Filters opened a green technology factory in Jiaxing, Zhejiang Province. UFI GREEN will develop advanced thermal management systems and filtration media for electric vehicles, home appliances, and industrial filtration.

Latin America Industrial Filtration Market Insights

The Latin America industrial filtration market is gaining traction due to rapid expansion in oil and mining activities. In 2024, ECLAC reported a 15.6% rise in Venezuelan crude oil production and increased offshore drilling in Brazil and Guyana. Additionally, mining and oil exports grew by 5% in 2024, boosting demand for industrial filtration in processing, emissions, air, and water treatment.

Middle East and Africa Industrial Filtration Market Drivers

The Middle East and Africa industrial filtration market is driven by rise in value–added manufacturing in this region. The rise in the value-added manufacturing in the Middle East and North Africa (MENA), from USD 387.63 billion in 2020 to USD 540.41 billion in 2023, indicates rapid industrial growth. This surge in manufacturing is driving the demand for industrial filtration solutions.

Saudi government initiatives like NIDLP is likely to boost Saudi Arabia’s industrial growth by investing in mining, energy, and logistics, aiding the demand for industrial filtration.

The global industrial filtration market players are concentrating in technological advancement, and partnerships to gain competitive edge.

Founded in 1984, headquartered in the United States, the company is dedicated to enhancing the quality of life for billions of people today, while laying the groundwork for a healthier and more sustainable future. The company provides a wide range of industrial filtration products under its renowned brand, Pall Corporation, catering to various verticals such as Aerospace and Defense, Chemicals & Polymers, Food & Beverage, Industrial Manufacturing,, Microelectronics, Oil & Gas, and Power Generation.

Founded in 1917, headquartered in the United States, the company is dedicated to addressing unsolved problems and making a positive impact on people's lives. The company provides a variety of industrial filtration products for industries such as industrial and chemical processing, oil and gas, power generation and renewable energy, electronics and semiconductors, and healthcare and life sciences.

Founded in 1911, headquartered in Ireland, Eaton is a leading power management company focused on enhancing quality of life and protecting the environment globally. The company is committed to sustainable operations and helping customers manage power efficiently. The company offers a variety of Industrial, Hydraulic and Life Science Filtration Solutions.

Founded in 1915, headquartered in the United States, E Donaldson Company is a global leader in the filtration industry, providing advanced solutions for complex filtration and contamination control challenges. The company offers provides a variety of industrial filtraers for different industries.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the global industrial filtration market are Alfa Laval AB, Atmus Filtration Technologies Inc., Pentair PLC, and Filtcare Technology Pvt. Ltd.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The industrial filtration market is assessed to grow at a CAGR of 4.63% between 2026 and 2035.

The major market drivers include increasing industrialisation in developing countries and growing focus towards air quality.

The key trends of the market include stringent laws by various governments, rising importance of health of workers and surroundings, and technological advancements in industrial filtration.

The significant types of industrial filtration in the market are liquid and air.

The major applications of industrial filtration in the market are automotive, food and beverage, chemicals and petrochemicals, pharmaceuticals, power generation, oil and gas, HVAC, and metal and mining, among others.

The different filter media of industrial filtration include filter paper, metal, activated carbon/charcoal, fiberglass, membrane, and non-woven fabric, among others.

The major regions in the market include North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

The various products of industrial filtration in the market are bag filter, cartridge filter, depth filter, filter press, drum filter, electrostatic precipitator, ULPA, and HEPA, among others.

The key global industrial filtration market players, according to the report, are Danaher Corporation, Parker Hannifin Corp., Eaton Corporation Plc, Donaldson Company, Inc., Alfa Laval AB, Atmus Filtration Technologies Inc., Pentair PLC, and Filtcare Technology Pvt. Ltd., among others.

In 2025, the global industrial filtration market reached an approximate value of USD 42074.60 Million.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 66157.98 Million by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Type |

|

| Breakup by Filter Media |

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share