Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global lactose market attained a value of USD 1.90 Billion in 2025. The market is further expected to grow in the forecast period of 2026-2035 at a CAGR of 3.60%, to reach USD 2.71 Billion by 2035.

Base Year

Historical Period

Forecast Period

As per industry reports, an estimated 70-75% of the world's population is lactose deficient, indicating a potential for market growth.

Surging demand for infant-grade and food-grade lactose, especially from developing countries like China is driving lactose market.

The USDA Dairy Data shows that per capita milk availability has been increasing in many states in India, indicating growing domestic consumption of dairy products and their byproducts like lactose.

Compound Annual Growth Rate

3.6%

Value in USD Billion

2026-2035

*this image is indicative*

Lactose, composed of glucose and galactose, is a by-product of cheese. When cheese is manufactured, the liquid whey gets separated, which is further evaporated and processed to obtain crystalline lactose. Several dairy products like cheese, butter, milk, and cream contain lactose. However, human breast milk has the highest concentrations of lactose. Commercially, lactose is produced in various purity ranges and colours, with each variant having specific characteristic properties.

The growing pharmaceutical sector in developing countries, particularly in Asia, is a significant factor fuelling lactose market expansion. Additionally, the increasing demand for lactose in food processing and infant formula manufacturing, particularly in major dairy-producing countries, is contributing to the market growth. Furthermore, the rising demand for food and infant-grade lactose from these countries is also boosting the growth of the market.

Increasing demand for refined-edible grade lactose, rising demand for infant formula, and increasing consumption for dairy products are factors shaping the lactose market outlook

The rising demand for refined-edible grade lactose is expected to aid the market growth in the forecast period due to the stringent guidelines regarding purity level of lactose in industries like pharmaceuticals. New innovations like dry-blend infant-grade lactose are also expected to contribute to segment’s growth.

The lactose market growth is also driven by the growing demand for infant formula among parents and declining rates of breastfeeding. Companies like Abbott and Mead Johnson are expanding their infant formula offerings to cater to the growing demand for lactose-based infant formula.

The pharmaceutical industry is driving the demand for lactose as an excipient in the production of antibiotics and painkillers. Approximately 60%–70% of pharmaceutical dosage forms contain lactose, making it one of the most widely used pharmaceutical excipients.

The market’s expansion is being driven by the growing demand for infant formula across the globe. The declining breast-feeding rates and the increasing awareness regarding the importance of infant nutrition are driving the demand for infant formula.

Moreover, the increasing R&D activities and the new product launches by the leading players are expected to further boost the lactose market development. Lactalis Ingredients, a major player, entered the pharmaceutical industry in October 2023 by launching its sieved and milled lactose monohydrate range Lactalpha. This expanded the company's offerings for clinical, infant, and food applications.

Lactose intolerance, a common digestive condition, affects individuals who have difficulty digesting lactose, the sugar found in milk and dairy products. This intolerance drives demand for lactose-free alternatives in the global lactose market. Further, the increasing disposable incomes and the rising standards of living in developing nations are significantly contributing to the industry growth. Additionally, the growing pharmaceutical industry, coupled with the increasing demand for baked goods, confectionery, and dairy products is also boosting the industry growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Lactose Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

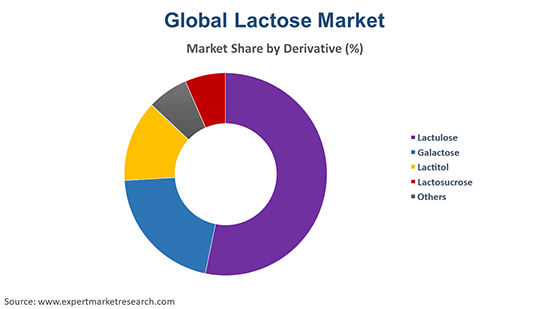

Market Breakup by Derivative

Market Breakup by Form

Market Breakup by End Use

Market Breakup by Region

Lactulose is the dominant derivative, driven by its widespread use in various applications

The lactulose segment dominates the market and is expected to continue its dominance due to its increasing use in various applications, particularly in the food and beverages industry where it is used as a sweetener and in the pharmaceutical industry where it is used as a laxative. Galactose is another significant derivative in the global lactose market, driven by its increasing use in various applications such as pharmaceuticals and cosmetics. In the cosmetics industry, it is used as a moisturiser.

Food and beverages segment holds a significant market share due to rising consumption of dairy products

The food segment is anticipated to grow at the fastest pace during the projected timeframe. This is due to the growing demand for dairy product standardisation by the food industry. The food industry has further accelerated lactose market development because demand for lactose has increased, driven by consumption of products like yoghurt, milk, cheese, butter, etc. The feed segment also has a substantial market share as lactose is used as an ingredient in pig feed and other animal feed products. The pharmaceutical industry also uses lactose as an excipient in the formulation of tablets and capsules.

North America leads the market due to its robust food, dairy, and pharmaceutical sectors

Geographically, North America is a significant region in the global market for lactose. The growth can be attributed to the increasing penetration of leading players, thriving food and beverages industry, and stringent food and safety regulations in the region. Moreover, the growing pharmaceutical industry is significantly contributing to the demand for refined-edible grade lactose, thus, further increasing the lactose market share in North America.

Meanwhile, the Asia Pacific is expected to witness a robust growth in the forecast period owing to the rapidly increasing demand for infant formula in countries like China and India. This can be attributed to the presence of a large population, rising awareness, and improving standards of living. Additionally, the increasing feed production in the region is also aiding the industry growth as lactose has applications in feed industry, especially as an ingredient for pig feed.

Market players are investing in research and development to enhance product quality and variety, as well as strategic partnerships to gain a competitive edge in the market

Fonterra Co-Operative Group Limited was founded in 2001 and its headquarters are in Auckland, New Zealand. Fonterra operates a fast-moving consumer goods business for dairy products and has several subsidiaries and joint-venture companies operating in markets around the world. The company's product portfolio includes milk, butter, cheese, and yoghurt.

Lactalis Group was founded in 1933 and is based in Mayenne, France. It is a dairy company known for its significant presence in the global dairy market. Lactalis has a range of brands, including Président, Galbani, and President, which are well-known for their cheese, milk, and other dairy products.

Kerry Group plc is an Irish food company that was founded in 1972. Its headquarters are in Tralee, Ireland. The company provides food ingredients, taste and nutrition solutions, and consumer foods to the food and beverage industry.

Agropur Cooperative was founded in 1938 and is headquartered in Quebec, Canada. The company operates through various brands and subsidiaries, focusing on quality and innovation in the dairy industry. Its product portfolio includes dairy products such as cheese, milk, and yoghurt.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other key players in the lactose market report include Royal FrieslandCampina and Arla Foods Amba, among others.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 3.60% between 2026 and 2035.

The major drivers of the market include the declining breast-feeding rates, increasing awareness regarding the importance of infant nutrition, growing pharmaceutical industry, and rising demand for baked goods.

Key trends aiding market expansion include the thriving dairy industry, the growing demand for infant formula, increasing research and development activities, and new product launches.

Regions considered in the market are North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa.

Based on derivative, the market is divided into lactulose, galactose, lactitol, and lactosucrose, among others.

The market is divided based on form into powder and granule.

The end-uses are food and beverages, confectionery, animal feed, pharmaceutical, and cosmetics, among others.

Key players in the market are Fonterra Co-Operative Group Limited, Lactalis Group, Royal FrieslandCampina, Kerry Group plc, Agropur Cooperative, and Arla Foods amba, among others.

In 2025, the lactose market reached an approximate value of USD 1.90 Billion.

The market is estimated to witness healthy growth in the forecast period of 2026-2035 to reach a value of around USD 2.71 Billion by 2035.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Derivative |

|

| Breakup by Form |

|

| Breakup by End Use |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share