Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The marine engine market size reached a value of approximately USD 15.02 Billion in 2025. The market is projected to grow at a CAGR of 3.60% between 2026 and 2035, reaching a value of around USD 21.39 Billion by 2035. The global market is witnessing significant growth, especially in the Asia Pacific region. Demand for both efficient and eco-friendly solutions is expected to result in significant growth in the marine engine market. Asia Pacific leads the way, capturing a significant share of the market. The sector is projected to grow even further amid innovations and increased maritime activities in the region.

Base Year

Historical Period

Forecast Period

According to BITRE, Australia's annual sea arrivals and departures are projected to increase from 40,000 to 50,000 by 2029-30.

According to SCIO, China's gross ocean product reached USD 1.31 trillion in 2022, constituting 7.8% of its GDP.

The National Marine Science Plan 2015-2025 outlined a goal for Australia's marine industry to generate USD 100 billion annually by 2025.

Both efficiency and environmental performance have greatly evolved in the marine engine market. Marine engines, which are generally heat engines, convert thermal energy into mechanical energy mostly by burning fuel. The engines drive all types of maritime vessels ranging from military boats, cruise ships and ferries, to small-scale fishing and government boats used in offshore operations. The need for reliable propulsion systems in marine transport is driving the demand for marine engines.

As climate change has gained more concerns in recent years with the ever-growing contribution of greenhouse gas (GHG) emissions, the market is steering toward cleaner and more efficient technological advances including specialized engines and clean energy technology. These are critical to reducing the environmental effects. Efficient electricity generation from marine engines is becoming increasingly popular due to efficiency and versatility, especially among industrial and offshore applications. Global market growth is expected to expand and the drive to greener alternatives will persist, with an emphasis on adapting solutions to meet this growing demand, whilst lowering emissions in the maritime industry, a major contributor to global trade.

Compound Annual Growth Rate

3.6%

Value in USD Billion

2026-2035

*this image is indicative*

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Market growth was significantly impacted by the COVID-19 pandemic's lack of access to raw materials.

The COVID-19 pandemic had a significant impact on the marine engine market with the spread of the virus forcing value chain disruptions and limiting access to raw materials. Marine engines require critical components, so this production stop had a significant impact. The manufacturers, in particular boat and engine manufacturers, took a heavy loss as supply chains broke down. The COVID-19 also led to a shortage of operating workforce, delaying production schedules. Procurement of raw materials, including metals and critical components, became challenging, resulting in soaring costs and constrained manufacturing capabilities. This was compounded by moving goods not being transportation during lockdowns which made it increasingly difficult for manufacturers to satisfy the demand in the market. Even after restrictions were lifted, the long-term impact of COVID-19 on raw material supply chains has hampered the recovery of the marine engine market.

The global marine engines market is now starting to gain from the business recovery and economic normalization, despite being shaken by the COVID-19 pandemic. With daily operations returning and vaccination impact has led to reduced mortality rates, the shipbuilding industry has experienced a resurgence. This even gave a market demand boost for marine engines in the renovation market. All these aspects is expected to growth as well as growth during the forecast period.

Advancements in engine efficiency, rise in international trade and maritime transport, and shift towards LNG fuel, are the major trends impacting marine engines market value.

The marine industry is prioritising fuel-efficient, environmentally friendly engines, with innovations like hybrid and electric propulsion systems aimed at cutting emissions and lowering operational expenses.

The global surge in maritime trade and shipping activities is fuelling demand for marine engines that are efficient and dependable, crucial for supporting cargo and passenger vessels, aiding the marine engines demand growth.

There is a growing adoption of liquefied natural gas (LNG) as a marine fuel due to its lower emissions compared to traditional marine fuels like heavy fuel oil.

Digital technologies, IoT, and predictive maintenance in marine engines boost efficiency, minimise downtime, and optimise performance through remote monitoring, diagnostics, and enhanced fleet management solutions.

Fuel source flexibility in contemporary marine engines to support development

One vital pointer in the marine engine market is the flexibility in fuel sources in innovative engine systems, which is likely to enhance growth. It provides the adaptability that marine propulsion systems need for different fuels, creating a step toward increased efficiency and less reliance on traditional fuels. With worries about greenhouse gases and emissions, many new marine engine systems are built with support for alternative, cleaner fuels. This drive is leading to the development of advanced fuel-efficient marine propulsion systems for ships, which could reduce environmental impact and help meet stringent regulations on emissions.

A key trend driving market growth is the modern marine engines' flexibility in terms of fuel sources. Accordingly, natural gas is being embraced in the shipping and boating industries as a cleaner alternative to traditional marine fuels, creating such a decrease in sulfur oxides and nitrogen oxides emissions. The transition is most evident in gas carriers, oil tankers, bulk carriers, and general cargo ships to meet stringent environmental factors and regulations. Flexibility in fuel consumption such as LNG is critical to minimize GHG emissions while ensuring sustainability across the vertical in container ships and other vessels, thus supporting overall market growth.

Marine engine market share reflects how demand is split across engine types, power classes, fuel technologies, and vessel categories. In practice, the mix differs by application: large commercial vessels (container ships, bulk carriers, tankers) tend to be dominated by high-power two-stroke marine engines for main propulsion, while four-stroke marine engines are widely used for auxiliary engines, marine gensets, and many medium-size propulsion needs. Share also shifts by build cycle (newbuilds vs engine retrofits) and by propulsion setup, including inboard engines, outboard engines, and integrated ship propulsion systems used in ferries, fishing boats, tugs, and offshore support vessels.

Competitive share is shaped less by a single spec and more by delivered lifetime value: fuel efficiency, uptime, global service reach, spare-parts availability, and compliance with IMO emission standards (including Tier III requirements) using solutions like SCR and EGR. Growth areas often pull share toward dual-fuel marine engines (notably LNG marine engines) and “alternative-fuel ready” platforms tied to decarbonization choices, while conventional marine diesel engine demand remains strong where fuel access, capex limits, and operating profiles favor proven systems. When comparing marine engine manufacturers, the most reliable view of market share usually comes from a combined read of installed base, order intake, shipyard fitment activity, and aftermarket service penetration across commercial vessels and marine power generation.

Seaborne trade's rapid growth will fuel the market

The marine engine market is primarily driven by high growth in seaborne trade. The recovery in the global economy, and the growth in seaborne trade, are driving greater demand for shipping services. International trade fueling demand for raw materials has further increased the dependence on shipping to fulfil those needs. Merchant ship operations are changing, where there are more moving containers and in addition, bulk goods in various places around the world. The future expansion of international trade is also anticipated to drive demand for marine engines, thus benefiting the market. As the global economy stabilizes, the demand for shipping containers will continue to grow, further pushing demand for efficient marine engines, helping the shipping sector support the economic expansion and drive technological advancements in the marine engines space. According to Indian Shipping Statistics (ISS), as of December 31, 2022, India's fleet of 1,520 vessels included 1,034 vessels (68%) in coastal trade, totalling 1.58 million GT, and 486 vessels (32%) in overseas trade, totaling 12.11 million GT. This rising shipping growth, especially in emerging markets, will continue to drive the marine engine market.

Growing need for gas-powered marine engines to support market expansion

Market growth is attributed to the growing need for gas-based marine engines. The preference for natural gas as a fuel source is due to low emissions and environmental benefits. Propane-based models are being adopted in part due to the need to comply with stricter emission norms that seek to reduce sulfur oxides and nitrogen oxides. Natural Gas (LNG and LPG) are seen as some of the cleanest types of fuel for marine propulsion, as the shipping industry makes its move to cleaner zero-carbon energy. These technologies are being embraced notably by gas carriers for compliance with emission regulations. The call for regulated consumption of fuel only serves to hasten the transition to natural gas as a viable alternative to traditional fuels. Given the continued emphasis on clean technologies, the demand for marine gas engines is set to witness substantial growth as shipping operators and regulators put significant ownership towards decreasing the proficiency of marine transportation with the help of alternative fuel technologies.

Stricter emission regulations and growing use of clean energy technologies could impede market expansion.

Growing acceptance of green energy technologies like solar, hydro, and wind power, as well as strict emission norms, can restrain the market growth of marine engines. The current move to new clean energy technologies also means that there will be limitations on marine engines powered by fossil fuels. Demand for compliance as MARPOL Annex VI NOx emissions limits and low sulfur fuel regulations take effect While the adoption of cleaner technologies is a prerequisite for environmental sustainability, it could also slow the market pace for traditional marine engines, as ships can now find upgradation to new systems or retrofitting existing equipment.

As stringent norms related to emissions are getting tougher and clean energy technologies are getting more widely adopted, both are posing as challenges to the marine engine market growth. Consequently, there is an increasing demand to limit the use and release of harmful substances, as evidenced by the tightening of regulations such as Directive 2011/65/EU / RoHS 2, which places limits on the use of harmful materials in machinery components. As these new demands are prompting engine makers to design and implement such novel alternatives, the process can be expensive and time-consuming. The intense pressure to comply with these standards may impede the development and production of conventional marine engines. Further, compliance with these regulations is also likely to hamper market growth, as it requires significant investments in technology upgrades, research, and redesigning of existing engines to comply with the latest environmental standards.

Growing attention on GHG reduction to support the growth of the gas carriers segment

Demand from oil tankers segment in the marine engine market is driven by the necessity of efficient propulsion systems conforming to environmental regulations. As emissions regulations become more stringent, operators of the largest oil tankers are looking at cleaner technologies. On the other hand, the stability in the bulk trading segment is mainly driven by the increasing requirement of bulk raw materials like iron ore, grains, and coal. General cargo ships are in high demand as the volume of international trade increases as it can transport various types of cargo. With an eye towards enhanced fuel economy and reduced emissions, operators are adopting advanced engine solutions. Bringing cleaner sources of energy, natural gas as well as renewable energy technologies, has also led to lower operating costs as well as compliance with strict emission norms.

Container ships are key to global commerce, so having them working effectively is a direct driver of global supply chain performance. As container volumes have increased, the market for marine engines for such ships has continued to change quickly. Technologies that enhance fuel efficiency and reduce GHG emissions are becoming increasingly important for engines. To meet increasingly stringent emission regulations, many operators are adopting hybrid designs that burn low-emission fuels like LNG.

The growth of the gas carriers segment is anticipated to be encouraged with an increase in the focus for reduction of GHGs. Gas carriers offer one of the preferred alternatives to traditional fuel. With the shipping industry aiming to reach international emissions regulations, such as MARPOL Annex VI, there is a growing trend in adopting green technologies, including engines powered by LNG.

Owing to the nature of the goods transported, chemical tankers demand highly-developed, safe, and efficient marine engines. Environmental engine technologies are also becoming the focus for these vessels to reduce the effects of harmful emissions. In this regard, with chemical tankers usually operating under stringent environmental regulations, operators are proactively investing in modern engine solutions that cater towards lowering both operational costs and the environmental footprint of fleet operations.

Support vessels that serve offshore oil, gas, and renewable energy sectors are adopting more fuel-efficient and environmentally-friendly technologies. They are pivotal for different offshore activities like logistics and maintenance. Social pressures have led to both low-sulfur fuel as well as many boats powered by alternative energy sources, and these have found a willing acceptance from support vessels, not only from a compliance standpoint but also an operational and consumption efficiency standpoint. Ferries and passenger ships are looking towards using cleaner marine engine technology to reduce emissions and improve fuel efficiency. Since these vessels serve a large number of passengers and sail primarily in coastal and sheltered waters, compliance with environmental regulations is necessary.

Smaller-capacity engines' modularity will allow the 0–10,000 HP segment to dominate the global market.

The modularity and versatility of some smaller-capacity (0-10,000 HP) engines are expected to hold the largest share of the global marine engine market, especially in the segment. These engines are typically sought by smaller ships, fishing boats and support vessels, all of which need relatively smaller, faster and more affordable power sources. The 10,000 - 20,000 HP segment is well-established and growing, as demand for medium-capacity engines in ships such as bulk carriers, tankers, and general cargo vessels continues to increase. It offers a better balance of power and fuel efficiency, making it widely used by vessels on long voyages.

In the 20,000 - 30,000 segment, big boat engines used for the transport of oil and big container ships are available. These engines are expected to deliver high power output in order to propel large, heavy ships, while also ensuring fuel-efficient operation and compliance with emission standards. Due to the economic and regulatory pressures arising in industrial engines specialization areas, the market moves to sustainable technologies. As a result, these companies are adopting cleaner fuels such as LNG and further improving energy efficiency.

Within the 30,000 - 40,000 HP segment, large ships, cruise ships and gas carriers dominate. Hence, these engines are high-efficiency operations engines, engineered to reduce operational costs per unit of power output. Ship owners are making this segment future-ready with hybrid propulsion systems and alternative fuels to comply with the stringent emission standards, and these technologies are gaining traction among the various OEMs. Marine engines between 40,000 to 50,000 HP can deliver high output in gigantic vessels such as large container ships and bulk carriers. These engines offer reliable power over long distances while remaining fuel-efficient in order to minimize operational costs. However, as attention turns to emission cutting, manufacturers are looking to new technologies such as dual-fuel engines and renewable energy solutions to ensure such vessels operate sustainably.

The segment of 50,000 - 60,000 HP caters to high power engines installed in ultra-large container ships, oil tankers, and specialized cargo ships. These engines are designed for long-haul routes and high-cargo loads with an emphasis on fuel efficiency and lower emissions. Around 60,000 - 70,000 HP range would normally be found in the largest container ships and some specialized ships. These heavy-duty engines meet the demands of high cargo throughput and long journey distances. The market for engines in this segment is growing, as bigger vessels are used for transoceanic travel. 70000 - 80000 HP engines are used to generate substantial amounts of power to keep these mega ships moving while still operating efficiently.

The 80,000 - 90,000 HP segment powers some of the largest commercial vessels in service in the global market. These do rot in heavy duty vessels, like large container ships and oil tankers. The 90,000 – 100,000 HP class engines are powerful enough to transport enormous amounts of cargo over long distances. The 100000 - 110000 HP are powerful engines fitted to the biggest of bulk carriers and maximized oil tankers and container vessels. The most powerful vessels such as the large crude carriers (VLCCs) and the largest container ships use engines greater than 110,000 HP. These engines are tailored for maximum power output so that the boats can carry the most massive cargoes and travel for thousands of nautical miles. Increased demand for larger ships directly translates into the need for ever-more efficient, more environmentally-friendly engine technologies.

Being one of the cleanest fuels for ships and boats, LNG will lead the way.

Heavy Fuel Oil (HFO) has conventionally been employed in marine engines as it is cheap, energy dense and readily available. However, it is also high in sulfur, resulting in large greenhouse gas emissions and pollutants like sulfur oxides. Environmental regulations are making the continued use of HFO less appealing. Intermediate Fuel Oil (IFO) is a combination of heavy fuel oil (HFO) and marine diesel oil (MDO) that provides the right balance of performance and cost. These are generally used within medium-speed engines, where mainly their predominant use is in large vessels, like bulk carriers and oil tankers. However, IFO still has a higher sulfur content compared to cleaner fuels.

Refined marine diesel fuel is commonly used in smaller vessels and high speed engines. MDO is more fuel-efficient, emitting lesser pollutants, which is why this fuel type is preferred for vessels operating in emission controlled areas. Marine Gas Oil is a low sulfur distillate fuel suitable for vessels operating in emission-controlled zones where sulfur is regulated. MGO is used in high-performing engines, including on cruise ships and ferries, and as a cleaner alternative to heavier marine fuels on smaller cargo vessels.

The use of natural gas for marine propulsion has been gaining momentum due to an environmental advantage including less carbon and virtually no sulfur oxides. Due to a global push for cleaner energy, natural gas has emerged as an alternative fuel for vessels, especially for any ships operating in an emission-controlled environment. It is commonly used in dual-fuel engines that enable vessels to run on natural gas as well as conventional marine fuels. Gas turbines are used in several marine applications due to their higher power to weight ratio and efficiency in selected vessels such as naval ships and fast ferries. These turbines can use different fuels, including natural gas, and are valued for their ability to produce vast amounts of power while occupying a smaller engine footprint.

The low environmental footprint of liquefied natural gas (LNG) is making it a new lead fuel in the marine engine market. When compared to traditional marine fuels such as heavy fuel oil (HFO) and intermediate fuel oil (IFO), LNG emits much less carbon dioxide, sulfur oxides, and nitrogen oxides.

The market will be dominated by low-speed marine engines because of their increasing use in large-capacity ships.

High-speed maritime engines are usually employed in marine vessels which demand fast acceleration and environmentally friendly operations under high load speeds, including ferries, passenger vessels and fast cargo vessels. They provide great performance but generally require more fuel. With the growing importance of fuel efficiency and environmental regulations, there is a growing demand for innovative solutions that improve fuel efficiency in high-speed internal combustion engines without sacrificing speed and performance.

Medium-speed marine engines find applications in a variety of vessels including bulk carriers, container ships, and tankers. They provide an ideal compromise of speed versus fuel economy at medium distances. These engines are more fuel-efficient than high-speed engines and are typically designed for dual-fuel operation, implementing flexibility in the fuel. As emission standards become more strict, medium-speed engines are also gaining importance in commercial shipping.

Low-speed marine engines are most often found on large boats, like oil tankers and container ships, where efficiency and costs matter to a considerable extent. These work slower but are more efficient, hence are used in large-scale commercial shipping. As energy-efficient technologies continue to gain traction, low-speed engines are being refined to meet increasingly stringent emissions regulations for sustainable shipping.

Supertankers will be powered by two-stroke engines, which will dominate the market.

Four-stroke marine engines are popular for high-fuel efficiency and reliability in vessels that turnover hours with low maintenance. These engines work with four different cycles (intake, compression, power, and exhaust) in one crankshaft rotation. Four-stroke engines are being utilized on small and medium-sized vessels, as in ferries and yachts, to be able to work at different speeds more effectively along with low emissions level compared to a two-stroke engine.

Two stroke engines are generally used in big ships like container ships, bulk-carriers, tankers, and more. These engines accomplish their power cycle in two strokes of the piston, delivering more power and slick simplicity of design. Two-stroke engines are more powerful and return higher power-to-weight ratios than the same displacement four-strokes at the low-end (RPM). They are also less economical, so they deliver less fuel per rotation of the crankshaft and with relatively more emissions.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

Commercial vessels marine engines deliver a balance of fuel efficiency and high-power output for commercial vessels such as oil tankers, tonnage carriers, and ferries. These ships operate on long journeys and thus demand engines that not only ensure dependable performance during long-distance journey, meet all emission regulation standards but also remain reasonably priced in terms of operational costs.

Moreover, offshore service vessels (OSVs) play a critical role in oil, gas, and renewable energy industries, providing assistance for offshore exploration and maintenance projects. These vessels require robust and dependable marine engines that can withstand challenges in extreme conditions. OSVs are also increasingly turning to dual-fuel and LNG-fueled engines to meet international environmental standards and support operational efficiencies for the long-term.

Cargo and container ships are critical to global trade. These ships have to keep their engines efficient and reliable, as they run on long routes and operate continuously. Indeed, many container vessels are currently replacing engines with LNG propulsion, as stricter environmental regulations and the demand for more efficient usage escalate, as pointed out previously.

Defense vessels, such as military ships and patrol vessels, rely on very specialized marine engines that provide high power and high endurance. These vessels work in high sea risk environments that need engines to run any high performance in extreme conditions. This includes a trend towards the adoption of hybrid and alternative fuel-powered engines by defense fleets to reduce environmental footprints while keeping these fleets operational, as militaries transition to cleaner technologies.

Efficient and eco-friendly engines are essential for passenger ships, like cruising and ferry businesses, to operate seamlessly with reliability and sustainability. However, some high passenger volume and strict environmental regulation areas are leading many passenger vessels to try out hybrid propulsion systems and low emission fuels such as LNG to reach emission regulations.

Naval vessels demand high-performance, rugged engines able to operate in diverse maritime environments. These ships including, aircraft carriers, submarines, destroyers and more, require powerplants that deliver not just power but also dependability, and speed. Moreover, as naval forces also look to minimize their carbon footprint, there is growing interest in fuel efficient and low-emission technologies. Modern naval fleets are pursuing hybrid propulsion systems and sustainable fuels to achieve defense and environmental objectives.

The North America marine engine market is growing substantially, due to its long coastline, large maritime trade, and powerful maritime infrastructure. Stringent emission regulations including the Environmental Protection Agency (EPA) guidelines are also propelling regional demand for high-end, fuel-efficient as well as eco-friendly marine engines. In addition to being leading countries in alternative fuels, such as LNG and hybrid systems, the U.S. and Canada also help drive a reduction in greenhouse gas emissions.

The Europe market for marine engines has become prominent, given a well-established shipping industry, and strict regulation policies, including the European Union's emission control policy, and MARPOL Annex VI. It plays an impactful role in demanding marine engines within the region as shipbuilding is a leading industry of these nations, particularly the case with Germany, Italy, and France. As decarbonization comes into increased focus, European shipowners are investing more in sustainable technologies such as LNG engines, fuel cells and hybrids.

The global marine engine market is led by Asia Pacific driven by the region's large shipping industry and manufacturing capacity. Notable marine engine manufacturers include top shipbuilding countries such as China, Japan and South Korea, which are major players in the global shipbuilding market. According to SCIO, China's gross ocean product reached USD 1.31 trillion in 2022, constituting 7.8% of its GDP. Moreover, the increasing trade volumes in the region and the expanding maritime infrastructure further drive market growth. Moreover, steady growth in shipping and offshore exploration drives the marine engine market in Latin America, particularly in Brazil and Mexico. These countries have increasing port infrastructure and oil and gas work offshore, creating demand for marine engines across offshore support vessels and cargo ships.

The marine engine market in the Middle East and Africa is also driven by the significant oil and gas reserves present in these regions, which supplement the growing maritime industry. In addition, high offshore exploration activities, especially in the Gulf region, and increasing requirements for transportation vessels in international trade is fueling demand for marine engines.

Market participants' creative marine engine solutions have guaranteed market expansion.

Key market players including MAN Energy, have significantly contributed to the growth of the market by providing advanced marine engine solutions. Designed to accommodate a wide range of marine types of engines ranging from commercial vessels, offshore support vessels, and defense applications, these solutions cater to specific needs. Equipped with turbocharged, intercooled diesel engines, these companies have pioneered advancements in marine engine technology to ensure compliance with stringent emission regulations while maintaining fuel efficiency and sustainability, thereby driving the market growth.

Founded in 1907 and headquartered in Kita-ku, Osaka. The company is involved in manufacturing mainly marine diesel engines and offers products for co-generation and other equipment.

Established in 1925 and headquartered in Irving, Texas, the company operates through three main segments: Construction Industries, Resource Industries, and Energy and Transportation, serving diverse sectors with specialized equipment.

Founded in 1884 and is headquartered in Chiyoda-ku, Tokyo. The company is operating in various sectors including power and energy, industrial machinery, urban infrastructure, aerospace, and defence.

Founded in 1919 and headquartered in Columbus, Indiana, this company is a global leader in power solutions. It operates through five business segments: Components, Engine, Distribution, Power Systems, and Accelera.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

March 2025

For its methanol-ready QSK60 IMO II and IMO III engines, which range in power from 2000 to 2700 horsepower (1491 to 2013 kW), Cummins Inc. announced DNV Approval in Principle (AIP). The AIP, which was obtained in June 2024, certifies that Cummins' retrofittable methanol dual-fuel solution satisfies the highest safety and performance requirements for the worldwide maritime market.

January 2025

Deere & Company unveiled the JD14 and JD18 marine engines. These engines will enable John Deere to provide marine customers with greater duty cycles* and a wider range of power, from 298 to 599 kW (400 to 803 horsepower). It is projected that production will start in 2026.

January 2024

Kolkata-based PSU GRSE and UK’s Rolls-Royce have signed an agreement under a 'frame and individual licence' to produce MTU IMO Tier II compliant Series 4000 marine engines for Indian government ships.

January 2024

Yanmar Power Technology (YPT), a subsidiary of Japan’s Yanmar Group, developed a hydrogen-fueled 4-stroke high-speed engine for power generation in coastal vessels as part of the Nippon Foundation’s zero-emission ship demonstration project in Japan.

December 2023

MAN Engines has expanded its workboat engine range by introducing the MAN D3872 series, featuring a V12 engine with a 30 L displacement—a milestone for the company—designed for medium- and heavy-duty applications.

September 2023

Honda Marine unveiled its BF350 V8 outboard engine at the Genoa International Boat Show, featuring a robust 5-litre V8 with a 60-degree configuration and advanced VTEC™ technology, showcasing a milestone in marine engine innovation.

“Global Marine Engine Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Ship Type

Market Breakup by Capacity

Market Breakup by Engine

Market Breakup by Type

Market Breakup by Fuel

Market Breakup by Application

Market Breakup by Speed

Market Breakup by Region

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The marine engines market was valued at USD 15.02 Billion in 2025.

The market is projected to grow at a CAGR of 3.60% between 2026 and 2035.

The revenue generated from the market is expected to reach USD 21.39 Billion by 2035.

The major market drivers include increasing number of leisure travellers, the expansion of the maritime transport sector, and the emergence of technologically advanced and highly efficient engines.

The key trends guiding the market include the introduction of stringent government regulations aimed at reducing emissions from marine vessels, the growing consumer awareness regarding the requirement for greener fuels, and the depleting traditional fuel supplies.

The market is broken down into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa.

The market is categorised according to the power range, which includes Up to 1,000 HP, 1,001 – 5,000 HP, 5,001 – 10,000 HP, 10,001 – 20,000 HP, and above 20,000 HP.

The market is categorised according to the engine, which includes auxiliary engine and propulsion engine.

Based on the type, the market is divided into two stroke and four stroke.

Based on the fuel, the market is divided into heavy fuel oil, marine diesel oil, intermediate fuel oil, marine gas oil, and others.

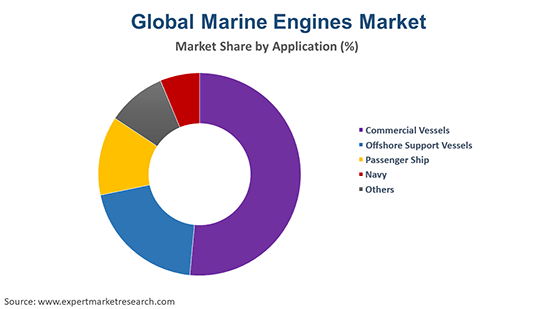

The significant applications of marine engines include commercial vessels, offshore support vessels, passenger ship, and navy, among others.

The market key players are the Hyundai Heavy Industries Engine Machinery, Caterpillar Inc., Mitsubishi Heavy Industries Group, Cummins Inc., Daihatsu Diesel Mfg. Co., Ltd., Wärtsilä Corporation, Deere & Company, Man Energy Solutions, Honda Motors Co. Ltd., Wartsila, Kongsberg, Mahindra Powerol, General Motors, Yanmar Holdings Co., Ltd., and Doosan Infracore, among others.

The marine diesel oil category holds a significant share of the market by fuel type.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Ship Type |

|

| Breakup by Capacity |

|

| Breakup by Engine |

|

| Breakup by Type |

|

| Breakup by Fuel |

|

| Breakup by Application |

|

| Breakup by Speed |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share