Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The global metal cutting tools market was valued at USD 92.03 Billion in 2025. Rising demand for electric vehicle component machining is driving cutting tool upgrades. Manufacturers are adopting advanced, wear-resistant materials and high-precision tooling to meet tighter tolerances, improve efficiency, and reduce production costs. In turn, the market is expected to grow at a CAGR of 7.60% during the forecast period of 2026-2035 to reach a value of USD 191.45 Billion by 2035.

A major force steering the market growth is the rapid automation of precision manufacturing, especially within industrial and automotive supply chains. Europe and East Asia have been pivotal markets, driven by the adoption of CNC-integrated smart tools. For instance, Germany’s Industry 4.0 initiative has driven a significant growth in intelligent machine tool demand. Meanwhile, Japan’s Ministry of Economy, Trade and Industry (METI) announced JPY 17.2 billion in grants to Japan Metals and Chemicals Co Ltd and JMC BM Co Ltd, in July 2025, for upgrading to AI-enabled cutting technologies, redefining the global demand in the metal cutting tools market.

Government-backed reindustrialisation strategies and the re-shoring of component manufacturing have intensified tool modernisation across sectors. In November 2024, the United States Department of Commerce allocated USD 7.86 billion under the CHIPS and Science Act to support localised manufacturing, including advanced tool systems. These efforts not only reduce foreign dependencies but also trigger demand for high-precision, low-vibration metal cutting systems across Tier I and II manufacturers globally.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

7.6%

Value in USD Billion

2026-2035

*this image is indicative*

EV manufacturing is reshaping tool procurement, especially for battery housing, chassis, and drive-train components. As electric drivetrains require lightweight alloys like aluminium and magnesium, manufacturers are leaning on high-speed carbide and polycrystalline diamond (PCD) cutting tools. Companies like Tesla are adopting custom-built CNC lathes for lightweight EV parts, reducing cycle time by a significant extent, accelerating the metal cutting tools market growth. On the other hand, the German Federal Ministry for Economic Affairs & Climate Action has also earmarked significant funds for high-precision machining innovation in e-mobility supply chains. This shift is not only enhancing tool sophistication but also fostering demand for adaptable, automated cutting solutions.

Digital machining is driving a paradigm shift in the metal cutting tools market. Tools are now being embedded with RFID and IoT sensors for real-time wear analysis. Companies like Sandvik Coromant and DMG Mori are rolling out AI-powered solutions that predict tool failure, thus reducing downtime. In February 2019, Sandvik launched its “CoroPlus ToolGuide” for live machine analytics in smart factories. Singapore’s Smart Industry Readiness Index (SIRI) adoption among SMEs has accelerated intelligent tool usage across Southeast Asia. By coupling automation with analytics, businesses are lowering operating costs while pushing for tighter tolerances and surface finish control.

Aerospace and defence manufacturing is fuelling demand for multi-axis and hybrid cutting tools. Firms like BAE Systems have introduced titanium-intensive structural components, prompting the installation of new boring and turning centres. Moreover, the United Kingdom Ministry of Defence’s EUR 2 billion Combat Air Strategy has further spurred supplier-level tool upgrades. Meanwhile, in the United States, Lockheed Martin’s F-35 program mandated specialised metal cutting innovations for titanium alloys, offering long-term procurement prospects. Countries bolstering indigenous defence are prompting further demand in the metal cutting tools market.

Eco-conscious manufacturing is transforming cutting tool compositions. Recycled carbide and water-based coolants are increasingly being used in tool fabrication. The European Commission’s EcoDesign Directive 2025 mandates circular economy compliance for industrial tools, bolstering the demand for recyclable and sustainable tooling. This metal cutting tools market trend is especially prominent in Scandinavia, where companies like Sandvik are pioneering circular tool loops, collecting used inserts and reprocessing them into new batches.

Leasing and subscription models for cutting tools are gaining momentum. TaaS allows manufacturers to access high-end tools without upfront capital. Japan’s Okuma and Germany’s Gühring are now offering full lifecycle tool management through monthly contracts. TaaS also improves traceability and recycling of tool materials, appealing to ESG-conscious B2B clients.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Global Metal Cutting Tools Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Product Type

Key Insight: Machining centres largely contribute to the metal cutting tools market value due to their versatility in multi-axis operations, while turning centres thrive in the market amid rising auto part demand. Milling machines remain crucial for shaping non-standard parts, and drilling machines serve in basic yet essential boring tasks. Boring machines have become indispensable for precision-driven heavy engineering, while grinding machines continue to support finishing operations in tool and die categories. Lathe machines are finding significant utility in bulk machining, especially in Asia-Pacific regions.

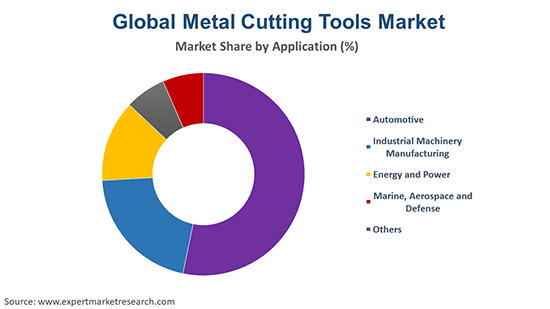

Market Breakup by Application

Key Insight: While automotive applications remain dominant in the metal cutting tools industry, energy and power observes rapid growth. Aerospace & defence categories require titanium and nickel alloy machining. Marine tool demand is rising due to naval fleet modernisation. Industrial machinery manufacturing continues to rely on multi-functional cutting tools for operational efficiency across verticals. Other applications including construction and agricultural machinery, demand versatile tools capable of handling diverse metals under variable loads.

Market Breakup by Region

Key Insight: Asia Pacific currently dominates the market due to strong manufacturing ecosystems and policy support for advanced tooling. North America follows closely with metal cutting tools demand rising from EV, aerospace, and defence sectors. Europe, backed by strict emissions regulations and high-precision manufacturing, maintains stable growth, especially in Germany and Italy. Latin America stands out as the fastest-growing market, driven by renewed infrastructure investments and regional supply chain integration. Meanwhile, the Middle East and Africa are gradually adopting modern tools, led by diversification into non-oil sectors like construction and industrial fabrication.

By Product Type, Machining Centre Dominates the Market due to Aerospace and EV Component Demand

Machining centres continue to dominate the market, primarily for their ability to combine multiple cutting functions in a single setup, reducing production time. Aerospace firms increasingly rely on 5-axis vertical machining centres to produce complex geometries in lightweight alloys. Their accuracy, rigidity, and tool-life monitoring capabilities make them ideal for precision-critical sectors like defence and electric aviation. With evolving material compositions and growing demand for hybrid part production, machining centres are expected to remain dominant for large-scale industrial manufacturing.

Turning centres are witnessing massive growth in the metal cutting tools market, particularly among Tier II automotive suppliers and industrial equipment fabricators. The fast adoption of CNC-equipped turning tools in markets like South Korea, Mexico, and Poland is attributed to increasing pressure for shorter lead times and custom batch manufacturing. These machines also come integrated with bar feeders, tool pre-setters, and IoT modules, making them a preferred choice in cost-sensitive yet quality-demanding environments.

By Application, the Automotive Category Dominates the Market Due to Large-Scale Component Machining

The automotive industry boasts considerable metal cutting tools demand growth, owing to both ICE and EV part manufacturing. Cutting tools are vital for machining cylinder heads, pistons, gears, and brake components. With Europe’s 2035 ban on ICE vehicles approaching, manufacturers are revamping production lines with advanced carbide tools for lightweight EV parts. Germany’s Bosch and India’s Tata Motors have invested in new CNC tool lines in 2024 to accelerate component machining. Demand for tight-tolerance machining, lightweight material shaping, and short-run production is pushing automakers towards smarter and faster cutting systems.

The energy sector is witnessing rapid growth in the metal cutting tools market, driven by wind turbine, hydro, and grid infrastructure developments. Large cast components such as turbine hubs and generator rotors require deep boring and heavy-duty milling, necessitating robust tools. Additionally, emerging economies investing in power grid expansion, like Vietnam and South Africa, are fuelling tool demand for transformer core and housing fabrication.

Asia Pacific Secures the Largest Share Due to Industrial Automation and Auto Exports

Asia Pacific leads the global metal cutting tools market, driven by extensive industrialisation in China, Japan, South Korea, and India. The region benefits from a strong automotive and electronics manufacturing base, paired with robust government support for digital manufacturing. Japan’s smart factory initiatives and India’s “Make in India” push have made CNC-based precision tooling a top priority. Moreover, export-driven economies like South Korea are investing in hybrid tools to enhance productivity and meet global demand.

Latin America is witnessing strong growth in terms of metal cutting tools market revenue, propelled by rising investments in construction, transportation, and mining. Countries like Brazil, Mexico, and Chile are upgrading outdated manufacturing systems, particularly in metal and mineral processing sectors. The influx of foreign investment for infrastructure development is fuelling demand for high-efficiency tools capable of handling heavy-duty applications. Mexico's proximity to the United States auto supply chain has also spurred local precision machining clusters.

Global metal cutting tools market players like Sandvik AB, Mitsubishi Materials, and DMG Mori are focusing on AI-driven tooling, smart sensor integration, and eco-friendly material innovation. These firms are not only expanding their product portfolios with IoT-enabled tools but also entering subscription-based Tool-as-a-Service (TaaS) models to capture SME clients. Companies are investing in hybrid machines that combine milling and turning to meet demand from aerospace and EV manufacturing.

Metal cutting tools companies can find opportunities in developing markets, particularly Southeast Asia and Latin America, where industrial automation is still evolving. Strategic collaborations with government-backed R&D initiatives are also growing. For example, collaborations with Germany’s Fraunhofer Institutes and Japan’s NEDO programme offer an edge in next-gen tool development. Players are also exploring additive tool manufacturing for faster prototyping and reduced material waste, which could redefine industry norms over the next decade.

Established in 1946 and headquartered in Kanagawa, Japan, Amada Co., Ltd. is a prominent manufacturer of metalworking machinery and cutting tools. The company caters to the metal cutting tools market through its advanced laser cutting machines, CNC punch presses, and precision tooling systems designed to optimise manufacturing efficiency.

Founded in 1956, Fanuc UK Ltd is a subsidiary of Fanuc Corporation, known for its CNC systems, robotics, and factory automation solutions. In the cutting tools domain, Fanuc provides precision CNC controls that enable enhanced toolpath accuracy and reduced cycle times. Their systems are widely used in machining centres for automotive, electronics, and aerospace industries.

Nachi-Fujikoshi Corp., established in 1928 and based in Toyama, Japan, is a leading global provider of high-precision cutting tools, bearings, robotics, and hydraulic equipment. In the cutting tools sector, the company delivers a comprehensive range of drills, end mills, and taps known for exceptional wear resistance and cutting performance.

Headquartered in Stockholm, Sweden and founded in 1862, Sandvik AB is a global engineering group that leads in cutting tools and tooling systems. Through its Sandvik Coromant division, the company delivers high-performance carbide inserts, milling cutters, and turning tools designed for precision machining in aerospace, energy, and automotive sectors.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Another key player in the market is Ceratizit Group, among others.

Explore the latest trends shaping the global metal cutting tools market 2026-2035 with our in-depth report. Gain strategic insights, future forecasts, and key market developments that can help you stay competitive. Download a free sample report or contact our team for customised consultation on metal cutting tools market trends 2026.

Carbide Tools Market

Continuous Integration Tools Market

Mexico Power Tools Market

Mexico Metal Cutting Tools Market

Power Tools Market

Drywall Tools Market

Drilling Tools Market

Concrete Tools Market

Flooring Tools Market

Concrete Mixing Machines and Tools Market

Hand Tools Market

Metal Forming Machine Tools Market

Machine Tools Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The market is projected to grow at a CAGR of 7.60% between 2026 and 2035.

Firms are expanding TaaS offerings, developing recyclable tools, forming government R&D partnerships, retrofitting legacy machines with IoT sensors, and automating inventory management for real-time tool performance monitoring and predictive maintenance.

The key trends propelling the industry forward are the increasing demand for networked machinery in industry 4.0 and expanding construction activity.

The major regions in the industry are North America, Latin America, Europe, the Middle East and Africa, and the Asia Pacific.

The various products are machining centre, turning centre, lathe machine, boring machine, grinding machine, milling machine, and drilling machine, among others.

By application, the market is divided into automotive, industrial machinery manufacturing, energy and power, marine, aerospace and defence, among others.

The major players in the market are Amada Co., Ltd, Fanuc UK Ltd, Nachi-Fujikoshi Corp., Sandvik AB, and Ceratizit Group, among others.

In 2025, the metal cutting tools market reached an approximate volume of 92.03 Billion.

High raw material costs, frequent tool replacements, and integration complexities with legacy systems remain top challenges. Limited digital infrastructure in emerging markets also hampers widespread adoption of smart cutting tools.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Product |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share