Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The Mexico pest control market attained a value of USD 1520.38 Million in 2025. The market is estimated to grow at a CAGR of 4.30% during 2026-2035 to reach a value of USD 2316.30 Million by 2035.

Base Year

Historical Period

Forecast Period

In 2023, Mexico had the presence of 53.6 million acres of land planted with crops.

In 2022, Mexico had around 217,320 economic units including offices, manufacturing plants, and distribution centers under the classification of “food and beverage manufacturing and processing.”

In Q2 2024, residential construction recorded a gross domestic product of USD 0.14 trillion, an increase of 11.5% compared to the same period in 2023.

Compound Annual Growth Rate

4.3%

Value in USD Million

2026-2035

*this image is indicative*

| Mexico Pest Control Market Report Summary | Description | Value |

| Base Year | USD Million | 2025 |

| Historical Period | USD Million | 2019-2025 |

| Forecast Period | USD Million | 2026-2035 |

| Market Size 2025 | USD Million | 1520.38 |

| Market Size 2035 | USD Million | 2316.30 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 4.30% |

| CAGR 2026-2035 - Market by Region | Yucatan Peninsula | 5.0% |

| CAGR 2026-2035 - Market by Region | Central Mexico | 4.4% |

| CAGR 2026-2035 - Market by Pest Type | Rodents and Wildlife | 5.2% |

| CAGR 2026-2035 - Market by Application | Commercial | 5.1% |

| 2025 Market Share by Region | The Bajío | 27.8% |

The Mexico pest control market is driven by its increased demand from sectors including agriculture, residential, and hospitality as well as innovations in pest control techniques.

In the Mexico agricultural sector, corn is one of the major crops. The corn crop protection market is dominated by the insecticides fipronil, chlorpyrifos, lambda-cyhalothrin and thiamethoxam. In FY 2024-25, the corn production in Mexico is expected to account for 25,000 KMT compared to 22,700 KMT produced in FY 2023-24.

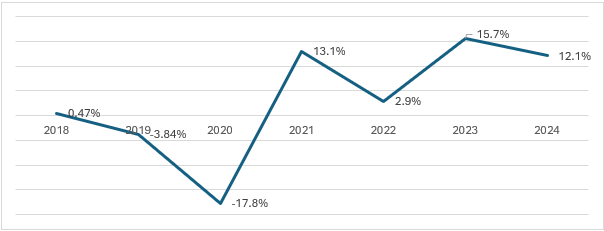

Figure: Trends in Construction Output in Mexico (Average Y-0-Y Change in %); 2019-2025

Pest control in the agricultural sector is a critical aspect of modern farming. It helps manage and reduce the risk of food insects and improve crop yields. As of 2023, Mexico is the leading crop protection market in Central America. The crop protection market in Mexico is dominated by major multinational companies. UPL is the leader in the local market, holding a 12% market share, followed by Syngenta with 11%, Bayer with 9%, FMC with 8% and Corteva with 7%. Next are BASF and Agricultura Nacional with 6% of market share each, followed by Adama and Sifatec with 4% each, and Sumitomo/Valent with 3%.

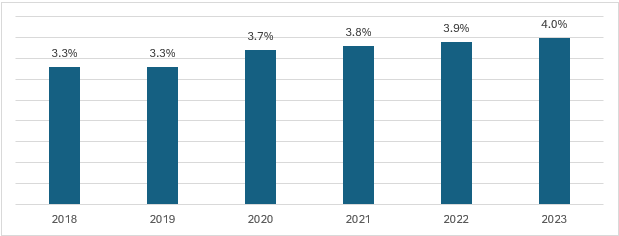

Figure: Agriculture, Forestry, and Fishing, Value Added (% of GDP) in Mexico; 2019-2025

Housing demand in Mexico continues to rise. This is reflected in the rising average price of single-family units. In Q3 2023, the average housing price in Mexico experience over 10% annual increase with an inflation-adjusted growth of approximately 5.5%.

In the absence of pest management, construction sites and buildings are susceptible to contamination, and health hazards posed by insects, rodents, and other pests. As a result, pest control helps to increase operational efficiency and improves the working environment for workers and occupants.

Expansion of the agricultural sector; rising number of construction and residential projects; growing tourism sector; and increasing demand for eco-friendly products are the key trends impacting the Mexico pest control market development

Pest control helps to improve crop yields, prevent disease, foster production, and help promote food security. In 2022, the Mexican agricultural sector consumed around 19,613.51 tons of pesticides. In 2023, the value-added contribution from agriculture, forestry, and fishing accounted for 4% of the Mexican GDP, compared to 3.3% in 2019.

Pest control is important for construction projects to protect structures and equipment. In 2023, the investment in construction increased by 20.8% compared to 2022. The increased construction of complexes necessitates the application of pest control to protect structure, equipment, and materials.

Pest control offers a safe environment to hotel guests and plays an integral part in hotel reputation. In January 2024, Mexico witnessed a 3.6% year-on-year increase in foreign tourist arrivals expanding the demand for hotel rooms and the need for pest control.

The Mexico pest control market is evolving with the development of new technologies and products. Manufacturers are focusing on eco-friendly options made with natural ingredients that effectively target various pests. Smart technologies, such as smart traps and sensors, are being used for real-time pest monitoring and control.

Demand for houses in Mexico is rising. As of 2022, Mexico needed to invest nearly 4% of its GDP annually to build 800,000 housing units each year over the next two decades to keep up with this demand. In 2023, Mexico's home sales totalled USD 25.73 billion and are expected to increase to USD 37.86 billion by 2028. This places Mexico among the top 20 countries worldwide for residential real estate transaction value. The increase in housing construction presents an opportunity for preventive residential pest control solutions, as pests can harm property and belongings in addition to transmitting diseases.

Increasing consumer preference for do-it-yourself (DIY) pest control solutions is driving the pest control market. These low-cost options allow customers to manage minor infestations on their own, offering both convenience and control. Additionally, purchasing chemicals from supermarkets is often more economical than hiring professional pest control services, further fuelling the demand for DIY solutions.

“Mexico Pest Control Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

Market Breakup by Pest Type

Market Breakup by Control Method

Market Breakup by Mode

Market Breakup by Application

Market Breakup by Region

| CAGR 2026-2035 - Market by | Region |

| Yucatan Peninsula | 5.0% |

| Central Mexico | 4.4% |

| Baja California | 4.2% |

| Northern Mexico | XX% |

| The Bajío | XX% |

| Pacific Coast | XX% |

The demand for food from the growing Mexican population is leading to a significant rise in agricultural production. As of 2023, producers transformed about 47,770 hectares of forest cover into agricultural land in Mexico. The major agricultural states in Mexico are Veracruz, Jalisco, Oaxaca, Sinaloa, and Chihuahua. The presence of significant agriculture activities in Mexico is accelerating the adoption of pest control methods to protect the contamination of produce, improve yield, and protect health of crops.

In Mexico states such as Mexico City, State of Sinaloa, and Tijuana significantly deal with the problem of bed bug infestation. These bugs are killed by spraying pesticides into cracks, baseboards, seams, and smaller areas where bed bugs thrive. By 2027, the construction of new hotel rooms is expected to grow by 4%, which would drive the demand for spray pest control in the hospitality sector.

Powdered pesticides work efficiently in preventing and controlling pest and disease outbreaks in agricultural areas, as well as in areas with limited water supplies. As of 2022, Jalisco, Veracruz, Oaxaca, Chihuahua, Sinaloa, and Sonora are the biggest agricultural producers in Mexico. Further, as of 2022, the crops with the most harvested area in Mexico included tomatoes (49,196 ha), asparagus (35,940 ha) and agave (26,562 ha).

The market players are focusing on providing products at competitive prices and high quality, with improved customer service, product support, and performance features.

Headquartered in Germany, the company specialises in production and distribution of a range of products, including chemicals, plastics, performance products, crop protection products, and oil and gas, among others. BASF maintains a significant global footprint, operating across over 93 countries with a network of 234 production sites.

Syngenta is a science-driven agtech company, based in Switzerland. Syngenta, part of the Syngenta Group, has a global presence with 53,000 employees across over 100 countries, driving innovations to transform crop production and promote sustainable agriculture worldwide.

Based in Mexico, Xtermin specializes in developing a broad spectrum of products designed for urban pest control. They cater to a variety of sectors, such as agriculture, urban environments, and food companies, providing tailored solutions for effective pest management and safety.

Biotor Labs specializes in the research, development, and production of innovative biological solutions for sustainable and environmentally friendly agriculture. Headquartered in Nicaragua, Biotor has built a strain library of over 100 microorganisms selected from various ecosystems.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other notable players operating in the Mexico pest control market are Velsimex, SA de CV, Vestaron Corporation, Med-X, Inc, and Nichino México S. de RL de CV, among others.

The state of Sonora in northern Mexico is of significant importance in the country’s agriculture sector, producing high-yielding varieties of wheat, barley, soya, cotton, chickpeas, safflower, forage, vegetables, grapes, citrus, and olives. During the fall/winter 2022-23 cycle, Sinaloa produced approximately 5.5 million tons of white corn, accounting for around 20% of Mexico's total production. Pest infestations can drastically alter corn production, significantly necessitating efficient pest control methods.

El Bajio which includes Aguascalientes, Guanajuato, part of Jalisco, and Querétaro is witnessing significant growth in the food processing sector. The capacity of the region for high-value agricultural production provides food manufacturers with a reliable supply of raw materials and while also providing logistical advantages.

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

The pest control market in Mexico attained a value of USD 1520.38 Million in 2025.

The Mexican market for pest control is estimated to grow at a CAGR of 4.30% during 2026-2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach a value of USD 2316.30 Million by 2035.

The factors driving the market growth are increasing residential construction activities, expansion of the food processing sector in Mexico, rising demand for environment friendly pest control solutions, and the growing agriculture activities.

The key regional markets for pest control in Mexico are Baja California, Northern Mexico, The Bajío, Central Mexico, Pacific Coast, and the Yucatan Peninsula.

The various modes of pest control include powder, spray, traps and baits, and others.

The applications include commercial, residential, industrial, and agriculture.

The key players in the market include BASF SE, Syngenta AG, Xtermin, Biotor Labs, S.A., Velsimex, SA de CV, Vestaron Corporation, Med-X, Inc, Nichino México S. de RL de CV among others.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Pest Type |

|

| Breakup by Control Method |

|

| Breakup by Mode |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share