Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

The pest control market size attained a value of USD 23.34 Billion in 2025. The industry is expected to grow at a CAGR of 5.00% during the forecast period of 2026-2035. By 2035, the market is expected to reach USD 38.02 Billion.

The surging incidences as well as increasing awareness of dengue, malaria, and Lyme diseases is fostering the pest control market development. According to industry reports, the number of cases of malaria across the globe reached 263 million in 2023. This has compelled consumers and governments to prioritize pest management for mitigating health hazards. This growing focus on health is further encouraging investments in eco-friendly and effective pest control products.

Integrated pest management (IPM) that combines biological, chemical, and mechanical methods, is gaining traction for sustainable pest control as it minimizes chemical pesticide use for aligning with global environmental regulations. Governments are promoting IPM to limit pesticide resistance and environmental damage. In March 2025, the United Kingdom Pesticides National Action Plan guided government and farmers in the country to collaboratively limit pesticide impacts on human health and the environment. This holistic approach drives demand for innovative products and services tailored to IPM principles.

The expanding agriculture sector to feed the thriving global population is elevating the pest control market value to protect crops and yields. Farmers are largely using biological pesticides and integrated pest management to combat pests sustainably. For instance, in April 2024, Bayer introduced its first bioinsecticide targeting arable crops for enhancing sustainable pest management in agriculture. The strong government support and rising investments in agricultural technologies are also favouring the market growth.

Base Year

Historical Period

Forecast Period

Compound Annual Growth Rate

5%

Value in USD Billion

2026-2035

*this image is indicative*

| Global Pest Control Market Report Summary | Description | Value |

| Base Year | USD Billion | 2025 |

| Historical Period | USD Billion | 2019-2025 |

| Forecast Period | USD Billion | 2026-2035 |

| Market Size 2025 | USD Billion | 23.34 |

| Market Size 2035 | USD Billion | 38.02 |

| CAGR 2019-2025 | Percentage | XX% |

| CAGR 2026-2035 | Percentage | 5.00% |

| CAGR 2026-2035 - Market by Region | Asia Pacific | 5.8% |

| CAGR 2026-2035 - Market by Country | India | 6.6% |

| CAGR 2026-2035 - Market by Country | China | 5.6% |

| CAGR 2026-2035 - Market by Pest Type | Insects | 5.7% |

| CAGR 2026-2035 - Market by Application | Residential | 5.5% |

| Market Share by Country 2025 | France | 3.1% |

Rapid urbanization, mainly in Asia and Africa, is driving the pest control market expansion due to higher human density and waste accumulation. According to industry reports, over 55% of Asia’s population is estimated to reside in urban areas by 2030, fuelling market growth. Urban environments are providing ample breeding grounds for pests, necessitating advanced pest management in commercial and residential sectors. This trend is pushing companies to innovate customized urban pest control solutions.

Increasing technology adoption is accelerating growth in the pest control market, driven by the integration of IoT-based sensors, AI-enabled monitoring systems, and remote data access solutions. In December 2023, BrightAI partnered with Pelsis to introduce next-generation AI-powered flylights for transforming pest control with smarter and more efficient insect management technology. These innovations are helping to reduce labour costs and increase treatment precision while attracting commercial clients. The digital transformation also enhances service transparency and predictive pest management, further accelerating market growth.

Environmental concerns and regulatory pressures are fuelling the demand for green solutions, adding to the pest control market growth. Customers are preferring botanical pesticides, biological controls, and low-toxicity chemicals, further compelling companies to form partnerships and develop sustainable insect control products. In July 2023, UPL Sustainable Agri Solutions launched Argyle, its new affordable, sustainable, and innovative pest control solution tailored for soybean and cotton crop protection. Eco-friendly offerings are also assisting companies to comply with regulations and appeal to environmentally conscious consumers.

Growing disposable incomes in developing countries is enabling households to invest in pest management services, further impacting the pest control market outlook. As per industry reports, India’s disposable personal income has surged from 273364818.90 INR million in 2022 to 296383300 INR million in 2023. Homeowners are seeking convenience and effective solutions for common pests, such as termites, rodents, and insects. Several providers are also offering tailored packages, including subscription services, to capitalize on this trend.

The rising rate of collaborations between pest control firms as well as biotech and technology companies for enhancing innovation is complementing the pest control industry growth. In February 2025, technology firm SenesTech partnered with Indian distributor Smark for introducing humane, non-lethal rodent control solutions to address public health concerns and infrastructure damages. Such partnerships are enabling access to cutting-edge technologies, expanding product portfolios and geographic footprints. Joint ventures and acquisitions are also helping companies to strengthen competitive advantages and accelerate growth.

Read more about this report - REQUEST FREE SAMPLE COPY IN PDF

The EMR’s report titled “Pest Control Market Report and Forecast 2026-2035” offers a detailed analysis of the market based on the following segments:

On the basis of pest type, the market is divided into:

Key Insight: Insects dominate the pest control industry due to their widespread presence in residential, commercial, and agricultural settings. Mosquitoes transmit deadly diseases, prompting significant demand for insecticides and fogging services. Urban centers frequently use integrated pest management services to control infestations, combining traps, baits, and biological agents. Leading companies are offering specialized insect control programs, while focusing on product innovations. In March 2025, Pelsis launched an AI-powered Digital Halo system for offering real-time flying insect monitoring via app alerts and analytics, driving significant adoption in homes, hospitals, and food-processing facilities.

By control method, the industry is segmented into:

Key Insight: Mechanical pest control market is inclusive of physical barriers and traps to prevent and eliminate pests that are present widely in homes and commercial settings. Mechanical control is favored for its immediate results, environmental safety, and ease of use without chemicals, further making way for innovations. In July 2024, Pelsis introduced a mouse trap, a rat trap, and a multi-use mouse box to cater to retail and home users. The food processing and hospitality sectors are also heavily relying on mechanical solutions to comply with hygiene regulations whilst minimizing chemical use.

Based on mode, the industry is categorised into:

Key Insight: Spray-based pest control industry is expanding due to their wide application, ease of use, and fast action. Used extensively in residential, agricultural, and commercial settings, sprays can target several insects. This has compelled major players to offer aerosol and liquid insecticide sprays for indoor and outdoor use. Catering to this trend, in May 2024, BASF launched its natural pyrethrin pesticide aerosol SUWEIDA® spray to assist homeowners with pest problems. Sprays are further preferred for immediate results and broad coverage. The convenience and effectiveness of sprays also drives their high demand across diverse sectors.

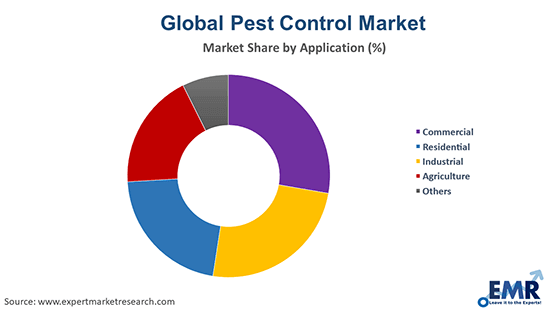

On the basis of application, the industry is segregated into:

Key Insight: The commercial segment significantly dominates the pest control market due to strict hygiene regulations and high customer traffic. Businesses, such as hotels, restaurants, hospitals, and office complexes are necessitating regular pest control services to maintain cleanliness and comply with health codes. For instance, in September 2023, Rentokil launched its Bed Bug Dog Detect service that deploys highly trained canines to identify early-stage bed-bug infestations in businesses. Pest control providers are offering tailored commercial packages, including fly control, rodent monitoring, and bed bug treatments. The recurring nature of services in this segment is also ensuring steady market demand.

The regional markets for the product include:

Key Insight: North America pest control market revenue is growing with stringent health regulations, high urbanization, and advanced infrastructure. The United States and Canada are experiencing high demand for both residential and commercial pest control services, including termite treatment, rodent monitoring, and bed bug eradication. The growing prevalence of vector-borne diseases is further fuelling the demand. As per industry reports, there were 9 cases of locally acquired malaria reported across Texas, Florida, and Maryland in August 2023. Additionally, smart traps and eco-friendly formulations are widely adopted due to growing environmental and public health awareness.

| CAGR 2026-2035 - Market by | Country |

| India | 6.6% |

| China | 5.6% |

| USA | 4.4% |

| France | 3.9% |

| Italy | 3.5% |

| Canada | XX% |

| UK | XX% |

| Germany | XX% |

| Japan | 3.4% |

| Australia | XX% |

| Saudi Arabia | XX% |

| Brazil | XX% |

| Mexico | XX% |

Rising Pest Control Need for Rodents & Termites

Rodents largely influence the pest control market due to their rapid reproduction rates, making their control both critical and continuous. Rats and mice are known for property damage, food contamination, and disease transmission, including hantavirus and salmonella. Rodent infestations are particularly problematic in urban and industrial areas, prompting the use of traps, rodenticides, and smart monitoring systems. Warehouses, restaurants, and hotels are investing heavily in rodent control with stringent hygiene regulations.

The pest control market share is growing from termites as they largely affect wooden structures in residential and commercial buildings. With their destructive capabilities, termite control services have grown essential in regions with warm, humid climates. Several companies are offering specialized termiticides for long-term protection. Supporting with an instance, in December 2023, Greenzone unveiled two innovative termiticide products to enhance termite protection and pest control effectiveness. The high cost of damage per incident is further increasing the demand for termite control services.

Escalating Demand for Biological & Chemical Pest Control

The biological pest control market is gaining momentum as it uses natural predators, parasites, and pathogens to manage pest populations. Ladybugs deployed to control aphids in agricultural fields exemplify this approach. Companies are promoting bio-insecticides containing beneficial organisms and microbial agents as eco-friendly alternatives. For instance, in May 2025, Bionema launched a United Kingdom-developed bioinsecticide NemaGen® that uses native entomopathogenic nematodes for soil pest control. This method is recording preference due to rising demand for sustainable, residue-free pest management, especially in organic farming.

The chemical segment of the pest control market is growing as it involves insecticides, rodenticides, termiticides, and fungicides that provide fast and broad-spectrum pest elimination. Chemical methods are especially preferred in emergency infestations, large-scale agriculture, and public health campaigns against disease vectors, such as mosquitoes. To that end, the influx of innovations focusing on safer formulations, lower toxicity, and targeted delivery systems is driving the segment growth.

Intensifying Usage of Pest Control Baits & Traps

Baits are largely contributing to the pest control industry, as they are especially effective against ants, cockroaches, and rodents. These products contain slow-acting toxicants combined with attractants, allowing pests to carry the poison back to colonies or nests. Baits offer minimal human exposure to chemicals and long-lasting control, making them ideal for sensitive areas, such as kitchens, schools, and hospitals. Rodent bait stations have further grown essential in food storage and commercial spaces.

The pest control market value is rising, driven in part by the growing use of traps for monitoring and managing pest populations without relying on chemical treatments. Snap traps for rodents, pheromone traps for insects, and UV light traps for flies are common. Technological innovations are enhancing trap efficiency through remote monitoring. Supporting with an instance, in February 2025, Bell Laboratories introduced Mouse iQ®, a Bluetooth-enabled smart trap to help technicians check rodent activity up to 100 ft away through smartphone. Traps are also especially valuable in commercial spaces where pesticide use is restricted.

Thriving Pest Control Adoption in Residential & Agriculture Sectors

The residential pest control market is backed by the surging awareness of pest-borne diseases, and concerns over home safety. Homeowners are widely using sprays, baits, and traps, due to the rising interest in eco-friendly solutions. Companies are introducing customized residential service plans, including monthly or quarterly treatments. Termite prevention and mosquito control are especially in demand in warmer regions. Smart-home pest solutions, such as automated sensors, are also gaining traction.

The agricultural segment in the pest control market is growing as it is critical for food security. Farmers are relying on chemical, biological, and mechanical methods to protect crops from pests. Pesticides, seed treatments, and biocontrol agents have grown largely popular. Government regulations and the rising demand for organic produce are further driving the adoption of sustainable methods. In August 2024, the Indian government launched AI-powered National Pest Surveillance System (NPSS) to identify pests for offering real-time and sustainable control advice to over 140 million farmers.

Swift Expansion of Pest Control Market in Europe & Asia Pacific

Europe is gaining traction in the pest control market, strongly influenced by environmental regulations and the growing preference for sustainable methods. Germany, the United Kingdom, and France are increasingly focusing on integrated and biological pest control solutions. Regulatory bodies, such as the European Chemicals Agency are enforcing strict pesticide usage rules, promoting the development of low-toxicity alternatives. Bed bug infestations in urban centres and pest issues in agriculture are also driving the market. Public-private partnerships are further supporting awareness campaigns, especially in schools and municipal institutions.

The growth of the Asia Pacific pest control market is fuelled by urbanization, agricultural expansion, and rising health concerns. The region is witnessing a high incidence of vector-borne diseases, further boosting the demand for mosquito control services. In July 2024, Japanese firms Kao Corporation and Earth Corporation launched an eco-friendly spray ARS Mos Shooter to prevent mosquitoes from flying in Thailand. Global players are entering partnerships or acquiring local firms to expand operations, while governments pushing for sustainable and residue-free pest control solutions.

Key contenders in the pest control market are deploying strategies that focus on growth, innovation, and customer retention. Companies are investing on developing eco-friendly, non-toxic, and bio-based pesticides to meet the increasing regulatory standards and consumer demand for safer solutions. Secondly, geographical expansion is helping firms to tap into emerging markets with growing urbanization and agricultural activities, further broadening their customer base. Thirdly, mergers and acquisitions are enabling companies to increase market share, acquire new technologies, and expand service portfolios quickly.

Lately, players are emphasizing digital transformation by adopting IoT-enabled pest monitoring systems and AI-driven analytics to improve service efficiency and customization. Strategic partnerships and collaborations with agriculture firms, local distributors, and government agencies are enhancing market penetration and trust. Companies are also investing in brand building and customer education while focusing on awareness about integrated pest management and sustainable pest control practices. Lastly, competitive pricing and service diversification are helping to retain clients by offering comprehensive solutions under one roof.

Anticimex International AB, founded in 1934 and headquartered in Stockholm, Sweden, specializes in modern pest control solutions. The company offers digital pest management services, including prevention, monitoring, and treatment for residential, commercial, and industrial clients, emphasizing eco-friendly and sustainable approaches.

BASF SE, founded in 1865 and headquartered in Ludwigshafen, Germany, provides a broad range of pest control products, including crop protection chemicals, fungicides, herbicides, and insecticides. The company focuses on innovation to improve agricultural productivity while ensuring environmental safety and sustainability.

Bayer AG, founded in 1863 with headquarters in Leverkusen, Germany, delivers extensive crop protection solutions. Bayer’s portfolio includes herbicides, insecticides, fungicides, and seed treatment products aimed at enhancing crop yields and quality through advanced scientific research and integrated pest management practices.

Syngenta Crop Protection, LLC, founded in 2000 and headquartered in Basel, Switzerland, offers crop protection products such as herbicides, fungicides, and insecticides. The company focuses on sustainable agriculture by providing innovative solutions to improve crop health, yield, and resilience against pests and diseases globally.

*Please note that this is only a partial list; the complete list of key players is available in the full report. Additionally, the list of key players can be customized to better suit your needs.*

Other players in the pest control market are Rollins, Inc., Rentokil Initial plc, and Dodson Pest Control, Inc., and among others.

Discover the latest pest control market trends 2026 with our in-depth report. Download your free sample now to explore key insights, growth drivers, and competitive analysis. Stay ahead in the pest control industry with trusted data and forecasts tailored for strategic planning and investment decisions. Don’t miss out on essential market intelligence for 2026 and beyond!

United States Pest Control Services Market

Colombia Pest Control Market

Mexico Pest Control Market

Spain Pest Control Market

Peru Pest Control Market

*While we strive to always give you current and accurate information, the numbers depicted on the website are indicative and may differ from the actual numbers in the main report. At Expert Market Research, we aim to bring you the latest insights and trends in the market. Using our analyses and forecasts, stakeholders can understand the market dynamics, navigate challenges, and capitalize on opportunities to make data-driven strategic decisions.*

Get in touch with us for a customized solution tailored to your unique requirements and save upto 35%!

In 2025, the market reached an approximate value of USD 23.34 Billion.

The market is projected to grow at a CAGR of 5.00% between 2026 and 2035.

The market is estimated to witness a healthy growth in the forecast period of 2026-2035 to reach about USD 38.02 Billion by 2035.

Key strategies boosting the market include technological innovation, such as remote monitoring, sustainable product launches, strategic partnerships, market expansion into emerging regions, and regulatory compliance. These approaches enhance service efficiency, customer trust, and environmental safety, driving market growth and adoption across commercial, residential, and agricultural sectors globally.

The key trends guiding the market growth include the rising introduction of eco-friendly pest control products and services and favourable government regulations.

The major regions in the pest control market include the Asia Pacific, Europe, the Middle East and Africa, Latin America, and North America.

The leading pest types in the market are insects, termites, rodents, and wildlife, among others.

The major control methods in the market are mechanical, biological, and chemical, among others.

The significant modes of pest control in the market are powder, spray, traps, and baits.

The various applications of pest control are commercial, residential, industrial, and agriculture, among others.

The key players in the market report include Anticimex International AB, BASF SE, Bayer AG, Syngenta Crop Protection, LLC, Rollins, Inc., Rentokil Initial plc, and Dodson Pest Control, Inc., among others.

The commercial segment significantly dominates the market due to strict hygiene regulations and high customer traffic.

Explore our key highlights of the report and gain a concise overview of key findings, trends, and actionable insights that will empower your strategic decisions.

| REPORT FEATURES | DETAILS |

| Base Year | 2025 |

| Historical Period | 2019-2025 |

| Forecast Period | 2026-2035 |

| Scope of the Report |

Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment:

|

| Breakup by Pest Type |

|

| Breakup by Control Method |

|

| Breakup by Mode |

|

| Breakup by Application |

|

| Breakup by Region |

|

| Market Dynamics |

|

| Competitive Landscape |

|

| Companies Covered |

|

| Report Price and Purchase Option | Explore our purchase options that are best suited to your resources and industry needs. |

| Delivery Format | Delivered as an attached PDF and Excel through email, with an option of receiving an editable PPT, according to the purchase option. |

Datasheet

One User

USD 2,499

USD 2,249

tax inclusive*

Single User License

One User

USD 3,999

USD 3,599

tax inclusive*

Five User License

Five User

USD 4,999

USD 4,249

tax inclusive*

Corporate License

Unlimited Users

USD 5,999

USD 5,099

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Strategic Solutions for Informed Decision-Making

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Share